Electrostatic Commercial Oil Fume Purification Equipment Market Size

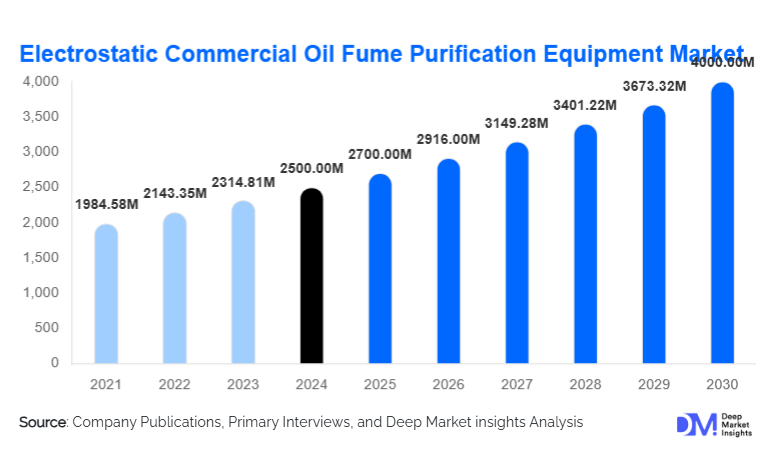

According to Deep Market Insights, the global electrostatic commercial oil fume purification equipment market size was valued at USD 2,500 million in 2024 and is projected to grow from USD 2,700 million in 2025 to reach USD 4,000 million by 2030, expanding at a CAGR of 8% during the forecast period (2025–2030). The market growth is primarily driven by increasing regulatory pressures on air quality, rising industrialization, and growing adoption of energy-efficient and technologically advanced oil fume purification solutions in commercial and industrial applications.

Key Market Insights

- Electrostatic precipitators dominate the market, owing to their high efficiency in removing oil fumes and particulate matter, accounting for approximately 60% of the global market share in 2024.

- Commercial kitchens represent the largest application segment, contributing around 50% of the market in 2024, driven by health, safety, and regulatory compliance requirements.

- Asia-Pacific leads the global market, with 45% of market share in 2024, supported by rapid industrialization, urbanization, and stringent air quality standards in countries such as China, Japan, and South Korea.

- North America and Europe hold significant market presence, led by robust industrial activities and well-established regulatory frameworks.

- Technological adoption, including IoT-enabled monitoring systems and automated cleaning mechanisms, is increasingly enhancing equipment efficiency and operational reliability.

- Emerging markets in Latin America and the Middle East are presenting new growth avenues, driven by industrial expansion and increasing awareness of indoor air quality.

What are the latest trends in the electrostatic commercial oil fume purification equipment market?

Technological Integration and Smart Systems

Manufacturers are integrating advanced technologies such as IoT sensors, automated cleaning, and real-time performance monitoring into electrostatic precipitators. These smart systems allow for predictive maintenance, energy optimization, and improved air purification efficiency. Commercial and industrial users increasingly prefer energy-efficient and low-maintenance systems, driving manufacturers to focus on innovation and automation. Smart electrostatic units also offer integration with building management systems, which is particularly appealing to large-scale commercial kitchens and industrial facilities seeking regulatory compliance and operational transparency.

Focus on Health and Safety Compliance

With growing awareness of the health hazards posed by oil fumes, there is an increased emphasis on installing high-efficiency electrostatic purification equipment in restaurants, hotels, and industrial food processing units. Regulatory compliance has become a significant driver, as governments mandate stricter air quality standards for commercial and industrial settings. Advanced equipment helps enterprises meet legal requirements while reducing liability, making health-conscious installations a mainstream practice. The market trend also includes retrofitting older kitchens with modern purification systems to maintain compliance with updated standards.

What are the key drivers in the electrostatic commercial oil fume purification equipment market?

Stringent Environmental Regulations

Governments across North America, Europe, and the Asia-Pacific are implementing stricter air quality laws, compelling commercial and industrial establishments to adopt advanced oil fume purification systems. Compliance with these regulations reduces environmental impact and helps avoid fines and operational interruptions. Increasing government monitoring of indoor and outdoor air quality further drives the adoption of electrostatic precipitators.

Rising Industrialization and Urbanization

The rapid expansion of commercial kitchens, food processing facilities, and manufacturing plants, particularly in emerging economies, is driving market growth. Urbanization leads to higher population density, emphasizing the need for cleaner air in both commercial and public spaces. Industrial activities, particularly in regions with stringent emissions norms, are increasingly adopting electrostatic purification equipment to meet compliance standards.

Technological Advancements

Innovations such as higher-efficiency filtration, energy-saving mechanisms, IoT-based monitoring, and automated cleaning systems are boosting adoption rates. These advancements enhance operational efficiency, reduce maintenance costs, and improve equipment lifespan, making electrostatic systems more attractive for commercial applications.

What are the restraints for the global market?

High Initial Investment

Advanced electrostatic purification systems involve substantial capital expenditure, which may be prohibitive for small and medium enterprises. The high upfront cost delays adoption, especially in regions with budget-sensitive businesses or low awareness about long-term operational benefits.

Maintenance and Operational Challenges

Electrostatic precipitators require periodic maintenance to sustain high efficiency. Labor-intensive cleaning processes and the need for skilled operators can increase operational costs, limiting adoption among smaller enterprises or in regions with low technical support availability.

What are the key opportunities in the electrostatic commercial oil fume purification equipment market?

Expansion in Emerging Markets

Rapid industrialization and urbanization in Asia-Pacific, Latin America, and the Middle East are creating significant opportunities for new market entrants. Establishing local manufacturing and service networks in these regions can reduce costs and improve accessibility. Government incentives for air pollution control, along with rising awareness about indoor air quality, further enhance growth potential.

Integration with Smart Technologies

The adoption of IoT-enabled purification systems, automated maintenance solutions, and real-time performance monitoring presents opportunities for differentiation. Companies can offer predictive maintenance services, energy-efficient operations, and improved air quality analytics, attracting high-end commercial and industrial clients seeking advanced solutions.

Government Incentives and Infrastructure Initiatives

Public infrastructure spending and initiatives such as “Make in India” and “Made in China 2025” encourage local manufacturing and the adoption of air purification technologies. These policies provide opportunities for private investments, joint ventures, and strategic partnerships that align with sustainable industrial growth objectives.

Product Type Insights

Electrostatic precipitators dominate the product landscape, accounting for approximately 60% of the global market in 2024. Their superior efficiency in capturing fine oil particles, lower energy consumption, and compliance with environmental standards make them the preferred choice for commercial kitchens and industrial facilities. Alternative systems, such as mechanical filters or combined hybrid solutions, are gaining attention in niche applications but remain less widespread due to lower efficiency and higher maintenance demands.

Application Insights

Commercial kitchens represent the largest application segment, contributing about 50% of global demand in 2024. Food processing facilities, hotels, and large-scale catering units are increasingly adopting electrostatic systems to meet hygiene and environmental standards. Industrial applications, such as frying operations in manufacturing plants, are emerging as high-growth areas due to stringent workplace safety and air quality regulations.

Distribution Channel Insights

Direct sales and OEM partnerships dominate distribution, particularly for large industrial and commercial installations. Online B2B platforms are emerging as secondary channels, offering ease of comparison, transparent pricing, and access to detailed technical specifications. Service agreements and maintenance contracts are increasingly bundled with equipment sales, providing recurring revenue streams for manufacturers and ensuring consistent performance for customers.

End-Use Insights

The foodservice industry is the primary end-user, including restaurants, hotels, and cloud kitchens. The industrial food processing sector is witnessing rapid growth, with increasing adoption of air purification solutions to ensure compliance and worker safety. Export-driven demand is notable in regions importing advanced purification technologies from China, Germany, and Japan, supporting growth in emerging markets seeking high-efficiency systems.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

The U.S. and Canada account for a significant portion of the North American market, driven by stringent environmental regulations and high adoption in commercial kitchens and food processing industries. North America held about 25% of the global market in 2024. Industrial expansion, coupled with technological adoption, supports steady growth in this region.

Europe

Germany, France, and the UK lead the European market with advanced regulatory frameworks and widespread adoption of electrostatic purification systems. Europe accounted for approximately 22% of the global market in 2024. Strong regulatory enforcement and industrial modernization initiatives make the region a stable and high-value market.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by China, Japan, and South Korea. Rapid industrialization, urbanization, and strong government incentives are fueling adoption. Emerging markets such as India and Southeast Asia are witnessing increasing investments in commercial kitchen air quality and industrial facilities, positioning the region for robust growth through 2030.

Latin America

Brazil and Mexico are key markets in Latin America, with growing awareness and adoption in commercial kitchens. While currently smaller in size, regional expansion and industrial growth are expected to accelerate demand.

Middle East & Africa

The UAE and Saudi Arabia represent emerging markets for oil fume purification equipment, primarily driven by the hospitality sector and new industrial facilities. In Africa, adoption is limited but growing, especially in high-end commercial kitchens and international hotels.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Electrostatic Commercial Oil Fume Purification Equipment Market

- Foshan Yichen Environmental Technology Co., Ltd.

- Hangzhou Kingsun Environmental Technology Co., Ltd.

- Shenzhen Jinhao Environmental Equipment Co., Ltd.

- Zhengzhou Shengmao Environmental Protection Technology Co., Ltd.

- Nanjing Rener Environmental Technology Co., Ltd.

- Shanghai Kaifeng Environmental Protection Equipment Co., Ltd.

- Beijing Bosi Environmental Protection Equipment Co., Ltd.

- Suzhou Sunbright Environmental Technology Co., Ltd.

- Guangzhou Fuxin Environmental Technology Co., Ltd.

- Fuzhou Baolin Environmental Protection Equipment Co., Ltd.

- Tianjin Huapeng Environmental Protection Equipment Co., Ltd.

- Wuxi Kairui Environmental Protection Equipment Co., Ltd.

- Hangzhou Xinhao Environmental Protection Equipment Co., Ltd.

- Dongguan Leke Environmental Protection Equipment Co., Ltd.

- Ningbo Jieda Environmental Protection Equipment Co., Ltd.

Recent Developments

- In March 2025, Foshan Yichen Environmental launched an IoT-enabled electrostatic precipitator for commercial kitchens in China, focusing on automated cleaning and real-time performance tracking.

- In January 2025, Hangzhou Kingsun expanded production capacity to meet growing demand in Southeast Asia and introduced energy-efficient models for industrial food processing plants.

- In November 2024, Shenzhen Jinhao Environmental signed a strategic partnership with a U.S. distributor to supply advanced electrostatic purification systems to North American commercial kitchens.