Fabric Wash & Care Market Size

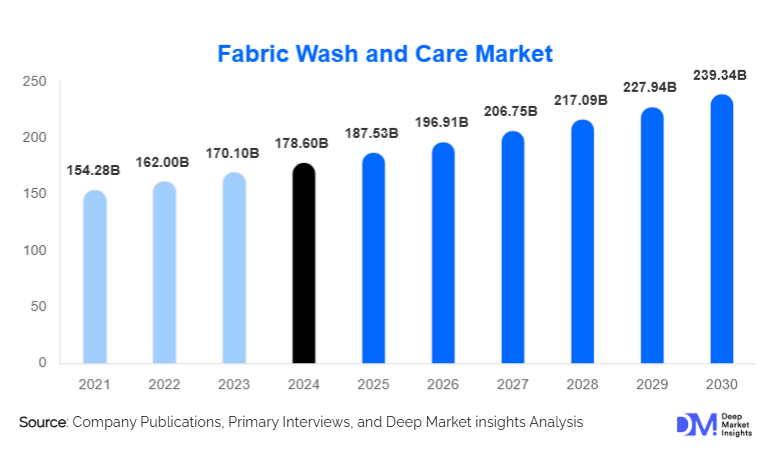

According to Deep Market Insights, the global fabric wash and care market size was valued at USD 178.6 billion in 2024 and is projected to grow from USD 187.53 billion in 2025 to reach USD 239.34 billion by 2030, expanding at a CAGR of 5.0% during the forecast period (2025–2030). Growth in the fabric wash & care market is primarily driven by rising hygiene awareness, increasing washing machine penetration in emerging economies, rapid adoption of eco-friendly and concentrated formulations, and the expansion of premium and specialized fabric care solutions tailored to evolving consumer needs.

Key Market Insights

- Detergents remain the dominant product category, representing roughly 55% of the market’s total value in 2024 and driving continual baseline demand.

- Liquid and concentrated formulations are expanding rapidly due to convenience, compatibility with modern washing machines, and sustainability-focused packaging.

- Asia-Pacific leads global demand, accounting for 35–40% of the market, driven by China, India, and rising urban consumption.

- Eco-friendly and biodegradable products are the fastest-growing segment, fueled by consumer environmental consciousness and regulatory pressure against harmful chemicals.

- Smart washing machines are reshaping product innovation, encouraging tailored detergents, precision-dosing systems, and IoT-connected laundry solutions.

- E-commerce and D2C platforms are transforming consumer purchasing behavior, especially for premium, subscription-based, and specialty fabric care products.

What are the latest trends in the fabric wash & care market?

Rise of Sustainable and Eco-Friendly Laundry Care

Consumers are increasingly shifting toward green, biodegradable, and low-impact laundry care solutions. Companies are introducing plant-based surfactants, plastic-free packaging, concentrated liquids, and refill systems that reduce environmental waste. Regulatory crackdowns on phosphates, microplastics, and non-biodegradable chemicals are accelerating this transition. Many brands are obtaining eco-certifications, investing in circular packaging, and partnering with environmental organizations to promote responsible consumption. The trend is redefining premium positioning in the market, with eco-products commanding higher margins and strong brand loyalty.

Technology-Integrated Laundry Solutions

Advances in washing-machine technology and digital ecosystems are reshaping the consumer laundry experience. Smart appliances with automated dosing, fabric recognition, and water-saving features require compatible high-efficiency detergents. Manufacturers are developing AI-enhanced formulations optimized for cold-water washes and shorter cycles. Digital platforms now support subscription-based detergent delivery, usage tracking, and personalized product recommendations. This technological shift is attracting younger, tech-savvy consumers and redefining product innovation in the category.

What are the key drivers in the fabric wash & care market?

Increasing Focus on Hygiene and Fabric Longevity

The global emphasis on cleanliness, fabric preservation, and health-conscious living continues to drive demand for detergents, stain removers, and fabric softeners. Consumers increasingly look for performance-oriented products with antibacterial, anti-odor, and color-protection benefits. The rise of specialized garments, such as activewear, delicates, and technical fabrics, further spurs demand for niche laundry formulations that maintain fabric quality over time.

Rising Washing Machine Penetration and Urban Lifestyle Changes

Growing adoption of automatic washing machines in Asia-Pacific, Latin America, and Africa is directly increasing demand for modern detergent formats such as liquids, pods, and HE (high-efficiency) formulations. Urbanization, dual-income households, and busy lifestyles contribute to higher laundry frequency and a stronger preference for convenient, ready-to-use products. This structural shift is creating long-term, steady growth across both premium and mass-market segments.

What are the restraints for the global market?

Volatile Raw Material Prices

Fluctuations in the cost of surfactants, enzymes, petrochemical derivatives, and specialty chemicals pose a significant challenge for manufacturers. Raw material volatility tightens margins, particularly in price-sensitive markets where producers cannot fully pass on rising costs to consumers. Dependence on global supply chains for specialty ingredients further increases vulnerability to geopolitical disruptions, transportation delays, and energy price fluctuations.

Regulatory and Environmental Compliance Challenges

Increasingly strict regulations on chemical safety, wastewater management, and sustainable packaging impose substantial compliance costs. Reformulating legacy products to remove phosphates, dyes, microplastics, or preservatives requires heavy R&D investment and time. Smaller players often struggle to meet such standards, which can restrict innovation, reduce competitiveness, or lead to product discontinuities.

What are the key opportunities in the fabric wash & care industry?

Premium and Specialty Laundry Care Solutions

There is a rising global demand for value-added products such as anti-allergen detergents, fragrance-infused softeners, cold-water detergents, and specialty cleaners for activewear and delicates. Premiumization offers significantly higher margins and strong customer loyalty. Brands that innovate around fabric-specific needs, advanced fragrance technology, and multifunctional performance are well-positioned to capture this fast-growing segment.

Expansion in Emerging Markets

Developing economies, particularly in Asia-Pacific, Latin America, and Africa, present vast opportunities driven by rapid urbanization, income growth, and expanding retail networks. Manufacturers investing in localized production, small-pack affordability, and region-specific formulations can capture significant market share. Government-backed initiatives such as local manufacturing incentives further strengthen opportunities in these high-potential regions.

Product Type Insights

Detergents dominate the fabric wash & care market, accounting for approximately 55% of the total global revenue in 2024. Liquid detergents and concentrated liquids continue to outperform traditional powders due to ease of use and improved compatibility with modern washers. Fabric softeners represent a strong complementary category, driven by consumer preferences for fragrance longevity and fabric conditioning. Stain removers and specialty care products, such as those for wool, silk, and sportswear, are rapidly gaining traction as consumers seek fabric-specific performance and extended garment lifespan. Eco-friendly variants across all product types are growing at the fastest rate.

Application Insights

Residential laundry applications remain the dominant segment, contributing over 60% of market value due to high-frequency household usage. Automatic washing machine users represent the fastest-growing subsegment, driving demand for low-sudsing, efficient, and machine-optimized detergents. Commercial and institutional laundry applications, including hospitality, healthcare, and industrial laundromats, constitute a significant portion of revenue due to the need for high-performance, bulk-volume detergents and softeners. Emerging applications include automotive and aviation textile care, particularly for upholstery and interior maintenance, creating niche opportunities for specialized formulations.

Distribution Channel Insights

Hypermarkets and supermarkets account for the largest share of fabric wash & care product sales, driven by strong product visibility and competitive pricing. However, e-commerce is the fastest-growing distribution channel, especially for premium, subscription-based, and eco-friendly offerings. Direct-to-consumer brands are leveraging digital marketing, auto-refill programs, and sustainability narratives to build loyal customer bases. Convenience stores and drugstores continue to hold relevance for everyday essentials and small pack sizes, particularly in densely populated urban markets.

End-Use / Customer Segment Insights

The residential segment forms the core of the market, supported by rising disposable incomes, lifestyle changes, and growing awareness of fabric maintenance. The hospitality sector, hotels and resorts, creates substantial demand for stain removal, disinfecting detergents, and softeners. Healthcare facilities require high-strength, antibacterial formulations for linens and uniforms. Industrial laundry services contribute consistently to demand, while automotive and aviation textile care represent promising growth niches. These segments also drive the adoption of high-performance and specialty laundry care products.

| By Product Type | By Form Type | By Application | By Distribution Channel | By End User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America represents 25–30% of the global market value, led by the United States. High disposable incomes, strong demand for premium and eco-friendly products, and wide adoption of smart washing machines influence regional growth. Liquid and capsule formats dominate due to convenience and compatibility with high-efficiency washers. Sustainability trends continue to shape innovation, with brands focusing on biodegradable formulations and plastic-free packaging.

Europe

Europe is a mature but innovation-driven market, known for strict environmental and chemical-safety regulations. Consumers exhibit a strong preference for eco-label-certified detergents and refillable packaging systems. Countries such as Germany, the U.K., and France lead consumption. Growth is steady, with sustainability and concentrated formulations driving product evolution. The market is also influenced by a shift toward cold-water washing and energy-efficient laundering.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing regional market, accounting for 35–40% of global demand. China and India are the primary growth engines, supported by expanding urban middle-class populations and increasing adoption of washing machines. Southeast Asian markets, Indonesia, Vietnam, and the Philippines, are emerging as important destinations for both mass-market and premium laundry products. Rising digital literacy fuels e-commerce expansion across the region.

Latin America

Latin America shows steady growth, driven by rising household consumption and increased availability of modern retail channels. Brazil and Mexico lead demand, particularly for liquid detergents and fabric softeners. Although per-capita spending remains lower than in North America or Europe, urban expansion and premiumization trends are boosting long-term prospects in the region.

Middle East & Africa

This region is characterized by growing urbanization and expanding hospitality and healthcare sectors. GCC countries, Saudi Arabia, UAE, Qatar, are key premium markets, with high consumption of liquid detergents and fabric conditioners. Sub-Saharan Africa offers long-term growth opportunities, driven by improving retail infrastructure and rising awareness of modern laundry solutions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Fabric Wash & Care Market

- Procter & Gamble (P&G)

- Unilever

- Henkel AG & Co. KGaA

- Reckitt Benckiser

- Colgate-Palmolive

- Kao Corporation

- Church & Dwight Co.

- Seventh Generation

- Jyothy Labs

- Liby Group

Recent Developments

- In 2025, Procter & Gamble expanded its portfolio of concentrated and plastic-free laundry formats, including detergent tiles designed to reduce packaging waste.

- In 2025, Unilever launched a new line of biodegradable, plant-based laundry detergents in Europe, aligning with tightening sustainability regulations.

- In 2025, Kao Corporation announced investments in advanced enzyme-based laundry technologies to improve cold-water wash efficiency and reduce energy consumption.