Fabric Toys Market Size

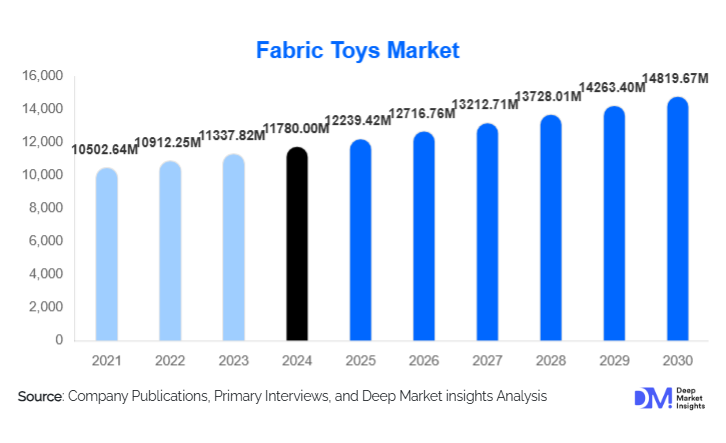

According to Deep Market Insights, the global fabric toys market size was valued at USD 11,780 million in 2024 and is projected to grow from USD 12,239.42 million in 2025 to reach USD 14,819.67 million by 2030, expanding at a CAGR of 3.9% during the forecast period (2025–2030). Market growth is primarily driven by rising demand for plush and comfort toys, increasing adoption of eco-friendly and organic fabrics, growing prevalence of “kidult” collectors, and rapid expansion of online retail channels that make fabric toys more accessible globally.

Key Market Insights

- Plush and stuffed animals remain the dominant product category, driven by strong emotional appeal, gifting demand, and character licensing.

- Eco-friendly and organic fabric toys are rapidly rising in popularity as parents and consumers seek sustainable, non-toxic play options.

- North America leads the global fabric toys market, supported by high toy spending, strong collector communities, and robust retail networks.

- Asia-Pacific is the fastest-growing region, fueled by expanding middle-class populations and booming e-commerce penetration.

- Smart and tech-enhanced plush toys are emerging as a premium segment, offering interactive learning and sensory engagement.

- Online marketplaces and D2C brands are reshaping distribution, enabling custom plush, limited drops, and global collector communities.

What are the latest trends in the fabric toys market?

Eco-Friendly & Sustainable Fabric Toys Accelerating

Sustainability stands at the forefront of innovation in the fabric toys market. Manufacturers are increasingly adopting organic cotton, bamboo fabrics, and recycled PET fibers to reduce environmental impact. Certifications such as GOTS and OEKO-TEX are becoming common quality indicators, helping brands attract eco-conscious parents. Recycled stuffing materials and biodegradable packaging are also gaining traction. This shift is further encouraged by growing regulatory pressure on plastics and synthetic materials, as well as rising consumer preference for toxin-free, ethically sourced toys. As sustainability becomes a core purchasing criterion, eco-friendly fabric toys are expected to command a growing premium segment.

Interactive & Smart Plush Toys Gaining Popularity

The integration of technology into soft toys is reshaping consumer expectations. Smart plush toys featuring sensors, Bluetooth connectivity, voice modules, and light or sound responses are becoming mainstream among tech-savvy parents. These toys offer interactive storytelling, emotional support functions, and early learning applications. Mobile app integration is emerging, enabling customized experiences such as name recognition, educational games, and adaptive play modes. This trend aligns strongly with the growing edtech movement and parents’ desire for safe, screen-light learning tools. As manufacturing costs decrease, interactive fabric toys are expected to become a significant high-value category by 2030.

What are the key drivers in the fabric toys market?

Growing Demand for Emotional Comfort & Therapeutic Toys

Fabric toys deliver unique emotional benefits, making them highly desirable across age groups. Plush toys are increasingly used as comfort objects for children and as stress-relief or décor items for adults, driven by trends like the “kidult” phenomenon. The rising emphasis on mental wellness has strengthened demand for fabric toys that provide emotional security, sensory comfort, and therapeutic value. Hospitals, therapy centers, and educational institutions are also incorporating plush toys into emotional development programs, reinforcing their wider relevance beyond traditional play.

Expansion of E-Commerce & Global Accessibility

The surge in e-commerce platforms has significantly broadened the reach of fabric toy manufacturers. Online channels offer convenience, product variety, customizable plush options, and access to global collector communities. D2C business models are enabling brands to offer personalized designs, limited-edition drops, and subscription plush boxes. Social commerce, especially through Instagram, TikTok, and community-driven platforms, is driving viral plush trends and boosting impulsive buying behavior. As digital penetration grows across emerging markets, online-driven fabric toy sales are expected to maintain strong momentum.

What are the restraints for the global market?

High Production Costs for Sustainable & Tech-Integrated Toys

While eco-friendly and smart fabric toys offer high growth potential, they also require costly materials, certified processes, and advanced manufacturing capabilities. Organic textiles, recycled fibers, and plant-based stuffing significantly increase production expenses. Smart plush toys further require electronics integration, child-safe casing, and compliance testing, all of which raise prices and restrict affordability. This cost pressure is a major barrier for small manufacturers and may limit market adoption among price-sensitive consumers.

Strict Safety & Quality Regulations

Fabric toys must meet stringent safety standards related to flammability, chemicals, detachable parts, and durability. For tech-enabled plush toys, additional regulations apply to electronics, battery safety, and data protection (where apps are involved). Navigating these regulations across multiple countries increases time-to-market and operational costs. Compliance complexity may hinder entry for new brands or slow the scaling of innovative product lines.

What are the key opportunities in the fabric toys industry?

Premium & Collectible Plush Toys for Adults

The global rise of adult collectors presents a lucrative opportunity. Limited-edition designs, character collaborations, high-quality fabrics, and artisanal plush products appeal strongly to adult buyers. Designer plush toys, pop-culture character lines, and nostalgia-driven collections are increasingly in demand. Many brands are capitalizing on this trend by launching seasonal drops, artist partnerships, and exclusive online releases. This segment offers higher margins and brand loyalty compared to traditional children-focused toys.

Growth of Educational & Therapeutic Fabric Toys

Early childhood education and sensory learning programs are boosting demand for soft educational toys such as tactile blocks, activity mats, interactive plush, and Montessori-inspired fabric toys. Schools and therapy centers are integrating fabric toys into emotional development and special-needs education. This offers long-term opportunities for manufacturers to develop curriculum-aligned fabric learning tools, sensory kits, and adaptive plush designed for neurodiverse children. The trend toward screen-free developmental play further strengthens this opportunity.

Product Type Insights

Stuffed animals and plush toys dominate the market, contributing around 40–45% of total global revenue. Their appeal spans infants, children, collectors, and décor enthusiasts. Dolls and rag dolls represent a stable mid-sized segment, while educational and smart plush are emerging as high-growth categories. Plush toys with embedded tech, such as talking modules, LED elements, and app-connected functions, are expected to see the fastest expansion through 2030. Eco-friendly product types (organic cotton plush, recycled-fabric toys) are steadily growing within the premium bracket, especially in Europe and North America.

Application Insights

Gifting remains the leading application segment, accounting for 35–40% of demand. Plush and fabric dolls are top choices for birthdays, holidays, and newborn celebrations. Play and recreational use is the second-largest segment, driven by young children’s preference for soft, safe toys. Emotional comfort applications, particularly among adults, are gaining traction due to rising mental health awareness. Educational fabric toys form a growing segment, supported by preschools and parents seeking tactile, sensory learning tools. Decorative and collectible use cases are also expanding, boosted by designer and pop-culture plush merchandise.

Distribution Channel Insights

Offline retail, including supermarkets, hypermarkets, and specialty toy stores, continues to dominate with 45–50% market share. Customers prefer evaluating softness, material quality, and safety before purchase. However, online platforms are the fastest-growing channel, supported by global marketplaces, D2C brand stores, and customization tools. Social commerce and influencer-led plush trends are accelerating online adoption. Subscription boxes for monthly plush drops and personalized plush services are emerging as attractive online niche channels.

Age Group Insights

Children aged 3–6 years represent the largest consumer segment, accounting for 35–40% of purchases due to high engagement in imaginative play. Infants and toddlers form the next key segment, driven by demand for safe, sensory-friendly toys. Older children (6–12 years) show interest in character plush and collectibles. Adults (“kidults”) constitute a rapidly rising high-value segment, purchasing premium plush for décor, emotional comfort, and collecting. Teen collectors and anime/pop-culture fandoms are also driving strong demand for niche plush lines.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America leads the fabric toys market with a 30–35% share. High toy spending, strong collector culture, and advanced retail distribution support the region's dominance. The U.S. market shows robust demand for licensed character plush, eco-friendly toys, and designer collectibles. E-commerce penetration and viral plush trends on social media further accelerate sales growth.

Europe

Europe is a developed and sustainability-driven market. Germany, France, and the U.K. lead demand for eco-friendly, premium, and artisanal plush toys. Strict safety and environmental regulations reinforce consumer trust. European buyers show a strong preference for organic textile toys, Montessori-inspired learning products, and high-quality collectible plush. Growth is steady, supported by established specialty toy networks.

Asia-Pacific

Asia-Pacific is the fastest-growing region, contributing 25–30% of the global market. China and India drive massive demand due to rising middle-class consumption, expanding digital retail, and growing interest in smart educational toys. Japan and South Korea show strong collector-driven plush markets influenced by anime, gaming, and pop-culture fandom. APAC’s rapidly evolving manufacturing ecosystem supports both domestic consumption and global export supply.

Latin America

Latin America represents a smaller but steadily growing segment. Brazil and Mexico lead demand, with consumers showing strong interest in mid-range plush, character dolls, and family gifting products. Increasing retail development and online adoption support market expansion. Collectible plush trends are also gaining traction among younger demographics.

Middle East & Africa

MEA shows rising demand, especially in the Gulf region, where high-income consumers seek premium plush and gift-oriented fabric toys. Africa, as a growing toy-importing region, is experiencing increased interest in affordable plush options and educational soft toys for early learning. Regional toy distributors and rising online marketplaces are expanding fabric toy penetration.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Fabric Toys Market

Recent Developments

- In May 2025, leading plush manufacturers expanded their eco-friendly product lines using organic cotton and recycled stuffing materials to meet sustainability standards in Europe and North America.

- In April 2025, several global brands introduced new interactive plush toys with upgraded sensor technology and app-linked learning modes, targeting the premium edtech category.

- In February 2025, collectible plush companies launched limited-edition seasonal drops, partnering with artists and pop-culture franchises to tap into growing adult collector demand.