Elevated Dog Bowls Market Size

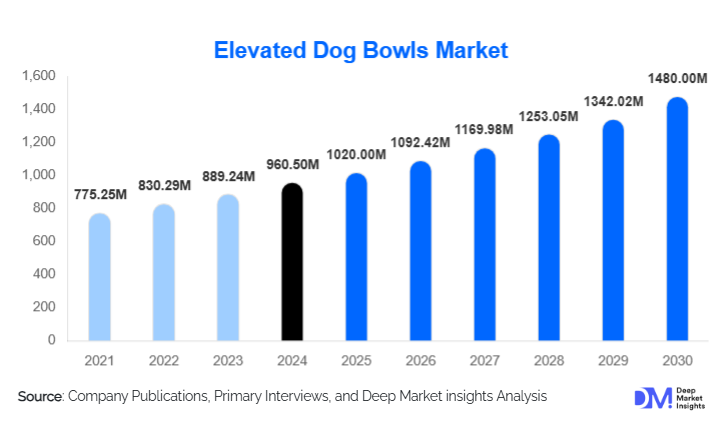

According to Deep Market Insights, the global elevated dog bowls market size was valued at USD 960.5 million in 2024 and is projected to grow from USD 1,020 million in 2025 to reach USD 1,480 million by 2030, expanding at a CAGR of 7.1% during the forecast period (2025–2030). The growth of the elevated dog bowls market is primarily driven by the rising trend of pet humanization, growing concerns over pet health and posture, and the increasing adoption of premium and ergonomic pet feeding accessories across residential and commercial pet care settings.

Key Market Insights

- Ergonomic and health-focused designs are driving the adoption of elevated dog bowls among pet owners concerned with digestive comfort and joint strain reduction.

- Premiumization of pet products is influencing demand for aesthetically designed, durable, and customizable elevated feeders that complement modern home décor.

- E-commerce channels dominate distribution, accounting for a growing share due to convenience, product variety, and access to premium international brands.

- Stainless steel and bamboo materials lead in market share, reflecting consumer preference for eco-friendly and long-lasting feeding solutions.

- North America remains the largest market, driven by high pet ownership rates and awareness of pet wellness benefits linked to elevated feeding systems.

- Asia-Pacific is the fastest-growing region, fueled by the rapid growth of urban pet populations and rising disposable income among pet owners in China, India, and Southeast Asia.

Latest Market Trends

Health and Posture-Oriented Product Innovation

Manufacturers are introducing ergonomically designed elevated bowls aimed at improving digestion, posture, and comfort for dogs of all sizes and breeds. These innovations target age-related conditions such as arthritis and cervical strain, making them especially popular among owners of senior dogs. Adjustable-height feeders and tilt-angle designs are becoming standard, enhancing feeding ergonomics. Furthermore, clinical studies highlighting the digestive benefits of raised feeding systems are strengthening consumer trust and accelerating product adoption among health-conscious pet owners.

Sustainable and Aesthetic Material Adoption

As sustainability becomes central to consumer purchasing decisions, manufacturers are shifting toward renewable and recyclable materials such as bamboo, stainless steel, and BPA-free plastics. Eco-friendly elevated dog bowls are also being marketed as luxury lifestyle products that align with home aesthetics, driving premium sales growth. Companies are launching customizable and handcrafted designs to appeal to pet owners who view pets as family members deserving of high-quality accessories. This trend is particularly strong in Europe and North America, where sustainability and interior compatibility are key buying factors.

Elevated Dog Bowls Market Drivers

Rising Pet Humanization and Health Awareness

The growing emotional attachment between pet owners and their animals has led to an increase in spending on premium health-related pet products. Elevated dog bowls, which promote comfortable feeding postures and reduce joint strain, are gaining popularity as essential wellness accessories. Increased awareness regarding canine digestion issues, bloating, and musculoskeletal disorders further supports the shift toward elevated feeding solutions. Pet influencers, veterinarians, and social media campaigns are also boosting consumer education, making pet ergonomics a mainstream consideration in feeding accessories.

Expansion of E-Commerce and Specialty Retail Networks

Online marketplaces such as Amazon, Chewy, and PetSmart are significantly expanding the accessibility of elevated dog bowls, offering a variety of sizes, materials, and customization options. Direct-to-consumer (D2C) brands are leveraging digital marketing and influencer collaborations to reach niche audiences, particularly millennial pet parents. Specialty pet retail chains are also expanding their premium product portfolios, driving higher sales of ergonomically designed feeders. The growing presence of subscription models and bundle deals for pet feeding accessories is further enhancing recurring sales potential.

Market Restraints

High Cost of Premium and Custom Designs

Premium elevated dog bowls featuring sustainable materials, height adjustment mechanisms, and designer aesthetics often come with higher price tags, limiting adoption among budget-conscious consumers. While affordable plastic models are available, the premium segment dominates growth, leading to a price sensitivity gap in emerging markets. The presence of counterfeit or low-quality alternatives online also dilutes consumer trust and impacts brand reputation, posing a challenge for established manufacturers.

Health Controversies and Design Misconceptions

Despite growing popularity, some veterinary studies have debated the link between elevated feeding and canine bloat risk, creating confusion among consumers. Inconsistent design standards and misleading marketing claims have led to skepticism in certain segments. Manufacturers must balance ergonomics with breed-specific safety features, supported by veterinary validation and transparent product labeling, to overcome these barriers and strengthen consumer confidence.

Elevated Dog Bowls Market Opportunities

Integration of Smart and IoT-Enabled Feeding Solutions

Smart elevated dog bowls equipped with sensors, automatic portion control, and connectivity features are emerging as a major innovation trend. These products help owners monitor feeding habits, portion sizes, and pet hydration levels via mobile applications. Integration with smart home ecosystems and AI-enabled pet care systems presents significant opportunities for differentiation in the premium market segment. Technology-driven convenience is particularly appealing to urban consumers and dual-income households seeking automated and health-monitoring solutions.

Customization and Breed-Specific Product Development

Demand for personalized and breed-specific elevated dog bowls is rising, with manufacturers offering custom height adjustments, dual feeding compartments, and modular accessories. Tailoring designs for small breeds, large dogs, and pets with medical conditions enhances product appeal and consumer satisfaction. Custom engravings, aesthetic finishes, and color variants are also gaining traction, especially in luxury and gifting segments. This focus on personalization provides opportunities for niche brands to capture loyal customer bases through D2C channels.

Product Type Insights

The market is segmented into single-bowl elevated feeders, double-bowl feeders, and adjustable-height feeders. Double-bowl feeders hold the largest share due to their dual functionality for food and water, while adjustable-height models are gaining rapid traction for their adaptability to different dog sizes and growth stages. Single-bowl feeders, often preferred for compact spaces or specific dietary needs, maintain steady demand across smaller households. Manufacturers are enhancing design aesthetics with anti-slip bases, removable bowls, and collapsible structures for easy cleaning and portability.

Material Insights

Stainless steel leads the material segment owing to its durability, hygiene, and corrosion resistance. Bamboo and wood variants are growing rapidly, reflecting eco-conscious consumer preferences and home décor integration. Plastic feeders remain popular in the budget segment due to affordability, lightweight design, and diverse color options. Meanwhile, hybrid designs combining steel bowls with wooden or silicone frames are gaining traction for their balance of performance and style.

Distribution Channel Insights

Online retail dominates the elevated dog bowls market, accounting for over half of global sales in 2024. Consumers favor digital platforms for convenience, product variety, and access to user reviews. Offline retail remains relevant in developed markets through specialty pet stores and supermarkets offering physical demonstrations and bundled promotions. The rise of D2C e-commerce brands and influencer-led marketing campaigns is further reshaping buyer engagement, with social media platforms emerging as discovery channels for niche and premium feeders.

| By Product Type | By Material | By Pet Size | By Distribution Channel | By End-Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America represents the largest share of the global elevated dog bowls market, supported by high pet ownership rates and strong consumer awareness regarding pet wellness. The United States accounts for the majority of sales, with premium and smart feeding products experiencing notable demand. Pet humanization trends, coupled with growing adoption of subscription pet care services, are reinforcing steady market expansion.

Europe

Europe holds a substantial share, driven by sustainability-conscious consumers and regulatory emphasis on eco-friendly materials. Countries such as Germany, France, and the U.K. are witnessing increased preference for bamboo and wooden feeders. European brands are also leading innovation in ergonomics and design aesthetics, aligning with the region’s strong demand for functional yet stylish home-integrated pet products.

Asia-Pacific

Asia-Pacific is the fastest-growing region in the elevated dog bowls market, led by China, India, Japan, and South Korea. Rising disposable income, urbanization, and expanding pet adoption are accelerating demand for ergonomic feeding solutions. E-commerce platforms such as Tmall, Flipkart, and Rakuten are playing a crucial role in product accessibility. Domestic brands are increasingly launching cost-effective yet design-oriented feeders to capture mid-income consumers.

Latin America

Latin America, particularly Brazil and Mexico, is witnessing steady growth due to increasing awareness of pet health and expanding distribution networks. The regional market is driven by rising demand for mid-range elevated feeders that combine functionality with affordability. Online sales and social media marketing are boosting consumer engagement and awareness across younger demographics.

Middle East & Africa

The Middle East & Africa region is experiencing gradual growth, supported by expanding pet ownership in urban centers such as Dubai, Riyadh, and Cape Town. Premium imported feeders dominate sales in these markets, while local manufacturers are entering the market with cost-effective models. The growing number of pet cafes, veterinary clinics, and grooming centers is further contributing to elevated feeder adoption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Elevated Dog Bowls Market

- Neater Feeder

- Pawfect Pets

- IRIS USA, Inc.

- PetFusion

- Outward Hound

- Frisco (Chewy Inc.)

- OurPets Company

- Petmate

- Ethical Products, Inc.

- PAWZ Road

Recent Developments

- In May 2025, Neater Feeder introduced a new range of adjustable elevated dog bowls featuring anti-spill barriers and antimicrobial surfaces to enhance pet hygiene.

- In March 2025, PetFusion launched a line of bamboo-based elevated feeders with minimalist designs targeting eco-conscious pet owners in North America and Europe.

- In January 2025, Outward Hound unveiled a smart feeding station equipped with portion tracking and Bluetooth connectivity to monitor pet consumption patterns.