Flooring Carpets Market Size

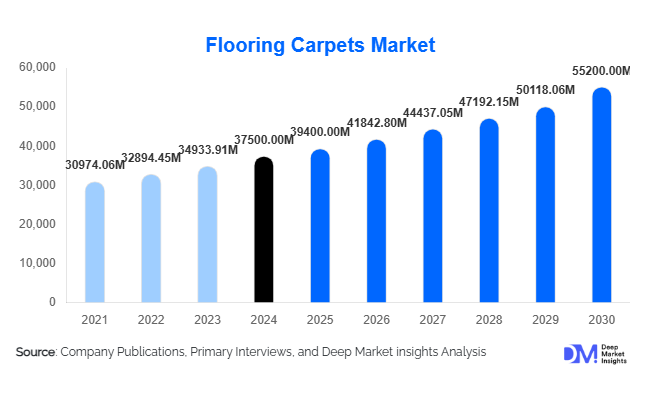

According to Deep Market Insights, the global flooring carpets market size was valued at USD 37,500 million in 2024 and is projected to grow from USD 39,400 million in 2025 to reach USD 55,200 million by 2030, expanding at a CAGR of 6.2% during the forecast period (2025–2030). The market growth is primarily driven by increasing urbanization, rising disposable income, growing residential and commercial infrastructure, and the adoption of premium and eco-friendly carpet solutions across global regions.

Key Market Insights

- Premium and eco-friendly carpets are gaining traction, reflecting rising consumer demand for sustainable and aesthetic flooring solutions in both residential and commercial sectors.

- Technological advancements in carpet production, including stain-resistant, anti-microbial, and modular designs, are enhancing durability and appeal, particularly in high-traffic areas.

- Residential end-use dominates globally, with increased homeownership and renovation activities driving demand for carpets with comfort and decorative value.

- North America and APAC lead the market, with the U.S., China, and India contributing the largest shares due to premium adoption, urbanization, and large-scale infrastructure development.

- Online retail channels are emerging as critical distribution platforms, enabling wider reach, customized offerings, and integration of digital visualization tools for consumers.

- Government initiatives and sustainability regulations are supporting the adoption of eco-friendly carpets and local manufacturing programs in regions such as APAC and Europe.

Latest Market Trends

Premium and Eco-Friendly Carpets on the Rise

Consumers are increasingly opting for premium and sustainable carpet solutions, such as wool and recycled polyester, to enhance aesthetics, indoor air quality, and environmental responsibility. Eco-certifications, green building compliance, and anti-microbial treatments are driving the adoption of high-end carpets across commercial offices, hotels, and residential projects. Modular carpet tiles are also gaining popularity, providing flexible installation and maintenance benefits, particularly in office and retail spaces. Manufacturers are emphasizing design innovation, color customization, and texture variety to appeal to style-conscious consumers.

Technological Advancements in Carpet Manufacturing

Emerging technologies such as stain-resistant coatings, advanced tufting, and durable synthetic fibers are enhancing product performance and lifespan. Carpet manufacturers are increasingly adopting automation and digital printing for customization, while online platforms allow consumers to visualize designs using AR/VR tools before purchase. This tech-driven trend is especially appealing to younger, design-savvy buyers and institutional clients seeking high-quality, cost-efficient flooring solutions.

Flooring Carpets Market Drivers

Urbanization and Residential Growth

The rapid growth of urban housing projects and commercial complexes in emerging economies is boosting demand for carpeting solutions. Rising disposable incomes, urban migration, and home renovation trends are leading to increased adoption of carpets that offer aesthetic appeal, comfort, and durability. Residential demand continues to expand, particularly in APAC countries like China and India, which are experiencing large-scale urbanization.

Shift Toward Premium and Sustainable Carpets

Consumer preference for eco-friendly, long-lasting, and design-oriented carpets is driving market growth. Wool carpets and recycled polyester variants are increasingly adopted due to environmental considerations and premium appeal. Corporate offices and luxury hotels also favor these products to align with sustainability initiatives and enhance interior design aesthetics, fueling demand across commercial applications.

Technological Innovation and Product Differentiation

New fiber technologies, modular carpet designs, and anti-microbial treatments are enhancing product performance and longevity. These innovations make carpets suitable for high-traffic areas such as offices, airports, and public spaces. Integration with online sales platforms and customization options also increases market reach and consumer engagement.

Market Restraints

High Cost of Premium Carpets

Premium materials such as wool and high-end nylon are expensive, limiting affordability for middle-income residential consumers, particularly in emerging markets. This price sensitivity slows adoption in cost-conscious regions.

Competition from Alternative Flooring

The availability of alternative flooring solutions, such as laminate, vinyl, and hardwood, poses a challenge for carpet manufacturers. These alternatives often offer lower maintenance costs and comparable durability, reducing carpet adoption in certain applications.

Flooring Carpets Market Opportunities

Eco-Friendly and Sustainable Carpet Solutions

With increasing environmental awareness and green building certifications, there is a growing opportunity for carpets made from recycled materials and sustainably sourced fibers. Governments and construction companies are supporting eco-friendly initiatives, which provide a strong growth avenue for manufacturers to innovate and differentiate their products.

Expansion in Emerging Residential and Commercial Markets

Emerging economies such as India, China, and Brazil are witnessing rapid urbanization and rising disposable income, fueling demand for residential carpets. Commercial developments, including offices, hotels, and retail spaces, are also adopting durable and aesthetically appealing carpet solutions, presenting substantial growth potential for manufacturers targeting mid-range and premium segments.

Digital and Online Retail Growth

The shift toward e-commerce enables manufacturers to reach wider audiences and offer customized solutions, such as AR/VR-based visualization and online consultations. Online platforms facilitate direct-to-consumer sales, enhance convenience, and expand market access, particularly in regions with limited brick-and-mortar retail penetration.

Product Type Insights

Nylon carpets dominate the market, accounting for approximately 34% of the 2024 market share due to their durability, stain resistance, and suitability across commercial and residential spaces. Wool carpets, although premium-priced, are gaining popularity in luxury residential and hotel applications for their eco-friendly and high-quality attributes. Polypropylene and polyester carpets serve mid-range and economy segments, providing cost-effective and moisture-resistant flooring options suitable for residential use.

Application Insights

Residential applications lead globally, holding 42% of the market share in 2024, driven by increased homeownership, urban housing projects, and renovation trends. Commercial use follows, fueled by offices, hotels, and hospitals adopting durable, design-oriented carpets. Industrial and public spaces also contribute to market demand, particularly in high-traffic areas requiring modular and low-maintenance carpet solutions. Emerging applications include airports, exhibition centers, and high-end retail outlets, which are increasingly investing in customized and premium carpets.

Distribution Channel Insights

Offline retail dominates with 56% of global sales, as consumers prefer tactile evaluation of carpet texture and color. However, online platforms are rapidly expanding, offering convenience, AR/VR-based visualization, and customization options. Direct B2B sales to commercial clients are significant in high-volume orders, particularly for institutional and industrial applications. Emerging digital channels and e-commerce marketplaces are driving growth, particularly in APAC and North America.

| By Product Type | By Application / End-Use | By Distribution Channel | By Price Tier |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for 30% of the global market in 2024. The U.S. is the largest contributor, with strong demand for premium carpets in residential and commercial spaces. Canada also shows growing adoption, driven by renovation projects and eco-friendly building initiatives. The market is supported by high disposable incomes, urban housing expansion, and a preference for aesthetically appealing and durable flooring solutions.

Europe

Europe holds around 25% of the global market, led by Germany, the U.K., and France. Premium and sustainable carpets are highly favored due to environmental awareness and green building regulations. Germany accounts for approximately 12% of the global market. Emerging demand from France and Spain is boosting growth, driven by new construction and commercial infrastructure projects.

Asia-Pacific

APAC is the largest regional market with a 38% share in 2024, driven by China and India. Rapid urbanization, rising middle-class incomes, and government housing initiatives contribute to strong residential and commercial demand. India shows the fastest regional growth at 8% CAGR, while China remains a major consumer and exporter of carpets globally. Japan, South Korea, and Australia also maintain steady demand for high-quality and design-oriented flooring solutions.

Latin America

Latin America accounts for 5% of the global market, led by Brazil and Argentina. Outbound demand for imported premium carpets is growing among commercial and high-income residential consumers. Retail, hospitality, and institutional projects are driving adoption in key urban centers.

Middle East & Africa

MEA represents 7% of the global market, with the UAE and Saudi Arabia as key consumers of luxury residential and commercial carpets. Africa, home to local production, is expanding domestic adoption in the institutional and public sectors. Intra-African trade and government-supported infrastructure projects are creating new market opportunities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Flooring Carpets Market

- Mohawk Industries

- Shaw Industries

- Interface Inc.

- Tarkett

- Beaulieu International Group

- Milliken & Company

- Masland Carpets

- J&J Flooring Group

- Dixie Group

- Bentley Mills

- Godfrey Hirst

- Balta Group

- Victoria Carpets

- Faus Group

- Cormar Carpets

Recent Developments

- In March 2025, Mohawk Industries launched a sustainable nylon carpet line with recycled content, targeting commercial and residential applications in North America and Europe.

- In April 2025, Shaw Industries expanded its modular carpet tile production in China, catering to growing demand in APAC commercial infrastructure projects.

- In June 2025, Interface Inc. introduced a globally certified carbon-neutral carpet collection, emphasizing eco-friendly production processes and premium design.