Ergonomic Chair Market Size

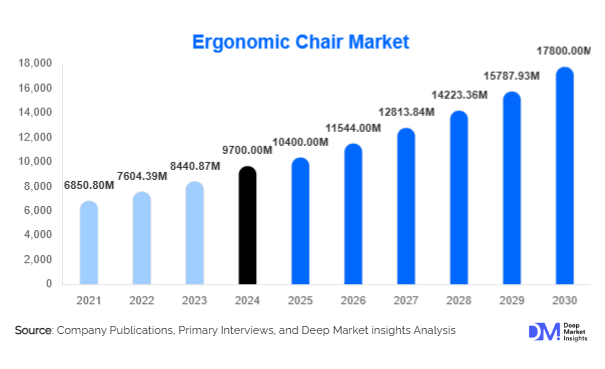

According to Deep Market Insights, the global ergonomic chair market size was valued at USD 9,700 million in 2024 and is projected to grow from USD 10,400 million in 2025 to reach USD 17,800 million by 2030, expanding at a CAGR of 11.0% during the forecast period (2025–2030). The market growth is primarily driven by increasing awareness of workplace ergonomics, the growing adoption of remote and hybrid work models, and rising health consciousness among office workers globally.

Key Market Insights

- Heightened focus on workplace wellness and ergonomic furniture adoption is propelling demand for adjustable chairs that reduce musculoskeletal disorders.

- Technologically advanced smart ergonomic chairs, integrating sensors, posture correction, and IoT connectivity, are gaining traction across corporate and home-office setups.

- North America dominates the ergonomic chair market, driven by widespread office ergonomics policies and high corporate spending on employee health.

- Asia-Pacific is the fastest-growing region, with rapid urbanization, rising office spaces, and an increasing e-commerce and IT workforce contributing to strong growth.

- Europe maintains steady growth, supported by workplace safety regulations and government initiatives promoting ergonomics.

- Increasing integration of sustainable materials and design innovation is reshaping product offerings and influencing consumer preference.

What are the prevailing trends currently influencing the global ergonomic chair market?

Integration of Smart Technology

Ergonomic chairs are evolving beyond traditional adjustable designs to incorporate smart technologies. Features such as posture monitoring sensors, connected mobile apps, and automated seat adjustments are becoming standard for high-end office chairs. Companies are also integrating IoT solutions that track usage patterns, suggest posture corrections, and link data to corporate wellness programs. These innovations not only improve user health outcomes but also appeal to tech-savvy professionals seeking data-driven workspace solutions.

Eco-Friendly and Sustainable Design

Increasing awareness of environmental sustainability is driving demand for chairs made with recycled, biodegradable, and low-emission materials. Leading manufacturers are focusing on certifications such as GREENGUARD and FSC to highlight sustainable sourcing. Chairs designed with modular and recyclable components are also gaining attention, allowing end-users to upgrade parts instead of replacing entire units, thus reducing environmental impact.

What are the primary growth drivers impacting the ergonomic chair market?

Rising Awareness of Workplace Health

Workplace ergonomics has become a significant focus globally, with increasing evidence linking poor seating to musculoskeletal disorders and decreased productivity. Companies are proactively investing in ergonomic chairs to improve employee health and reduce absenteeism. This trend is particularly strong in IT, finance, and corporate office environments where employees spend prolonged periods seated.

Shift Toward Remote and Hybrid Work Models

The proliferation of remote and hybrid work setups has boosted demand for ergonomic home office furniture. Employees are increasingly seeking chairs that provide comfort, support, and posture correction for extended home usage. The convenience of direct-to-consumer online sales channels further supports rapid adoption across residential markets.

Government Regulations and Workplace Guidelines

Occupational safety and health regulations in regions like North America and Europe mandate proper ergonomic practices in workplaces. These regulations drive corporate procurement of ergonomic chairs and ensure compliance, further fueling market growth. Workplace wellness programs incentivize employers to invest in ergonomically designed furniture as part of broader employee health initiatives.

What are the key challenges and restraints affecting the global ergonomic chair market?

High Product Costs

Advanced ergonomic chairs, especially those with smart technology and premium materials, come at a higher price point. This cost factor restricts adoption among small businesses and price-sensitive consumers, limiting market penetration in certain regions.

Limited Awareness in Developing Markets

Despite rising global trends, awareness of ergonomic health benefits remains low in developing countries. Lack of education, limited workplace ergonomics regulations, and affordability concerns act as restraints on market growth in these regions.

Which strategic opportunities exist for stakeholders in the ergonomic chair market?

Integration of AI and IoT in Chairs

There is a significant opportunity to integrate AI-powered posture correction and IoT-enabled monitoring into ergonomic chairs. This can enable companies and individuals to track seating behavior, improve productivity, and reduce health risks, opening high-value segments in the corporate and luxury home-office market.

Expansion in Emerging Markets

Rapid urbanization and expansion of corporate and IT sectors in countries like India, China, and Brazil present enormous opportunities. Educating consumers and businesses about the benefits of ergonomic chairs can drive growth in these high-potential markets.

Customization and Modular Seating Solutions

Offering customizable chairs tailored to user preferences—including adjustable lumbar support, seat height, and materials—presents an opportunity to differentiate products. Modular designs that allow component upgrades increase product lifespan and appeal to environmentally conscious buyers.

Product Type Insights

Adjustable office chairs dominate the global market, accounting for approximately 45% of 2024 sales. Their popularity stems from versatility, comfort, and wide adoption in corporate settings. Executive chairs hold roughly 30% market share, preferred for premium offices and home executives. Task chairs and gaming chairs are growing rapidly due to remote work and esports trends, together representing around 25% of the market, with high adoption among younger demographics.

Application Insights

Corporate offices remain the largest end-use application for ergonomic chairs, representing over 50% of the market in 2024. Home offices and residential setups are emerging as fast-growing segments, driven by remote work trends, accounting for nearly 20% of demand. Specialized applications such as healthcare, labs, and control rooms contribute 10–15%, while gaming chairs are a niche yet high-growth application. Export-driven demand is rising, with North America and Europe importing high-end chairs from APAC manufacturers.

Distribution Channel Insights

Online sales platforms, including direct-to-consumer websites and e-commerce marketplaces, dominate distribution due to convenience, product variety, and competitive pricing. Office furniture distributors and B2B suppliers remain critical for corporate procurement. Physical retail channels, including specialty furniture stores, still serve mid-tier customers. Subscription-based corporate leasing models and bulk procurement contracts are emerging trends in large organizations.

Traveler Type Insights

N/A for ergonomic chairs; instead, focus is on end-user segments: corporate employees, remote workers, gamers, healthcare professionals, and home-office users, all driving differentiated demand patterns.

| By Product Type | By End-Use Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America leads the global ergonomic chair market, holding 35% of the 2024 share. The U.S. and Canada show high adoption rates due to strict workplace ergonomics regulations, corporate wellness programs, and remote work adoption. Demand is concentrated in IT, finance, healthcare, and corporate sectors, with U.S. companies driving premium chair procurement.

Europe

Europe holds approximately 28% of the 2024 market, with Germany, the U.K., and France leading adoption. Regulatory mandates and ergonomic workplace standards drive growth. Germany shows strong growth potential due to industrial office infrastructure modernization, while the U.K. focuses on hybrid work setups.

Asia-Pacific

Asia-Pacific is the fastest-growing region with a CAGR of 13% between 2025-2030. China, India, Japan, and Australia drive demand, fueled by urbanization, IT industry expansion, and rising awareness. Emerging markets in Southeast Asia are also gaining traction, presenting new growth opportunities for manufacturers.

Latin America

Brazil, Mexico, and Argentina contribute to moderate growth. Demand is emerging in corporate offices, home setups, and growing IT hubs. Regional adoption is limited by cost sensitivity but is expected to accelerate with awareness campaigns.

Middle East & Africa

GCC countries like the UAE and Saudi Arabia show high growth in premium office setups, while South Africa leads adoption in the African region. Infrastructure development and government incentives for office ergonomics drive moderate demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Ergonomic Chair Market

- Herman Miller

- Steelcase

- Haworth

- Humanscale

- Knoll

- HNI Corporation

- Okamura Corporation

- Eurotech Seating

- ErgoHuman

- Topstar GmbH

- Global Furniture Group

- Sedus Stoll

- RFM Furniture

- La-Z-Boy

- Fursys Co., Ltd.

Recent Developments

- In January 2025, Herman Miller launched a new AI-integrated ergonomic chair series, focusing on posture tracking and adaptive lumbar support.

- In March 2025, Steelcase expanded its European distribution network to meet growing demand for smart ergonomic office chairs in Germany and France.

- In June 2025, Humanscale introduced eco-friendly chairs made from recycled materials, targeting corporate sustainability programs globally.