Eyelash and Brow Growth Enhancer Market Size

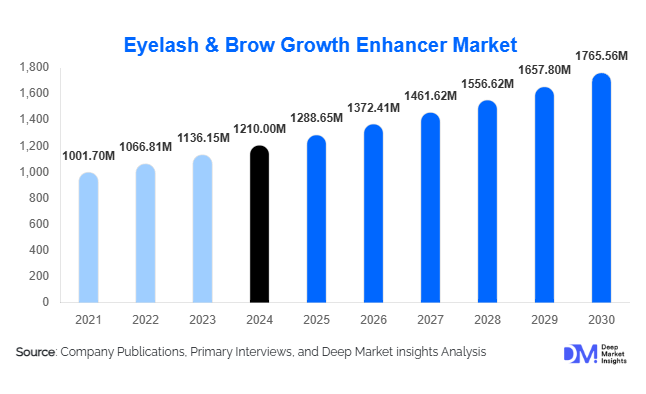

According to Deep Market Insights, the global eyelash and brow growth enhancer market size was valued at USD 1,210 million in 2024 and is projected to grow from USD 1,288.65 million in 2025 to reach USD 1,765.56 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The market growth is primarily driven by rising consumer focus on personal grooming, increasing demand for advanced and clinically tested cosmetic solutions, and the growing adoption of e-commerce and direct-to-consumer sales channels globally.

Key Market Insights

- Peptide-based and natural formulations are leading product trends, driven by consumer preference for safe and effective eyelash and brow growth solutions.

- Online channels dominate distribution, with e-commerce platforms expanding access to premium and niche products across regions.

- North America holds the largest market share, owing to high consumer awareness, disposable income, and established cosmetic regulatory frameworks.

- Asia-Pacific is emerging as the fastest-growing market, fueled by rising beauty consciousness, increasing middle-class affluence, and strong digital retail penetration.

- Technological innovations in formulations, including peptide-enriched serums, growth-factor solutions, and microbiome-friendly products, are reshaping product development and boosting market adoption.

Latest Market Trends

Advanced Formulation and Efficacy Testing

Market participants are increasingly emphasizing dermatologically tested and clinically proven products. Peptide-based serums, vitamin-enriched solutions, and herbal formulations are gaining traction among consumers seeking visible results without adverse effects. Clinical trials and efficacy certifications enhance consumer confidence, supporting repeat purchases and higher market penetration. Additionally, hybrid formulations integrating growth enhancers into daily cosmetics such as mascaras are becoming popular, offering multifunctional appeal.

Digital Retail and Direct-to-Consumer Strategies

The proliferation of e-commerce platforms and brand-owned websites is transforming product accessibility. Consumers can now access premium, niche, and international brands conveniently. Social media campaigns, influencer endorsements, and virtual product demonstrations are driving engagement, particularly among younger demographics. Subscription models and personalized product recommendations are emerging, increasing consumer loyalty and repeat sales. Digital marketing analytics also allows brands to target specific consumer segments with tailored messaging.

Market Drivers

Rising Beauty and Personal Care Awareness

Increasing focus on aesthetics, self-care routines, and the desire for enhanced appearance are driving demand for eyelash and brow growth products. Social media influence, celebrity endorsements, and influencer marketing are encouraging consumers to adopt these products, particularly in North America and Europe. Both female and male consumers are seeking fuller, darker, and healthier eyelashes and brows, leading to higher adoption of growth enhancers.

Technological Advancements in Product Development

Innovative formulations incorporating peptides, biotin, vitamins, and botanical extracts have improved product effectiveness. Clinical validation and dermatological testing are reinforcing consumer trust. Hypoallergenic and microbiome-friendly products are also contributing to wider adoption, catering to sensitive skin and specialized consumer needs.

Growth of E-Commerce and Global Retail Channels

Online retail channels have expanded market reach, particularly in emerging economies. Consumers benefit from product comparisons, user reviews, and home delivery convenience. Brands leveraging social media marketing, AR-based virtual trials, and influencer partnerships are seeing increased engagement and higher conversion rates. Subscription-based offerings further support recurring revenue streams.

Market Restraints

High Product Pricing

Premium eyelash and brow growth enhancers, particularly clinically proven or prescription-based products, remain expensive. This limits accessibility in price-sensitive regions and may slow adoption in emerging markets, where consumers may prefer lower-cost alternatives or natural oils.

Regulatory and Compliance Challenges

Stringent regulatory standards for cosmetic products, including ingredient restrictions and safety testing, can delay product launches and increase operational costs. Navigating approvals across regions such as the EU, USA, and Japan requires significant investment, which may pose a barrier for smaller players entering the market.

Market Opportunities

Expansion in Emerging Markets

Asia-Pacific and Latin America present significant growth opportunities. Rising disposable incomes, beauty awareness, and digital retail penetration in countries like India, China, Brazil, and Mexico are driving demand. Companies can leverage localized marketing, influencer campaigns, and partnerships with local retailers to increase market penetration in these regions.

Technological Integration in Product Innovation

New formulations incorporating peptides, vitamins, and growth factors, as well as microbiome-friendly products, offer differentiation opportunities. AI and AR technologies for virtual try-ons and product trials are improving consumer engagement and online sales conversion. Brands investing in R&D for safer, faster-acting, and multifunctional products can capture premium segments effectively.

Government Initiatives Supporting Local Manufacturing

Programs such as “Make in India” and “Made in China 2025” encourage domestic production, reducing reliance on imports. Favorable policies and incentives for technology adoption allow companies to establish cost-effective production facilities, expand manufacturing capabilities, and enhance market reach globally.

Product Type Insights

Serums dominate the market, accounting for approximately 45% of the 2024 market share. Peptide-based serums are leading due to proven efficacy and high consumer trust. Oils and conditioners, including castor and botanical oils, account for 30% of the market, favored for natural and home-based regimens. Prescription-based treatments hold a smaller share (around 15%) but are growing steadily due to clinically validated results. OTC treatments account for the remaining 10%, appealing to consumers seeking accessible, non-prescription solutions.

Application Insights

Daily cosmetic use integrated with growth enhancers remains the largest application segment, driven by multifunctional products such as mascara with lash growth properties. Home-based treatment applications using serums and oils are growing due to convenience and affordability. Spa and professional salon treatments are niche but gaining traction, particularly in North America and Europe, as consumers seek premium, professional-grade results.

Distribution Channel Insights

Online retail dominates with over 50% of global sales, supported by e-commerce platforms and D2C websites. Offline channels, including specialty beauty stores and pharmacies, contribute around 40%, primarily in mature markets. Department stores and high-end retail outlets account for the remaining 10%. Digital marketing and influencer-led campaigns are increasingly shaping consumer buying patterns.

Consumer Demographics Insights

Women account for approximately 85% of market demand, while male adoption is growing steadily, especially in urban centers. Age-wise, the 26–35 years segment leads consumption, driven by higher beauty consciousness and social media influence. The 18–25 years segment is the fastest-growing, primarily in online channels, seeking innovative and multifunctional products. Consumers above 50 years represent a smaller but growing segment interested in age-defying cosmetic solutions.

| By Product Type | By Formulation | By Application Method | By Distribution Channel | By Consumer Demographics |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America dominates with a 35% share of the 2024 market. High disposable income, strong beauty awareness, and established regulatory frameworks contribute to demand. The U.S. leads in consumption, followed by Canada, with serums and OTC products being the most popular.

Europe

Europe accounts for approximately 28% of the market, with Germany, the U.K., and France leading adoption. Eco-friendly and clinically tested products are highly preferred. The region emphasizes sustainable, ethical cosmetics, driving growth in peptide-based serums and natural oils.

Asia-Pacific

APAC is the fastest-growing region, driven by India, China, Japan, and South Korea. Rising middle-class income, digital retail penetration, and influencer marketing are fueling demand. India and China represent significant growth potential due to evolving beauty standards and urbanization.

Middle East & Africa

Middle East demand is led by the UAE and Saudi Arabia, focusing on premium products. African markets, particularly South Africa, show steady growth in urban centers. High interest in luxury cosmetics and beauty enhancements supports market expansion.

Latin America

Brazil, Mexico, and Argentina are the primary contributors. While market penetration is lower than in other regions, rising beauty awareness and online retail growth are creating new opportunities. Consumers favor natural and multifunctional products.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Eyelash and Brow Growth Enhancer Market

- L’Oréal

- Estée Lauder

- RevitaLash Cosmetics

- Shiseido

- Amorepacific

- Elizabeth Arden

- Rodan + Fields

- NuFACE

- Grande Cosmetics

- Physicians Formula

- BeautyBio

- Velour Lashes

- Billion Dollar Brows

- Jafra Cosmetics

- Oriflame

Recent Developments

- In March 2025, RevitaLash Cosmetics launched a new peptide-based serum line, enhancing lash and brow growth with clinically tested results.

- In January 2025, L’Oréal introduced a multifunctional mascara integrating lash growth properties, targeting e-commerce channels in North America and Europe.

- In June 2024, Shiseido expanded its brow enhancer product line in Asia-Pacific, combining natural ingredients with dermatologist-tested formulations for sensitive skin.