Floor Sweeper Market Size

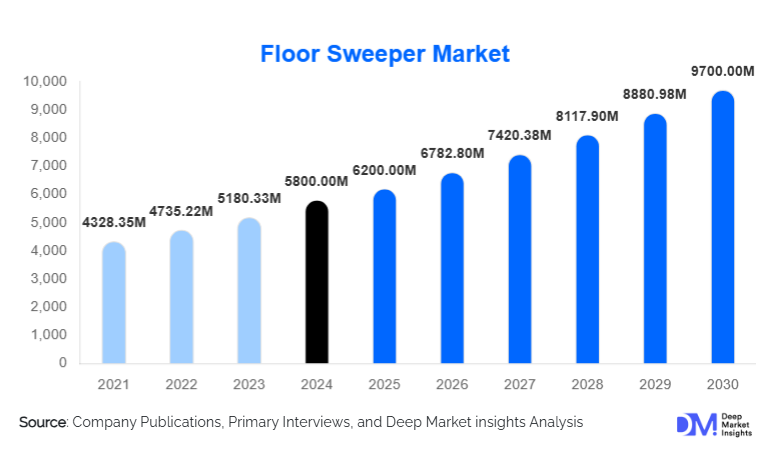

According to Deep Market Insights, the global floor sweeper market size was valued at USD 5,800 million in 2024 and is projected to grow from USD 6,200 million in 2025 to reach USD 9,700 million by 2030, expanding at a CAGR of 9.4% during the forecast period (2025–2030). The floor sweeper market growth is primarily driven by increasing industrial automation, rising demand for hygienic and efficient cleaning solutions across commercial and municipal spaces, and technological advancements in autonomous and battery-powered sweeping equipment.

Key Market Insights

- Automation and robotics are transforming the floor sweeper market, enabling facilities to reduce labor costs and improve cleaning efficiency with semi-automatic and fully autonomous models.

- Electric and hybrid sweepers are gaining traction, driven by sustainability goals and stricter emission regulations in Europe, North America, and the Asia-Pacific.

- Industrial and warehouse applications dominate demand, accounting for the largest market share due to expanding e-commerce and logistics operations.

- Asia-Pacific is the fastest-growing region, with China and India leading the adoption of both industrial and municipal sweepers.

- Public infrastructure spending and smart city projects are boosting demand, particularly for street sweepers and outdoor cleaning solutions.

- Technological adoption, including IoT-enabled maintenance, AI-based navigation, and predictive analytics, is shaping competitive dynamics and product differentiation.

What are the latest trends in the floor sweeper market?

Autonomous and Smart Cleaning Technologies

Manufacturers are increasingly integrating AI, IoT, and robotic technologies into floor sweepers. Autonomous sweepers with obstacle detection, mapping capabilities, and cloud-based monitoring are reducing reliance on manual labor, particularly in warehouses, airports, and large commercial spaces. Predictive maintenance systems allow real-time monitoring of battery health, brush performance, and component wear, reducing downtime and enhancing operational efficiency. The adoption of autonomous solutions is expected to grow steadily, driven by labor shortages and demand for consistent cleaning quality.

Shift Towards Eco-Friendly and Electric Models

Battery-powered and hybrid sweepers are becoming mainstream due to sustainability regulations and indoor air quality requirements. Companies are replacing gasoline and diesel-powered units with electric alternatives, which offer lower operational costs, reduced noise, and compliance with emission norms. Lithium-ion battery improvements have increased runtime and reduced charging times, further supporting adoption. Governments and municipal bodies in Europe, North America, and APAC are actively promoting eco-friendly sweepers through subsidies and incentives.

What are the key drivers in the floor sweeper market?

Industrial Expansion and Warehouse Automation

Rapid e-commerce growth and industrialization have increased the demand for efficient cleaning solutions in warehouses and manufacturing facilities. Automated sweepers ensure hygiene, safety, and operational efficiency over large indoor areas. Rising warehouse automation investments have made semi-automatic and autonomous sweepers a preferred choice, contributing significantly to market growth.

Government Initiatives and Public Infrastructure Spending

Urban cleaning initiatives, smart city projects, and municipal investment programs are driving the adoption of street and heavy-duty sweepers. Countries in APAC and the Middle East are allocating billions toward sanitation and infrastructure, creating opportunities for high-capacity sweepers with low emissions and high efficiency.

Technological Advancements and Digital Integration

Innovation in IoT connectivity, AI-based navigation, and cloud monitoring has increased demand for high-tech sweepers. Manufacturers offering predictive maintenance, autonomous operation, and energy-efficient systems are outperforming traditional equipment, attracting industrial and commercial buyers.

What are the restraints for the global market?

High Upfront Costs

Autonomous and heavy-duty sweepers require significant capital investment, limiting adoption by small and medium-sized enterprises. Prices range between USD 15,000 and 50,000 per unit, which can be prohibitive for cost-sensitive buyers.

Maintenance Complexity

The sophisticated electronics, battery systems, and AI features of modern sweepers necessitate skilled technicians. In regions with limited service infrastructure, this can impede adoption and affect operational reliability.

What are the key opportunities in the floor sweeper market?

Expansion in Emerging Economies

Countries such as India, Indonesia, Vietnam, and Brazil offer significant growth potential due to rising industrialization, organized retail, and logistics sectors. Mechanized cleaning adoption in these regions remains below 20%, allowing early movers to establish market leadership through cost-effective and locally adapted solutions.

Integration of Smart Technologies

Opportunities exist in AI-driven navigation, IoT-enabled predictive maintenance, and fully autonomous robotic sweepers. These technologies improve efficiency, reduce labor dependency, and offer data-driven insights for industrial and municipal applications.

Government Incentives and Infrastructure Spending

Funding for urban cleaning, smart city initiatives, and industrial modernization in APAC, the Middle East, and Europe presents lucrative opportunities. Manufacturers that align with sustainability standards and emission regulations can secure long-term contracts and expand market penetration.

Product Type Insights

Ride-on sweepers dominate the market, accounting for approximately 34% of 2024 revenue, due to their efficiency in large industrial facilities, airports, and municipal projects. Walk-behind and compact robotic sweepers are growing rapidly in commercial and residential applications, while heavy-duty street sweepers are essential for public infrastructure and city cleaning programs.

Application Insights

Industrial and warehouse applications account for 38% of the market, driven by e-commerce and logistics expansion. Commercial spaces, including malls, airports, and offices, are adopting semi-automatic and robotic sweepers. Municipal cleaning, street sweeping, and residential/institutional applications are emerging as significant growth areas.

Distribution Channel Insights

Direct OEM sales dominate industrial applications, while distributors and dealers serve mid-tier markets. Online platforms and e-commerce channels are increasingly important for compact, robotic, and residential sweepers, offering easy access, pricing transparency, and product comparisons.

End-User Insights

Manufacturing and warehousing are the largest end-users, valued at USD 2.2 billion in 2024. Hospitality, retail, healthcare, and municipal sectors are expanding rapidly. E-commerce and logistics growth is particularly driving industrial adoption, while government infrastructure projects stimulate street sweeper demand. Export-driven demand remains strong, with China, Germany, and Italy leading manufacturing and exports of industrial sweepers.

| By Product Type | By Power Source | By Application | By End User | By Sales Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 28% of the global market, with the U.S. and Canada leading demand for autonomous and battery-powered sweepers. Industrial automation and regulatory compliance are key growth drivers, with a CAGR of approximately 8.5% through 2030.

Europe

Europe held 25% of the market in 2024, driven by Germany, France, and Italy. The focus on eco-friendly, electric sweepers and replacement demand supports steady growth. Sustainability regulations and industrial modernization programs enhance market potential.

Asia-Pacific

APAC is the fastest-growing region, representing 36% of the market. China and India lead adoption due to industrial expansion, smart city initiatives, and rising municipal investment. Southeast Asia and Japan also contribute to steady market growth, particularly in autonomous and electric sweepers.

Middle East & Africa

MEA accounts for 6% of the market, with growth driven by the UAE, Saudi Arabia, and South Africa. Heavy-duty outdoor sweepers and street cleaning solutions dominate this region, supported by public infrastructure spending.

Latin America

LATAM represents 5% of the market, with Brazil and Mexico leading adoption in industrial and municipal applications. The region is gradually embracing mechanized cleaning solutions due to urbanization and logistics modernization.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Floor Sweeper Market

- Tennant Company

- Nilfisk A/S

- Karcher GmbH

- Hako GmbH

- Dulevo International

- IPC Group

- Roots Multiclean

- Comac SpA

- Cleanwill

- Fimap

- Hefei Gaomei Cleaning Equipment

- Boschung

- Alfred Kärcher SE & Co. KG

- RCM S.p.A.

- Elgin Sweeper Company

Recent Developments

- In January 2025, Tennant Company launched a new autonomous electric floor sweeper for warehouses, offering 24/7 operational capability and IoT monitoring.

- In March 2025, Nilfisk introduced hybrid street sweepers in Europe, aligning with EU Stage V emission regulations and municipal adoption programs.

- In July 2025, Karcher unveiled a robotic compact sweeper targeting retail and airport applications, emphasizing energy efficiency and minimal operator supervision.