Flip Flops Market Size

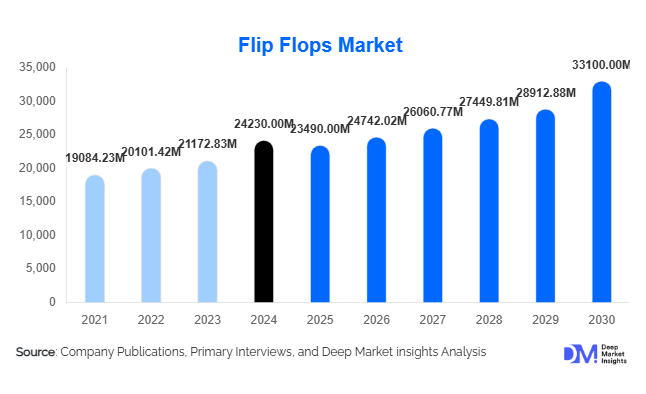

According to Deep Market Insights, the global flip flops market size was valued at USD 24,230 million in 2024 and is projected to grow from USD 25,490 million in 2025 to reach USD 33,100 million by 2030, expanding at a CAGR of 5.33% during the forecast period (2025–2030). The growth of the flip flops market is primarily driven by rising consumer demand for casual and comfortable footwear, the increasing popularity of flip flops across fashion and leisure segments, and the expansion of production capabilities in emerging markets, including Asia-Pacific and Latin America.

Key Market Insights

- Eco-friendly and sustainable materials are shaping consumer choices, with increasing adoption of recycled plastics, natural rubber, and biodegradable components in flip-flop production.

- Customization and personalization trends are attracting consumers seeking unique designs, including interchangeable straps, colors, and print options.

- Asia-Pacific dominates manufacturing and demand, led by China, India, and Vietnam, which are key producers and consumers of affordable and stylish flip flops.

- North America remains a major consumption hub, particularly the U.S., driven by fashion trends and leisure-driven footwear adoption.

- Technological adoption in production and e-commerce platforms is enhancing consumer accessibility, enabling online sales growth and direct-to-consumer marketing.

- Travel and leisure activities fuel seasonal demand, with flip flops being a preferred footwear choice for warm climates and tourism-driven regions.

Latest Market Trends

Eco-Conscious Material Adoption

Flip-flop manufacturers are increasingly introducing sustainable and recycled materials into their products to appeal to environmentally conscious consumers. EVA (Ethylene-Vinyl Acetate) continues to dominate due to its lightweight and durable properties, while natural rubber and biodegradable alternatives are gaining traction. Leading brands are incorporating recycled plastics from ocean waste and using plant-based materials, enhancing brand reputation and aligning with global sustainability initiatives. These trends are expected to continue as consumer awareness around eco-friendly fashion grows.

Customization and Fashion Integration

Consumer preference is shifting toward personalized flip flops, offering options such as color, strap style, and decorative elements. Collaborations with fashion brands, designers, and influencers have elevated flip-flops from casual essentials to style statements. Digital platforms allow consumers to design custom products online, bridging fashion with convenience. Seasonal trends, limited-edition collections, and influencer marketing campaigns are driving higher engagement, particularly among millennials and Gen Z demographics.

Flip Flops Market Drivers

Comfort and Affordability

Flip flops are lightweight, easy to wear, and highly comfortable, making them a preferred choice for everyday casual footwear. Affordability allows them to cater to a broad demographic, spanning high-income consumers seeking leisure products to budget-conscious buyers in emerging markets. The combination of cost-effectiveness and convenience positions flip-flops as a consistent driver of global market growth.

Travel and Leisure Activity Growth

Rising domestic and international travel has positively impacted flip-flop demand. Tourists and leisure travelers favor flip flops for their comfort, portability, and suitability for warm climates. Beach tourism, resort visits, and casual outdoor activities significantly contribute to seasonal spikes in sales, particularly in Asia-Pacific, Latin America, and North America.

Fashion and Lifestyle Influence

Flip flops are increasingly integrated into fashion trends, with designer collaborations, limited-edition collections, and influencer endorsements boosting consumer appeal. Social media platforms amplify visibility, encouraging impulse buying and positioning flip flops as both functional and fashionable footwear.

Market Restraints

Durability Concerns

Despite popularity, flip flops are often perceived as less durable compared to other footwear options, limiting adoption among consumers seeking long-lasting products. Manufacturers need to invest in improved materials and design to address this challenge.

Seasonal Demand Fluctuations

Demand for flip flops is heavily influenced by seasonal factors, particularly in colder climates. This seasonal dependency can create revenue volatility for manufacturers and retailers, requiring strategic inventory management and market diversification.

Flip Flops Market Opportunities

Expansion in Emerging Markets

Emerging economies, including India, China, Brazil, and Vietnam, present untapped growth opportunities due to increasing urbanization and disposable incomes. Affordable and stylish flip flops are gaining popularity, particularly in leisure, fashion, and tourism sectors, creating a sizable market for both global and local manufacturers.

Integration of Technology in Sales and Marketing

E-commerce platforms, D2C websites, and AI-driven marketing tools are enabling personalized consumer experiences and wider product reach. Virtual try-ons, AR-based customization, and targeted digital campaigns are enhancing engagement and expanding market penetration globally.

Rise in Sustainable and Eco-Friendly Offerings

The shift toward sustainability allows new entrants and established players to differentiate products. Brands focusing on biodegradable, recycled, or plant-based flip flops are expected to attract environmentally conscious consumers, providing a competitive edge and premium pricing opportunities.

Product Type Insights

EVA-based flip flops dominate the market, accounting for approximately 40% of global sales in 2024 due to their comfort, light weight, and durability. Classic designs remain the most popular, holding 45% of the market share, while newer fashion-forward designs are steadily gaining traction in urban centers. The female segment leads end-user preference with 67% of consumption, reflecting the demand for stylish and comfortable designs.

Application Insights

Leisure and casual wear remain the dominant applications for flip flops, particularly in tourism and resort-based activities. Growing trends include beachwear, indoor/outdoor casual fashion, and workplace casual footwear. Export-driven demand from fashion-conscious markets in North America and Europe supports growth, while tourism-driven consumption peaks seasonally in Asia-Pacific and Latin America.

Distribution Channel Insights

Offline retail, including specialty footwear stores and supermarkets, holds a 65% market share in 2024 due to consumer trust and product availability. Online platforms are rapidly growing, offering direct-to-consumer options, personalized designs, and global accessibility. Social media marketing and influencer campaigns are increasingly shaping consumer purchase decisions.

End-Use Insights

The fashion and leisure segments are driving the majority of demand. Travel and tourism industries are significant consumers, while casual workwear and lifestyle adoption further boost market growth. Emerging applications include eco-tourism footwear, sports, and indoor home wear, opening new end-use opportunities globally.

| By Product Type | By Material | By End-User | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America, particularly the U.S. and Canada, accounts for 25% of the global market in 2024. Fashion trends, casual footwear adoption, and leisure-driven consumption drive demand, while e-commerce platforms support growth in personalized products.

Europe

Europe represents 20% of the market, led by Germany, France, and the U.K. Consumer preference for style, eco-conscious materials, and fashion integration fuels growth. Sustainability trends are particularly strong among younger demographics.

Asia-Pacific

Asia-Pacific is the fastest-growing region due to large populations, rising middle-class incomes, and strong manufacturing presence. India, China, and Vietnam are key markets for both production and consumption. Seasonal tourism and domestic leisure activities further drive regional demand.

Latin America

Brazil and Mexico are primary markets, with growing outbound tourism demand and warm climates supporting flip-flop adoption. Emerging urban fashion trends are creating new sales channels.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, is experiencing growing demand for luxury and designer flip-flops. Africa remains a production hub, particularly in sustainable and eco-friendly manufacturing, supporting both local consumption and export demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Flip-Flops Market

- Havaianas

- Crocs

- Nike

- Adidas

- Skechers

- Puma

- Reebok

- Deckers Outdoor

- Sanuk

- Quiksilver

- Roxy

- Teva

- Volcom

- Rainbow Sandals

- American Eagle Outfitters

Recent Developments

- In June 2025, Havaianas launched a sustainable line of flip flops using recycled ocean plastics and plant-based EVA.

- In April 2025, Crocs expanded its customization platform globally, allowing consumers to design unique flip-flop patterns online.

- In March 2025, Nike introduced a limited-edition fashion-forward flip-flop collection targeting lifestyle and leisure segments in North America and Europe.