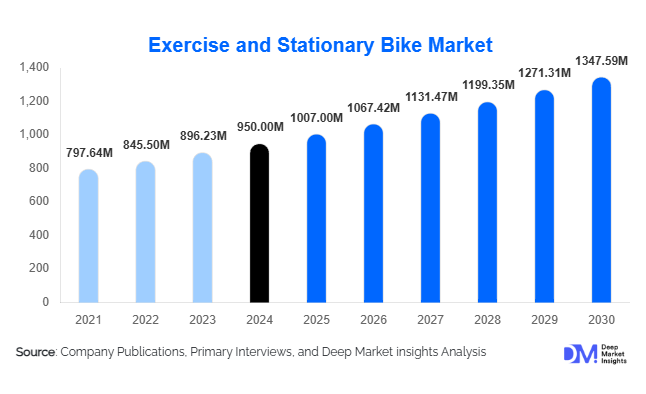

Exercise and Stationary Bike Market Size

According to Deep Market Insights, the global exercise and stationary bike market size was valued at USD 950 million in 2024 and is projected to grow from USD 1,007.00 million in 2025 to reach USD 1,347.59 million by 2030, expanding at a CAGR of 6.0% during the forecast period (2025–2030). The market growth is primarily driven by rising health and wellness awareness, increasing adoption of home-based fitness solutions, and technological advancements in smart and connected stationary bikes.

Key Market Insights

- Home-fitness adoption is driving demand for residential stationary bikes, supported by hybrid work models, convenience, and increasing health consciousness.

- Smart and connected bikes are transforming the market, offering interactive workouts, app connectivity, and virtual training sessions that enhance engagement and recurring revenue models.

- North America dominates the market, with high disposable incomes and an established fitness culture contributing to a 38% share of the 2024 market.

- Asia-Pacific is the fastest-growing region, driven by rising urbanization, increasing disposable income, and expanding e-commerce channels.

- Online retail is the leading distribution channel, accounting for approximately 40% of market sales, reflecting the shift from offline to e-commerce and direct-to-consumer sales.

- Spin/indoor cycling bikes lead the product segment, representing about 35% of market value in 2024 due to popularity in home and commercial fitness setups.

Latest Market Trends

Smart and Connected Fitness Integration

Manufacturers are increasingly integrating IoT-enabled features, AI-driven workout programs, and subscription-based content into stationary bikes. Interactive virtual training sessions, live-streamed classes, and app-based performance tracking have become critical differentiators. These innovations not only improve customer engagement but also generate recurring revenue through subscriptions. Connected bikes are increasingly designed to provide ecosystem stickiness, linking wearables and health apps, and offering performance analytics to enhance user experience.

Rise of Home-Fitness Adoption

The global shift towards home fitness, accelerated by the pandemic, continues to shape the market. Consumers are seeking convenient, space-efficient solutions like upright, recumbent, and spin bikes that fit into residential spaces. Hybrid work models and time constraints have made home workouts more appealing. Manufacturers are catering to this trend with compact designs, foldable bikes, and affordable smart options, often bundled with online workout subscriptions. This trend is particularly pronounced in North America, Europe, and emerging Asia-Pacific markets.

Exercise and Stationary Bike Market Drivers

Rising Health and Wellness Awareness

The increasing prevalence of lifestyle-related health conditions, such as obesity, cardiovascular disease, and diabetes, has driven consumers to adopt regular exercise routines. Stationary bikes offer a low-impact cardiovascular workout, suitable for a wide range of age groups, from young adults to seniors. Health-focused campaigns, social media fitness challenges, and online communities have further reinforced consumer engagement with home and commercial stationary bike usage.

Technological Innovation in Fitness Equipment

The integration of smart technology, including magnetic/electromagnetic resistance systems, AI-adaptive programs, and VR-based immersive workouts, has enhanced the appeal of stationary bikes. Premium connected bikes allow users to access live classes, track performance metrics, and compete virtually. These technological innovations provide differentiation for manufacturers and justify higher price points, fueling market growth in both developed and emerging markets.

Growing Corporate Wellness and Rehabilitation Applications

Corporate wellness programs and rehabilitation centers are increasingly deploying stationary bikes to promote health, productivity, and recovery. Organizations incentivize employees to maintain fitness through in-office gyms or subsidized home equipment. Rehabilitation clinics use recumbent and dual-action bikes for low-impact therapy, contributing to incremental demand. These emerging applications expand market reach beyond traditional home and commercial fitness segments.

Market Restraints

High Price Sensitivity

Premium connected stationary bikes often command high prices, which can limit adoption in emerging markets and price-sensitive consumer segments. Additional subscription costs for smart content may further discourage purchase. Maintenance, shipping, and replacement parts add to the total cost of ownership, creating barriers for widespread adoption.

Market Saturation in Mature Regions

In North America and Western Europe, many households purchased stationary bikes during the pandemic, leading to slower replacement cycles. Monotonous workouts and low engagement without interactive features contribute to underutilization and abandonment. This saturation can potentially slow growth in mature markets, requiring manufacturers to innovate continuously to sustain interest.

Exercise and Stationary Bike Market Opportunities

Expansion in Emerging Markets

Asia-Pacific, Latin America, and the Middle East are poised for rapid growth due to rising disposable income, urbanization, and e-commerce expansion. Localized marketing strategies, affordable smart bike options, and financing models for home-fitness equipment offer significant potential. Manufacturers entering these regions early can capture market share before premium segments saturate.

Smart Connected Ecosystems and Subscriptions

Integrating IoT-based workouts, subscription services, and virtual fitness content provides recurring revenue streams and enhances product differentiation. Partnerships with app developers, fitness influencers, and digital platforms can boost engagement, retention, and long-term customer loyalty. Subscription-based ecosystems allow manufacturers to leverage recurring revenue, offsetting high initial investment costs for premium bikes.

Corporate Wellness and Rehabilitation Applications

Expanding partnerships with employers, health insurers, and medical/rehabilitation facilities offers bulk sales opportunities. Corporate wellness programs incentivize fitness through in-office installations or subsidized home equipment. Rehabilitation centers require specialized bikes for therapy, providing niche demand. New entrants can target these sectors with purpose-designed products, leasing models, or integrated service offerings.

Product Type Insights

Spin/indoor cycling bikes lead the market, representing approximately 35% of the global market value in 2024. Their popularity stems from adaptability across home and commercial fitness setups, interactive virtual training programs, and suitability for both cardiovascular and high-intensity workouts. Upright and recumbent bikes also remain significant, particularly for rehabilitation and low-impact home exercise, while smart/connected bikes are experiencing faster growth due to premium adoption trends.

Application Insights

Home/residential use dominates the market (45% of 2024 value) due to convenience, hybrid work trends, and growing health awareness. Commercial gyms and health clubs maintain steady demand, while corporate wellness programs and rehabilitation centers are emerging applications. Export-driven demand from Asia-Pacific manufacturers to North America and Europe also contributes to market expansion.

Distribution Channel Insights

Online retail leads distribution (40% share), driven by e-commerce adoption, direct-to-consumer models, and broader accessibility. Offline specialty fitness stores remain relevant for premium products and commercial setups. Institutional sales, including corporate wellness and rehabilitation centers, represent a growing niche with bulk order potential.

End-Use Insights

Home/residential end-use remains the largest and fastest-growing segment, followed by commercial gym/health club installations. Corporate wellness and rehabilitation centers are gaining traction, creating diversified demand streams. New applications in corporate and medical sectors enhance incremental market growth, while export markets continue to drive global volume.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds the largest market share (38% in 2024), with strong home-fitness adoption, high disposable income, and premium product preference. The U.S. leads demand, followed by Canada, driven by interactive, connected bikes and online retail channels.

Europe

Europe accounts for 30% of the market, led by Germany, the U.K., and France. Sustainability trends, fitness awareness, and well-developed e-commerce infrastructure support growth. Germany and the U.K. dominate premium connected bike adoption.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by China, India, Japan, and Australia. Rising disposable income, urbanization, and online sales channels are expanding market penetration. Growth in China and India exceeds double-digit CAGR, presenting significant opportunities for manufacturers.

Latin America

Brazil, Mexico, and Argentina show gradual uptake, particularly for mid-range and premium home-fitness equipment. Outbound exports from Asia and targeted marketing are facilitating growth.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, is a high-income market for premium and connected bikes. Africa, while a smaller market, is emerging in the corporate wellness and institutional fitness segments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Exercise and Stationary Bike Market

- Peloton Interactive, Inc.

- ICON Health & Fitness, Inc.

- Technogym S.p.A.

- Brunswick Corporation

- Johnson Health Tech Co., Ltd.

- Nautilus, Inc.

- Precor Incorporated

- Echelon Fitness Multimedia LLC

- Matrix Fitness Technologies, Inc.

- Spirit Manufacturing, Inc.

- Wattbike Ltd.

- Schwinn Fitness

- Octane Fitness

- Life Fitness

- Sunny Health & Fitness

Recent Developments

- In June 2025, Peloton launched an upgraded connected bike with AI-adaptive workouts and expanded live-streamed classes to increase user engagement and subscription retention.

- In March 2025, Technogym introduced a compact smart home bike designed for urban apartments in the Asia-Pacific region, targeting emerging markets with mid-range pricing.

- In January 2025, ICON Health & Fitness announced expansion of manufacturing facilities in China to meet rising demand in export-driven markets, leveraging “Made in China 2025” incentives.