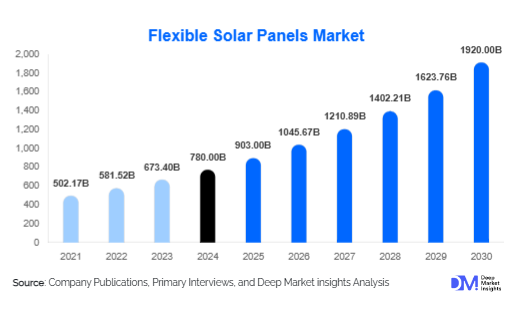

According to Deep Market Insights, the global flexible solar panels market size was valued at USD 780 million in 2024 and is projected to grow from USD 903 million in 2025 to reach USD 1,920 million by 2030, expanding at a CAGR of 15.8% during the forecast period (2025-2030). The growth of the flexible solar panels market is primarily driven by rising adoption of portable renewable energy solutions, increasing demand for lightweight solar applications in consumer electronics and transport, and government incentives supporting green energy expansion.

Flexible Solar Panels Market Size

Key Market Insights

- Thin-film solar technologies such as CIGS and OPV dominate innovation, offering flexibility and lightweight form factors unmatched by crystalline panels.

- Off-grid applications and rural electrification are emerging as strong demand drivers, particularly in the Asia-Pacific and Sub-Saharan Africa.

- Consumer electronics integration is a growing trend, with solar wearables, IoT devices, and portable chargers entering the mainstream market.

- Asia-Pacific leads global demand, fueled by large-scale adoption in China, Japan, and India.

- North America remains a high-value market, supported by U.S. policies such as the Inflation Reduction Act promoting solar deployment.

- Government incentives and corporate sustainability commitments are accelerating flexible solar adoption in commercial buildings and EV applications.

What are the latest trends in the flexible solar panels market?

Off-Grid Energy Adoption

Flexible solar panels are increasingly being used in off-grid power solutions, including rural electrification kits, portable chargers, and mobile power stations. Their lightweight, durable, and flexible design makes them ideal for remote communities lacking grid connectivity. With over 800 million people still without reliable access to electricity, demand for such decentralized solar solutions is growing rapidly, especially across Asia and Africa.

Integration into Consumer Electronics

Wearables, IoT devices, and smartphones are being fitted with organic photovoltaics (OPV) and thin-film cells. These solar-integrated electronics provide continuous charging capabilities, reducing dependence on conventional batteries. Tech companies are experimenting with integrating solar into smartwatches, fitness trackers, and wireless headphones, aligning with consumer preferences for sustainable and self-powered devices.

What are the key drivers in the flexible solar panels market?

Rising Demand for Portable Renewable Solutions

As consumers and industries shift toward mobile and off-grid energy, flexible solar panels are becoming the preferred solution. They are lightweight, bendable, and easy to install across unconventional surfaces, making them attractive for vehicles, boats, and camping equipment.

Government Incentives and Policy Support

Global policies such as the U.S. Inflation Reduction Act, EU Green Deal, and China’s renewable capacity expansion programs provide direct subsidies, tax credits, and R&D support. This is lowering entry barriers for manufacturers and encouraging widespread adoption.

Electric Vehicle and Aerospace Integration

The automotive sector is exploring solar integration for electric vehicles (EVs), while aerospace players are adopting lightweight panels for satellites and drones. These applications are not only technologically feasible but also supported by increasing investment into sustainable mobility and defense energy independence.

What are the restraints for the global market?

Lower Efficiency Compared to Crystalline Silicon Panels

Flexible panels typically operate at 10-15% efficiency, compared to over 20% for crystalline silicon. This makes them less competitive in utility-scale projects where land and space efficiency are critical.

High Production and R&D Costs

The manufacturing process for CIGS and OPV technologies remains cost-intensive. Limited economies of scale and the need for continuous innovation result in higher per-watt costs compared to traditional solar panels.

What are the key opportunities in the flexible solar panels industry?

Rural Electrification and Off-Grid Demand

Emerging markets in Africa and the Asia-Pacific are investing heavily in decentralized solar systems. Flexible panels, due to their portability and ease of deployment, are positioned to capture a large share of this market segment.

Consumer Electronics and IoT Integration

Flexible solar technologies can be integrated into wearables, smart devices, and IoT sensors. This offers tech companies a unique opportunity to differentiate their products while enhancing sustainability.

Building-Integrated Photovoltaics (BIPV)

The construction sector is exploring flexible solar integration into rooftops, facades, and urban infrastructure. Governments promoting net-zero buildings are likely to accelerate BIPV adoption, creating a multibillion-dollar market opportunity.

Product Type Insights

CIGS panels dominate the market, accounting for over 38% of the global share in 2024. Their higher efficiency compared to a-Si and CdTe, combined with mechanical flexibility, makes them the preferred choice across industrial and commercial applications. Organic photovoltaics (OPV) are growing fastest, projected to expand at over 20% CAGR, supported by demand from consumer electronics and wearables.

Application Insights

Off-grid applications lead the global market with a 32% share in 2024. These include RVs, boats, portable chargers, and rural electrification projects. The fastest-growing segment is consumer electronics, expected to achieve a CAGR above 18% as solar-integrated devices gain traction among environmentally conscious consumers.

Distribution Channel Insights

Direct sales dominate the market, particularly for industrial and commercial buyers. However, online retail is the fastest-growing channel, driven by demand for portable solar kits, consumer devices, and DIY rooftop installations. Offline specialty distributors remain relevant for large projects requiring EPC expertise.

End-Use Industry Insights

The automotive industry is adopting flexible solar panels in electric vehicles, buses, and trucks to improve energy efficiency. Aerospace and defense applications are also significant, driven by demand for lightweight power sources in drones, satellites, and military equipment. Consumer electronics represent a new frontier, with growth potential exceeding 20% CAGR due to integration in wearables and mobile devices.

| By Product Type | By Application | By End-Use Industry | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds 28% of the market in 2024, with the U.S. leading adoption due to strong policy incentives and a growing EV sector. Canada is witnessing a rising interest in off-grid solar for remote communities.

Europe

Europe accounts for 24% of the market, with Germany, France, and the U.K. at the forefront of BIPV adoption. The EU’s carbon neutrality goals are fostering widespread deployment in commercial buildings.

Asia-Pacific

Asia-Pacific leads the global market with a 35% share in 2024. China dominates manufacturing and demand, while Japan and South Korea are adopting flexible panels for electronics and mobility applications. India’s rural electrification push is expected to create exponential growth opportunities.

Latin America

Latin America is emerging, led by Brazil, Chile, and Mexico. Off-grid rural electrification programs and solar adoption in agriculture are key drivers in this region.

Middle East & Africa

MEA holds a smaller but rapidly growing share, with adoption driven by off-grid energy needs in Sub-Saharan Africa and large-scale infrastructure projects in GCC nations. South Africa is the leading market, supported by a growing solar manufacturing ecosystem.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Note: The above countries are part of our standard off-the-shelf report, we can add countries of your interest

Regional Growth Insights Download Free Sample

Key Players in the Flexible Solar Panels Market

- SunPower Corporation

- First Solar Inc.

- Hanergy Thin Film Power Group

- SoloPower Systems

- Flisom AG

- Heliatek GmbH

- MiaSolé Hi-Tech Corp.

- Global Solar Energy, Inc.

- Alta Devices (part of Hanergy)

- PowerFilm Solar

- Ascent Solar Technologies

- Energy Conversion Devices

- Solar Frontier (Showa Shell Sekiyu K.K.)

- Trina Solar Ltd. (flexible PV division)

- LG Electronics (flexible solar R&D)

Recent Developments

- In July 2025, Heliatek GmbH announced the commercialization of its next-generation organic photovoltaic panels, targeting integration into consumer electronics and wearables.

- In May 2025, SunPower launched a flexible solar product line for RVs and marine applications in North America.

- In March 2025, Hanergy Thin Film Power expanded its CIGS panel manufacturing facility in China, boosting annual output by 25%.

- In January 2025, Flisom AG secured funding for scaling BIPV projects across Europe, integrating flexible panels into commercial building facades.

Frequently Asked Questions

How big is the flexible solar panels market?

According to Deep Market Insights, the global flexible solar panels market size was valued at USD 780 million in 2024 and is projected to grow from USD 903 million in 2025 to reach USD 1,920 million by 2030, expanding at a CAGR of 15.8% during the forecast period (2025-2030).

What are the key opportunities in the market?

Key opportunities include off-grid energy solutions, integration into consumer electronics and IoT devices, and adoption in building-integrated photovoltaics (BIPV) across commercial and residential sectors.

Who are the leading players in the market?

SunPower Corporation, First Solar Inc., Hanergy Thin Film Power Group, SoloPower Systems, Flisom AG, Heliatek GmbH, MiaSolé Hi-Tech Corp., Global Solar Energy, PowerFilm Solar, and Ascent Solar Technologies are the leading global players.

What are the factors driving the growth of the market?

The growth is driven by rising demand for portable and lightweight solar solutions, government renewable energy incentives, electric vehicle and aerospace adoption, and increasing consumer awareness of sustainable energy.

Which are the various segmentation that the market report covers?

The market report is segmented as follows: By Product Type, By Application, By End-Use Industry, By Distribution Channel, By Region.