Field Hockey Equipment Market Size

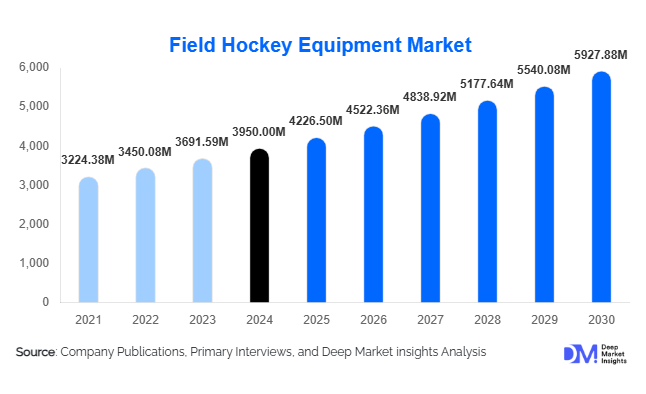

According to Deep Market Insights, the global field hockey equipment market size was valued at USD 3,950 million in 2024 and is projected to grow from USD 4,226.50 million in 2025 to reach USD 5,927.88 million by 2030, expanding at a CAGR of 7% during the forecast period (2025–2030). The market growth is primarily driven by increasing adoption of advanced composite hockey sticks, rising participation in professional and youth leagues, expansion of school and club-level hockey programs, and growing awareness regarding fitness and team sports globally.

Key Market Insights

- Composite and high-performance sticks dominate equipment sales, offering lightweight designs and enhanced durability, preferred by both professional and youth players.

- Online retail channels are rapidly expanding, allowing amateur and club-level players easier access to a wide variety of global brands and products.

- Europe and APAC are major markets, with countries like the Netherlands, Germany, India, and Australia leading demand due to established leagues and growing grassroots programs.

- Technological integration in equipment, including sensors in sticks and ergonomic protective gear, is gaining traction among professional teams and academies.

- Youth and women’s hockey programs are emerging as key growth drivers, leading to increased demand for age- and gender-specific equipment.

- Export-driven demand is strengthening, with manufacturers from the Netherlands, India, and Australia exporting to countries with developing hockey infrastructure.

What are the latest trends in the field hockey equipment market?

Shift Toward Composite and Smart Equipment

Manufacturers are increasingly focusing on lightweight, durable composite sticks and ergonomic protective gear. Smart sticks embedded with sensors for performance tracking and data analytics are gaining popularity among elite players and academies. This trend is driving innovation, enhancing training outcomes, and providing a competitive edge for professional teams. Adoption of synthetic turf-specific footwear and customizable grip technologies is also increasing, improving player comfort and game efficiency.

Growth in Youth and Women’s Hockey Programs

Grassroots initiatives and school-level hockey programs are contributing to rising participation in youth hockey. Similarly, women’s hockey is gaining prominence in Europe, North America, and APAC, stimulating demand for gender-specific equipment. Manufacturers are now producing sticks, footwear, and protective gear tailored for younger and female players, addressing performance needs while maintaining affordability. This trend is expected to strengthen long-term market demand across multiple segments.

What are the key drivers in the field hockey equipment market?

Rising Popularity of Field Hockey Globally

International tournaments, professional leagues, and the inclusion of field hockey in events like the Olympics are driving demand for equipment. Participation in school, college, and club-level programs is encouraging purchases of sticks, protective gear, footwear, and apparel. Increasing awareness regarding fitness and team sports is also contributing to market expansion.

Technological Innovation in Equipment

Advancements in material science, including carbon and hybrid sticks, high-grip footwear, and ergonomic protective gear, have improved player performance and safety. Integration of smart sensors in sticks and shoes enables performance tracking, attracting professional and elite players to invest in premium equipment.

Investment in Sports Infrastructure

Government and private sector spending on turf fields, hockey academies, and stadiums is creating demand for high-quality equipment. School and community programs in emerging markets, particularly in India and China, are major contributors to growing sales.

What are the restraints for the global market?

High Cost of Premium Equipment

Advanced composite sticks and professional-grade protective gear are relatively expensive, limiting accessibility for amateur and youth players in developing regions. High prices may restrict adoption among casual players, slowing growth in certain markets.

Seasonal and Regional Popularity

Field hockey’s popularity varies by region. Markets with limited infrastructure or a preference for other sports, such as North America and parts of LATAM, exhibit lower adoption rates, which constrains market expansion for manufacturers in those regions.

What are the key opportunities in the field hockey equipment market?

Expansion in Emerging Markets

Countries like India, China, and Brazil present significant growth opportunities. Rising government support for sports programs and increased participation at school and college levels provide avenues for manufacturers to introduce affordable, high-performance equipment tailored to local needs.

Technological Integration in Equipment

Smart sticks with motion sensors, performance-tracking footwear, and ergonomic protective gear are differentiating products in the market. Integration of analytics and app-based performance monitoring enables manufacturers to offer premium solutions with recurring revenue models for professional players and teams.

Women’s and Youth Hockey Programs

Growing emphasis on women’s and youth hockey programs globally is boosting demand for age- and gender-specific sticks, shoes, and protective gear. Manufacturers can develop specialized products to cater to these segments, enhancing adoption and brand loyalty.

Product Type Insights

Composite hockey sticks dominate the market with approximately 35% share in 2024, driven by durability, lightweight design, and performance benefits. Protective gear, including gloves, shin guards, and headgear, follows, with growing adoption in school and club programs. Footwear designed for turf and indoor play is gaining popularity due to ergonomic designs and sport-specific performance requirements. Apparel and accessories complement primary equipment sales, especially in professional leagues and organized clubs.

Application Insights

Professional and elite players are the largest end-users, accounting for 40% of 2024 demand. School and university programs are the fastest-growing segments due to government and private investments in youth sports infrastructure. Amateur and recreational players contribute to steady demand, especially in developed markets. Export-driven demand is notable, with countries like the Netherlands, India, and Australia exporting high-quality sticks, protective gear, and balls to emerging hockey markets.

Distribution Channel Insights

Offline retail, including specialty sports stores, accounts for 45% of market revenue, driven by expert guidance and try-before-buy preferences among professional and club-level players. Online sales are growing rapidly due to convenience, access to international brands, and ease of comparison shopping. Direct sales to clubs and organizations are significant in institutional procurement programs and government-supported hockey initiatives.

| By Product Type | By Player Level | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds 15% of the global market in 2024, led by the U.S. and Canada. Growth is supported by women’s hockey programs, college leagues, and amateur club participation. While demand is moderate compared to Europe and APAC, increasing awareness of fitness and team sports is driving steady growth.

Europe

Europe is the largest regional market with a 30% share in 2024, led by the Netherlands and Germany due to established leagues, professional clubs, and strong youth participation. Belgium and Spain are the fastest-growing markets in the region, benefiting from government support and grassroots programs. Professional clubs heavily invest in premium sticks, protective gear, and apparel.

Asia-Pacific

APAC shows the fastest growth (9% CAGR), driven by India, China, Japan, and Australia. Expanding school and college programs, increasing participation in international tournaments, and growing middle-class affluence contribute to rising equipment sales. India is a major market due to national-level programs and government-backed initiatives like Khelo India.

Latin America

Brazil and Argentina are emerging markets, primarily driven by youth and amateur programs. Demand is increasing for mid-range and entry-level equipment for school and recreational use. Export-driven purchases supplement local demand as professional leagues expand.

Middle East & Africa

South Africa dominates African demand, supported by club-level hockey infrastructure. UAE and other Gulf countries are emerging as high-income markets with growing interest in organized hockey leagues and international tournaments. Intra-African participation is also rising, enhancing regional market potential.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Field Hockey Equipment Market

- Grays International

- Adidas AG

- STX Sports

- Kookaburra Sport

- Brabo Hockey

- Hockey Direct

- TK Hockey

- OS Hockey

- Slazenger

- Reece Australia

- Warrior Sports

- Dita Hockey

- Ashaway

- Maverik Sports

- Harrow Sports

Recent Developments

- In March 2025, Grays International launched a new line of composite sticks with integrated sensor technology for professional training analytics.

- In April 2025, Adidas introduced a turf-specific footwear range optimized for agility and reduced injury risk in elite and youth hockey players.

- In June 2025, Kookaburra Sport expanded its global export network to APAC, increasing the supply of premium sticks and protective gear to emerging hockey markets.