Face Shield Screen Market Size

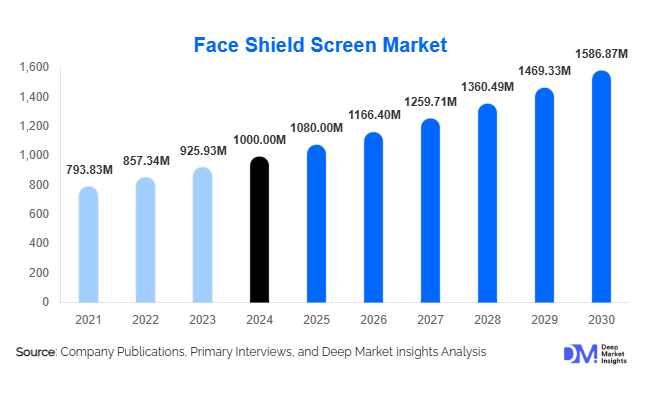

According to Deep Market Insights, the global face shield screen market was valued at USD 1,000 million in 2024 and is projected to grow from USD 1,080.00 million in 2025 to reach USD 1,586.87 million by 2030, expanding at a CAGR of 8% during the forecast period (2025–2030). The market growth is primarily driven by rising awareness of workplace safety, increasing demand for infection control in healthcare, industrialization in emerging economies, and the adoption of advanced, reusable face shield technologies that combine durability with comfort and compliance with safety regulations.

Key Market Insights

- Shift toward reusable and premium face shields is gaining traction due to sustainability concerns, cost efficiency over time, and increasing adoption in healthcare and industrial sectors.

- Healthcare remains the largest end-use segment, with hospitals, clinics, and dental facilities driving demand for full-face, anti-fog, and ergonomically designed shields.

- North America dominates the market, with the U.S. and Canada leading adoption owing to stringent safety regulations and large-scale industrial and healthcare procurement.

- Asia-Pacific is the fastest-growing region, driven by rapid industrialization, rising healthcare infrastructure, and increasing workplace safety awareness in countries like China and India.

- Technological innovations, including anti-fog coatings, scratch-resistant materials, ergonomic designs, and smart PPE integration, are enhancing product appeal and market penetration.

- Export-driven demand from low-cost manufacturing hubs in Asia is supplying developed markets, ensuring sustained global market expansion.

Latest Market Trends

Transition to Reusable and Advanced Shields

Manufacturers are increasingly focusing on reusable shields with enhanced features such as anti-fog, scratch resistance, adjustable headbands, and full-face coverage. Sustainability and cost-efficiency are key drivers, with hospitals and industrial facilities seeking shields that can be sanitized and reused multiple times. Premium features, including ergonomic designs and better optical clarity, are becoming standard requirements, especially in healthcare and high-risk industrial applications.

Integration of Smart PPE Technologies

Innovations in materials and design are enabling new product functionalities. Some face shields are being integrated with sensors for real-time monitoring, improved visibility, and even communication systems in industrial settings. Digital and IoT-enabled PPE solutions are gaining interest among industrial enterprises, enhancing compliance tracking and reducing human error in high-risk environments.

Face Shield Screen Market Drivers

Increased Awareness of Occupational Safety

Post-pandemic, workplace safety and infection control have become top priorities across healthcare, construction, and manufacturing industries. Organizations are investing heavily in PPE to ensure worker safety and regulatory compliance. Hospitals and industrial plants are increasingly mandating full-face shields as standard protective equipment, driving consistent market demand.

Stringent Safety Regulations and Compliance

Government regulations worldwide, including OSHA in the U.S., EN standards in Europe, and emerging occupational safety mandates in Asia-Pacific, require comprehensive eye and face protection. Compliance with these regulations encourages both private and public institutions to adopt high-quality shields, accelerating market growth.

Industrialization and Infrastructure Expansion

Rapid industrial and construction growth in emerging economies such as India, China, and Southeast Asian nations has heightened demand for protective equipment. The requirement for face shields in factories, chemical plants, and construction sites ensures sustained adoption and positions the market for long-term expansion.

Market Restraints

Cost Pressures and Alternative Products

Entry-level face shields face stiff competition from lower-cost substitutes or improvised solutions in some industrial and construction settings. Cost sensitivity can constrain the adoption of premium shields and limit average selling prices, especially in price-sensitive regions.

Raw Material Volatility

Fluctuations in the prices of plastics such as polycarbonate and PETG can impact manufacturing costs. Supply chain disruptions or import restrictions can further limit production and slow market growth, posing a challenge for manufacturers reliant on consistent material availability.

Face Shield Screen Market Opportunities

Regulatory-Driven Expansion

Growing workplace safety regulations in emerging markets create opportunities for both new and existing players. Companies that comply with certification standards (ANSI, EN) and introduce innovative, high-quality shields can capture early-mover advantage, especially in regions where regulations are increasingly enforced.

Emerging Regional Demand

Asia-Pacific, Latin America, and parts of Africa represent high-growth potential due to industrialization, healthcare expansion, and increasing awareness of occupational safety. Establishing localized production, cost-effective distribution channels, and region-specific product designs can significantly increase market share in these regions.

Technological and Reusable Product Innovation

Innovations such as smart shields, anti-fog coatings, ergonomic designs, and sustainable materials present opportunities for differentiation. Premium, reusable shields offer higher margins and cater to sustainability-conscious consumers, while 3D-printed or bio-based shields can create niche market segments for early adopters.

Product Type Insights

Full-face shields dominate the market, accounting for 61% of the 2024 market, due to comprehensive coverage and suitability in healthcare and high-risk industrial environments. Half-face shields are growing in niche applications where limited face protection suffices. Reusable premium shields are preferred for durability, comfort, and anti-fog features, while entry-level disposable shields remain prevalent in low-cost or temporary use cases.

Application Insights

Healthcare is the largest application segment (28–30% share in 2024), driven by hospitals, dental clinics, and laboratories. Industrial and construction sectors are rapidly adopting face shields to protect workers from debris, chemicals, and airborne particles. Chemical, oil & gas, and mining industries are emerging end-users requiring specialized, high-durability shields. Consumer and retail applications are smaller but growing, particularly in response to public health awareness and personal protective trends.

Distribution Channel Insights

Face shields are primarily distributed through direct industrial procurement, healthcare suppliers, and online platforms. Bulk orders from hospitals and factories dominate, but e-commerce channels for smaller purchases and individual consumers are growing. B2B partnerships with PPE distributors and industrial safety firms are significant for reaching high-volume end-users efficiently.

End-Use Insights

Healthcare remains the largest and fastest-growing end-use segment due to infection control mandates. Industrial manufacturing and construction are emerging as high-growth segments driven by increased safety regulations. Chemical, oil & gas, and mining sectors are adopting specialized face shields. Export-driven demand from low-cost manufacturing regions (India, China, Southeast Asia) to developed markets (North America, Europe) remains a critical growth factor.

| By Material Type | By Tier / Value Type | By Usage Type | By Product Type | By End-Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounted for 30–35% of the global market in 2024, led by the U.S. due to stringent workplace safety regulations, large healthcare infrastructure, and industrial adoption. Premium and reusable face shields dominate the region, supported by strong regulatory enforcement and large-scale procurement.

Europe

Europe held a 25–30% market share in 2024, with Germany, the UK, and France leading adoption. The region shows moderate growth, driven by compliance with occupational safety standards, robust healthcare systems, and established industrial protocols. The market emphasizes reusable shields and compliance-certified products.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with China and India as primary contributors. Rapid industrialization, expanding healthcare infrastructure, and rising awareness of worker safety are driving growth. CAGR in this region is projected to exceed the global average, offering high-potential opportunities for local and international manufacturers.

Latin America

Latin America accounted for 5–7% of the 2024 market. Brazil, Mexico, and Argentina are key markets. Growth is emerging as industrialization and healthcare awareness improve, and demand for imported quality PPE rises.

Middle East & Africa

MEA also accounted for 5–7% of the global market in 2024. The GCC countries and South Africa are the main contributors, with demand driven by construction, oil & gas, and industrial safety initiatives. Growth is moderate but supported by infrastructure expansion and increased PPE imports.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Face Shield Screen Market

- 3M Company

- Honeywell International Inc.

- Kimberly-Clark Corporation

- MSA Safety Incorporated

- Alpha Pro Tech Ltd.

- Medline Industries, Inc.

- Lakeland Industries, Inc.

- Uvex Safety Group

- Gateway Safety Inc.

- Pyramex Safety Products LLC

- Casco Bay Molding

- Prestige Ameritech

- Sanax Protective Products

- Drägerwerk AG

- Bullard Company

Recent Developments

- In May 2025, 3M Company launched a new line of reusable anti-fog face shields targeting healthcare and industrial clients, enhancing safety and comfort.

- In April 2025, Honeywell introduced ergonomic, lightweight full-face shields for the chemical and construction industries, aimed at improving user compliance and durability.

- In February 2025, Alpha Pro Tech expanded its global manufacturing footprint in Asia-Pacific to meet growing export demand for premium PPE face shields.