Eyeliner Market Size

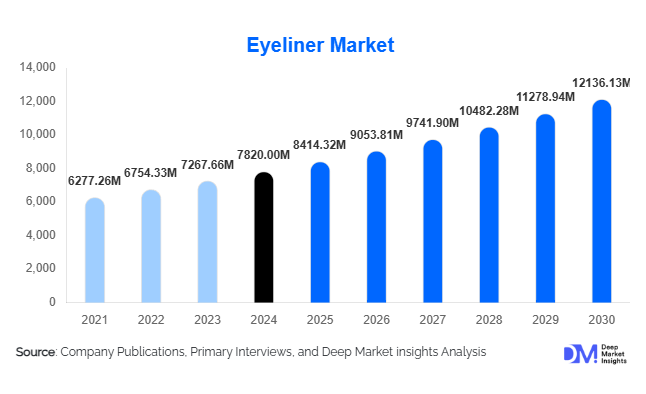

According to Deep Market Insights, the global eyeliner market size was valued at USD 7,820 million in 2024 and is projected to grow from USD 8,414.32 million in 2025 to reach USD 12,136.13 million by 2030, expanding at a CAGR of 7.6% during the forecast period (2025–2030). The eyeliner market growth is primarily driven by the increasing demand for long-lasting and waterproof formulations, the surge in beauty consciousness among Gen Z and millennial consumers, and the expanding influence of social media and beauty influencers on global cosmetic trends.

Key Market Insights

- Shift toward clean and vegan formulations is redefining product innovation, as consumers increasingly prioritize cruelty-free and sustainable beauty options.

- Asia-Pacific leads global eyeliner consumption, driven by strong demand in countries such as China, India, Japan, and South Korea.

- North America remains a key innovation hub for premium and hybrid eyeliners featuring skincare benefits and advanced applicator technologies.

- Online retail channels dominate eyeliner sales, with e-commerce platforms and D2C beauty brands gaining rapid traction among young consumers.

- Technological innovation in applicator design, including precision tips and magnetic liners, is enhancing ease of use and accuracy for end-users.

- Celebrity and influencer-led collaborations are shaping consumer preferences, significantly boosting brand visibility and product adoption.

Latest Market Trends

Rise of Clean Beauty and Sustainable Packaging

The eyeliner market is witnessing a surge in demand for clean beauty products formulated without parabens, sulfates, or animal-derived ingredients. Major brands are investing in recyclable or biodegradable packaging to align with eco-conscious consumer values. Refillable eyeliner pens and paper-based packaging are gaining traction, offering both sustainability and convenience. The clean beauty trend is particularly strong in North America and Europe, where regulatory standards and consumer awareness are driving brand differentiation through transparency and ethical sourcing.

Technological Integration and Smart Eyeliners

Innovations in formulation and applicator design are reshaping the eyeliner segment. Smart eyeliners with temperature-sensitive pigments, magnetic properties for false lashes, and ergonomic designs are gaining popularity. Some brands are incorporating skincare elements such as vitamin E and hyaluronic acid to enhance lash and lid health. Digital try-on tools using AR and AI are also revolutionizing the online shopping experience, allowing consumers to visualize shades and styles before purchasing. This fusion of technology and beauty is making eyeliner products more personalized and accessible.

Eyeliner Market Drivers

Growing Influence of Beauty Influencers and Social Media

The rapid rise of influencer marketing and visual-first platforms such as Instagram, TikTok, and YouTube has accelerated eyeliner adoption across global demographics. Tutorials, trends like the “graphic eyeliner look,” and viral beauty challenges have amplified consumer interest in experimenting with new styles. The ability of influencers to quickly popularize niche products, such as colored and metallic eyeliners, has made social media a dominant force in shaping purchase behavior and market growth.

Expanding Male Grooming and Gender-Neutral Cosmetics

Gender inclusivity is transforming the eyeliner market, as cosmetic brands increasingly target male and non-binary consumers. Eyeliners designed for subtle definition and unisex branding are becoming mainstream. Celebrity endorsements by male figures and K-pop idols have normalized eyeliner use beyond traditional female segments. This cultural shift, supported by growing acceptance of self-expression through makeup, is significantly widening the consumer base.

Market Restraints

Counterfeit Products and Brand Imitation

The proliferation of counterfeit eyeliner products, particularly in online marketplaces, poses a major challenge for established brands. These imitations often contain harmful chemicals and compromise consumer safety, leading to brand reputation risks. The lack of stringent regulations in emerging markets exacerbates this issue, pushing companies to invest in authentication technologies and anti-counterfeit packaging.

Fluctuating Raw Material Costs

Volatility in the prices of raw materials such as pigments, waxes, and cosmetic-grade polymers affects production costs. Additionally, rising sustainability standards and the shift toward natural ingredients have increased supply chain complexities. These factors may restrain profit margins for manufacturers, especially smaller or emerging beauty brands operating in the mass-market segment.

Eyeliner Market Opportunities

Innovation in Waterproof and Long-Wear Formulations

Consumers increasingly prefer eyeliners that withstand humidity, sweat, and long hours of wear. This trend presents significant opportunities for brands to develop advanced waterproof and smudge-proof formulations with gentle removal properties. Incorporating skin-friendly ingredients that prevent irritation while ensuring long wear is likely to drive brand loyalty and repeat purchases.

Emergence of Hybrid and Multi-Functional Eyeliners

The rising consumer demand for convenience and efficiency is fueling the development of hybrid eyeliners that combine multiple benefits, such as eyeliner-serum blends for lash nourishment or eyeliner-eyeshadow dual formats. This innovation caters to fast-paced lifestyles and simplifies beauty routines, particularly among urban consumers. Hybrid formats are expected to gain substantial traction in premium and mid-range categories.

Product Type Insights

Liquid eyeliners dominate the global market, favored for their precision and bold pigmentation. Pencil eyeliners maintain a strong presence due to ease of application and affordability, while gel-based eyeliners are popular among professionals seeking long-lasting, smudge-resistant results. Felt-tip and pen eyeliners are rapidly gaining momentum for their portability and precision in creating graphic designs, appealing to younger consumers seeking trend-driven styles.

Distribution Channel Insights

Online retail remains the leading distribution channel, fueled by influencer marketing, digital try-ons, and exclusive e-commerce launches. Offline retail, including specialty stores, supermarkets, and department stores, continues to serve as an essential touchpoint for consumers preferring physical trials. Direct-to-consumer (D2C) sales through brand websites are expanding rapidly, enabling personalized marketing and subscription-based offerings. Emerging models like social commerce and live-stream selling are also transforming how eyeliners are marketed and sold globally.

| By Product Type | By Application | By Distribution Channel | By End-User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains a mature market characterized by high product innovation and strong consumer demand for vegan, cruelty-free eyeliners. The U.S. dominates regional sales, supported by major brands such as Maybelline, Fenty Beauty, and Urban Decay. E-commerce and influencer collaborations are key growth accelerators in this region.

Europe

Europe’s eyeliner market is driven by clean beauty movements and strict cosmetic regulations that promote transparency and sustainability. The U.K., Germany, and France are leading markets, with rising demand for refillable and eco-packaged eyeliners. European consumers show strong interest in minimalist, natural-look makeup styles that emphasize subtle eye definition.

Asia-Pacific

Asia-Pacific dominates global eyeliner demand, propelled by high consumption in China, India, Japan, and South Korea. The popularity of K-beauty and rising disposable incomes are fueling continuous innovation in textures, colors, and applicator designs. The region also serves as a key manufacturing hub for both premium and mass-market eyeliner brands.

Latin America

Latin America is witnessing a rising demand for affordable and waterproof eyeliners, particularly in Brazil and Mexico. Urbanization, social media influence, and growing access to international brands through e-commerce are key growth drivers. Local beauty brands are expanding their portfolios with colorful and tropical-inspired shades to cater to diverse consumer preferences.

Middle East & Africa

Rising beauty awareness and the influence of global fashion trends are fueling eyeliner adoption in the Middle East & Africa. Countries such as Saudi Arabia and the UAE represent strong markets for premium eyeliner products, driven by the cultural emphasis on eye makeup. Local brands are increasingly blending traditional formulations with modern packaging and applicator innovations.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Eyeliner Market

- L’Oréal S.A.

- Unilever (Lakmé, Pond’s)

- Procter & Gamble (CoverGirl)

- Estée Lauder Companies Inc.

- Revlon Inc.

- Shiseido Co., Ltd.

- Coty Inc.

- LVMH (Fenty Beauty, Benefit Cosmetics)

Recent Developments

- In August 2025, L’Oréal launched a new line of refillable liquid eyeliners made from recycled aluminum packaging, reinforcing its commitment to sustainability.

- In May 2025, Fenty Beauty introduced a smart eyeliner featuring temperature-reactive pigments that adapt to skin tone and lighting conditions.

- In February 2025, Shiseido announced the expansion of its “Synchro Ink” eyeliner range across Southeast Asia, targeting Gen Z consumers with bold, artistic looks.