Fishing Gear Market Size

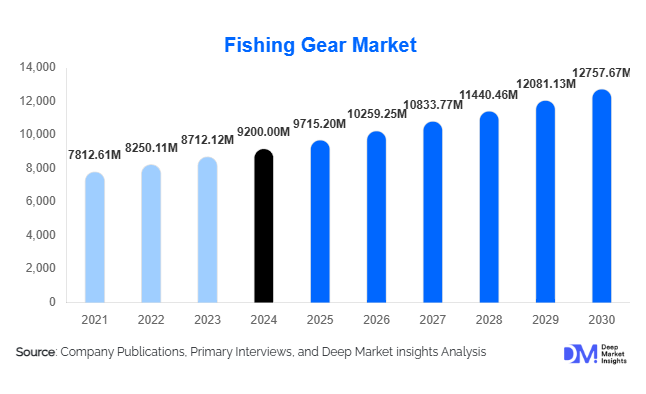

According to Deep Market Insights, the global fishing gear market size was valued at USD 9,200 million in 2024 and is projected to grow from USD 9,715.20 million in 2025 to reach USD 12,757.67 million by 2030, expanding at a CAGR of 5.6% during the forecast period (2025–2030). The fishing gear market growth is primarily driven by the modernization of commercial fleets, rising participation in recreational fishing, rapid aquaculture expansion, and technological advancements in fishfinding electronics and high-performance materials.

Key Market Insights

- Commercial nets and industrial fishing gear dominate market value, reflecting bulk procurement by commercial fisheries and aquaculture operations globally.

- Recreational and angling equipment is premiumizing, with rising demand for rods, reels, lures, and electronic accessories in APAC and LATAM markets.

- Asia-Pacific holds the largest market share (39%), led by China, Japan, India, and Vietnam, due to fleet modernization and aquaculture growth.

- North America (20%) is a major consumer of premium recreational gear, with strong adoption of fishfinders, GPS systems, and high-end tackle.

- Technological integration, including smart fishfinding devices, GPS-enabled equipment, and IoT-enabled fleet management, is reshaping both commercial and recreational fishing gear usage.

- Regulatory trends and sustainability initiatives are driving demand for selective gear, biodegradable nets, and environmentally friendly solutions.

Latest Market Trends

Technological Advancements in Fishing Gear

Fishing gear manufacturers are increasingly integrating technology into both commercial and recreational products. Modern fishfinders, sonar systems, GPS-based navigation tools, and integrated IoT devices enhance operational efficiency for commercial fleets and improve the recreational fishing experience. Subscription-based software for fleet management, catch logging, and predictive analytics is emerging as a high-margin, recurring revenue stream. Additionally, premium rods, reels, and lines now incorporate advanced composites, corrosion-resistant coatings, and high-modulus synthetic fibers, enabling longer lifespan and improved performance.

Sustainability and Regulatory Compliance Driving Gear Innovation

Governments and regulatory agencies worldwide are enforcing bycatch reduction, traceability, and selective fishing requirements. This is creating a surge in demand for eco-friendly and selective fishing gear. Biodegradable nets, escape panels, and specialized aquaculture systems are gaining traction, particularly in regions such as Europe, North America, and APAC. Compliance-focused innovations not only reduce ecological impact but also provide market access advantages, as certified gear is often required for exports to environmentally conscious regions.

Fishing Gear Market Drivers

Commercial Fleet Modernization

Fleet upgrades in emerging and developed markets are driving demand for high-performance nets, winches, hydraulic gear, and electronic devices. Modernized fleets improve operational efficiency, fuel consumption, and catch rates, creating higher-value procurement opportunities for equipment manufacturers. Government subsidies and fleet renewal programs in APAC and LATAM are further fueling commercial demand.

Recreational Fishing Growth

Rising disposable incomes, urban leisure trends, and tourism-driven angling are boosting demand for recreational fishing gear. High-end rods, reels, lures, and electronics cater to premium segments, while entry-level and mid-range products expand accessibility. APAC and LATAM are the fastest-growing markets in recreational segments due to an expanding middle class and rising angler participation.

Aquaculture Expansion

Global aquaculture is one of the fastest-growing sources of seafood, driving demand for specialized nets, cage systems, mooring gear, and feed-handling equipment. Countries such as China, Vietnam, Brazil, and Chile are investing heavily in aquaculture infrastructure, creating a strong and recurring B2B demand pipeline for fishing gear manufacturers.

Market Restraints

Raw Material Price Volatility

Price fluctuations in high-modulus polyethylene, nylon, fluorocarbon fibers, and steel components affect profitability, particularly for commercial net and line manufacturers. Supply chain disruptions can lead to delayed deliveries, inventory challenges, and cost pressures.

Regulatory & Sustainability Compliance Costs

Compliance with bycatch reduction, gear traceability, and environmental standards increases R&D and certification expenses. Small players face higher entry barriers, and existing manufacturers may experience longer product development cycles and increased operational costs.

Fishing Gear Market Opportunities

Tech-Enabled Gear & Electronics Retrofits

Integration of fishfinders, sonar, GPS navigation, and IoT devices in commercial and recreational gear offers high-margin growth opportunities. Fleet management solutions and subscription-based analytics provide recurring revenue streams. Advanced electronics and digital monitoring systems are increasingly sought after in modernized fleets and premium recreational segments.

Sustainable and Selective Gear Design

Selective nets, biodegradable materials, and bycatch reduction devices cater to environmentally regulated markets. Governments, NGOs, and certified seafood buyers are willing to pay premiums for eco-compliant gear, opening new revenue opportunities for manufacturers that invest in sustainable product development.

Emerging APAC & LATAM Recreational Markets

Rising middle-class wealth and recreational angler participation in China, India, Vietnam, Brazil, and Mexico are expanding the demand for premium rods, reels, lures, and accessories. Local manufacturing and regional assembly reduce logistics costs and accelerate market penetration for new entrants.

Product Type Insights

Commercial nets dominate market value due to bulk procurement by industrial fisheries and aquaculture operations. Rods and reels represent the largest share in recreational segments, while electronic accessories and synthetic fiber-based lines are premiumized products with higher margins. Traps, pots, and specialized aquaculture equipment constitute high-value niche segments, especially in APAC and LATAM.

Application Insights

Marine offshore and coastal applications account for the majority of market value (65%), driven by commercial fleet operations and aquaculture cage systems. Freshwater recreational angling is growing rapidly in APAC and LATAM, fueled by tourism, leisure activities, and social media trends. Aquaculture applications are a high-growth segment for cage nets, mooring, and feed-handling gear.

Distribution Channel Insights

Specialist retail and brick-and-mortar stores remain dominant for recreational gear (40%), offering personalized service, fitting, and premium brand experiences. Online marketplaces are rapidly gaining share, particularly for electronics and consumer-level tackle. Commercial gear is largely distributed via B2B contracts, government tenders, and OEM agreements, while aquaculture systems are often procured directly from manufacturers or specialized distributors.

End-User Insights

Commercial fisheries account for 58% of the 2024 market, followed by recreational anglers and aquaculture buyers. Aquaculture and recreational segments are the fastest-growing due to expanding fleets, leisure participation, and high-value product adoption. Government and research agencies constitute a smaller but strategically important segment.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds 20% of the global market, led by the U.S. and Canada. Strong recreational fishing participation, premium electronics adoption, and well-established commercial fleets drive demand. Mexico is emerging as a fast-growing market for fleet modernization and recreational fishing.

Europe

Europe accounts for 18% of the market, with Norway, Spain, France, and the U.K. leading commercial and recreational gear consumption. Sustainability-driven regulations and high-value fleet upgrades shape procurement. Eastern Europe shows faster growth in modernization-driven commercial purchases.

Asia-Pacific

APAC is the largest regional market (39%), with China, Japan, India, and Vietnam leading both commercial and recreational demand. Fleet modernization, aquaculture expansion, and growing middle-class leisure fishing contribute to rapid growth. Vietnam and India are the fastest-growing countries in the region.

Latin America

LATAM accounts for 12%, led by Brazil, Peru, Chile, and Mexico. Strong export-oriented fisheries, recreational participation, and aquaculture development drive growth. Brazil and Peru are the fastest-growing countries in the region.

Middle East & Africa

MEA holds 11% of the market. Coastal fisheries, aquaculture expansion in Egypt, and specialized commercial procurement in South Africa are key drivers. The Gulf States are emerging as a premium recreational market.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Fishing Gear Market

- Shimano Inc.

- Globeride, Inc.

- Pure Fishing

- Rapala VMC Corporation

- Gamakatsu Co., Ltd.

- Mustad

- Okuma Corporation

- Toray Industries, Inc.

- Cortland Line Company

- Momoi Fishing Line Co., Ltd.

- Teijin Limited

- Van Staal

- Garmin (Marine Electronics)

- AEGIS / Engineered Net Suppliers

- Regional OEM Net Manufacturers (APAC & LATAM)

Recent Developments

- In May 2025, Shimano launched a new series of high-strength rods and reels with advanced composite materials targeting APAC recreational markets.

- In April 2025, Rapala introduced smart lures integrated with Bluetooth sensors for performance tracking, targeting premium anglers in North America and Europe.

- In February 2025, Toray Industries expanded production of ultra-high-modulus polyethylene fibers for commercial nets and aquaculture cages in Vietnam and India.