Firefighter Clothing Market Size

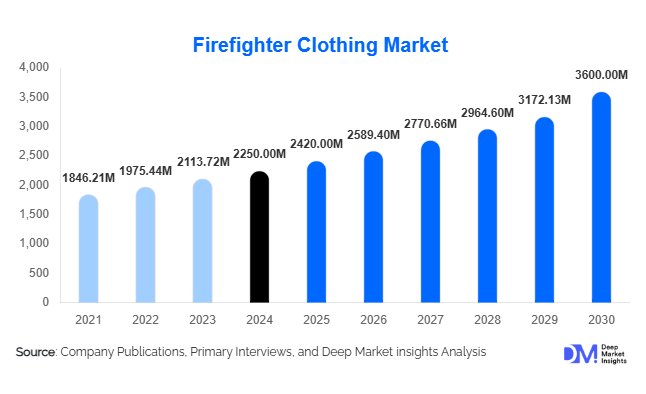

According to Deep Market Insights, the global firefighter clothing market size was valued at USD 2,250 million in 2024 and is projected to grow from USD 2,420 million in 2025 to reach USD 3,600 million by 2030, expanding at a CAGR of 7.0% during the forecast period (2025–2030). The market growth is primarily driven by increasing regulatory mandates for firefighter safety, rising incidences of urban and wildland fires, growing adoption of smart textiles and embedded sensor technologies, and expansion of industrial firefighting services across emerging economies.

Key Market Insights

- Turnout/bunker suits dominate the product landscape, forming the core of structural firefighting ensembles and accounting for nearly 45–50% of market revenue due to mandatory safety compliance and periodic replacement cycles.

- Aramid-based fabrics remain the most widely used material, valued for superior flame resistance, durability, and compliance with global standards like NFPA and EN, driving adoption in both developed and emerging regions.

- North America leads the market in value, owing to high investments in fire safety infrastructure, stringent regulations, and frequent wildland fire incidents, with the U.S. as the largest contributor.

- Asia-Pacific is the fastest-growing region, fueled by urbanization, industrial expansion, and rising government expenditure on firefighter safety programs in countries such as China and India.

- Technological integration is reshaping protective clothing, with smart textiles, embedded sensors, moisture management, and ergonomic design improving firefighter safety and operational efficiency.

Latest Market Trends

Smart and Sensor-Enabled Firefighter Gear

Firefighter clothing is increasingly integrating smart technologies to enhance safety and operational efficiency. Garments equipped with temperature, heart rate, and environmental sensors provide real-time monitoring for heat stress, toxic gas exposure, and firefighter location during emergencies. IoT-enabled PPE solutions are gaining traction, particularly in North America and Europe, offering early hazard warnings and enabling data-driven decision-making. This trend not only improves individual safety but also facilitates coordinated firefighting operations by transmitting critical information to command centers.

Lightweight and Sustainable Materials

There is a growing emphasis on reducing the weight of protective clothing without compromising performance. Innovations include aramid blends, composite fabrics, and advanced moisture-barrier layers that provide thermal protection while enhancing comfort and mobility. Sustainability is also becoming a priority, with manufacturers developing recyclable fabrics and self-decontaminating materials to minimize environmental impact. This aligns with increased regulatory scrutiny on firefighter health and environmental responsibility, particularly in Europe and North America.

Firefighter Clothing Market Drivers

Regulatory Compliance and Safety Standards

Stringent standards such as NFPA 1971, EN 469, and ISO regulations mandate high-performance protective gear for structural and industrial firefighting. Fire departments and industrial operators are required to procure compliant garments, driving consistent demand for certified turnout suits, gloves, helmets, and boots. The regulatory environment ensures continuous replacement cycles and adoption of upgraded materials, supporting market growth globally.

Rising Incidences of Urban and Wildland Fires

Increasing urbanization, climate change, and industrialization have led to more frequent and severe fire incidents worldwide. Wildland fires, particularly in North America, Australia, and parts of Europe, have surged, necessitating specialized protective gear. Industrial sectors such as oil & gas, chemicals, and manufacturing are also investing heavily in firefighter clothing to mitigate operational risks, further expanding market demand.

Focus on Firefighter Health and Ergonomics

Fire departments are increasingly aware of long-term health risks, including heat stress, musculoskeletal injuries, and exposure to toxic substances. Demand for ergonomic, lightweight, and moisture-managing clothing is rising, leading manufacturers to innovate with advanced materials, modular designs, and comfort-enhancing features. This trend improves the adoption of premium gear, particularly in developed markets where health and safety budgets are prioritized.

Market Restraints

High Cost of Advanced Materials

Premium firefighter clothing with aramid, PBI fibers, and smart sensor integration comes at a high cost. This limits widespread adoption in cost-sensitive regions, especially in developing countries where municipal and industrial budgets are constrained. Price pressure can slow down market growth for high-performance products.

Maintenance and Lifecycle Challenges

Firefighter clothing requires regular maintenance, cleaning, and periodic replacement, which can be operationally complex and expensive. Procurement delays, supply chain disruptions, and logistical challenges further restrict timely adoption, particularly in emerging markets. Departments may operate with aging gear due to budget or administrative limitations, posing a restraint to growth.

Firefighter Clothing Market Opportunities

Smart Textiles and Embedded Sensor Integration

There is a growing opportunity for manufacturers to develop garments with real-time monitoring and safety alerts. Integration of IoT devices, wearable sensors, and environmental hazard detection can significantly enhance firefighter safety. Both new entrants and established players can leverage these technologies to differentiate products, gain regulatory approval advantages, and enter premium market segments.

Emerging Market Expansion

Asia-Pacific, Latin America, and the Middle East regions are experiencing rapid urbanization, industrial growth, and increasing government expenditure on fire safety. This creates opportunities for mid-tier and premium firefighting clothing suppliers to supply compliant gear for municipal and industrial applications. Collaborations with local manufacturers, government tenders, and regional partnerships can accelerate penetration in these fast-growing markets.

Product Type Insights

Turnout / bunker suits dominate the product landscape, accounting for roughly 45–50% of market revenue. These garments provide mandatory structural protection and are central to every firefighter ensemble. Replacement cycles, regulatory mandates, and increasing adoption of advanced materials drive their dominance. Gloves, boots, helmets, and accessories collectively represent significant volume but contribute less to revenue compared to full suits. Trends indicate a move toward modular and ergonomic designs with improved thermal and moisture barrier performance.

Application Insights

Municipal fire departments remain the largest end-use segment, representing approximately 50–60% of demand in 2024. Industrial firefighting, wildland fire services, and military applications are growing rapidly, driven by industrialization, climate change-related wildfires, and specialized fire risks. Industrial users, particularly in oil & gas and chemicals, are investing in high-performance gear for worker safety, creating premium product opportunities. Emerging applications include offshore/marine firefighting and airport crash/rescue services, which require specialized protective clothing.

Distribution Channel Insights

Direct sales to fire departments and industrial clients dominate the market, ensuring regulatory compliance and customized procurement. Specialist PPE distributors and dealers provide reach in regions lacking centralized procurement systems. E-commerce and online platforms are emerging as complementary channels, enabling smaller departments and new entrants to access certified products. OEM partnerships and government tender-based channels are also critical in high-volume deployments.

End-User Insights

Municipal fire departments are the primary buyers due to regulatory mandates, replacement cycles, and standardized procurement. Industrial clients, particularly in oil & gas, chemicals, and manufacturing, are increasingly investing in protective clothing to comply with workplace safety regulations. Wildland firefighting services, especially in North America and Australia, are experiencing high growth due to climate-driven wildfire activity. Military and airport fire services represent niche but high-value segments requiring specialized clothing.

| By Product Type | By Material Type | By End-Use Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads the market with a 35–40% share in 2024. The U.S. dominates due to large municipal fire departments, high replacement cycles, stringent NFPA regulations, and frequent wildland fire incidents. Canada also contributes significantly, particularly for wildland gear. Demand is primarily for premium turnout suits and advanced materials, with smart PPE adoption accelerating growth.

Europe

Europe accounts for 25–30% of the global market, with Germany, the UK, France, and Italy as major contributors. Strong EN standards, industrial safety regulations, and sustainability initiatives drive demand for high-performance and environmentally friendly firefighter clothing. Eastern Europe and Scandinavia are witnessing higher growth rates due to modernization efforts and updated safety standards.

Asia-Pacific

Asia-Pacific is emerging as the fastest-growing region, with China, India, Japan, South Korea, and Australia driving demand. Rapid urbanization, industrialization, and government investment in fire safety infrastructure support growth. China and India are key markets for mid-tier and premium products, while Australia focuses on wildland firefighting gear.

Latin America

Latin America contributes 5–10% of the market, led by Brazil, Mexico, and Argentina. Industrial growth and urban expansion are driving demand for firefighter clothing, primarily for municipal and industrial applications. Outbound imports from North America and Europe supplement the local supply.

Middle East & Africa

The region holds 5–8% of the market, with the GCC countries and South Africa leading demand. Oil & gas industry safety requirements, high disposable income, and government-led modernization programs are key drivers. Premium imports dominate due to limited local manufacturing capabilities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Firefighter Clothing Market

- MSA Safety

- Honeywell International Inc.

- Globe Manufacturing Company LLC

- DuPont de Nemours, Inc.

- 3M Company

- Lion Apparel

- Lakeland Industries

- Rosenbauer International

- VIKING Life-Saving Equipment

- Drägerwerk AG

- PGI Inc.

- Sioen NV

- TEXPORT GmbH

- TenCate Protective Fabrics

- Ansell Limited

Recent Developments

- In April 2025, MSA Safety launched a new range of smart turnout suits with embedded heat and moisture sensors for U.S. municipal fire departments.

- In March 2025, Honeywell International introduced lightweight, modular bunker suits for industrial firefighting applications in Europe and Asia-Pacific.

- In February 2025, Globe Manufacturing expanded its production facilities in India to serve the growing demand for mid-tier firefighter clothing in emerging Asian markets.