Electric Massager Market Size

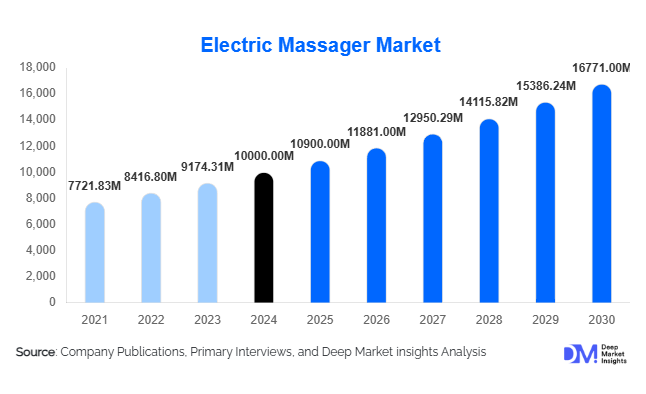

According to Deep Market Insights, the global electric massager market size was valued at USD 10,000 million in 2024 and is projected to grow from USD 10,900 million in 2025 to reach USD 16,771 million by 2030, expanding at a CAGR of 9.0% during the forecast period (2025–2030). The electric massager market growth is primarily driven by increasing wellness awareness, a rise in sedentary lifestyles leading to muscular discomfort, and the rapid adoption of smart, connected personal-care devices globally.

Key Market Insights

- Smart and AI-integrated massagers are transforming traditional pain-relief products into data-driven wellness companions.

- Asia-Pacific is the fastest-growing region, fueled by urbanization, e-commerce growth, and rising disposable incomes in China and India.

- North America remains the largest market, accounting for about 35 % of global value in 2024, led by strong consumer spending on wellness electronics.

- Online and D2C channels dominate distribution, capturing nearly 45 % of global sales as brands leverage digital marketing and influencer promotion.

- Technological innovation, including heat therapy, EMS, and hybrid AI programs, is fueling premiumization and repeat purchase cycles.

- Wellness and sports recovery applications are driving product diversification, appealing to both health-conscious and fitness-driven consumers.

Latest Market Trends

Smart and Connected Wellness Devices

Electric massagers are evolving into intelligent wellness systems, integrating Bluetooth and Wi-Fi connectivity, app-based controls, and AI-driven personalization. Consumers can now track muscle recovery, stress levels, and device-usage analytics, creating a seamless connection between fitness apps and relaxation devices. These features enhance engagement and enable recurring monetization through software updates and accessory sales. Manufacturers are also focusing on ergonomic, cordless, and battery-efficient designs to complement modern lifestyles.

Expansion of At-Home Therapeutic Devices

Post-pandemic health consciousness and hybrid work cultures have elevated demand for at-home therapeutic devices. Consumers prefer portable, user-friendly solutions that offer professional-grade massage experiences without clinic visits. Massage chairs and handheld percussion devices have witnessed strong adoption among middle-income households. Companies are introducing compact, foldable units with customizable intensity levels, targeting younger urban users and senior citizens alike.

Electric Massager Market Drivers

Rising Wellness Awareness and Lifestyle-Related Ailments

Increased prevalence of back pain, muscle fatigue, and stress disorders exacerbated by sedentary work habits has amplified global demand for electric massagers. The devices offer affordable, non-invasive pain relief and relaxation, aligning with growing health-and-wellness priorities. This shift from reactive treatment to preventive self-care underpins sustained market expansion.

Technological Innovation and Product Diversification

Continuous innovation, ranging from deep-tissue percussion and infrared heating to smart-sensor massage mapping, has enhanced the appeal of electric massagers. Integration of AI algorithms enables tailored massage modes based on body zones and tension levels. These advancements attract tech-savvy consumers willing to pay premium prices for personalized experiences, lifting overall market value.

Rapid Growth of Online Retail and D2C Sales

E-commerce platforms have democratized access to electric massagers, particularly in emerging markets. Online reviews, influencer endorsements, and direct shipping facilitate trust and global reach. Manufacturers increasingly adopt direct-to-consumer models, enabling better brand control, margin improvement, and data-driven marketing strategies. This channel transformation is one of the strongest catalysts for market growth.

Market Restraints

High Product Costs in Emerging Markets

Premium massage chairs and multi-function devices remain expensive for many consumers in developing economies, limiting penetration. High import duties, logistics costs, and currency fluctuations further inflate retail prices, making affordability a key barrier to volume growth.

Preference for Traditional Therapy Methods

Despite rising device adoption, many consumers still prefer manual massages or physiotherapy for perceived effectiveness. Limited clinical validation for some electric massagers and inconsistent safety standards across regions challenge broader medical acceptance, particularly in rehabilitation use.

Electric Massager Market Opportunities

Smart-Technology Integration and AI Personalization

Manufacturers have the opportunity to enhance customer loyalty and pricing power by embedding smart sensors, voice control, and AI algorithms. Personalized massage analytics, wellness dashboards, and app subscriptions can generate recurring revenue streams, shifting massagers from one-time purchases to connected wellness ecosystems.

Emerging-Market Expansion and Localized Production

Asia-Pacific, Latin America, and parts of Africa present vast untapped potential as disposable incomes rise. Localization of design, multilingual interfaces, and region-specific price points can dramatically expand adoption. Government initiatives such as “Make in India” and “Made in China 2025” support local manufacturing, improving export competitiveness and reducing costs.

Institutional and Corporate Wellness Adoption

Beyond household users, electric massagers are penetrating spas, rehabilitation centers, and corporate wellness programs. Companies integrating wellness spaces in offices are emerging as a lucrative B2B segment. Hospitals and physiotherapy clinics adopting certified devices for patient recovery further diversify end-use demand.

Product Type Insights

Stationary or Chair Massagers dominate the market, representing about 30 % of 2024 revenue. Their premium nature, comprehensive coverage, and ability to simulate professional massage techniques make them a preferred choice for high-income consumers and wellness facilities. Handheld and wearable massagers are expanding rapidly, catering to mobile lifestyles and fitness recovery use cases.

Technology Insights

Vibration and percussion technology accounts for nearly 35 % of global sales, offering affordability and versatility across applications. Advanced hybrid systems combining vibration, heat therapy, and compression are gaining traction in premium tiers, especially among athletes and physiotherapy users seeking deeper muscle recovery.

Application Insights

Pain relief and muscle recovery remain the largest application segment, contributing approximately 40 % of market value in 2024. Rising musculoskeletal disorders and consumer focus on daily stress management drive repeat purchases. Sports and fitness recovery applications show the fastest growth trajectory as awareness of muscle health gains prominence.

End-User Insights

Residential users dominate with about a 60 % share, fueled by at-home wellness and the affordability of portable devices. The commercial segment, including spas and clinics, is expanding steadily, while institutional healthcare adoption is expected to accelerate as more devices gain therapeutic certifications.

Distribution Channel Insights

Online and e-commerce sales capture roughly 45 % of the global market, supported by digital marketing and doorstep delivery convenience. Offline specialty stores continue to serve the premium segment, allowing consumers to test high-value products like massage chairs prior to purchase. Hybrid omnichannel strategies are emerging as a differentiator among leading brands.

| By Product Type | By Technology | By Application | By End User | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads with 35 % of the global market value in 2024, driven by high consumer spending on wellness electronics and robust distribution networks. The United States dominates regional demand, emphasizing premium chairs and smart handhelds. Rising adoption in corporate wellness programs and medical rehabilitation centers reinforces steady growth.

Europe

Europe represents about 20 % of the global market, with Germany, the U.K., and France as key contributors. Aging populations and strong wellness culture sustain demand for therapeutic chairs and heat-assisted massagers. EU product-safety standards and growing eco-design requirements are influencing innovation and manufacturing practices.

Asia-Pacific

Asia-Pacific accounts for roughly 30 % of the market share in 2024 and is the fastest-growing region. China leads in both production and consumption, followed by Japan, South Korea, and India. Rising middle-class income, online retail penetration, and local manufacturing incentives underpin double-digit growth rates through 2030.

Latin America

Latin America holds an 8–10 % share, led by Brazil and Mexico. Expanding wellness culture and e-commerce adoption are key growth factors. Mid-range handheld devices appeal to urban consumers seeking affordable relaxation and fitness-recovery tools.

Middle East & Africa

MEA represents 7 % of the market, with rapid uptake in GCC countries supported by wellness tourism and luxury hospitality. Africa’s local manufacturing remains nascent but is benefiting from increased imports of affordable Asian products. The region’s strong hospitality sector provides steady B2B demand for spa-grade equipment.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Electric Massager Market

- Panasonic Corporation

- OSIM International Ltd.

- Beurer GmbH

- Hyperice Inc.

- HoMedics Inc.

- Therabody Inc.

- Medisana GmbH

- Casada International GmbH

- Johnson Health Tech Co., Ltd.

- Inada Co., Ltd.

- Breo Inc.

- Luraco Technologies Inc.

- RoboTouch (India)

- Naipo Technologies Inc.

- Brookstone Company LLC