Fine Mist Sprayers Market Size

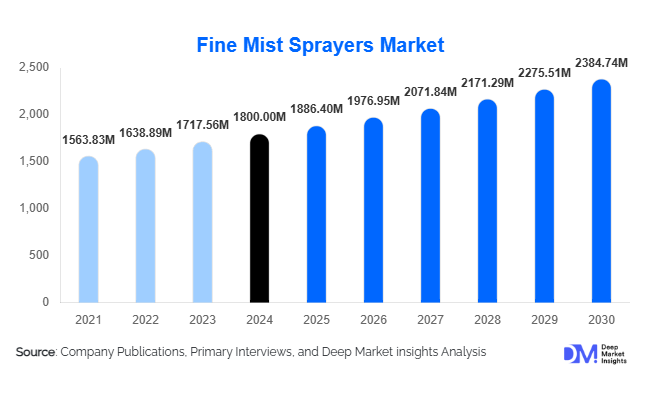

According to Deep Market Insights, the global fine mist sprayers market size was valued at USD 1,800 million in 2024 and is projected to grow from USD 1,886.40 million in 2025 to reach USD 2,384.74 million by 2030, expanding at a CAGR of 4.8% during the forecast period (2025–2030). The market’s steady growth is primarily driven by the rising demand for convenient, precision-based dispensing solutions across personal care, cosmetics, household cleaning, healthcare, and agricultural applications.

Key Market Insights

- Personal care and cosmetics lead market demand, accounting for over 50% of the global fine mist sprayers market in 2024.

- Asia-Pacific is the fastest-growing regional market, driven by rapid industrialization, urbanization, and rising disposable incomes in China and India.

- Plastic sprayers dominate the material type, representing nearly 68% of the total market due to cost efficiency and mass availability.

- Perfume and deodorant applications hold the largest share, accounting for approximately 47% of the global market.

- Technological innovation in nozzle design and eco-friendly materials is shaping competitive differentiation and premiumization in packaging.

- The top five players collectively control 40–50% of the global market, highlighting moderate consolidation and intense competition for innovation leadership.

Latest Market Trends

Sustainable and Eco-Friendly Packaging

Growing global awareness of plastic waste is accelerating the adoption of sustainable packaging solutions in fine mist sprayers. Manufacturers are increasingly shifting toward recyclable plastics, post-consumer recycled (PCR) materials, aluminum components, and refillable spray systems. Luxury cosmetic brands are collaborating with sprayer producers to develop aesthetically refined, eco-conscious packaging. This trend is reshaping product differentiation and aligns with the global transition toward circular economy practices and extended producer responsibility (EPR) frameworks.

Smart and Technologically Advanced Sprayers

Fine mist sprayer manufacturers are investing in technology that improves performance, user convenience, and sustainability. Advanced nozzle systems enabling ultra-fine atomization, adjustable spray patterns, and low-resistance pumping mechanisms are gaining traction. The integration of sensor-based or IoT-enabled sprayers for medical and industrial applications is emerging. These innovations enhance dosage accuracy, reduce waste, and appeal to the premium end of the market, particularly in healthcare and professional cosmetics.

Fine Mist Sprayers Market Drivers

Expanding Personal Care and Cosmetic Consumption

Global demand for skincare, haircare, and fragrance products continues to surge, directly fueling the consumption of fine mist sprayers. Premiumization trends and the rise of travel-friendly, compact packaging formats have strengthened sprayer adoption. Increasing product launches in beauty and grooming categories worldwide further support market expansion.

Post-Pandemic Hygiene and Home Care Growth

The COVID-19 pandemic triggered lasting behavioral shifts toward enhanced hygiene and cleanliness. Fine mist sprayers have become essential components for disinfectant and surface cleaning products, providing controlled distribution and user-friendly operation. The shift from aerosols to non-pressurized mist dispensers for household and public sanitation drives ongoing demand growth.

Technological and Material Innovations

Continuous innovations in materials and design, such as precision-engineered nozzles and ergonomic trigger systems, are improving user experience. Manufacturers are focusing on lightweight, durable plastics, refillable containers, and improved mist dispersion technologies. These innovations enhance product aesthetics, environmental compliance, and brand differentiation.

Market Restraints

Raw Material Price Volatility

Fluctuations in polymer and metal prices significantly impact production costs for fine mist sprayers. Rising resin costs, energy expenses, and supply-chain disruptions strain manufacturer margins. Additionally, evolving environmental regulations restricting certain plastics introduce compliance and cost challenges.

Market Saturation in Developed Economies

In mature markets such as North America and Europe, saturation in personal care and home cleaning products limits volume growth. Competition in the basic plastic sprayer segment is intense, leading to commoditization and pricing pressure. Growth opportunities, therefore, depend on product innovation and entry into emerging regional markets.

Fine Mist Sprayers Market Opportunities

Sustainable Product Development

The transition toward environmentally responsible packaging is creating new value pools. Companies investing in recyclable, refillable, and biodegradable sprayer solutions are likely to capture regulatory and consumer-driven opportunities. Partnerships between packaging manufacturers and sustainability-focused brands are becoming a key strategy for differentiation.

Emerging Regional Demand

Rapid growth in personal care and hygiene product consumption across Asia-Pacific, Latin America, and the Middle East is expanding the global market footprint. Rising disposable incomes, urbanization, and local manufacturing initiatives such as “Make in India” and “Made in China 2025” enhance domestic sprayer production and export potential.

Smart and Precision Sprayer Systems

The evolution of smart packaging, incorporating IoT and sensor-based mist dispensers, presents opportunities in healthcare, agriculture, and industrial maintenance. Fine mist sprayers capable of dosage control, adjustable spray intensity, and remote monitoring can create premium sub-segments for advanced applications.

Product Type Insights

Pump/Fingertip sprayers dominate the market, accounting for nearly 55% of global revenue in 2024. Their popularity stems from their broad adoption in cosmetics, personal care, and perfume packaging. Compact designs, precise spray patterns, and ergonomic usability have made them the preferred choice for both manufacturers and consumers. Trigger sprayers follow, primarily used in home-care applications such as cleaning and disinfection, while continuous and aerosol sprayers serve niche industrial and professional uses.

Material Insights

Plastic sprayers represent around 68% of the total market value in 2024 due to affordability, lightweight properties, and scalability in mass production. However, rising environmental scrutiny is driving rapid growth in metal and hybrid material sprayers, especially within luxury cosmetics and reusable packaging lines. These sustainable alternatives are expected to gain market share over the forecast period.

Application Insights

Perfumes and deodorants dominate application demand, contributing approximately 47% of the total market value in 2024. Fine mist sprayers provide consistent atomization, critical for fragrance performance and user experience. Household cleaning and sanitization applications are expanding steadily, while pharmaceutical and agricultural uses are emerging as high-growth niches driven by the demand for fine droplet precision and hygienic dispensing.

End-Use Industry Insights

The personal care and cosmetics industry accounted for over 52% of global market demand in 2024. This segment’s expansion is supported by premiumization trends and growing middle-class consumption globally. The healthcare and pharmaceutical segment is the fastest-growing, with increasing use of fine mist sprayers in nasal sprays, disinfectants, and topical medications. The home care industry continues to contribute significant demand through cleaning and air freshener products.

| By Product Type | By Material Type | By Application | By Distribution Channel | By End-Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounted for roughly 38% of the global fine mist sprayers market in 2024. The region’s dominance is supported by established personal care brands, a robust home-cleaning industry, and innovation in premium packaging. The U.S. leads regional consumption, with steady replacement demand and early adoption of sustainable materials.

Europe

Europe holds approximately 23% of the global market share in 2024. Demand is driven by regulatory emphasis on recyclable packaging and strong luxury cosmetic manufacturing in France, Germany, and the U.K. European brands are increasingly partnering with sprayer producers to develop sustainable, refillable solutions aligned with EU circular economy goals.

Asia-Pacific

Asia-Pacific commands around 30% market share and is the fastest-growing region, expected to grow at 7–9% annually. China is a key manufacturing hub for global exports, while India is emerging as a high-growth consumption market. Expanding domestic production capacity and government initiatives promoting local packaging manufacturing are reinforcing the region’s dominance in supply and demand.

Latin America

Latin America contributes about 6% of the global market share, led by Brazil and Mexico. Increasing urbanization and consumer demand for hygiene and beauty products are driving regional growth, though reliance on imports for sprayer components remains high.

Middle East & Africa

The MEA region holds a modest share ( 5%) but is experiencing rising demand in GCC nations, particularly the UAE and Saudi Arabia. Growth is supported by increasing consumption of premium cosmetics and home-care products. South Africa remains a key hub for regional distribution and packaging assembly.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top 15 Companies in the Global Fine Mist Sprayers Market

- AptarGroup Inc.

- Silgan Holdings Inc.

- Albea S.A.

- Coster Tecnologie Speciali S.p.A.

- Precision Valve Corporation

- Rieke Packaging Systems

- Goldrain Industrial Co., Ltd.

- Sun-Rain Packaging Co., Ltd.

- Yuyao Shunlong Sprayer Co., Ltd.

- XJT Packaging Co., Ltd.

- Venlo Group B.V.

- Napla Co., Ltd.

- Nuobang Plastic Industries Co., Ltd.

- Chong Woo Packaging Co., Ltd.

- Zhejiang JM Industry Co., Ltd.

Recent Developments

- In May 2025, AptarGroup launched a new PCR-plastic fine mist sprayer line targeted at luxury cosmetic brands, aiming for 30% recycled content integration.

- In April 2025, Silgan Holdings expanded its China facility to boost local manufacturing capacity and reduce lead times for Asian customers.

- In February 2025, Albea introduced a metal-collar refillable perfume sprayer series for European luxury brands, enhancing premium sustainable packaging options.