Equestrian Apparel Market Size

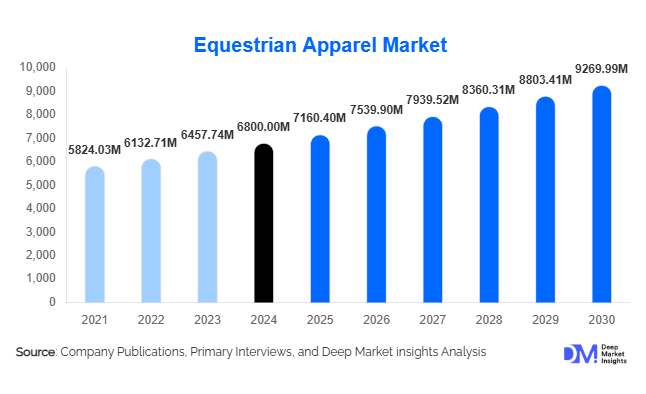

According to Deep Market Insights, the global equestrian apparel market size was valued at USD 6,800 million in 2024 and is projected to grow from USD 7,160.4 million in 2025 to reach USD 9,269.99 million by 2030, expanding at a CAGR of 5.3% during the forecast period (2025–2030). The market growth is primarily driven by rising participation in equestrian sports (both competitive and recreational), increasing demand for technical performance apparel and protective gear among riders, and the shift toward direct-to-consumer and online channels, which broaden global reach and reduce traditional retail constraints.

Key Market Insights

- Performance apparel and safety gear are increasingly prioritized: Riders and clubs are demanding technical fabrics, certified helmets and boots, and apparel that offers enhanced comfort and protection, driving premium segment growth.

- Sustainability and traceability are gaining importance: Brands are incorporating recycled materials, bio-leathers, and transparent sourcing practices, appealing to environmentally conscious consumers and institutional buyers alike.

- Online and direct-to-consumer channels dominate growth: E-commerce enables specialist brands to reach international buyers, offer customization and faster product innovation, and bypass traditional retail constraints.

- North America holds the largest share: With high participation rates, strong competition circuits, and premium spend, the region remains the leading value contributor to the global market.

- Asia-Pacific is the fastest-growing region: Emerging riding schools, rising disposable income, and increased equestrian tourism in countries such as China and India are fueling higher growth rates in this region.

- Technological integration is reshaping the category: From moisture-management fabrics and 4-way stretch breeches to smart helmets and AR/virtual fit tools, innovation is enabling higher ASPs and differentiated positioning.

What are the latest trends in the equestrian apparel market?

Premium Performance Apparel Gaining Traction

Brands are increasingly focusing on high-performance features tailored to equestrian sport demands, such as advanced stretch fabric breeches, weather-proof outerwear, and certified impact-resistant helmets. This premiumization trend is driven by serious riders who value safety, fit, and brand reputation, and by clubs/institutions that mandate higher safety standards. As a result, average selling prices are rising, especially in developed markets, and product replacement cycles are shortening due to frequent competition. This shift toward premium gear is altering the apparel mix: performance-oriented lines are overtaking casual leisure wear in value terms.

Sustainability & Traceability in Equestrian Apparel

Consumers place growing emphasis on ethical manufacturing, recycled textiles, and low-impact leathers in equestrian apparel. Brands are responding by introducing traceability programs (e.g., verified recycled content, leather origin tracking) and by emphasizing lower-impact finishes (PFC-free DWR, recycled yarns). This trend is particularly strong in Europe and North America, where sustainability credentials can become a key differentiator. In turn, this encourages innovation in supply chain, material sourcing, and certification, extending the appeal of equestrian apparel beyond traditional riders into lifestyle-oriented buyers who seek fashionable, sustainable options.

What are the key drivers in the equestrian apparel market?

Growing Participation in Equestrian Sports

Participation across competitive disciplines (such as show jumping, dressage, eventing) as well as recreational and leisure riding has been on the rise, particularly in North America and Europe. New riding schools, youth pony clubs, and equestrian tourism packages are expanding the addressable consumer base. This rising base of both casual and serious riders increases demand for both standard apparel (breeches, shirts) and high-performance gear (helmets, boots, jackets). Additionally, professional circuits and club uniforms reinforce regular replacement cycles and branded apparel purchases, Premiumization on, and Performance Fabric Adoption.

Riders increasingly demand apparel with advanced performance attributes, such as 4-way stretch, moisture management, abrasion resistance, and weatherproofing. This push toward higher quality and technical features enables brands to command higher average selling prices. The result is an increased value contribution from premium lines compared with basic casual apparel. As riders become more performance-oriented and aware of safety, the market is shifting upward in terms of segment mix, boosting value growth even in mature regions.

Shift to Online Channels and Direct-to-Consumer Models

The growth of e-commerce and D2C brand operations has lowered entry barriers for specialist equestrian apparel brands, expanded geographic reach beyond traditional brick-and-mortar tack shops, and enabled faster product iteration and personalization. Online channels support global shipping, direct feedback loops, and subscription/rental models (especially for youth competition wear). This channel shift accelerates growth by tapping younger, digitally-native riders and enabling smaller players to scale internationally.

Restraints: Raw-Material & Supply Chain Volatility

Many equestrian apparel items depend on leather, specialty textiles, and technical foams. Price volatility in leather hides, synthetic yarns, and freight rates can compress margins, particularly among mid-market brands. Additionally, supply chain disruptions (raw-material shortages or logistics delays) create cost pressures and risk for manufacturers and brands, limiting flexibility and placing upward pressure on consumer prices.

Restraints: Limited Addressable Base and Price Sensitivity in Emerging Markets

Although the participation base is expanding, the core equestrian rider community remains relatively niche compared to mass sports and apparel markets. In many emerging economies, equestrian sport is still developing, and consumers are more price-sensitive, limiting the addressable premium market. Without tailored lower-price lines or value propositions, growth in these regions may lag, constraining global expansion pace in absolute dollar terms.

What are the key opportunities in the equestrian apparel industry?

Adventure-Lifestyle and Riding Tourism Synergies

The intersection of equestrian sport, lifestyle apparel, and tourism offers a strong opportunity. Riding holidays, equestrian resorts, and tourism-based horse experiences are expanding in APAC, LATA, M, and parts of Europe. Brands that can develop versatile apparel lines suitable for both riding and resort/leisure wear (technical jackets that double as casual outerwear, boots usable inside/outside the saddle) capture broader audiences and drive incremental purchases, especially for leisure travelers and lifestyle-oriented consumers.

Club & Institutional Procurement and Export Growth

Riding schools, equestrian clubs, nd national federations often procure apparel and gear in bulk (uniforms, helmets, jackets). Targeting these institutional channels is a stable volume opportunity. Moreover, export growth into emerging markets, where local manufacturing is weak but demand is growing, opens new geographies for specialist brands. Localization of supply chains, regional fit tools, and targeted distribution partnerships can secure recurring institutional contracts and export growth across APAC and LATAM.

Sustainable Materials and Traceable Value Chains

The demand for sustainable apparel is strong and growing. Equestrian apparel brands that invest in circular materials (recycled polyesters, bio-leathers), chemical-free coatings, and transparent sourcing can differentiate themselves in competitive markets. Institutional buyers (clubs, federations) are increasingly factoring ESG credentials into procurement decisions. This opens opportunities for premium-positioned brands to expand margin and gain loyalty among riders and organizations that place value on environmental responsibility.

Product Type Insights

Within the product-type segmentation, riding jackets and show coats continue to dominate global value share, accounting for roughly 22–25% of total market revenue in 2024. These products command the highest average selling prices due to their essential role in competition attire, performance-driven fabrics, and their dual purpose as both functional gear and fashion statement pieces. Their dominance is reinforced by global show standards and weather protection needs, which make them a necessity across all major riding disciplines. Moreover, luxury brands and high-end equestrian designers increasingly integrate tailored fits, breathable membranes, and water-resistant coatings, enhancing both performance and aesthetics.

Breeches and jodhpurs follow closely in market volume, representing approximately 20% of total sales. Growth in this segment is powered by the integration of performance fabrics and stretch-fit innovations that improve rider comfort and mobility during both training and competition. Brands are investing in ergonomic design and advanced textiles that offer compression, breathability, and durability, key differentiators for repeat purchases among frequent riders.

Helmets remain a crucial safety-driven segment, expanding steadily due to regulatory enforcement and heightened awareness campaigns about rider protection. Mandated helmet use in professional and amateur competitions has accelerated replacement cycles and premiumization, particularly in North America and Europe. Meanwhile, riding boots are benefiting from a fashion crossover trend, where riders and enthusiasts use them beyond the stable environment, blurring the lines between technical gear and luxury lifestyle footwear.

Shirts and base layers have emerged as an all-season category, supported by the growing culture of year-round training and layering. Technical materials with UV protection, moisture control, and thermal adaptability have become standard, enhancing functional appeal. Gloves and socks show moderate but consistent growth, driven by incremental improvements in grip technology and micro-comfort. Finally, accessories such as belts, gaiters, and personalized gear bags are witnessing rising traction due to branding, customization, and gifting trends, providing non-seasonal revenue for manufacturers.

Application / Discipline Insights

The show jumping discipline represents the largest application segment globally, accounting for an estimated 35–38% share of the total equestrian apparel market in 2024. Its leadership stems from the high number of registered riders, frequent competition events, and strict dress code regulations that necessitate premium show coats, tailored breeches, gloves, and helmets. The dynamic nature of this discipline also drives frequent gear replacement and innovation adoption.

Dressage and eventing jointly contribute to over 25% of the market, where emphasis on aesthetics, comfort, and formal appearance drives apparel purchases. Meanwhile, trail and recreational riding comprise a large base of casual users seeking durability, affordability, and comfort, although the average spend per rider is lower. A notable trend is the increasing lifestyle crossover, as equestrian-inspired apparel finds appeal among non-riders for its premium, functional aesthetic, transforming once-niche technical wear into fashionable casual apparel.

Distribution Channel Insights

E-commerce and direct-to-consumer (D2C) channels dominate modern equestrian apparel sales, accounting for over 45% of transactions globally in 2024. Digital platforms have democratized access for riders in emerging markets, enabling brands to offer broader size ranges, personalization options, and competitive pricing. Enhanced virtual fitting tools and augmented reality previews are accelerating online adoption, particularly among younger demographics.

Traditional tack shops and specialist retailers continue to play a pivotal role in premium equipment and fitting-sensitive product sales, notably helmets and boots. Institutional procurement by riding schools, clubs, and national federations provides recurring contracts, ensuring volume stability. Emerging distribution trends include subscription and rental models, particularly appealing for junior riders who frequently outgrow gear, signifying a growing shift toward flexible, sustainable consumption models.

End-User / Customer Type Insights

Recreational riders form the largest consumer base by volume, accounting for roughly 40% of total apparel sales. Their purchases are primarily driven by comfort, affordability, and multipurpose use for leisure or training. However, competitive riders account for the highest value contribution due to frequent gear replacement, brand loyalty, and the preference for certified and premium products. Youth and junior riders are emerging as a critical growth driver, bolstered by expanding pony clubs, riding academies, and sponsorship programs. Institutional buyers such as riding schools and clubs are increasingly adopting branded uniforms and safety gear, strengthening B2B demand consistency.

Age Group Insights

The 31–50 years segment dominates the equestrian apparel market, accounting for around 37% of total revenue in 2024. This group combines stable disposable income, active participation in competitions, and strong brand affinity. The 18–30 years demographic is the fastest-growing, driven by social media influence, digital purchasing behavior, and preference for fashionable, performance-oriented products. Riders aged 51–65 years contribute to premium and safety-driven purchases, prioritizing comfort and durability over price. The under-18 youth segment, supported by structured junior programs, is expanding rapidly, with frequent product replacement cycles due to growth and evolving safety regulations.

| By Product Type | By Application / Discipline | By Distribution Channel | By End-User / Customer Type | By Age Group |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market, representing roughly 33% of global revenue in 2024. The region’s growth is supported by a large and structured rider base, extensive competition circuits such as the US Equestrian Federation, and a high willingness to spend on safety-certified helmets and premium apparel. Elevated disposable income levels and cultural affinity for equestrian activities, from hunter-jumper and rodeo to Western pleasure, continue to reinforce demand. The strong network of tack stores, online platforms, and professional leagues ensures steady product turnover. In addition, widespread safety campaigns and regulation compliance further stimulate replacement purchases of certified gear.

Europe

Europe is the second-largest market, accounting for approximately 31% of the global share in 2024. The region’s demand is deeply rooted in its equestrian heritage, dense competition schedules, and the integration of equestrian fashion into mainstream luxury culture. The UK, Germany, the Netherlands, and France remain key hubs with sophisticated buyer segments valuing craftsmanship and sustainability. European consumers exhibit a high preference for eco-certified fabrics and heritage brands, driving a premiumization trend that extends into lifestyle apparel. The growing collaboration between fashion houses and equestrian brands is enhancing aesthetic appeal and pushing the category into new demographics.

Asia-Pacific

The Asia-Pacific region is projected to be the fastest-growing, with a CAGR exceeding 7% through 2030. The expansion of riding schools, equestrian clubs, and training academies in China, India, and Southeast Asia is introducing a new generation of riders. Rising disposable incomes and urban leisure lifestyles are generating fresh demand for both technical apparel and fashion-forward equestrian wear. Moreover, cross-border e-commerce is allowing international brands to penetrate emerging markets cost-effectively. Mature markets such as Australia and Japan continue to drive steady premium apparel sales, particularly in safety gear and outerwear.

Latin America

Latin America contributes around 3–6% of global market value, with localized demand concentrated in Argentina, Brazil, and Mexico. These nations host vibrant equestrian traditions, from polo to dressage, fostering steady consumption of specialized apparel. Although price sensitivity remains a restraint, the growing presence of premium international brands and regional distributors is expanding accessibility. Domestic manufacturing is limited, creating import-driven opportunities for established global suppliers. The increasing popularity of equestrian tourism and sport clubs also promotes consistent year-round demand.

Middle East & Africa

While accounting for a modest 1–3% of the global market, the Middle East & Africa region plays a strategic role in the luxury equestrian apparel landscape. The Gulf Cooperation Council (GCC) countries, particularly the UAE, Saudi Arabia, and Qatar, are fostering equestrianism as part of their cultural and national prestige, leading to strong demand for luxury riding apparel and accessories. The region’s equestrian fashion segment benefits from high-income consumers seeking exclusivity and brand recognition. Meanwhile, African nations such as South Africa and Kenya are witnessing growing equestrian sport participation and tourism, opening opportunities for mid-tier performance apparel.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Equestrian Apparel Market

- Ariat International

- Pikeur

- Charles Owen

- Samshield

- Tredstep Ireland

- Riders International

- Dublin

- Equiline

- Goode Rider

- Eskadron

- Mountain Horse

- Parlanti

- LeMieux

- Roeckl

- Helite

Recent Developments

- In 2024–2025, a major performance-apparel brand announced the launch of a new line of certified multi-impact helmets specifically tailored for youth competition, reflecting increasing safety standards in junior equestrian sports.

- In late 2024, one premium apparel manufacturer announced a full recycled-leather boot collection, reinforcing the sustainability trend in premium equestrian gear and appealing to environmentally conscious riders.

- In early 2025, a specialist D2C equestrian brand expanded its global e-commerce platform to include virtual fit tools for competition breeches and jackets, targeting faster growth in Asia-Pacific markets.