Flowers & Ornamental Plants Market Size

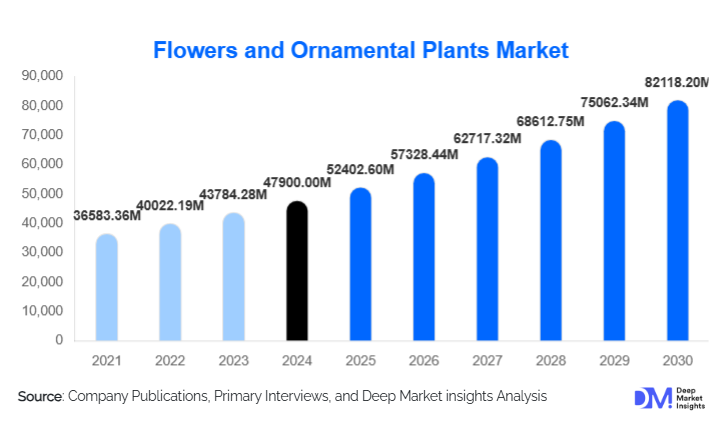

According to Deep Market Insights, the global flowers and ornamental plants market size was valued at USD 47,900.00 million in 2024 and is projected to grow from USD 52,402.60 million in 2025 to reach USD 82,118.20 million by 2030, expanding at a CAGR of 9.4% during the forecast period (2025–2030). This growth is driven by rising consumer demand for indoor plants, expanding e-commerce flower sales, and increasing investment in controlled-environment agriculture and urban greening.

Key Market Insights

- Cut flowers remain the dominant product category globally, driven by traditional gifting, export trade, and high-value perishable stems.

- Potted and foliage ornamentals are growing strongly, especially in response to biophilic design trends and interior landscaping in commercial and residential spaces.

- Wholesale auctions and B2B channels continue to dominate global trade flows, particularly in Europe and for export-oriented growers.

- Greenhouse cultivation is the leading production method, due to its ability to provide a year-round supply and protect high-value crops.

- Large commercial producers and exporters dominate the global value chain, leveraging scale, logistics, and post-harvest technology.

- Mid-market price tier plants (retail and potted varieties) make up the largest share of consumer demand, combining affordability with wide accessibility.

- Asia-Pacific is the fastest-growing regional market, fueled by rising incomes, urbanization, and online sales growth in China and India.

What are the latest trends in the Flowers & Ornamental Plants Market?

Digitally Driven Flower Purchases & Subscriptions

Consumers are increasingly buying flowers and potted plants via online channels, including subscription services. Digital platforms are enabling florists and growers to reach customers directly, reducing dependency on traditional retail. The recurring subscription model is especially powerful, converting once-off gift purchases into repeat orders, improving cash flow for growers, and reducing waste through better inventory forecasting.

Sustainable & Local Production Momentum

In response to climate concerns and rising transport costs, locally grown flowers and ornamentals are gaining popularity. Greenhouse growers in regions previously reliant on imports are scaling up, and “locally grown” branding is being used as a price and value differentiator. There is also growing demand for sustainably produced plants, with certification and traceability gaining importance across developed markets.

Technology in Cultivation and Post-Harvest

Advanced breeding techniques (e.g., tissue culture, genetics for longer vase life) and controlled-environment agriculture (CEA) are becoming more widely adopted. These methods allow for year-round production, better quality, and lower losses. At the same time, improvements in cold-chain logistics, modified atmosphere packaging, and climate-controlled greenhouses are reducing post-harvest waste, increasing shelf life, and enabling broader export reach.

What are the key drivers in the Flowers & Ornamental Plants Market?

Rising Consumer Demand for Indoor & Wellness-Focused Greenery

Urbanization, remote work, and wellness trends have led to a surge in demand for indoor plants. Consumers are using decorative foliage and flowering potted plants as part of home décor and mental-well-being strategies. This has encouraged growers to produce more high-margin, aesthetically pleasing varieties that appeal to lifestyle buyers.

Urban Greening & Corporate Landscaping Initiatives

Governments and corporations are investing significantly in green public spaces, living walls, and interior landscaping, driven by sustainability goals and employee wellness programs. These initiatives boost demand for bedding plants, shrubs, small trees, and foliage plants, offering a recurring, institutional market for growers and landscapers.

Technological Advancements & Genetic Innovation

Innovations in plant breeding and post-harvest processing are enabling longer-lasting cut flowers and more resilient potted varieties. Combined with automation in greenhouse control (climate, irrigation) and improved logistics, these advances are reducing waste, improving profitability, and expanding growers’ geographic reach.

What are the restraints for the global market?

High Logistics & Trade Barriers

The flower industry is highly perishable and often relies on air freight for international trade. Transport costs, customs regulations, and phytosanitary requirements can significantly erode margins. These barriers make it difficult for smaller growers to compete globally and add financial risk for exporters.

Seasonality & Inventory Risk

Demand for cut flowers is highly seasonal, peaking around holidays and special occasions. Growers often face mismatches between production cycles and demand, leading to either overproduction (waste) or underproduction (lost sales). This risk is exacerbated by the perishability of the product and the need for precise demand forecasting.

What are the key opportunities in the Flowers & Ornamental Plants Industry?

Scaling Subscription & Direct-to-Consumer Models

There is major potential for growers, florists, and start-ups to expand digital channels. Subscription-based flower delivery and plant-of-the-month clubs are ideal for building recurring revenue. By leveraging data (customer preferences, purchasing patterns), businesses can tailor assortments, reduce unsold inventory, and improve margin stability. Micro-fulfillment hubs in urban centers can support fast delivery and a reduced carbon footprint.

Expansion into Controlled-Environment Production

Controlled-environment agriculture (CEA), including vertical farming, offers new paths for producing high-value ornamentals year-round. Growers can invest in greenhouses, climate-controlled facilities, and tissue-culture labs to scale production of premium, niche, or exotic varieties. CEA reduces dependence on weather and imports and enables the local supply of high-margin plants.

Leveraging Urban Greening & Public Policy

Many cities are increasingly targeting green space development, tree-planting mandates, and sustainability goals. Growers, landscapers, and plant service companies can partner with municipalities to supply bedding plants, shrubs, and trees. This presents a recurring business model through planting contracts, maintenance, and long-term landscaping partnerships.

Product Type Insights

Cut flowers dominate in value due to high export share, frequency of gifting, and premium consumer willingness to pay. Potted flowering plants (indoor) are growing rapidly in response to wellness and interior-design trends, especially among millennials and urban dwellers. Ornamental foliage plants are also gaining traction, particularly for subscriptions and plant-leasing applications. Bedding plants (annuals and seasonal) are essential for landscaping projects, while bulbs, tubers, and ornamental seeds support propagation and hobbyist markets.

Application Insights

The retail & gifting segment remains the single largest application, with both impulse and planned purchases. Interior landscaping is expanding as offices, hotels, and malls integrate living plants to improve aesthetics and well-being. Event floristry supports weddings and corporate events, where premium arrangements and designer bouquets are in demand. Landscaping & urban greening is a growing institutional use case, especially in cities pushing sustainability and green infrastructure.

Distribution Channel Insights

The most significant distribution channel remains wholesale and auction, particularly for the international cut-flower trade. Traditional retail florists cater to local and gifting demand, while supermarkets and big-box stores offer mass-market floral and potted plant options. Online D2C platforms are rapidly expanding, providing personalized subscription services and direct delivery. Landscape contractors and institutional buyers also procure directly for public green projects and corporate interiors.

End-User / Buyer Type Insights

Individual consumers purchasing plants for home décor, gifting, and personal well-being form a large, growing segment. Commercial buyers, offices, hotels, and retail spaces increasingly lease plants or contract plant maintenance. Event planners and florists represent a high-value, design-oriented segment. Exporters and wholesalers drive global trade, particularly for cut-flowers, supplying auctions and re-export hubs.

| By Product Type | By Application | By Distribution Channel | By End User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

The United States is a major buyer in the global ornamentals market, especially for cut flowers, potted plants, and premium bouquets. High disposable income, digital adoption, and strong corporate demand for interior landscaping are key growth drivers. Online subscriptions and gifting are also very mature in this region, contributing to consistent growth.

Europe

Europe leads in cut-flower consumption and acts as a global distribution hub via its wholesale auctions (especially in the Netherlands). Sustainability is a major factor in European demand, with buyers increasingly preferring local and low-carbon options. Domestic greenhouse production is also increasing to reduce reliance on imports.

Asia-Pacific

The Asia-Pacific region is one of the fastest-growing markets, driven by urbanization, a rising middle class, and a growing culture of gifting and indoor décor. Countries like China and India are seeing strong uptake in e-commerce and subscription-based plant services. Indoor foliage and flowering plants are also very popular in this region as consumers prioritize wellness and aesthetic home spaces.

Latin America

Countries such as Ecuador and Colombia are key exporters of cut flowers to North America and Europe, driving much of the region’s ornamental plant economies. Domestic consumption is growing more slowly, but affluent urban populations are increasingly buying potted plants and floral decor for gifting and events.

Middle East & Africa

Kenya and Ethiopia are prominent exporters of cut flowers, particularly to European markets. The Middle East (e.g., UAE, Saudi Arabia) is also emerging as a significant importer of premium potted plants and designer flower arrangements, supported by high-income populations and luxury retail demand. Intra-African trade and regional landscaping initiatives are also starting to take off.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Flowers & Ornamental Plants Market

- Dümmen Orange

- Selecta One

- Ball Horticultural Company

- Sakata Seed Corporation

- PanAmerican Seed / Ball Seed (ornamental seeds)

- Florensis

- Takii & Co.

- Marginpar

- Elsner

- Washington Bulb Co.

- Multiflora

- Syngenta Flowers (breeding division)

- Florex Group

- Chrysal (flower-care solutions)

- Dümmen Group (parent breeder/producer)

Recent Developments

- In 2024–2025, several large producers scaled up vertical farming facilities for potted ornamentals, integrating climate control and automation to boost year-round production and reduce reliance on seasonal imports.

- Major breeding firms (e.g., Dümmen Orange, Selecta One) launched new cultivars with extended vase life and novel foliage, increasing their penetration in export markets and subscription services.

- Greenhouse growers in Europe and Asia began forming partnerships with urban greening programs, supplying plants for municipal landscaping, green façades, and biophilic office designs as ESG initiatives expand.