Firefighting Glove Market Size

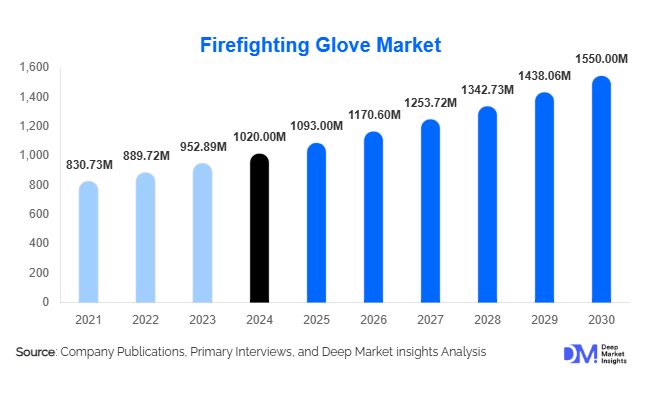

According to Deep Market Insights, the global firefighting glove market size was valued at USD 1,020 million in 2024 and is projected to grow from USD 1,093 million in 2025 to reach USD 1,550 million by 2030, expanding at a CAGR of 7.1% during the forecast period (2025–2030). The market growth is primarily driven by increasing demand for advanced personal protective equipment (PPE), rising urbanization and industrial activities, and stricter government regulations for fire safety and emergency response services worldwide.

Key Market Insights

- Municipal fire departments remain the largest end-users, driving procurement of structural firefighting gloves that meet stringent safety standards.

- Technological innovations in materials such as Nomex, Kevlar, and PBI are enhancing the heat resistance, durability, and ergonomic design of firefighting gloves.

- North America dominates the market, led by high adoption rates in the U.S. and Canada due to strict OSHA and NFPA compliance requirements.

- Asia-Pacific is the fastest-growing region, fueled by rapid industrialization, urban expansion, and emerging municipal fire services in China and India.

- Export opportunities are expanding to emerging markets in Africa, Latin America, and the Middle East, where local production of advanced gloves is limited.

- Technological integration with features such as touchscreen compatibility, anti-vibration materials, and ergonomic designs is reshaping product offerings and improving firefighter efficiency.

Latest Market Trends

Advanced Material Adoption

Firefighting gloves are increasingly being manufactured with advanced heat-resistant materials such as Nomex, Kevlar, and PBI to enhance protection against high temperatures, flames, and hazardous chemicals. This trend is being driven by stricter safety regulations and the need for durable, lightweight gloves that allow better dexterity. Manufacturers are investing heavily in research and development to develop gloves with multi-layer protection, moisture-wicking liners, and reinforced grips for rescue operations. Demand for gloves that comply with NFPA, EN 659, and ISO standards is shaping production trends, particularly for municipal and industrial fire services globally.

Technology-Enhanced Gloves

Emerging technologies are being integrated into firefighting gloves to improve operational safety and functionality. Gloves with touchscreen-compatible fingertips, anti-vibration padding for rescue work, and improved grip materials are increasingly preferred. Some companies are exploring smart gloves equipped with sensors for heat detection or real-time communication with command centers. These innovations appeal to municipal, industrial, and military fire units seeking high-performance protective gear that enhances safety and efficiency in critical operations.

Firefighting Glove Market Drivers

Stringent Safety Regulations

Rising global and regional regulations on firefighter safety are compelling municipal and industrial fire services to adopt advanced gloves. Agencies are required to comply with standards such as NFPA 1971 and EN 659, creating a steady demand for certified gloves. Government procurement programs, particularly in North America and Europe, are driving continuous purchases and upgrades to ensure compliance and safety for frontline personnel.

Industrialization and Urbanization

Rapid urban expansion and industrialization in Asia-Pacific, Latin America, and the Middle East have increased fire-related risks in residential, commercial, and industrial settings. Consequently, fire departments and industrial fire brigades are upgrading personal protective equipment, particularly gloves, to improve operational safety. High-growth construction sectors and oil & gas facilities are contributing to consistent demand for heat-resistant and durable gloves.

Technological Advancements in Materials

Innovations in materials like Nomex, Kevlar, and PBI are allowing gloves to withstand higher temperatures, resist chemical exposure, and offer ergonomic comfort. These advanced gloves enable firefighters to perform operations more safely and efficiently. Manufacturers are also focusing on combining multiple fabrics to optimize both flexibility and protection, attracting end-users seeking premium solutions.

Market Restraints

High Cost of Advanced Gloves

Premium firefighting gloves are expensive due to the high cost of advanced materials and multi-layer construction. This cost barrier limits adoption in smaller municipalities or budget-constrained industrial units, particularly in emerging economies. While safety is critical, budget limitations can slow market penetration for high-end gloves.

Dependence on Raw Material Availability

Availability of specialized materials such as Kevlar, Nomex, and PBI is limited, and fluctuations in raw material prices can impact production costs. Manufacturers must manage supply chain constraints and pricing pressures to maintain profitability and ensure continuous supply for global customers.

Firefighting Glove Market Opportunities

Government Safety Initiatives

Government initiatives for firefighter safety, occupational health, and emergency preparedness are creating new procurement opportunities. Programs to modernize municipal fire departments, industrial safety regulations, and defense safety protocols are driving demand for certified gloves. Emerging markets are particularly poised for growth as governments invest in protective equipment for newly formed fire services.

Technological Innovation and Product Development

Integration of cutting-edge materials and ergonomic designs presents opportunities for differentiation. Gloves featuring touchscreen compatibility, anti-vibration padding, and enhanced grip provide superior performance. Smart gloves with heat detection sensors or real-time monitoring can capture premium market segments, particularly in defense and industrial fire units.

Growth in Industrial and Urban Fire Services

Rapid industrialization and urbanization in the Asia-Pacific and Latin America are expanding the market for industrial and municipal firefighting gloves. Rising awareness about occupational safety, coupled with mandatory protective gear standards, is boosting glove demand. Private security firms and large infrastructure projects are also emerging as niche applications for advanced firefighting gloves.

Product Type Insights

Gauntlet-style gloves dominate the market due to their extended wrist protection and seamless integration with turnout jackets. Structural firefighting gloves are the largest segment, required for municipal and urban fire services. Wildland gloves are gaining traction in regions with forest fire risks, while technical gloves and rescue gloves serve niche industrial, defense, and emergency applications.

Application Insights

Municipal fire departments account for the majority of global demand, representing 60% of the market. Industrial fire services in oil & gas, chemical, and manufacturing sectors are growing rapidly, driven by stringent safety regulations. Emerging applications include private security, airports, and large construction sites where on-site firefighting capability is critical. Export-driven demand from developed regions to emerging markets is also contributing to market expansion.

Distribution Channel Insights

Direct sales dominate the market, particularly for municipal and industrial clients procuring certified gloves in bulk. Retail and offline stores serve smaller clients and individual purchases, while e-commerce platforms are increasingly used for convenience, especially in regions with emerging safety awareness. Manufacturers are leveraging digital channels for direct marketing and bulk orders, enhancing penetration in both developed and emerging markets.

End-User Insights

Municipal fire departments represent the largest end-users, followed by industrial fire services, defense, and private security sectors. Municipal clients show recurring procurement cycles due to wear and replacement needs. Industrial end-users are adopting specialized gloves for chemical resistance and high-temperature operations, particularly in Asia-Pacific and North America. The defense sector is gradually increasing the adoption of multi-functional gloves for rescue and combat applications.

| By Product Type | By Material | By Type | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America dominates the firefighting glove market, accounting for 32% of the global share in 2024. High adoption is driven by regulatory compliance, large municipal budgets, and advanced industrial safety programs. The U.S. leads demand, followed by Canada, due to well-established fire safety standards and investment in industrial PPE.

Europe

Europe accounts for 28% of the global market, with Germany, the U.K., and France leading adoption. Stringent safety standards, combined with industrial fire safety initiatives, drive consistent demand. European markets are also early adopters of innovative glove materials and smart technologies, supporting premium segment growth.

Asia-Pacific

Asia-Pacific is the fastest-growing region due to rapid industrialization, urbanization, and emerging municipal fire services. China and India are key markets, driven by new infrastructure projects and growing occupational safety awareness. Japan, South Korea, and Australia also contribute steady demand, particularly for premium gloves in industrial and urban firefighting applications.

Latin America

Brazil and Argentina are emerging markets, with growth driven by industrial safety investments and urban fire services. Adoption remains lower than in developed regions, but increasing awareness and government procurement programs are expanding market potential.

Middle East & Africa

UAE, Saudi Arabia, and South Africa are leading markets, particularly for industrial and municipal applications. Regional growth is supported by government infrastructure investments, oil & gas industry safety programs, and urban fire service expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Firefighting Glove Market

- Honeywell International Inc.

- Ansell Limited

- Lakeland Industries

- MSA Safety Incorporated

- Globe Manufacturing Company

- Ironclad Performance Wear

- Morning Pride Manufacturing

- Safety Gloves International

- Portwest Ltd.

- PBI Performance Products

- Bullard

- Drägerwerk AG & Co. KGaA

- KCL GmbH

- DuPont Personal Protection

- Bristol Uniforms

Recent Developments

- In May 2025, Lakeland Industries launched a new line of lightweight, touchscreen-compatible structural firefighting gloves for municipal departments in North America.

- In April 2025, MSA Safety Incorporated introduced a multi-layer Kevlar/Nomex industrial glove for oil & gas operations in APAC.

- In February 2025, Honeywell International Inc. expanded its European production capacity for PBI gloves to meet rising demand in municipal and industrial firefighting services.