Ethernet Adapter Market Size

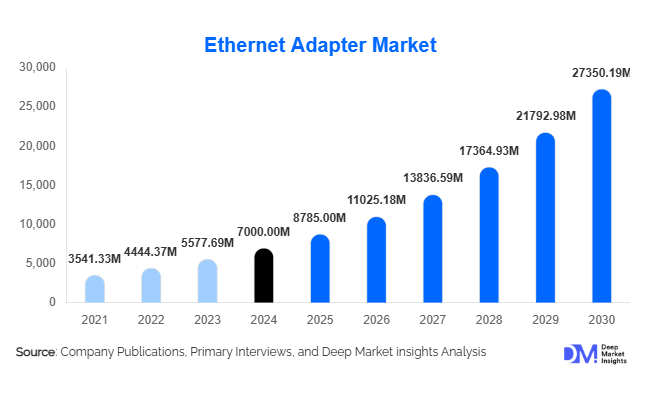

According to Deep Market Insights, the global Ethernet adapter market size was valued at USD 7,000.00 million in 2024 and is projected to grow from USD 8,785.00 million in 2025 to reach USD 27,350.19 million by 2030, expanding at a CAGR of 25.5% during the forecast period (2025–2030). The market growth is primarily driven by the rapid expansion of data centre infrastructure, increasing demand for high-speed wired connectivity, adoption of multi-gigabit networking in enterprise and industrial applications, and the growing integration of Ethernet in embedded and IoT systems worldwide.

Key Market Insights

- Enterprise and data centre networking upgrades are accelerating demand, particularly for 10 GbE, 25 GbE, and higher-speed Ethernet adapters to support virtualisation, cloud, and AI/ML workloads.

- Industrial automation and IoT adoption are driving growth for embedded and ruggedised adapters used in smart factories, robotics, automotive Ethernet, and connected devices.

- North America leads the market with the largest share, owing to mature data centre infrastructure, hyperscale cloud presence, and early adoption of multi-gigabit networking solutions.

- Asia-Pacific is the fastest-growing region, driven by digital infrastructure expansion, telecom upgrades, and industrial digitalisation in China, India, Japan, and Australia.

- Consumer and SMB demand for high-performance wired connectivity is rising, especially in gaming, streaming, and remote work setups, supporting the growth of USB, Thunderbolt, and multi-gigabit adapters.

- Technological adoption, such as SmartNICs, DPUs, multi-port configurations, and support for RDMA/RoCE and Time-Sensitive Networking, is reshaping product offerings.

Latest Market Trends

Data Centre and Hyperscale Network Expansion

Cloud providers and hyperscale data centres are investing heavily in high-performance Ethernet adapters to handle increasing data traffic, AI workloads, and virtualisation needs. Multi-port, low-latency, and high-speed adapters (25 GbE, 50 GbE, 100 GbE) are becoming standard in modern servers and storage arrays. Companies are integrating offload features, RDMA, and DPU capabilities to enhance network efficiency and reduce CPU load, making Ethernet adapters central to data centre modernisation efforts.

Industrial and Embedded Ethernet Growth

Ethernet adoption in industrial automation, automotive, and IoT devices is accelerating. Ruggedised, embedded, and multi-gigabit adapters are increasingly deployed in factories, smart manufacturing setups, and connected vehicles. These adapters provide deterministic, high-speed, and reliable connectivity crucial for Industry 4.0 and real-time control systems. Industrial Ethernet standards like TSN (Time-Sensitive Networking) are driving demand for specialised adapters capable of precise timing and synchronisation.

Ethernet Adapter Market Drivers

Rapid Upgrade of Enterprise and Cloud Infrastructure

The growth of cloud services, virtualisation, and AI workloads is prompting enterprises and hyperscale providers to replace legacy 1 GbE adapters with higher-speed solutions. This trend fuels demand for internal PCIe and multi-port adapters in servers, storage, and networking equipment, offering high throughput, low latency, and reliability.

Rising Industrial Automation and IoT Integration

As factories, robotics, automotive, and smart cities adopt Ethernet for deterministic connectivity, the need for embedded and industrial-grade adapters grows. Ethernet adapters in these applications ensure high-speed data transmission and real-time control, making them a critical component of modern industrial networks.

Consumer and SMB Adoption of High-Speed Networking

Gamers, content creators, and SMB offices increasingly rely on wired connectivity for low latency and stability. USB, Thunderbolt, and internal desktop adapters provide reliable multi-gigabit connections, boosting market demand. This segment continues to grow alongside remote work, high-definition streaming, and home office networking.

Market Restraints

High Deployment Costs for High-Speed Adapters

Adapters supporting 25 GbE and above come with higher costs, installation complexity, and host compatibility requirements. SMBs and smaller enterprises may find the investment challenging compared to 1 GbE or 10 GbE alternatives, limiting adoption in cost-sensitive segments.

Competition from Advanced Wireless Solutions

High-performance Wi-Fi 6/6E/7 and private 5G deployments reduce the reliance on wired connectivity in certain residential and SMB environments. This limits the market potential for Ethernet adapters in areas where wireless adoption is sufficient.

Ethernet Adapter Market Opportunities

High-Speed Networking for AI and Hyperscale Data Centres

Hyperscale cloud and AI infrastructure demand multi-gigabit adapters with advanced offload features. Suppliers offering 25/50/100 GbE adapters with RDMA, DPU integration, and multi-port capabilities can capture high-value enterprise contracts and long-term partnerships with cloud providers.

Industrial Ethernet and Embedded Applications

Industry 4.0 initiatives, automotive Ethernet, and IoT growth create opportunities for ruggedised, deterministic Ethernet adapters. Embedded adapters for industrial controllers, robotics, and smart devices are an emerging high-growth segment, offering premium pricing and long-term demand stability.

Emerging Market Expansion

Asia-Pacific, Latin America, and MEA regions are modernising digital infrastructure and expanding telecom networks. Localised manufacturing, government initiatives, and telecom upgrades create growth potential for lower-cost adapters and mid-tier solutions. Companies entering these regions can capitalise on volume-driven demand and long-term infrastructure investments.

Product Type Insights

Internal PCIe adapters dominate the Ethernet adapter market, particularly in servers and embedded systems, owing to their high throughput, reliability, and low-latency performance. Their integration within existing enterprise and data center systems provides cost-effectiveness while supporting high-performance computing needs. External adapters, including USB and Thunderbolt variants, are prevalent in consumer and SMB segments due to their portability, plug-and-play functionality, and ease of deployment across diverse environments. Multi-port adapters are gaining traction in enterprise networks, as they enhance redundancy, load balancing, and virtualization capabilities. High-speed adapters (25 GbE and above) are increasingly adopted in hyperscale data centers to meet growing demands for bandwidth-intensive applications, AI workloads, and storage virtualization, positioning them as a critical segment driving market expansion.

Application Insights

Servers remain the largest application segment, driven by enterprise, cloud, and hyperscale deployments requiring robust and high-bandwidth connectivity. Industrial and embedded systems represent the fastest-growing applications, spurred by IoT integration, automotive Ethernet adoption, and industrial automation initiatives. Consumer desktops and laptops maintain relevance, particularly in gaming, streaming, and remote-work environments, where ease of connectivity and performance are prioritized. Network equipment, including switches and routers, also drives adoption of multi-port and high-speed adapters, ensuring efficient data routing, traffic management, and reliable backplane connectivity. Segment-specific drivers, such as high bandwidth for PCIe in servers and plug-and-play functionality for USB in consumer systems, reinforce these application trends.

Distribution Channel Insights

OEM and direct-to-system integration dominate enterprise and industrial deployments due to the need for high-performance, integrated solutions. Online retail and e-commerce channels serve consumer and SMB segments, providing convenient access to USB and Thunderbolt adapters. System integrators and industrial solution providers are increasingly bundling Ethernet adapters with automation or IoT solutions, while direct partnerships with hyperscalers and server OEMs remain critical for high-value, multi-port, and high-speed deployments. This multi-channel approach ensures broad market penetration while catering to diverse end-user needs.

End-User Segment Insights

Enterprise and data center customers drive bulk adoption of internal PCIe and multi-port adapters, reflecting their need for high throughput, reliability, and scalability. Industrial OEMs increasingly demand embedded and ruggedized adapters for automation, manufacturing, and IoT applications, emphasizing durability and deterministic connectivity. Consumer and SMB buyers focus on plug-and-play external adapters for residential and small office networks, prioritizing affordability and ease of installation. Segment-specific drivers such as high-performance computing for enterprise, industrial automation for embedded systems, and portability for consumer adapters naturally guide these adoption patterns.

Age Group Analogy Insights

Technology adoption maturity can be analogized to age groups: early adopters of high-speed and SmartNIC solutions are akin to “31–50 years,” representing enterprises and hyperscalers prioritizing cutting-edge performance. Industrial embedded applications correspond to “18–30 years,” highlighting rapid growth, experimentation, and innovation adoption. Legacy 1 GbE consumer adapters align with the “51–65 years” segment, reflecting slower adoption and stable, low-risk demand patterns.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for 35% of the global Ethernet adapter market in 2024. The U.S. leads due to mature data centre infrastructure, early adoption of multi-gigabit networking, and strong enterprise IT spending. Canada and Mexico contribute smaller shares. High-speed server and multi-port adapter adoption is supported by the region’s emphasis on cloud computing, hyperscale data centres, and enterprise digital transformation initiatives. Segment drivers, such as PCIe adapters for low-latency, high-bandwidth applications, and external adapters for SMB convenience, further reinforce market growth in North America.

Europe

Europe holds 25% market share, with Germany, the U.K., and France leading demand. The region’s growth is fueled by strong industrial automation adoption, smart manufacturing initiatives, and advanced enterprise IT networks. Industrial Ethernet and embedded solutions are witnessing rapid uptake due to regulatory focus on Industry 4.0 standards and digitalisation. Segment-specific drivers, including embedded adapters for industrial systems and internal PCIe adapters for enterprise servers, contribute significantly to the market’s steady expansion.

Asia-Pacific

APAC is the fastest-growing region, with China, India, Japan, and Australia as key markets. Rapid urbanisation, increasing industrial digitalisation, and rising demand for high-speed internet drive growth. Data centre expansion, smart manufacturing adoption, and industrial IoT integration are primary regional drivers. Multi-gigabit enterprise solutions, ruggedised embedded adapters, and consumer-grade external adapters are all experiencing strong uptake, supported by government initiatives to enhance digital infrastructure and connectivity.

Latin America

LATAM accounts for 5–7% of the market, with Brazil and Argentina leading adoption. Growth is supported by increasing investments in digital infrastructure, enterprise network upgrades, and limited but expanding data centre build-out. Segment drivers such as PCIe internal adapters for small to medium-sized enterprise servers and plug-and-play USB adapters for SMBs are contributing to moderate but accelerating growth in the region.

Middle East & Africa

MEA represents 3–4% of the global market, with the UAE, Saudi Arabia, and South Africa as primary contributors. Growth is fueled by smart city initiatives, ICT infrastructure development, and industrial automation projects. Enterprise and industrial customers are increasingly adopting high-reliability internal and embedded adapters, while consumer adoption of external adapters remains modest. Segment-specific drivers, including high-bandwidth PCIe adapters for enterprise applications and ruggedised solutions for industrial environments, are key enablers of regional growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Ethernet Adapter Market

- Intel Corporation

- Broadcom Inc.

- NVIDIA Corporation

- Marvell Technology Group

- Realtek Semiconductor Corporation

- TP-Link Technologies Co., Ltd.

- D-Link Corporation

- Belkin International, Inc.

- ASUSTeK Computer Inc.

- StarTech.com

- Lenovo Group

- Anker Technology (UK) Ltd.

- TRENDnet, Inc.

- Linkreal

- Xilinx (AMD)

Recent Developments

- In 2025, Intel launched new multi-port 100 GbE adapters targeting hyperscale cloud deployments with RDMA and offload capabilities.

- In 2025, NVIDIA (Mellanox) expanded its SmartNIC portfolio for enterprise and industrial Ethernet applications, focusing on AI workloads and automation.

- In 2024, Broadcom introduced next-generation 25 GbE and 50 GbE adapters for data centers, improving throughput and reducing CPU load in virtualized environments.