Feminine Wipes Market Size

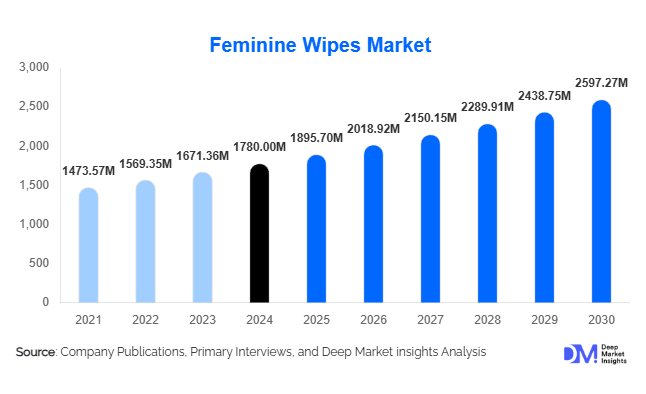

According to Deep Market Insights, the global feminine wipes market size was valued at USD 1780.00 million in 2024 and is projected to grow from USD 1895.70 million in 2025 to reach USD 2597.27 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The market’s growth is primarily driven by increasing awareness of feminine hygiene, the shift toward eco-friendly and biodegradable formulations, and growing adoption through e-commerce and direct-to-consumer channels.

Key Market Insights

- Rising hygiene awareness and changing consumer lifestyles are fueling the adoption of daily feminine wipes as an essential part of women’s hygiene routines.

- Biodegradable and organic formulations are rapidly gaining traction as consumers and regulators emphasize sustainable and skin-safe products.

- Asia-Pacific and North America dominate the market, collectively accounting for over 70% of global revenue in 2024.

- E-commerce and D2C sales channels are reshaping purchasing patterns, offering discreet, recurring, and subscription-based models.

- Postpartum and maternity care wipes are emerging as high-growth subcategories due to hospital and clinical use expansion.

- Technological innovation in nonwoven fabrics is enhancing product softness, biodegradability, and packaging efficiency.

What are the latest trends in the feminine wipes market?

Shift Toward Sustainable and Biodegradable Wipes

Consumer preference is moving strongly toward eco-conscious products made from biodegradable, compostable, or plant-based fibers such as bamboo, cotton, or cellulose. This shift aligns with global sustainability trends and regulatory moves to phase out single-use plastics. Brands are reformulating wipes to exclude parabens, alcohol, and artificial fragrances, while also highlighting cruelty-free and vegan certifications. The rise of green packaging, recyclable wraps, compostable sachets, and paper-based flow wraps further supports environmental goals. Sustainability has moved from niche positioning to mainstream value, driving premium product launches and differentiation among key players.

Digital Commerce and Subscription Models

Feminine wipes are increasingly sold through online channels that emphasize discretion, convenience, and recurring purchases. Subscription-based models offer consumers regular product replenishment while allowing brands to maintain direct engagement and gather behavioral data. Digital campaigns on social media platforms like Instagram and TikTok have also become instrumental in normalizing intimate hygiene discussions, breaking cultural taboos, and promoting new product lines. This trend is expanding brand reach, especially among Gen Z and millennial women in emerging economies.

What are the key drivers in the feminine wipes market?

Rising Awareness of Feminine Hygiene and Health

Increasing awareness of intimate hygiene and its link to overall women’s health is a core driver of the global feminine wipes market. Public health campaigns, school-based programs, and workplace hygiene initiatives have normalized daily feminine care practices. As women seek convenient solutions for freshness and cleanliness, feminine wipes have become a staple across age groups. The ongoing dialogue around women’s health, supported by NGOs and government programs, continues to expand the addressable consumer base, particularly in Asia and Latin America.

Convenience and Portability in Modern Lifestyles

The demand for on-the-go hygiene products is rising due to fast-paced urban lifestyles, travel, and work-related mobility. Compact, individually wrapped wipes and pocket-sized packs cater perfectly to these needs. The trend toward active living, sports, fitness, and travel is also broadening the scope of use cases. This shift in behavior is driving higher usage frequency, expanding consumption beyond menstrual cycles into daily hygiene routines.

Innovation in Materials and Formulations

Continuous innovation in nonwoven substrates, skin-friendly surfactants, and dermatologically tested formulations has elevated product quality and trust. Manufacturers are introducing pH-balanced, fragrance-free, and antibacterial wipes designed for sensitive skin. In parallel, the adoption of flushable and compostable wipes has positioned brands at the intersection of convenience and environmental responsibility, appealing to eco-conscious consumers globally.

What are the restraints for the global market?

Substitution by Alternative Hygiene Products

The feminine wipes market faces competition from alternative intimate-care formats such as washes, foams, and reusable wipes. Some consumers prefer liquid-based products for perceived superior hygiene, particularly in developed regions. This substitution risk moderates category expansion and pressures manufacturers to innovate continuously in texture, formulation, and packaging to maintain relevance.

Rising Raw Material and Regulatory Costs

Volatile costs of nonwoven materials, packaging, and natural ingredients impact manufacturer profitability. Additionally, evolving regulatory standards concerning microplastics, labeling, and flushability increase compliance costs and delay product introductions. Companies must balance innovation with cost efficiency to sustain margins in an increasingly competitive landscape.

What are the key opportunities in the feminine wipes industry?

Emerging Market Penetration and Hygiene Education

Expanding feminine hygiene education in Asia-Pacific, Latin America, and the Middle East creates immense untapped potential. Governments and NGOs are actively promoting female health and hygiene awareness, breaking traditional taboos. Brands that invest in localized education campaigns and culturally sensitive marketing can unlock new consumer segments and establish long-term loyalty.

Green Innovation and Premiumization

The shift toward sustainable materials and ethical production opens opportunities for brands to command premium pricing. Biodegradable wipes using bamboo, lyocell, or organic cotton align with regulatory and environmental goals while attracting eco-conscious consumers. Investing in clean-label R&D and transparent sourcing can further strengthen brand equity and margins.

Direct-to-Consumer and Customization Models

Digital-first and D2C models allow companies to offer personalized product bundles, subscription packs, and sensitive-skin variants. Leveraging data analytics for customization enables better inventory management and enhances brand loyalty. This approach also helps smaller brands compete with established players through agility and community-driven marketing.

Product Type Insights

Daily intimate hygiene wipes dominate the global feminine wipes market, accounting for nearly 70% of total market share in 2024. Their leadership is attributed to increasing adoption among working women, urban dwellers, and travelers seeking freshness and comfort on the go. These wipes are widely used for daily cleansing, travel convenience, and post-exercise hygiene, making them a recurring purchase product in both developed and emerging markets. The rise of workplace participation and growing focus on convenience-led hygiene continue to drive demand across North America, Europe, and Asia. Innovation in pH-balanced, alcohol-free, and dermatologically tested formulations is further strengthening consumer trust and brand loyalty.

Menstrual or sanitary wipes form the next significant category, driven by growing retail bundling with sanitary napkins and tampons. Market growth is underpinned by menstrual hygiene awareness campaigns and the rise of eco-conscious consumers preferring chemical-free solutions. Medicated or postpartum wipes represent a fast-growing niche segment, supported by the increasing prevalence of gynecological care needs, hospital-based usage, and rising clinical recommendations. Meanwhile, post-intercourse and sexual wellness wipes are gaining visibility through discreet e-commerce platforms and direct-to-consumer (DTC) brands that normalize intimate health discussions. Lastly, travel and on-the-go bulk packs are expanding rapidly across retail and convenience stores, appealing to busy consumers seeking multipack value options.

Material Insights

Synthetic nonwoven wipes continue to lead the global market, contributing approximately 48% of revenue in 2024 due to cost-effectiveness, ease of mass production, and wide material availability. However, environmental concerns and tightening single-use plastic regulations are pushing brands to transition toward biodegradable and plant-based substrates such as bamboo fiber, organic cotton, and viscose. These sustainable alternatives are expected to register a CAGR of over 8% from 2025–2030. Manufacturers are increasingly adopting hybrid material blends that balance durability, comfort, and eco-compliance, while aligning with global sustainability mandates and consumer preferences for natural products.

Distribution Channel Insights

Supermarkets and hypermarkets remain the dominant distribution channel, accounting for roughly 37% of global market revenue in 2024. The strength of this segment lies in consumer trust, immediate accessibility, and the availability of diverse brand options. However, online retail and D2C (Direct-to-Consumer) platforms are witnessing the fastest expansion, projected to grow at a CAGR exceeding 9% through 2030. This surge is supported by discreet purchasing behavior, personalized subscription models, and influencer-led brand marketing. Pharmacies and drugstores continue to play a critical role, particularly for medicated and dermatologist-endorsed products, serving as the go-to channels for health-conscious consumers seeking verified quality and safety standards.

End-User Insights

Adult women aged 26–45 years represent the largest end-user group, contributing nearly 50% of the global market value in 2024. This demographic’s higher disposable income, urban lifestyle, and focus on personal wellness drive steady consumption. Teenagers and young adults form the fastest-growing user base, influenced by social media awareness, influencer education on intimate care, and increasing comfort around open discussions of feminine hygiene. Postpartum women and hospital-based users represent a specialized but rapidly growing end-use segment, particularly in developed markets where medical recommendations and maternity hygiene standards are high. The growing adoption of feminine wipes in maternity kits and clinical postpartum care underscores an important opportunity for manufacturers to collaborate with healthcare institutions.

| By Product Type | By Material | By Distribution Channel | By End User |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific (APAC)

The Asia-Pacific region dominates the global feminine wipes market, holding approximately 36% of total market share in 2024 (valued at around USD 0.77 billion). Key contributors include China, India, Japan, and South Korea. The region’s growth is propelled by its vast population of women of reproductive age, rising disposable income, and accelerating urbanization. Increasing hygiene awareness campaigns, particularly government-backed initiatives in India and Southeast Asia, are driving mass-market adoption. Regional players are focusing on affordable SKUs and localized formulations to cater to culturally diverse preferences. Furthermore, the surge in online retail penetration and cross-border e-commerce has amplified product accessibility across developing economies. Drivers: demographic scale, rapid urbanization, expanding female workforce, and growing awareness of hygiene and sustainability.

North America

North America accounted for nearly 35% of the global feminine wipes market in 2024, equating to about USD 0.74 billion. The U.S. remains the largest national market, driven by high hygiene standards, advanced retail infrastructure, and the popularity of premium and dermatologist-tested products. The region’s e-commerce ecosystem and subscription-based DTC models (e.g., Dollar Shave Club and Rael) have further fueled product accessibility. Increasing focus on ingredient transparency, fragrance-free formulations, and eco-friendly packaging continues to resonate with health-conscious consumers. Drivers: premiumization, ingredient transparency, high disposable income, and digital retail adoption across pharmacies and online channels.

Europe

Europe represents approximately 28% of global market revenue in 2024, led by the U.K., Germany, and France. The market is highly regulated under EU cosmetic and single-use product directives, encouraging sustainable innovation and biodegradable materials. Consumer demand is shifting sharply toward organic, hypoallergenic, and certified vegan products. Brands such as Essity and Beiersdorf are pioneering plant-based formulations to align with environmental policies. Drivers: strict regulatory standards, high sustainability focus, consumer preference for biodegradable materials, and premium private-label expansion in Western Europe.

Latin America

Latin America accounts for roughly 6% of global feminine wipes revenue in 2024, led by Brazil, Mexico, and Argentina. The region’s market is transitioning from traditional feminine hygiene methods to modern disposable wipes, supported by expanding retail distribution and growing awareness of intimate care benefits. Multinational companies are increasingly investing in local production facilities and marketing campaigns to capture emerging middle-class consumers. Drivers: urban retail expansion, rising hygiene awareness, affordability-driven innovation, and improved distribution infrastructure across urban centers.

Middle East & Africa (MEA)

MEA holds an estimated 5% of the global market share in 2024, yet it presents significant untapped potential. GCC countries such as Saudi Arabia and the UAE are witnessing rising demand for premium, fragrance-free wipes, particularly within urban female populations. Meanwhile, Sub-Saharan Africa is seeing growth through healthcare and NGO-led hygiene programs targeting educational institutions and maternal health. Cultural sensitivity and awareness campaigns play a major role in shaping adoption rates. Drivers: growing hygiene education, increasing female workforce participation, niche premium demand in GCC markets, and improved healthcare access across Africa.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Feminine Wipes Market

- Procter & Gamble

- Kimberly-Clark Corporation

- Johnson & Johnson

- Edgewell Personal Care

- Unicharm Corporation

- Albaad

- Corman S.p.A.

- Essity AB

- Rael Inc.

- The Honey Pot Company

- Natracare

- Bodywise (UK) Ltd

- Ontex Group NV

- TZMO SA

- Kao Corporation

Recent Developments

- In April 2025, Procter & Gamble launched a new range of biodegradable feminine wipes under its Always brand, using bamboo-based fibers and plastic-free packaging to align with sustainability commitments.

- In March 2025, Kimberly-Clark announced an expansion of its Asian manufacturing capacity for personal hygiene wipes to meet surging demand in India and Southeast Asia.

- In January 2025, Rael Inc. introduced an organic and pH-balanced feminine wipe line in the U.S. and Europe, targeting sensitive-skin consumers through D2C online subscriptions.