Flue-Cured Tobacco Market Size

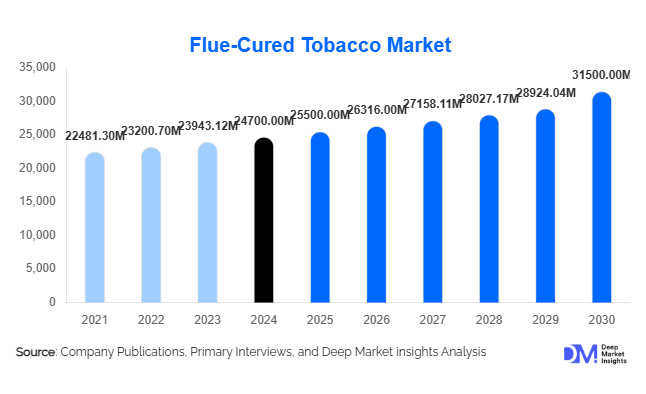

According to Deep Market Insights, the global flue-cured tobacco market size was valued at USD 24,700 million in 2024 and is projected to grow from USD 25,500 million in 2025 to reach USD 31,500 million by 2030, expanding at a CAGR of 3.2% during the forecast period (2025–2030). The market growth is primarily driven by sustained demand from cigarette manufacturers, increasing exports from major producing countries, and rising premiumization and sustainability trends in tobacco production and consumption.

Key Market Insights

- Premium and choice quality flue-cured leaves dominate the market, attracting manufacturers seeking high-quality, flavorful, and consistent leaf for cigarettes and specialty tobacco products.

- Asia-Pacific and North America remain critical regions, with India, China, and the U.S. accounting for significant production, consumption, and export volumes.

- Export-driven demand is expanding, supported by favorable trade policies, government incentives, and increasing consumption in emerging markets.

- Organic and sustainable flue-cured leaf adoption is rising, driven by consumer preferences and regulatory compliance requirements in premium markets.

- Technological integration, including controlled environment curing, AI-assisted grading, and traceability solutions, is improving quality and operational efficiency.

Latest Market Trends

Premiumization and Sustainable Leaf Adoption

Producers are increasingly focusing on premium-grade and sustainable flue-cured leaves. High-quality leaf is essential for premium cigarettes, cigars, and specialty tobacco products, and consumers in developed markets are willing to pay a premium for certified organic or environmentally sustainable products. Adoption of controlled-environment curing, improved grading, and quality traceability systems is enhancing consistency and reducing losses. This trend is fostering long-term growth in premium segments, especially in North America and Europe, where regulatory and consumer expectations drive demand for quality and sustainability.

Export and Trade Expansion

Export volumes from producing countries like India, Brazil, and Malawi are rising steadily. Enhanced logistics, quality improvement programs, and trade agreements are supporting access to key manufacturing hubs worldwide. Export-oriented growth is particularly pronounced for high-quality flue-cured tobacco, which commands higher margins and ensures stability amid domestic market fluctuations. Countries like Indonesia, Belgium, and China are leading importers of flue-cured leaf, increasing demand for premium and standardized grades.

Flue-Cured Tobacco Market Drivers

Sustained Demand from Cigarette Manufacturers

Despite regulatory pressures and shifting consumer preferences, cigarette production remains the primary driver of flue-cured tobacco demand. Bright, flavorful, and smooth flue-cured Virginia leaf is preferred for mainstream and premium blends, ensuring consistent market demand. Export-oriented cigarette manufacturing further stabilizes demand across multiple geographies.

Premiumization and Quality Differentiation

Growing consumer preference for high-quality and specialty tobacco products is encouraging producers to invest in premium-grade leaves. Organic, sustainable, and certified leaves provide differentiation in international markets and offer higher margins. Technological advancements in curing, grading, and traceability are supporting these quality improvements.

Export and Emerging Market Opportunities

Expanding trade networks and rising disposable incomes in emerging markets, particularly in the Asia-Pacific and parts of Africa, are driving global demand for flue-cured tobacco. Government incentives, export subsidies, and infrastructure development are helping producers capture new market segments, further strengthening growth.

Market Restraints

Regulatory and Health Concerns

Stringent regulations, including high taxation, labeling requirements, and marketing restrictions, are limiting growth in several regions. Rising health awareness and anti-smoking campaigns reduce domestic consumption, especially in developed markets, creating a potential slowdown in market expansion.

Price Volatility and Environmental Risks

Flue-cured tobacco production is highly sensitive to input costs, including labor, fuel for curing barns, fertilizers, and transport. Weather variability, climate change, and pest infestations can affect yield and quality, increasing production costs and reducing profit margins. Compliance with environmental and sustainability standards may also necessitate additional investment, acting as a constraint for smaller producers.

Flue-Cured Tobacco Market Opportunities

Premium and Organic Leaf Production

Investment in high-quality, certified organic, and sustainably farmed leaf provides opportunities for higher returns. Producers targeting premium cigarettes and specialty markets can capitalize on rising consumer awareness and willingness to pay for quality and traceable products. Adoption of advanced curing technologies and quality monitoring systems enhances competitiveness and market differentiation.

Expansion in Emerging Markets

Asia-Pacific and parts of Africa represent high-growth markets due to favorable agronomic conditions, lower production costs, and rising tobacco consumption. Government incentives, trade facilitation, and improved logistics are creating opportunities for increased export volumes and market penetration. Producers can leverage these trends to secure stable revenue streams and long-term growth.

Technological Integration and Innovation

Adopting AI-assisted grading, controlled-environment curing, digital traceability, and efficient logistics systems enhances production efficiency, leaf quality, and sustainability compliance. These technological interventions reduce losses, improve operational margins, and create opportunities for differentiation in competitive markets.

Product Type Insights

Premium and choice-grade flue-cured leaves dominate the market, accounting for approximately 30–35% of global value. These leaves are highly sought after for cigarettes, premium cigars, and specialty tobacco products due to their superior flavor, brightness, and smoothness. Organic and sustainable leaves represent a growing niche (5–10%), particularly in export-oriented markets and premium product segments.

Application Insights

Cigarette production remains the primary application, representing nearly 60–65% of flue-cured tobacco demand. Specialty cigars, pipe tobacco, and roll-your-own products are secondary applications, driven by premiumization and niche market growth. Export of raw and semi-processed leaves is increasingly important, particularly from India, Brazil, and Malawi, to meet demand in manufacturing hubs globally.

Distribution Channel Insights

Leaf auctions, direct farm sales, and leaf merchants remain key distribution channels. Increasingly, vertical integration by manufacturers ensures direct procurement from growers or controlled intermediaries. Export channels are critical for premium leaf, and digital platforms for procurement and quality tracking are being gradually adopted to streamline operations and ensure consistency.

End-Use Insights

Cigarette manufacturers continue to be the largest end-users, supported by both domestic and export demand. Premium cigar and specialty tobacco production is growing faster due to rising consumer preference for quality and unique flavor profiles. Emerging uses in smokeless tobacco and alternative products are incremental contributors. Export-driven consumption supports significant volumes, with India exporting FCV leaf worth USD ~716 million in FY24.

| By Product Type | By Application | By Distribution Channel | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

The U.S. is a key producer and consumer of flue-cured leaf, especially for premium blends. Despite declining smoking rates, the market remains sizeable due to high-quality demand and export-oriented production. North America accounts for approximately 30–35% of the global market value in 2024.

Europe

Europe focuses on premium, specialty, and organic tobacco products. The U.K., Germany, and France lead in demand for quality-certified leaf, representing roughly 20–30% of global market value. Sustainability and regulatory compliance drive consumption trends, with growth primarily in premium segments.

Asia-Pacific

Asia-Pacific, led by India, China, and Southeast Asia, is a fast-growing region for flue-cured tobacco. Rising domestic consumption, export growth, and favorable production conditions contribute to 25–30% of the global market share. India is a major exporter, while China shows increasing domestic manufacturing demand.

Latin America

Brazil and Argentina are primary producers, with export-oriented growth driving the market. Domestic consumption is steady but smaller in proportion. Latin America contributes 10–15% of global market value and is projected to grow steadily with trade expansion.

Middle East & Africa

African producers such as Malawi and Zimbabwe supply significant volumes for export. While domestic consumption is limited, the region’s export-driven market and improving infrastructure present opportunities. Combined, the Middle East & Africa account for 5–10% of the global market value, with higher growth potential in certain African producing countries.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Flue-Cured Tobacco Market

- China National Tobacco Corporation

- Philip Morris International

- British American Tobacco

- Japan Tobacco

- Altria Group

- KT&G

- Universal Corporation

- Alliance One International

- R.J. Reynolds Tobacco Company

- PT Gudang Garam Tbk

- Donskoy Tabak

- Taiwan Tobacco & Liquor Corporation

- Thailand Tobacco Monopoly

- ITC Limited (India)

- Swedish Match

Recent Developments

- In 2024–2025, Indian FCV producers expanded organic and sustainable leaf production to capture premium export markets.

- In early 2025, technological adoption of controlled environment curing and AI-assisted grading was implemented by several large U.S. and European leaf processors to improve quality and consistency.

- In 2025, Brazil and Malawi invested in export infrastructure and trade agreements to increase flue-cured tobacco shipments to emerging Asian markets.