Fabric Protector Market Size

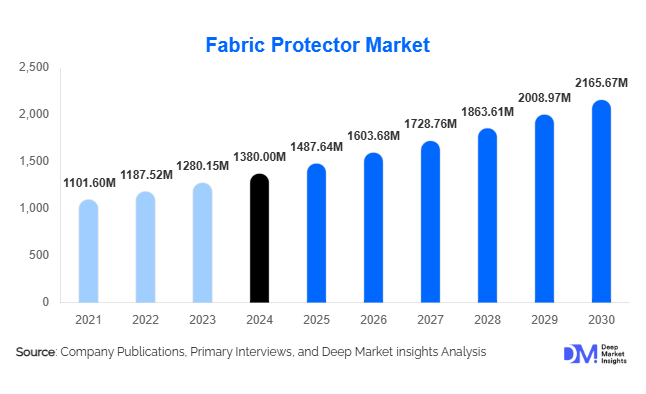

According to Deep Market Insights, the global fabric protector market size was valued at USD 1,380 million in 2024 and is projected to grow from USD 1,487.64 million in 2025 to reach USD 2,165.67 million by 2030, expanding at a CAGR of 7.8% during the forecast period (2025–2030). The market growth is primarily driven by rising consumer demand for stain-resistant, long-lasting fabrics, growing adoption of advanced coating technologies in textiles and upholstery, and increased awareness regarding fabric maintenance across residential and commercial applications.

Key Market Insights

- Rising demand for stain- and water-resistant fabrics across apparel, automotive interiors, and home furnishings is fueling market expansion.

- Eco-friendly and fluorine-free fabric protectors are gaining traction as sustainability regulations tighten globally.

- Commercial sectors such as hospitality, healthcare, and automotive are major adopters due to heavy fabric usage and maintenance requirements.

- Technological innovations in nanocoatings and bio-based repellents are creating new growth avenues for manufacturers.

- Asia-Pacific dominates production and consumption due to strong textile manufacturing bases in China, India, and Japan.

- Online retail channels are expanding accessibility for DIY and consumer-grade fabric protection products.

Latest Market Trends

Shift Toward Sustainable and Fluorine-Free Formulations

Manufacturers are increasingly transitioning toward sustainable, PFOA- and PFAS-free formulations to meet stringent environmental standards. Water-based and plant-derived protectors are replacing traditional fluoropolymer coatings, aligning with consumer and regulatory preferences for non-toxic materials. Brands are investing in R&D to develop high-performance alternatives that maintain durability and hydrophobicity without compromising eco-safety. The trend reflects the broader movement toward green chemistry in the textile and home care industries.

Integration of Nanotechnology for Enhanced Fabric Performance

Nanotechnology is revolutionizing fabric protection by providing ultra-thin coatings that resist stains, spills, and UV degradation while preserving breathability. Nano-coatings offer long-lasting protection that withstands multiple washes, making them ideal for high-performance clothing, automotive interiors, and outdoor textiles. Companies are integrating silica nanoparticles and polymer matrices into their product lines to enhance abrasion resistance and hydrophobic behavior. These advancements are driving premiumization across both consumer and industrial segments.

Fabric Protector Market Drivers

Increasing Textile and Upholstery Consumption

The expanding global textile industry, particularly in home décor, apparel, and automotive sectors, is fueling demand for fabric protection solutions. Consumers are prioritizing products that extend fabric life, prevent discoloration, and reduce cleaning costs. Rising disposable incomes and lifestyle upgrades are boosting sales of upholstered furniture and luxury textiles, further supporting demand for protective coatings. Hospitality and healthcare sectors, with their high turnover of fabric assets, remain consistent commercial demand drivers.

Growing Awareness of Fabric Maintenance and Hygiene

Post-pandemic hygiene consciousness has increased consumer emphasis on cleanliness and fabric protection. Fabric protectors with antimicrobial and anti-odor properties are gaining popularity in residential and institutional settings. Marketing campaigns highlighting the longevity, cost-efficiency, and eco-safety of protective sprays and coatings are accelerating adoption, particularly in North America and Europe.

Market Restraints

Regulatory Restrictions on Chemical Compositions

Stringent environmental regulations regarding the use of fluorochemicals and volatile organic compounds (VOCs) pose significant challenges for manufacturers. Compliance with frameworks such as REACH (Europe) and EPA (U.S.) increases production costs and limits formulation flexibility. These restrictions are compelling companies to invest heavily in sustainable chemistry innovation, delaying product launches and raising development costs.

High Cost of Advanced Coatings

Nanotechnology-based and eco-friendly protectors, while effective, are more expensive to produce compared to traditional chemical coatings. This cost differential can deter adoption, particularly among price-sensitive consumers and small textile producers. Furthermore, reapplication requirements and limited consumer education on usage efficiency remain barriers to large-scale market penetration.

Fabric Protector Market Opportunities

Expansion in the Automotive and Hospitality Sectors

The automotive and hospitality industries present significant untapped potential for high-performance fabric protectors. Growing demand for luxury car interiors, stain-proof upholstery, and durable seating materials is creating steady opportunities. Hotels, restaurants, and event venues are investing in professional-grade protectors to maintain fabric aesthetics and extend replacement cycles, driving consistent B2B demand growth.

Development of Smart and Self-Healing Coatings

Emerging innovations in smart coatings that self-repair micro-scratches and restore repellency are shaping the next generation of fabric protection solutions. These intelligent coatings are particularly suited for high-end textiles, outdoor fabrics, and wearable technology. Partnerships between material science firms and textile manufacturers are expected to accelerate the commercialization of these advanced protectors over the coming decade.

Product Type Insights

The global fabric protector market is segmented by chemistry into water-based, solvent-based, and fluorochemical systems. Water-based formulations lead the market, driven by eco-regulations and consumer preference for low-VOC, non-toxic, and odorless protection solutions. Solvent-based protectors retain niche demand in professional and legacy markets due to their fast-drying and deep-penetration performance, though their usage is declining in regions enforcing strict VOC compliance. Fluorochemical-based products have historically delivered superior stain and water repellency but are increasingly under regulatory and consumer pressure due to PFAS-related concerns.

In terms of formulation, aerosol sprays dominate consumer sales owing to convenience, ease of DIY application, and widespread retail placement. Concentrates and professional-grade coatings are gaining traction in B2B channels, particularly among textile mills and automotive OEMs seeking cost-efficient, scalable, and high-performance finishes. The market is progressively shifting toward bio-based and nanotechnology-enhanced products, combining sustainability with enhanced durability and multi-functionality such as antimicrobial, UV-resistant, and self-healing properties.

Application Insights

Home textiles and upholstery represent the dominant application segment, driven by premium furniture purchases, the hospitality industry’s growing emphasis on stain protection, and increased consumer awareness of long-term fabric care. Apparel applications are expanding, fueled by fashion-care trends emphasizing fabric longevity and easy home re-treatment of outdoor and sportswear. Automotive interiors remain a critical growth area, propelled by OEM and aftermarket demand for durable, easy-clean surfaces in seats and headliners. Industrial and protective textiles form a smaller but high-value segment, driven by oil-, chemical-, and abrasion-resistant performance requirements in uniforms and technical fabrics.

End-User Insights

The household consumer segment leads the market, supported by rising awareness, DIY-oriented packaging, and increasing online product availability. The B2B segment, including textile manufacturers, automotive OEMs, and hospitality suppliers, drives volume through integrated applications during production, cost optimization per square meter, and certification requirements for sustainability and durability.

Distribution Channel Insights

E-commerce remains the most dynamic distribution channel, propelled by convenience, subscription-based replenishment models, consumer reviews, and social media-driven awareness. B2B direct and professional channels continue to dominate industrial and institutional supply, driven by long-term contracts, performance specification needs, and technical service support. The integration of omni-channel retail strategies combining online marketing with in-store visibility is increasingly common among leading brands targeting both DIY consumers and commercial buyers.

| By Type (Chemistry) | By Technology | By Application | By End User | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains a mature yet high-value market for fabric protectors, underpinned by strong demand from the furniture, home textiles, and automotive aftermarket segments. The U.S. leads adoption of eco-friendly and fluorine-free sprays, supported by consumer awareness of stain-care and fabric hygiene. A well-established retail and e-commerce network enables easy product access and repeat purchases. Regional growth is driven by household stain-care awareness, robust aftermarket demand, and established retail infrastructure. However, high regulatory scrutiny around PFAS chemicals in certain states continues to accelerate the shift toward compliant, water-based alternatives.

Europe

Europe stands as the global leader in sustainable fabric protector innovation, driven by advanced chemical policies and stringent regulations such as REACH and PFAS phase-out initiatives. Nations including Germany, France, and the U.K. are investing heavily in green chemistry and nanotechnology-based repellents. The region benefits from a robust textile, home décor, and upholstery manufacturing ecosystem. Growth is primarily driven by regulatory compliance pressures, consumer preference for certified green products, and premium home-textile demand. Manufacturers focusing on fluorine-free, high-performance coatings are gaining a competitive advantage across both retail and B2B channels.

Asia-Pacific

Asia-Pacific dominates global production and is the fastest-growing regional market, accounting for the bulk of textile manufacturing and export activities. Key contributors include China, India, and Japan, which combine large-scale industrial capacity with increasing domestic consumption. Regional growth is driven by rapid urbanization, expanding middle-class income, and the rise of local manufacturing bases. The region remains price-sensitive but is witnessing a shift toward mid- and premium-grade formulations as awareness of sustainability and quality protection grows. Expanding e-commerce penetration and the automotive industry’s growth further bolster demand.

Latin America

Latin America is an emerging market led by Brazil, Mexico, and Argentina, characterized by growing interest in upholstery and home fabric protection. Urban housing modernization, lifestyle upgrades, and the hospitality sector’s expansion are fueling adoption. However, fragmented distribution networks and limited consumer education constrain faster growth. Regional expansion is driven by residential upgrades, rising hospitality investments, and opportunities for national-level brand rollouts. Increasing local partnerships and retail consolidation efforts are expected to improve accessibility in the coming years.

Middle East & Africa

The Middle East & Africa region is showing steady growth potential, supported by rising automotive manufacturing, hospitality expansion, and large-scale infrastructure projects. The UAE, Saudi Arabia, and South Africa are leading markets with growing demand for interior fabric protection in hotels, residential projects, and vehicles. Regional growth is driven by expanding construction and automotive sectors, coupled with an import-driven premium for quality fabric care products. Increasing awareness of fabric longevity and hygiene is also propelling adoption across both institutional and household segments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Fabric Protector Market

- 3M (Scotchgard)

- TriNova

- Guard Industrie

- Nano-Tex

- Carr & Company

- Thompson’s Company

- Vectra International

Recent Developments

- In July 2025, 3M announced the launch of a new PFAS-free Scotchgard fabric protector line focusing on sustainable water-based technology.

- In May 2025, Guard Industrie introduced an advanced nanotech coating for industrial fabrics offering enhanced oil and stain repellency.

- In February 2025, Nano-Tex partnered with Asian textile manufacturers to integrate smart nano-coatings into high-performance apparel lines.