Electric Lunch Box Market Size

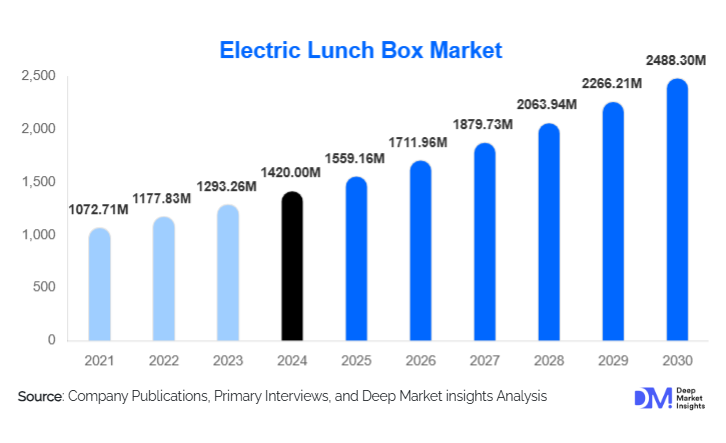

According to Deep Market Insights, the global electric lunch box market size was valued at USD 1,420 million in 2024 and is projected to grow from USD 1,559.16 million in 2025 to reach USD 2,488.30 million by 2030, expanding at a CAGR of 9.8% during the forecast period (2025–2030). The consistent growth of the market is driven by rising consumer preference for portable meal-heating solutions, increasing urban workforce populations, and growing adoption of energy-efficient, food-safe home appliances. Advancements in PTC heating technology, improved thermal insulation, and integration of smart temperature control systems are further enhancing product demand across commercial and residential settings.

Key Market Insights

- Shift toward portable, energy-efficient food-heating devices as consumers prioritize convenience and healthy home-cooked meals.

- Office professionals and students account for over 55% of product usage, driven by the need for on-the-go hot meals.

- Asia-Pacific dominates global consumption due to dense working populations and strong manufacturing ecosystems.

- Technological upgrades such as smart temperature control, spill-proof builds, and stainless-steel food containers are shaping product differentiation.

- Growing demand for electric lunch boxes in travel, logistics, and healthcare workforce segments as hot-meal access becomes an employee-wellness focus.

- E-commerce continues to expand its penetration, contributing over 40% of global sales in 2024.

What are the latest trends in the Electric Lunch Box Market?

Rise of Smart & IoT-Enabled Electric Lunch Boxes

Manufacturers are increasingly integrating smart technologies into electric lunch boxes to enhance convenience and user engagement. Features such as app-controlled heating, temperature monitoring, auto shut-off, and programmable meal timers are becoming mainstream. Bluetooth and Wi-Fi-enabled smart lunch boxes allow users to control heating cycles remotely, ensuring better meal safety and consistent warming. Integration with IoT platforms is also supporting energy-efficient operations and personalized meal preferences. These advances appeal strongly to office workers, students, and commuters seeking more intelligent and hygienic meal solutions.

Growing Popularity of Portable & Car-Compatible Heating Solutions

DC-powered (12V/24V) electric lunch boxes are gaining traction among drivers, gig workers, and logistics personnel. With increasing time spent on the road, portable food warmers compatible with car adaptors are providing convenient meal accessibility. Many brands are offering multi-port compatibility, including car, truck, and USB connections, to expand usability. This trend aligns with the rise of outdoor, camping, and travel-based lifestyles, making portable heating solutions a major driver of product innovation and adoption.

What are the key drivers in the Electric Lunch Box Market?

Growing Demand for Home-Cooked and Healthy Meals

With rising global awareness of health and nutrition, consumers increasingly prefer home-cooked meals over fast food. Electric lunch boxes enable convenient on-the-go meal heating, supporting healthier eating habits. Office employees, students, and field workers favor these products for their ability to maintain food freshness and hygiene. This shift toward healthier lifestyles, especially after the pandemic, continues to drive strong growth in the electric lunch box industry.

Rising Urbanization and Commuter Workforce Expansion

Urban professionals with long commutes are turning to electric lunch boxes as a practical solution for hot meals without needing microwaves. Growing adoption among gig workers, truck drivers, and delivery personnel further amplifies demand. Enhanced product features such as spill-proof containers, rapid heating technology, and dual-compartment designs are supporting broader adoption across diverse user groups.

What are the restraints for the global market?

Safety Concerns and Battery Limitations

Electric lunch boxes face challenges related to overheating, short circuits, and battery durability in rechargeable models. Low-cost, unregulated imports, especially in developing markets, raise concerns about product quality and user safety. Additionally, heavy power consumption and limited battery life in portable units restrict usage, particularly for outdoor activities and long commutes. Compliance with safety standards remains a key challenge for market expansion.

Competition from Microwave Alternatives and Thermal Containers

The widespread availability of microwaves in workplaces and the popularity of insulated thermal lunch boxes pose significant competition. Consumers often perceive microwaves as faster and more convenient, while insulated lunch boxes offer low-cost, electricity-free meal options. This creates adoption barriers in regions with easy access to shared kitchen appliances or consumer preference for non-electric meal storage solutions.

What are the key opportunities in the Electric Lunch Box Market?

Eco-Friendly & Energy-Efficient Heating Solutions

Growing global interest in sustainability is creating opportunities for energy-efficient heating technologies such as ceramic heating elements, low-voltage PTC heating, and recyclable container materials. Brands adopting BPA-free plastics, stainless steel interiors, and low-energy heating systems can differentiate themselves in a crowded market. Developing solar-powered or hybrid-powered electric lunch boxes also represents an emerging innovation opportunity, especially for outdoor users.

Expansion in Corporate & Institutional Meal Solutions

Corporations, universities, and industrial facilities are increasingly adopting electric lunch box programs to support employee wellness. Bulk procurement of electric lunch boxes for staff empowerment, meal safety, and productivity is growing. Custom-branded solutions for schools, factories, and transportation companies present a major revenue opportunity for market players.

Product Type Insights

Electric heated lunch boxes dominate the market due to their simplicity and widespread consumer preference. Self-heating steam-based models are gaining popularity for delivering uniform heating and improved meal texture. Insulated electric lunch boxes continue to attract users who prioritize temperature retention throughout the day. Portable food warmers with multi-voltage compatibility are rapidly becoming preferred by commuters, truck drivers, and frequent travelers.

Application Insights

Office employees represent the largest consumer segment, driven by the need for convenient and hygienic workday meals. Drivers, including truckers, cab operators, and delivery personnel, are a fast-growing user group, supported by the rise of car-compatible electric lunch boxes. Students favor budget-friendly, compact models for everyday use. Outdoor users and travelers increasingly seek high-capacity, multi-functional warmers designed for camping and road trips.

Distribution Channel Insights

Online retail dominates the market, with e-commerce platforms offering diverse product options, user reviews, and dynamic pricing. Specialty appliance stores and large retail outlets remain important channels for consumers seeking in-person product evaluation. Direct-to-consumer (D2C) brands are strengthening their presence with subscription-based models, warranty extensions, and bundled meal-prep accessories. Social media and influencer-led marketing are playing a critical role in shaping consumer preferences.

Traveler Type Insights

Office commuters form the largest share of electric lunch box users, followed by drivers who benefit from 12V/24V car-compatible warmers. Students are increasingly adopting compact, affordable models for daily campus use. Families represent a growing segment, with interest in multi-compartment and child-safe designs. Outdoor travelers and campers contribute to the emerging demand for high-capacity, portable heating solutions.

Age Group Insights

Adults aged 25–45 account for the largest market share due to high workforce participation and a strong preference for healthy, portable meal solutions. Younger consumers aged 18–25 drive demand for budget-friendly, trendy, and compact designs. Older users aged 50 and above prefer user-friendly, safety-focused models with auto shut-off and low-voltage heating systems. Families and multi-generational households also contribute to sustained product adoption.

| By Product Type | By Heating Technology | By Connectivity & Power Source | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains one of the largest markets for electric lunch boxes due to high workforce mobility, strong adoption of smart kitchen appliances, and a preference for healthy meal routines. The U.S. and Canada show strong demand for smart-enabled and car-compatible models, supported by well-developed retail networks and increasing remote work flexibility.

Europe

Europe demonstrates a growing demand driven by health-focused consumers and sustainability-oriented product innovations. Countries such as Germany, the U.K., and France lead adoption due to strong commuter populations and a focus on BPA-free, eco-friendly materials. E-commerce continues to be a dominant channel for purchasing lunch box solutions.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with China and India driving massive adoption due to large working populations, rising disposable income, and strong preferences for home-cooked meal culture. Japan and South Korea show high demand for technologically advanced and compact electric lunch boxes. Increasing urbanization and rising student populations further accelerate regional growth.

Latin America

Latin America shows expanding demand, particularly in Brazil, Mexico, and Argentina, where urban workers are increasingly seeking convenient, portable food-warming solutions. Growth is supported by rising middle-class spending and expanding online retail penetration.

Middle East & Africa

The region is experiencing steady growth driven by expatriate communities, long-distance commuters, and rising demand for portable heating solutions in countries such as the UAE, Saudi Arabia, and South Africa. Strong retail expansion and increasing adoption of compact household appliances support market development.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Electric Lunch Box Market

- Hamilton Beach Brands, Inc.

- Zojirushi Corporation

- Hotlogic

- Crock-Pot (Newell Brands Inc.)

- Aroma Housewares Company

- Midea Group

- Milton (Hamilton Housewares)

- Bear Electric Appliance Co., Ltd.

Recent Developments

- In February 2025, Hotlogic launched a new smart-connected lunch box line with app-controlled heating and energy-efficient PTC elements.

- In March 2025, Hamilton Beach introduced a multi-compartment electric lunch box designed for commuters and gig workers, featuring rapid heating and spill-proof sealing.

- In May 2025, Aroma Housewares expanded its portable food warmer range with car-compatible 12V/24V models targeting long-distance drivers and logistics employees.