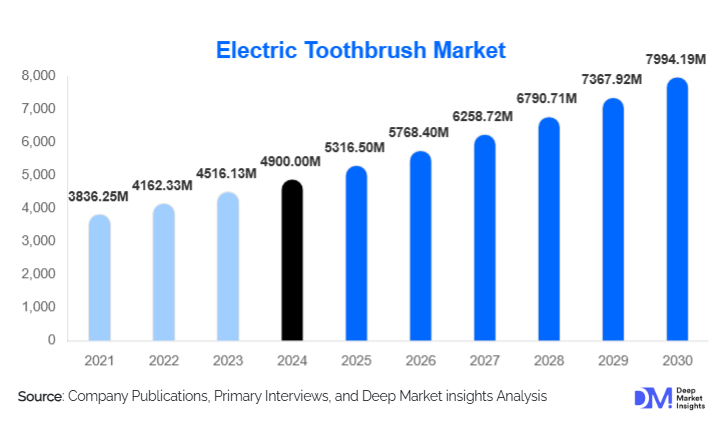

Electric Toothbrush Market Size

According to Deep Market Insights, the global electric toothbrush market size was valued at USD 4,900.00 million in 2024 and is projected to grow from USD 5,316.50 million in 2025 to reach USD 7,994.19 million by 2030, expanding at a CAGR of 8.5% during the forecast period (2025–2030). Growth in the electric toothbrush market is primarily driven by rising oral hygiene awareness, increasing adoption of smart connected toothbrush technologies, and surging demand for premium, rechargeable models across both developed and emerging economies.

Key Market Insights

- Rechargeable electric toothbrushes dominate the global landscape, accounting for nearly two-thirds of market revenue in 2024, supported by longer battery life and premium features.

- Smart and connected toothbrushes are rapidly growing as consumers increasingly embrace app-based brushing guidance, AI-based feedback, and pressure-sensing technologies.

- Asia-Pacific has become the largest and fastest-growing regional market, driven by rising income levels and expanding e-commerce penetration in China and India.

- Adults represent more than 80% of global electric toothbrush users, reflecting a strong willingness among adults to invest in premium oral-care products.

- Eco-friendly electric toothbrushes are emerging as a key trend, as brands incorporate recyclable brush heads, biodegradable materials, and sustainable packaging.

- Subscription-based replacement head models are reshaping long-term customer retention and increasing revenue predictability for manufacturers.

What are the latest trends in the electric toothbrush market?

Rise of Smart, App-Connected Toothbrushes

Manufacturers are increasingly integrating smart features such as Bluetooth connectivity, AI-powered brushing analytics, real-time pressure sensors, and personalized oral-health coaching. These devices allow users to optimize brushing behavior through mobile dashboards, progress tracking, and AI-driven suggestions. Adoption is particularly strong among tech-savvy millennials, young parents, and premium buyers. Brands are also expanding interoperability with broader digital health ecosystems, enabling integration with dental checkup reminders, preventive care apps, and tele-dentistry platforms. This trend is transforming electric toothbrushes from simple cleaning devices into intelligent oral-care companions.

Growing Shift Toward Sustainable Oral-Care Products

Environmental sustainability is shaping next-generation toothbrush development. Manufacturers are adopting biodegradable materials, recyclable brush heads, and low-energy charging systems to appeal to eco-conscious consumers. Some brands are piloting take-back programs for used brush heads, while others are integrating plant-based materials and reducing plastic in packaging. As regulatory pressure increases and younger consumers prioritize environmental responsibility, sustainable electric toothbrushes are emerging as a competitive differentiator, especially in Europe and North America.

What are the key drivers in the electric toothbrush market?

Increasing Awareness of Oral Health

Global oral-care awareness is rising due to improved education, dentist recommendations, and growing emphasis on preventive health. Electric toothbrushes offer consistent cleaning performance, superior plaque removal, and gum-care benefits compared to manual brushing. As consumers prioritize dental hygiene, demand for technologically advanced oral-care devices continues to accelerate, particularly in urban markets.

Technological Advancements in Oral-Care Devices

Rapid innovation in motor technology, bristle design, battery performance, and AI-based coaching is driving consumer upgrades toward premium models. Features like multiple brushing modes, quiet motors, real-time pressure sensors, and app-based analytics enhance both convenience and brushing effectiveness. As smart-home ecosystems expand, electric toothbrushes are becoming an integral part of connected personal-care routines, fueling market expansion across all major regions.

What are the restraints for the global market?

High Upfront and Maintenance Costs

Electric toothbrushes are significantly more expensive than manual ones, limiting adoption in cost-sensitive markets. Premium rechargeable models are priced at a substantial premium, and replacement brush heads add recurring expenses that deter long-term use. Limited availability of affordable options in developing countries further restricts market penetration, especially outside urban centers.

Limited Access in Emerging Markets

In many low- and middle-income regions, lack of distribution infrastructure, low oral-care awareness, and price sensitivity hinder the adoption of electric toothbrushes. Replacement brush heads are often unavailable in rural retail channels, and e-commerce access remains uneven. These challenges slow the overall penetration rate despite rising disposable incomes in emerging economies.

What are the key opportunities in the electric toothbrush industry?

Eco-Friendly and Sustainable Toothbrush Innovation

The shift toward environmentally responsible consumer goods creates opportunities for brands to differentiate through recycled plastics, biodegradable brush heads, solar-powered charging bases, and low-waste packaging. Companies investing in carbon-neutral or circular-design toothbrush models can capture a new wave of eco-conscious consumers, particularly in Europe and North America. Sustainability-oriented features also support regulatory alignment and enhance brand reputation.

Growth Potential in Emerging Markets

Urbanization and income growth in India, China, Brazil, and Southeast Asia offer significant expansion opportunities. Consumers in these markets are transitioning from manual to powered brushes, and affordable, entry-level electric models can unlock massive new demand. Partnerships with dental clinics, awareness campaigns, and government oral-care programs can further accelerate adoption. As e-commerce expands, global brands have increasing access to emerging-market consumers at scale.

Product Type Insights

Rechargeable electric toothbrushes dominate the global market, capturing approximately 65% of revenue due to longer battery life, advanced features, and growing preference for sustainable, non-disposable devices. Sonic and oscillating-rotational rechargeable brushes are especially popular among adults seeking premium oral-care performance, as they provide superior plaque removal, gum care, and longer device lifespans compared to battery-powered alternatives. Battery-powered models remain relevant among price-sensitive buyers and travelers, although they account for a smaller portion of the market due to shorter lifespan and limited functionality. Specialty and smart toothbrushes featuring AI coaching, Bluetooth connectivity, app-based feedback, and high-frequency vibration technologies represent the fastest-growing subsegments, driven by increasing consumer demand for personalized oral-care experiences, premiumization trends, and integration with digital health ecosystems. The trend toward connected oral-care devices is accelerating adoption, particularly among tech-savvy adults and families who seek precise brushing guidance and long-term dental health monitoring.

Application Insights

Adult electric toothbrushes account for the largest share of global demand, representing over 80% of revenue. Adults are driving growth due to higher disposable incomes, greater oral-health awareness, and strong influence from preventive dental care recommendations. Premium and smart models are particularly popular in this segment, with advanced features like pressure sensors, multiple brushing modes, and real-time app feedback contributing to higher adoption. Children’s electric toothbrushes, though a smaller segment, are experiencing rapid growth, driven by parental awareness of early dental hygiene, gamified brushing apps, soft bristles, and colorful designs that encourage regular use. Professional-use toothbrushes endorsed or sold through dental clinics are expanding steadily, benefiting from dentist recommendations, oral-health campaigns, and subscription-based brush-head programs that ensure consistent user engagement and replacement cycles.

Distribution Channel Insights

Supermarkets and hypermarkets remain the leading distribution channel, accounting for over 40% of global sales due to convenience, product visibility, and wide availability. E-commerce is the fastest-growing channel, fueled by exclusive online discounts, subscription-based brush-head replacements, detailed product comparisons, and rapid delivery networks. Pharmacies and drugstores continue to influence the adoption of health-focused and premium models, particularly in urban regions. Dental clinics and professional channels are increasingly important for premium and smart toothbrushes, as dentist recommendations strongly drive consumer trust and product adoption. Direct-to-consumer brands leveraging social media, influencer marketing, and subscription models are reshaping the competitive landscape, particularly in tech-savvy and younger demographics.

End-User Insights

Adult users dominate the electric toothbrush market due to higher purchasing power, emphasis on preventive oral health, and willingness to invest in premium or smart devices. Children constitute a growing segment, encouraged by parental focus on dental care, gamified brushing experiences, and visually appealing designs. Family bundles and multi-pack devices are gaining traction as households seek cost efficiency and convenience, while premium smart toothbrushes appeal to tech-savvy individuals who value personalized oral-care feedback, data-driven brushing improvements, and long-term dental health tracking. Adoption in schools and dental programs also supports awareness among younger users, creating a pipeline for long-term market growth.

| By Product Type | By Bristle Type | By Technology / Head Movement | By End User | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains one of the largest markets globally, driven by strong adoption in the U.S. and Canada. Growth is fueled by high disposable incomes, widespread preventive dental awareness, and a preference for premium, rechargeable, and smart toothbrushes. Adults dominate adoption, while families increasingly invest in connected devices for children. Subscription-based replacement brush-head models, robust retail infrastructure, and high online penetration further drive sales. Additionally, government dental health campaigns and insurance coverage for preventive dental care encourage regular upgrades to electric toothbrushes, reinforcing sustained regional growth.

Europe

Europe is a mature, innovation-driven, and sustainability-conscious market. Consumers in Germany, the U.K., and France show strong adoption of premium rechargeable and smart toothbrushes due to growing awareness of oral health and environmental considerations. Eco-friendly materials, recyclable brush heads, and compliance with strict European regulatory standards are key adoption drivers. Rising digital literacy supports the adoption of app-connected toothbrushes, while dental associations and professional campaigns promote advanced oral-care devices. Regulatory emphasis on product safety and sustainable packaging encourages innovation and adoption, making Europe both a high-value and technology-driven market.

Asia-Pacific

Asia-Pacific is the fastest-growing region, capturing more than 34% of the global market share. Rapid urbanization, rising disposable incomes, growing health awareness, and increasing e-commerce penetration are primary growth drivers. China and India lead the adoption of both affordable battery-powered and premium rechargeable toothbrushes, while Japan and South Korea show strong uptake of smart and app-connected devices. Regional drivers include government oral-health campaigns, increasing urban dental clinic penetration, rising middle-class health-conscious consumers, and tech-savvy younger populations who prefer connected, AI-driven toothbrushes. The proliferation of online retail platforms further facilitates access to electric toothbrushes, accelerating adoption across diverse demographics.

Latin America

Latin America is witnessing gradual adoption, led by Brazil, Mexico, and Argentina. Urban health awareness, expanding retail and e-commerce channels, and rising disposable incomes among middle- and upper-income groups are driving growth. The leading segment—rechargeable toothbrushes—is preferred due to longer battery life and enhanced cleaning efficiency, while mid-range and smart toothbrushes are gaining traction. Professional dental endorsements and government oral-health initiatives further encourage adoption in urban centers. Increasing internet penetration and social media influence are accelerating awareness and willingness to invest in premium oral-care devices.

Middle East & Africa

Demand in the Middle East is growing, driven by high-income consumers in the UAE, Saudi Arabia, and Qatar who favor premium rechargeable and smart toothbrushes. Africa, while earlier in the adoption cycle, is experiencing growth in urban centers such as South Africa, Nigeria, and Kenya. Key growth drivers include expanding pharmacy and retail infrastructure, oral-health campaigns, rising dental clinic penetration, and increasing consumer awareness of oral hygiene benefits. Rechargeable brushes and mid-range smart devices are leading segments due to convenience, long battery life, and improved brushing efficiency. Import-led supply chains and growing e-commerce adoption in the region further support market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Electric Toothbrush Market

- Procter & Gamble (Oral-B)

- Koninklijke Philips N.V.

- Colgate-Palmolive

- Xiaomi

- Water Pik, Inc.

- Quip

- FOREO

- Panasonic Corporation

Recent Developments

- In March 2025, Oral-B expanded its iO Series line with new AI-enabled pressure-sensing features and a recyclable brush-head initiative.

- In January 2025, Philips launched a sustainability-focused Sonicare model made from 70% recycled plastics and biodegradable packaging.

- In April 2025, Colgate introduced an affordable smart electric toothbrush designed for emerging markets, featuring Bluetooth connectivity and a low-cost subscription head replacement model.