Fencing Equipment Market Size

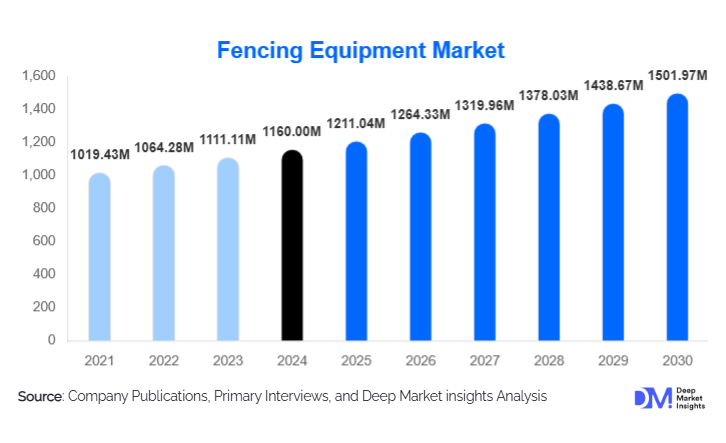

According to Deep Market Insights, the global fencing equipment market size was valued at USD 1,160.00 million in 2024 and is projected to grow from USD 1,211.04 million in 2025 to reach USD 1,501.97 million by 2030, expanding at a CAGR of 4.4% during the forecast period (2025–2030). Growth in this market is primarily driven by rising participation in fencing as both a competitive and recreational sport, increasing institutional adoption by schools and universities, and continued innovation in smart and lightweight fencing gear.

Key Market Insights

- Weapons and protective gear dominate the global fencing equipment market, together accounting for more than 60% of total revenue in 2024.

- Europe leads the global market with over 40% share in 2024, supported by a long-standing fencing tradition and high levels of institutional participation.

- Asia-Pacific is the fastest-growing region, projected to expand at a 6–8% CAGR driven by youth sports programs and club-level growth in India and China.

- Smart and electronic fencing systems are gaining traction, integrating wireless scoring, performance sensors, and digital analytics.

- Online retail and direct-to-consumer channels are reshaping distribution dynamics, offering accessibility to new entrants and amateur fencers globally.

- Custom-fitted and eco-friendly materials are emerging as key trends, with brands emphasizing safety, comfort, and sustainability.

Latest Market Trends

Smart Fencing Gear and Wireless Scoring

Technological integration is redefining fencing equipment. Manufacturers are developing wireless scoring systems, sensor-embedded jackets, and smart helmets capable of recording touch accuracy and speed metrics. These systems are gaining popularity across professional tournaments and clubs due to their enhanced precision and ease of setup. The incorporation of IoT-based analytics enables fencers to assess performance in real time, thereby modernizing training programs. As prices decline, adoption among amateur and institutional users is expected to surge.

Rise of Grassroots and Educational Programs

Federations and sports ministries worldwide are introducing fencing in school curricula to diversify athletic engagement. The surge of youth academies in Asia-Pacific and Latin America has expanded the market base for entry-level gear. Institutional bulk purchases and community-driven clubs are stimulating steady revenue streams for manufacturers. This grassroots movement is expected to sustain long-term market growth as more players transition from beginner to competitive levels.

Fencing Equipment Market Drivers

Expanding Participation in Fencing

The sport’s inclusion in global events such as the Olympics and its growing media coverage have contributed to an upsurge in participation. Rising popularity among women and youth categories, along with recreational fencing classes, is broadening the consumer base for protective gear and weapons.

Product Innovation and Material Advancements

Continuous product improvement, such as carbon-fiber blades, impact-resistant masks, and advanced textile armor, has encouraged replacement purchases and premium upgrades. Lightweight and ergonomic designs enhance performance, fueling brand differentiation and revenue growth.

Institutional and Club-Based Demand

Educational institutions and sports academies are now investing in fencing infrastructure, creating bulk procurement opportunities. Government funding and public-private partnerships to promote Olympic sports are bolstering sales for standardized gear and scoring systems.

Market Restraints

High Equipment Costs and Limited Awareness

Competitive-grade weapons and electronic scoring systems are relatively expensive, which deters beginners and schools with limited budgets. Additionally, a lack of awareness in emerging markets restricts rapid adoption outside traditional strongholds.

Long Replacement Cycles

Fencing gear is durable and designed for multi-year usage, reducing replacement frequency. This extends product lifecycles, limiting recurring revenues for manufacturers and slowing unit volume growth.

Fencing Equipment Market Opportunities

Emerging Market Expansion

Countries such as India, Brazil, and China are witnessing increased fencing participation through school initiatives and new clubs. Manufacturers can capitalize by offering affordable starter kits, institutional discounts, and localized distribution partnerships to gain early market share.

Smart and Connected Equipment

The introduction of wireless scoring, sensor-enabled training robots, and real-time analytics platforms represents a major opportunity. Integrating digital technology not only enhances user experience but also increases recurring revenue potential through accessory upgrades and software subscriptions.

Direct-to-Consumer Customization

Brands are increasingly leveraging online platforms to offer custom sizing, engraving, and performance tuning. Personalized gear appeals to athletes seeking brand identity and ensures repeat purchases. Growth in e-commerce logistics further supports this trend.

Product Type Insights

Weapons, including foil, épée, and saber, remain the largest product category, accounting for approximately 35% of global fencing equipment revenue in 2024. This dominance is driven by high competition and training frequency, as well as replacement cycles following national and international tournaments. Successful performances by national teams in global championships further encourage the purchase of professional-grade weapons among both clubs and individual fencers. The protective clothing segment, which includes certified jackets, breeches, gloves, and masks, follows closely. Its growth is supported by mandatory safety standards and federation regulations that require athletes and institutions to use certified protective gear, particularly in educational and club settings.

Masks and headgear also contribute a significant share, underpinned by recurring replacement demand triggered by safety certifications and inspection-based renewal requirements. Meanwhile, scoring and electrical systems are emerging as the fastest-growing product category, projected to register over 7% CAGR through 2030. This expansion is fueled by the modernization of fencing halls and tournaments, which are transitioning to digital scoring and wireless technology to enhance competition accuracy and audience engagement. Additionally, training aids and fencing robots are gaining traction in professional academies and coaching centers, reflecting a global trend toward data-driven training and performance analytics. Finally, accessories and consumables, such as grips, body cords, and tips, provide steady, recurring revenue streams for manufacturers due to frequent replacement cycles and consistent wear-and-tear across all experience levels.

End-User Insights

Amateur and recreational fencers represent the largest customer base, capturing approximately 45% of the total market share in 2024. Their demand is driven by growing interest in fencing as a lifestyle and fitness-oriented sport, often marketed as “physical chess” due to its strategic and mental elements. Educational institutions, including schools, colleges, and universities, are the fastest-growing end-user segment. This rise is propelled by the inclusion of fencing in extracurricular and collegiate athletic programs, scholarship pathways, and the increasing availability of affordable institutional kits. National sports policies promoting fencing as a youth development tool are further accelerating adoption in this segment.

Professional and competitive fencers constitute a smaller yet high-value market segment, defined by their preference for premium, high-performance gear. Regular equipment upgrades aligned with international competition cycles sustain this segment’s contribution to total revenue. Meanwhile, training centers and fencing academies represent a strong recurring demand base, purchasing in bulk for student use and integrating advanced systems such as fencing robots and scoring simulators. Their emphasis on durability, standardization, and efficiency in training programs continues to create stable procurement patterns worldwide.

Distribution Channel Insights

Offline retail channels, comprising specialty sports stores, club partnerships, and authorized distributors, currently dominate the market, accounting for over 60% of global sales in 2024. These outlets remain essential for professional and advanced users who prioritize fitting precision, product trials, and direct relationships with coaches and suppliers. The key driver here is the high-touch sales process that ensures correct sizing and certification verification for competitive-grade gear.

Online retail and direct-to-consumer (D2C) sales, however, are growing at an impressive rate of over 8% CAGR through 2030. The expansion of global e-commerce platforms allows brands to reach niche consumer bases across geographies while maintaining transparent pricing and customization options. Online channels are particularly effective for starter kits, accessories, and mid-range products, where cost and convenience are primary purchasing drivers. Subscription-based replenishment models and digital marketing campaigns targeting fencing communities are also enhancing brand loyalty and increasing digital conversion rates.

| By Product Type | By Discipline | By End User | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

Europe

Europe remains the largest and most mature fencing equipment market, commanding approximately 40% of global revenue in 2024. The region’s dominance is underpinned by a rich fencing heritage and the presence of strong national federations in France, Italy, and Germany. These nations have deep-rooted club ecosystems, well-established competition structures, and leading global manufacturers, ensuring consistent demand for both entry-level and elite-grade equipment. The European market is also driven by high adherence to international safety and performance standards, spurring demand for certified protective clothing and scoring systems.

North America

North America accounts for approximately 30% of the global fencing equipment market revenue in 2024, led by the United States, which maintains one of the world’s largest organized fencing communities. The region benefits from well-structured collegiate and youth-level programs, fostering equipment sales through school-based and club-level participation. High investment in sports infrastructure and the growing popularity of fencing scholarships in U.S. universities further boost market penetration. The adoption of wireless scoring systems and data-integrated training platforms also contributes to steady modernization within clubs and academies.

Asia-Pacific

The Asia-Pacific region is the fastest-growing fencing equipment market globally, representing roughly 18% of total revenue in 2024. China, Japan, South Korea, and India are emerging as key demand centers, supported by rapid urbanization, rising disposable incomes, and government-backed sports initiatives. Countries like China and South Korea are investing heavily in fencing academies and Olympic-level training programs, creating opportunities for both local and international manufacturers. Growing grassroots participation, particularly through school and after-school sports programs, is fueling demand for beginner kits and affordable institutional gear.

Latin America

Latin America contributes approximately 6% of the global fencing equipment market in 2024, with Brazil and Argentina serving as primary hubs. While the regional market is smaller compared to Europe or North America, it shows growing potential due to developing club networks, urban youth sports programs, and expanding international exposure. Affordability remains a key factor influencing purchasing behavior, favoring mid-range and used equipment sales. The entry of regional distributors offering financing and rental options has further improved access to fencing gear in urban centers.

Middle East & Africa

The Middle East & Africa (MEA) region accounts for nearly 6% of the global market share in 2024. Growth is concentrated in Gulf Cooperation Council (GCC) nations, South Africa, and Egypt, where fencing is gaining visibility through international competitions and sports diversification programs. Countries like Saudi Arabia and the UAE are investing in youth sports academies and organizing regional fencing events, stimulating demand for both imported and locally distributed gear. However, infrastructure gaps and limited local manufacturing capabilities continue to constrain full-scale market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Fencing Equipment Market

- Absolute Fencing Gear

- Uhlmann Fechtsport

- Leon Paul Equipment Co.

- Allstar Fencing

- PBT Fencing

- Blu Gauntlet Fencing Gear

- Prieur Sports

- Alliance Fencing Equipment LLC

- Miyazaki Fencing Goods

- Mizuno Corporation (Fencing Division)

- Adidas (Fencing Division)

- Dunlop Sports (Fencing Division)

- Korfanty Fencing Gear

- Saber Fencing Goods

- FWF Fechtwelt

Recent Developments

- In June 2025, Leon Paul introduced a new generation of carbon-fiber blades integrating wireless touch sensors to enhance scoring accuracy and reduce latency.

- In March 2025, Absolute Fencing Gear launched a sustainability initiative to recycle metal waste and develop eco-fabric protective clothing.

- In January 2025, Uhlmann Fechtsport expanded its online direct-sales platform, enabling customized fitting options and global delivery to over 50 countries.