Flame Retardant Work Clothes Market Size

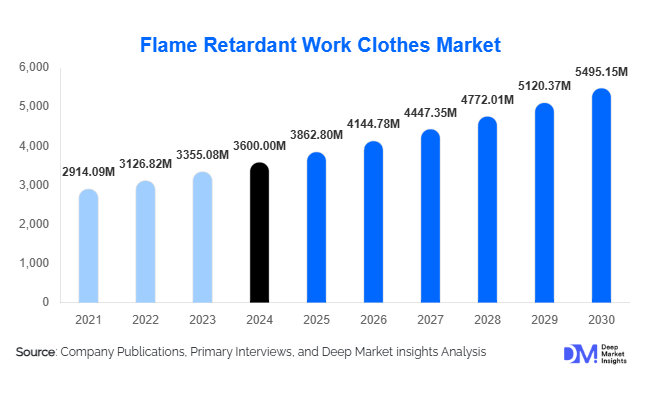

According to Deep Market Insights, the global flame-retardant work clothes market size was valued at USD 3,600 million in 2024 and is projected to grow from USD 3,862.80 million in 2025 to reach USD 5,494.15 million by 2030, expanding at a CAGR of 7.3% during the forecast period (2025–2030). The market growth is primarily driven by the increasing focus on industrial safety standards, rising occupational hazard awareness, and expanding usage across industries such as oil & gas, manufacturing, utilities, and construction.

Key Market Insights

- Growing enforcement of workplace safety regulations globally is compelling employers to adopt certified flame-retardant (FR) protective clothing.

- Oil & gas and mining industries remain dominant end users, accounting for a significant share of FR workwear demand due to high exposure to thermal and flash fire risks.

- Asia-Pacific is emerging as the fastest-growing regional market, led by industrial expansion in China, India, and Southeast Asia.

- Technological innovation in lightweight, breathable, and multifunctional FR fabrics is reshaping user comfort and compliance adoption rates.

- Sustainability trends are promoting the development of eco-friendly and recyclable FR textiles with reduced chemical usage.

Latest Market Trends

Integration of Smart and Functional Textiles

Manufacturers are increasingly integrating advanced technologies such as moisture management systems, antistatic properties, and wearable sensors into FR workwear. These innovations enhance comfort and safety, allowing real-time monitoring of worker conditions in high-risk environments. Smart textiles equipped with temperature and exposure tracking are becoming commercially viable, especially in oilfield and chemical plant operations.

Eco-Friendly FR Fabric Development

Environmental concerns are driving demand for sustainable FR fabrics made from organic cotton, aramid blends, and recycled fibers. Companies are investing in waterless dyeing techniques and bio-based flame-retardant coatings to reduce environmental impact. The shift toward circular textile economies aligns with corporate sustainability goals and regulatory pressures for greener industrial operations.

Market Drivers

Stringent Industrial Safety Standards

Government regulations such as OSHA, NFPA 2112, and EN ISO 11612 mandate flame-resistant protective clothing in hazardous workplaces. Increased compliance requirements in oil & gas, electrical utilities, and welding industries are major catalysts driving adoption. Employers are prioritizing FR apparel as part of broader safety culture initiatives to mitigate fire-related workplace injuries and fatalities.

Expansion of Hazardous Work Environments

Rapid industrialization and infrastructure development in emerging economies are expanding the number of workers exposed to heat, fire, and electrical hazards. The construction boom, energy production, and transportation sectors are fueling continuous demand for durable and certified FR workwear to ensure employee protection and regulatory compliance.

Market Restraints

High Cost of Advanced FR Fabrics

The relatively high production cost of aramid, modacrylic, and treated cotton FR fabrics poses a barrier to market penetration, particularly in developing economies. Small and medium enterprises often delay adoption due to cost constraints, affecting overall market scalability.

Limited Product Awareness in Emerging Regions

Despite regulatory advances, many industries in low- and middle-income countries lack sufficient awareness of the benefits and necessity of FR protective clothing. Training and certification gaps continue to hinder widespread adoption, especially in informal construction and manufacturing sectors.

Market Opportunities

Emergence of Multifunctional Protective Apparel

Demand is rising for protective clothing that combines flame resistance with other properties such as chemical splash protection, arc flash resistance, and antistatic capability. Manufacturers are capitalizing on this trend by introducing multi-hazard solutions to meet the evolving needs of industrial users, particularly in the petrochemical and electrical sectors.

Technological Collaboration and Product Innovation

Strategic collaborations between fabric developers, safety apparel brands, and technology companies are enabling the development of advanced FR garments with enhanced comfort and durability. Adoption of nanotechnology, 3D weaving, and digital prototyping is creating opportunities for performance differentiation and faster market rollouts.

Product Type Insights

Treated cotton fabrics currently dominate due to affordability and wide availability, while inherent FR fibers such as aramid and modacrylic are gaining traction in premium segments for superior durability. Blended fabrics combining comfort and extended protection are expected to witness the fastest growth through 2030.

Application Insights

Oil & gas remains the leading application segment, followed by electrical utilities, manufacturing, and construction. Growing mechanization in these sectors, along with stricter safety audits, is expected to boost product penetration. Mining and chemical processing industries are also emerging as key opportunity areas for FR apparel manufacturers.

Distribution Channel Insights

Offline distribution via industrial suppliers and safety equipment dealers remains dominant. However, online B2B procurement channels are expanding rapidly as companies leverage digital platforms for customized bulk orders and direct-to-operator sales. E-commerce is increasingly favored for small-scale purchases by contractors and SMEs.

| By Fabric Type | By Garment Type | By End-Use Industry | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds a significant market share, driven by strict OSHA and NFPA compliance requirements. The U.S. oil & gas and utility sectors continue to dominate demand, with growing replacement cycles for upgraded protective gear. Technological innovation and sustainability initiatives are further strengthening market maturity.

Europe

Europe is witnessing steady growth supported by workplace safety enforcement and industrial modernization in sectors such as power generation and chemical processing. The region is a frontrunner in adopting sustainable and recyclable FR fabrics, particularly in Western Europe and the Nordic countries.

Asia-Pacific

Asia-Pacific is projected to record the fastest CAGR during 2025–2030, driven by rapid industrialization and rising occupational safety awareness. China, India, and Indonesia are major contributors, with local manufacturers increasingly producing cost-effective FR apparel for domestic and export markets.

Latin America

Brazil and Mexico are leading regional markets due to expanding oil, gas, and mining activities. Government efforts to enhance worker safety and foreign investment in industrial projects are strengthening long-term demand potential.

Middle East & Africa

Gulf countries are experiencing growing demand for FR workwear in oilfield operations and infrastructure development. Africa’s mining and energy projects are also contributing to steady regional adoption, supported by rising foreign investment in extractive industries.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Flame Retardant Work Clothes Market

- DuPont de Nemours, Inc.

- Honeywell International Inc.

- Bulwark FR

- Carhartt, Inc.

- 3M Company

- VF Corporation (Timberland PRO, Dickies)

- Ansell Limited

- TenCate Protective Fabrics

- Lakeland Industries, Inc.

- Portwest Ltd.

Recent Developments

- In September 2025, DuPont announced the launch of its next-generation Nomex® Comfort series, designed for lightweight durability and improved thermal protection in oil & gas applications.

- In July 2025, TenCate Protective Fabrics introduced an eco-engineered FR fabric line made with 50% recycled fibers, targeting sustainable protective workwear production.

- In April 2025, Honeywell expanded its partnership with Middle Eastern oil companies to supply high-performance, multi-hazard FR apparel for refinery workers.