Educational Tourism Market Size

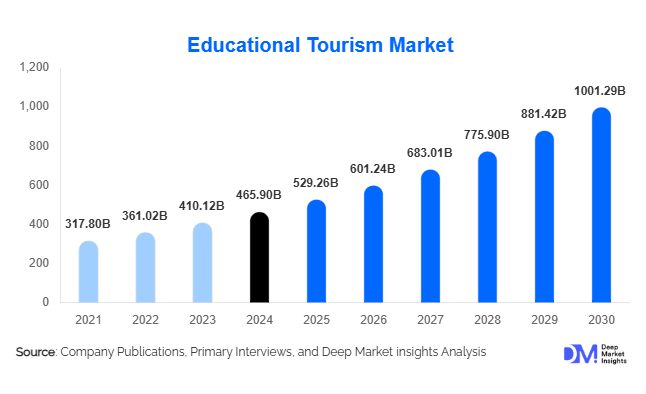

According to Deep Market Insights, the global educational tourism market size was valued at USD 465.90 billion in 2024 and is projected to grow from USD 529.26 billion in 2025 to reach USD 1,001.29 billion by 2030, expanding at a CAGR of 13.6% during the forecast period (2025–2030). Educational tourism market growth is primarily driven by rising global student mobility, increasing professional upskilling travel, and expanding participation from emerging economies that view travel-based learning as a long-term investment in human capital.

Key Market Insights

- The 16–25-year age group dominates the market, accounting for around 40% of global demand, driven by undergraduate, exchange, and internship-based travel programs.

- Asia-Pacific leads with approximately 40% market share, supported by large student populations and rising disposable incomes in China, India, Japan, and South Korea.

- College-level and undergraduate programs contribute over 36% of total spending, owing to growing cross-border academic collaborations and exchange initiatives.

- Professional development and executive education travel is emerging as the fastest-growing subsegment, supported by corporate globalization and digital transformation.

- Hybrid learning-travel models, AR/VR-enabled tours, and digital exchange platforms are reshaping how institutions and learners engage in international education experiences.

- Government-led education diplomacy and scholarship programs are expanding inbound student tourism in North America, Europe, and the Asia-Pacific.

Latest Market Trends

Hybrid Learning-Travel Experiences

The convergence of digital learning and physical travel is creating a new class of hybrid educational tourism. Universities and private operators are introducing programs that begin with online coursework, followed by immersive on-site experiences. Augmented and virtual reality (AR/VR) tools enable deeper contextual understanding at historical, scientific, or cultural landmarks. This approach makes educational tourism more accessible and cost-efficient, especially for students from developing economies seeking global exposure at reduced cost. Hybrid learning-travel is expected to represent a significant share of total program enrollments by 2030.

Rising Demand for Professional Upskilling Travel

Professionals and executives increasingly view international travel as an opportunity for skill enhancement, networking, and leadership development. Educational tourism providers are partnering with global universities and industry bodies to design specialized programs, executive retreats, cross-cultural workshops, and certification-based study tours. This segment, accounting for about 34% of market revenue in 2024, is expanding rapidly due to corporate globalization and the need for diverse, experience-based learning environments.

Experiential and Sustainable Educational Travel

Sustainability and cultural authenticity have become defining features of modern educational travel. Institutions and operators are embedding service-learning, community engagement, and heritage preservation into their programs. From language immersion in rural villages to cultural exchange and conservation study tours, educational tourism is evolving beyond classroom learning. The rise of eco-conscious travel preferences among younger generations is also encouraging providers to adopt responsible tourism standards and carbon-neutral operations.

Educational Tourism Market Drivers

Globalization of Education and Student Mobility

The increasing internationalization of higher education is a primary driver of educational tourism. Cross-border partnerships, scholarship schemes, and student exchange agreements have boosted global learner mobility. According to industry data, over five million students currently study abroad, a figure projected to rise significantly by 2030. The ease of international travel and growing institutional cooperation have cemented education-based tourism as a major sub-sector of the global travel economy.

Rising Disposable Incomes and Middle-Class Expansion

Rapid economic development across Asia-Pacific, Latin America, and the Middle East has expanded the pool of middle-income families able to invest in educational travel. As higher education becomes both a status symbol and an employment requirement, families increasingly allocate funds to international study trips, language camps, and certification programs abroad. This demographic expansion is reshaping global demand, turning countries like India, China, and Brazil into major source markets.

Growing Preference for Experiential Learning

Learners increasingly value real-world engagement and immersive cultural experiences. Educational tourism bridges this gap by blending travel with academic, linguistic, or vocational goals. As a result, programs offering on-site fieldwork, cultural immersion, or direct industry exposure are seeing higher participation rates, especially among Gen Z and millennial learners.

Market Restraints

High Cost and Accessibility Barriers

Despite expanding access, educational tourism remains cost-intensive. Travel fares, accommodation, and program fees create affordability challenges, particularly for students from lower-income regions. Economic uncertainty and exchange rate volatility further constrain participation. Operators are responding by introducing scholarships, hybrid programs, and shorter-duration modules, but affordability remains a significant restraint.

Regulatory and Visa Constraints

Visa complexity, varying academic credit recognition, and geopolitical uncertainty can limit cross-border mobility for educational travelers. Inconsistent accreditation standards and safety concerns in some destinations also pose operational challenges. Simplifying visa frameworks and enhancing institutional cooperation are essential to unlocking further market potential.

Educational Tourism Market Opportunities

Emerging Regional Demand in Developing Economies

Countries in Asia-Pacific, Latin America, and the Middle East are experiencing a surge in outbound educational travel, fueled by rising youth populations and government-backed education initiatives. By establishing partnerships with universities and leveraging cultural exchange programs, operators can capture this growing demand. These regions also offer opportunities for inbound tourism through affordable, high-quality learning destinations.

Technology-Integrated Learning Journeys

Adopting advanced technologies, AI-driven learning management systems, VR cultural simulations, and blockchain-based credentialing can transform program quality and scalability. Providers that integrate tech-enhanced pre-travel learning modules with immersive in-country experiences can reach new audiences while lowering operational costs.

Corporate and Executive Education Travel

The professional development travel segment offers high margins and repeat clientele. Corporations are sponsoring international workshops, cross-border innovation tours, and cultural competence training to support global operations. This presents a lucrative avenue for providers to create tailored, premium offerings with longer stay durations and strategic partnerships with corporate HR departments.

Product Type Insights

The educational tourism market is broadly segmented into academic programs (including study abroad, exchange, and internships), short-term study tours (covering language, heritage, and science trips), and professional certification travel. Among these, professional and executive learning travel dominates global revenue, accounting for nearly 38% of the 2024 market, driven by employer demand for short, intensive upskilling and micro-credential programs. Undergraduate and youth-oriented study tours lead in volume terms, supported by credential portability and international alliances that drive semester/credit programs. Short-term experiential tours lasting one to three weeks are growing rapidly due to their affordability, flexibility, and high scalability for institutions and operators.

Application Insights

Educational tourism applications span formal academic credit programs, language immersion and cultural exchange, and professional skill development travel. Language immersion, especially in English, Mandarin, and Spanish, remains a cornerstone of international education tourism, driven by tourism and heritage conservation funding as well as curricula emphasizing experiential history. The fastest-growing application is professional certification and executive learning travel, boosted by global corporations sponsoring workforce upskilling programs. Additionally, research and fieldwork-based educational travel is expanding, supported by cross-border research grants and institutional collaborations. Hybrid service-learning programs that merge education with community engagement and sustainability projects are also gaining momentum.

Distribution Channel Insights

Institutional partnerships, including universities, schools, and government networks, dominate distribution, accounting for more than 45% of total enrollments in 2024. The channel’s strength lies in reputation, transnational partnerships, and trust-based relationships. However, private operators and digital D2C platforms are growing rapidly by offering flexible short courses, integrated travel services, and digital learning options. Online booking platforms increasingly include end-to-end solutions such as insurance, visa assistance, and virtual campus previews. This is expanding reach, particularly for short study tours, which benefit from vocational and cultural learning scalability and affordable online discovery channels.

Traveler Type Insights

Students aged 16–25 years comprise about 40% of the global educational tourism market in 2024, largely driven by tuition goals, career outcomes, and exchange program participation. Working professionals form the second-largest traveler group, propelled by employer-sponsored executive programs and short-term international residencies. Family-based educational travel is rising, especially for cultural and heritage tours that support intergenerational learning. Teachers and delegations represent a notable niche, often funded by ministries or academic institutions seeking professional development abroad. Meanwhile, senior lifelong learners (aged 55+) are emerging as a fast-growing group, motivated by enrichment trips and heritage learning programs emphasizing lifelong education and cultural immersion.

| By Purpose of Travel | By Education Level | By Program Type / Product | By Customer Type | By Booking Flow / Direction |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

The Asia-Pacific (APAC) region leads the global educational tourism market, accounting for roughly 40% of the total market share (USD 190–200 billion in 2024). China, India, Japan, South Korea, and Australia are both major source and destination markets. The region’s growth is underpinned by rapidly rising outbound student numbers, expanding youth populations, increasing disposable incomes, and government-led initiatives promoting international study and inbound university partnerships. India and China are the fastest-growing outbound markets, while Australia and Japan attract high volumes of inbound learners through globally ranked universities and specialized field programs. Regional governments are actively positioning education as a soft-power tool, aligning with national “Study Abroad” strategies and digital education exchange initiatives.

North America

North America accounted for approximately 28% of the global educational tourism market (USD 135 billion in 2024), led by the United States and Canada. The region benefits from strong inbound demand for STEM programs, world-leading research institutions, and well-established university brands that attract international students for short-term programs and executive education. The U.S. remains a top choice for academic and professional programs, supported by extensive scholarship frameworks and global partnerships. Canada’s pro-immigration and student-friendly visa policies are strengthening its role as a preferred destination for long-term academic travel. Moreover, North America’s ecosystem of innovation, cultural diversity, and digital learning integration continues to enhance its competitive edge in the educational tourism landscape.

Europe

Europe represents nearly 27% of the global educational tourism market, anchored by the U.K., Germany, France, Spain, and Italy. Growth is driven by a dense concentration of world-class universities, short geographical distances that facilitate multi-country study tours, and a deep-rooted demand for cultural and heritage-based learning. The Erasmus+ program and robust intra-European academic mobility networks sustain high intra-regional movement, while inbound students from Asia-Pacific and North America drive diversification. Heritage-focused field trips, historical site programs, and language schools across Western Europe remain consistent contributors to inbound educational tourism revenues.

Latin America

Latin America is an emerging region in the educational tourism market, currently holding under 10% global share. Brazil, Mexico, Chile, and Argentina are at the forefront of growth, supported by expanding domestic edutourism, biodiversity, and environmental learning programs, and increasing interest in exchange programs with Europe and North America. Regional universities are forming more bilateral partnerships with European institutions, while domestic tourism boards promote educational field trips linked to ecology and cultural heritage. Despite economic fluctuations, affordability and cultural richness make Latin America an attractive base for both inbound and outbound education travel growth.

Middle East & Africa

The Middle East and Africa collectively represent a smaller but rapidly growing segment of the global market. Current share is below 8%, yet investment activity is intensifying. Regional expansion is driven by education infrastructure development, government scholarships, and niche opportunities in heritage, archaeology, and environmental fieldwork. The UAE and Saudi Arabia lead regional growth through education city projects and global university collaborations. African nations such as South Africa, Kenya, and Egypt are leveraging their heritage and eco-tourism assets to attract academic visitors. However, political instability and uneven visa frameworks remain challenges in parts of the region. Long-term, scholarship-backed initiatives like “Study in UAE” and pan-African education mobility programs are expected to drive steady growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Educational Tourism Market

- EF Education First

- Kaplan International

- Study Group

- CIEE (Council on International Educational Exchange)

- WorldStrides

- Road Scholar

- Global Vision International (GVI)

- International Education Services (IES)

- ACE Cultural Tours

- Kesari Tours Pvt. Ltd.

- Atlantis Erudition & Travel Services

- ATG Travel

- Capital Tours Inc.

- Global Educational Travel

- AAI Edutourz

Recent Developments

- June 2025: EF Education First launched its “Hybrid Global Classroom” initiative, combining online language learning with cultural immersion tours across 30 countries.

- April 2025: Kaplan International announced partnerships with universities in India and Malaysia to offer dual-degree travel programs for international students.

- February 2025: CIEE introduced sustainability-focused educational tours emphasizing eco-literacy and community engagement in Southeast Asia.