Edible Cutlery Market Size

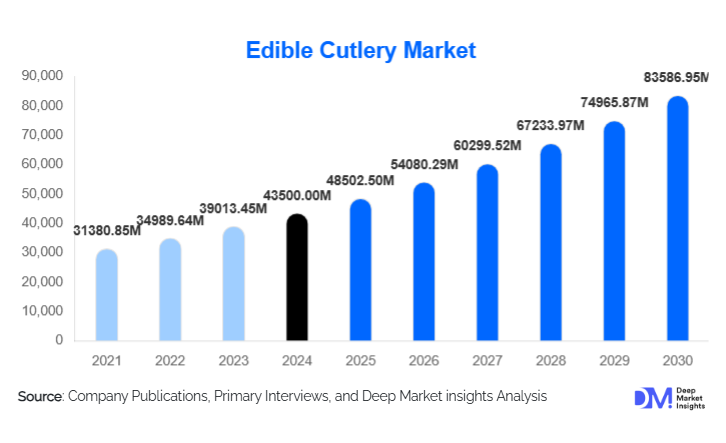

According to Deep Market Insights, the global Edible Cutlery Market size was valued at USD 43,500 million in 2024 and is projected to grow from USD 48,502.5 million in 2025 to reach USD 83,586.95 million by 2030, expanding at a CAGR of 11.50% during the forecast period (2025–2030). The edible cutlery market growth is primarily driven by increasing government restrictions on single-use plastics, rising consumer awareness of sustainable alternatives, and technological advances in edible utensil manufacturing using natural grains, pulses, and multigrain materials.

Key Market Insights

- Edible cutlery is emerging as a sustainable replacement for single-use plastic utensils, aligning with global zero-waste and circular economy initiatives.

- Foodservice and hospitality sectors dominate demand, accounting for more than 80% of global edible cutlery consumption in 2024.

- North America leads the global market, holding nearly 37% share, supported by stringent plastic bans and strong sustainability policies.

- Asia-Pacific is the fastest-growing region, with rising production and export capacity in India, China, and Southeast Asia.

- Online distribution channels dominate, capturing over 75% of sales as D2C edible cutlery brands expand through e-commerce and B2B portals.

- Innovation in multigrain and flavored utensils (sweet, savory, chocolate, and spiced variants) is driving premiumization in this niche market.

What are the latest trends in the Edible Cutlery Market?

Government-Led Plastic Bans Accelerating Adoption

Global regulatory pressure against single-use plastics is the most significant catalyst for edible cutlery adoption. Governments across North America, Europe, and Asia are implementing restrictions on disposable plastic utensils, prompting restaurants, airlines, and food delivery platforms to switch to sustainable, biodegradable, or edible alternatives. Countries such as India and France have introduced strict national policies banning plastic cutlery, which has accelerated demand for edible spoons, forks, and straws. This regulatory shift is fostering large-scale procurement contracts and encouraging start-ups to expand production capacity in compliance with eco-certification standards.

Rising Innovation in Material Science and Flavor Development

Manufacturers are investing in advanced formulations that enhance heat resistance, durability, and taste of edible utensils. New product lines are being launched using pulses, millets, rice bran, and multigrain compositions, enabling customization for sweet and savory applications. Innovations such as chocolate-based dessert spoons and flavored straws are appealing to cafés, event organizers, and hotels seeking differentiation. Research into improving shelf-life and moisture resistance is also expanding edible cutlery’s usability across climates and storage conditions, further enhancing product reliability and global scalability.

What are the key drivers in the Edible Cutlery Market?

Environmental Regulations and Sustainability Awareness

Governments worldwide are tightening restrictions on plastic waste. The EU’s Single-Use Plastics Directive, U.S. state-level bans, and India’s Plastic Waste Management Rules have collectively propelled eco-friendly alternatives like edible cutlery into mainstream awareness. Heightened consumer consciousness around plastic pollution and ocean waste is pushing foodservice brands to adopt edible utensils as part of their ESG (Environmental, Social, Governance) commitments.

Expansion of the Foodservice Industry

The rapid growth of the foodservice and catering sector, including quick-service restaurants, cloud kitchens, and airline catering, has significantly boosted demand for single-use utensils. With many brands pledging to eliminate plastics from operations, edible cutlery presents a viable, marketing-friendly substitute. The segment benefits from volume procurement contracts, particularly in North America and Asia-Pacific, where institutional catering and QSR chains are scaling sustainable dining solutions.

Consumer Preference for Novelty and Experiential Dining

Modern consumers, particularly millennials and Gen Z, are drawn to novelty-driven, eco-conscious products. Edible cutlery provides both functionality and experiential appeal, offering a tangible contribution to sustainability. Social media virality and influencer-led campaigns around “zero waste dining” have also accelerated awareness, driving higher adoption in cafes, events, and household use.

What are the restraints for the global market?

High Production Costs and Limited Scale

Compared with traditional plastic utensils, edible cutlery incurs higher production costs due to food-grade raw materials, specialized baking equipment, and quality control standards. Limited economies of scale and low mechanization rates in emerging regions hinder mass affordability, restraining faster penetration among budget-sensitive markets and small-scale food operators.

Awareness and Durability Concerns

Despite growing publicity, consumer awareness of edible cutlery remains relatively low in many developing economies. Concerns over shelf-life, taste neutrality, heat resistance, and breakage also limit trust among new buyers. Continuous education and quality improvement efforts are essential to overcome perception barriers and expand market acceptance.

What are the key opportunities in the Edible Cutlery Industry?

Regulatory Tailwinds and Policy Incentives

Global bans on single-use plastics present a once-in-a-generation growth opportunity for edible cutlery manufacturers. Policy incentives, such as tax benefits, green manufacturing subsidies, and plastic credit schemes, can accelerate plant expansions and encourage private investments. Companies aligning with certification standards (compostability, food safety) are best positioned to win procurement contracts from institutional buyers and governments.

Emerging Markets and Export Growth

Developing regions like South Asia and Africa offer high-volume, low-cost manufacturing potential, enabling export-oriented business models. India, for instance, is witnessing a rapid scale-up of edible spoon and straw production, catering to both domestic and international demand. Favorable trade policies and eco-labelling initiatives can further strengthen export opportunities to the U.S. and EU markets.

Innovation in Product Formats and Integration

The introduction of flavored spoons, edible straws, and multigrain sporks creates diversification opportunities. Integration with meal kits, catering packs, and branded events extends utility beyond restaurants. As packaging sustainability becomes a priority, edible utensils are being paired with compostable boxes and biodegradable wraps, offering holistic, eco-friendly dining solutions.

Product Type Insights

Spoons dominate the edible cutlery market, accounting for approximately 38% of global revenue in 2024. Their versatility across desserts, soups, and beverages makes them the preferred entry point for consumers and businesses transitioning from plastic to edible options. Spoons also have simpler manufacturing requirements, allowing greater cost efficiency and mass-scale production compared to knives or forks. Edible straws and sporks are emerging segments expected to grow rapidly with beverage and on-the-go meal trends.

Raw Material Insights

Corn-based edible cutlery leads the market with about 43% share in 2024, owing to its cost-effective production and easy availability. Corn flour’s pliability and neutral taste make it ideal for mass-market spoons and forks. Wheat-bran and rice-bran materials are gaining traction for premium, flavored, and high-fiber variants, while multigrain and pulse-based formulations cater to the health-conscious consumer base seeking natural, protein-rich alternatives.

Application Insights

Commercial foodservice is the leading application segment, representing over 80% of global edible cutlery demand. Restaurants, catering companies, airlines, and event organizers are adopting edible utensils to meet sustainability mandates and corporate social responsibility goals. Household use remains a smaller but fastest-growing segment, driven by online sales and eco-friendly lifestyle adoption. Institutional applications—schools, hospitals, and public sector events—are also expanding as public procurement shifts toward green products.

Distribution Channel Insights

Online channels dominate edible cutlery sales, capturing nearly 79% of total revenue in 2024. Direct-to-consumer e-commerce and B2B online procurement portals offer convenience, visibility, and scalability for emerging brands. Offline channels such as supermarkets, specialty stores, and catering distributors are gradually expanding as awareness increases. Strategic partnerships with online marketplaces and restaurant supply platforms continue to fuel digital growth and global reach.

| By Product Type | By Material Type | By Flavor Type | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global edible cutlery market with around 36.8% share in 2024. The U.S. and Canada’s proactive legislation against plastic waste, combined with strong adoption in foodservice and event catering, has cemented the region’s leadership. Key players are headquartered in the U.S., leveraging advanced baking technologies and flavor innovations. Consumer willingness to pay premium prices for sustainable dining products ensures steady regional growth.

Europe

Europe maintains a significant market position due to EU-wide bans on single-use plastics and widespread eco-conscious consumer behavior. The U.K., Germany, France, and Italy are major demand centers. European producers are emphasizing biodegradable certifications and local-sourcing initiatives to strengthen competitive positioning and align with the EU Green Deal.

Asia-Pacific

Asia-Pacific is the fastest-growing region, supported by expanding foodservice infrastructure and increasing export capabilities. India, China, and Japan are major growth hubs, with India emerging as a key manufacturing and export base. Rising domestic consumption, government bans on plastic utensils, and the expansion of eco-startups make APAC a critical contributor to future market expansion.

Latin America

Latin America is in early adoption stages, with Brazil and Mexico witnessing emerging demand through the hospitality and events sectors. Import-driven availability and eco-awareness campaigns are gradually building the foundation for broader acceptance, especially among urban consumers.

Middle East & Africa

The Middle East and Africa exhibit modest but growing demand for edible cutlery, particularly in the UAE and South Africa, where large hospitality events and sustainability initiatives encourage adoption. The region is expected to post above-average CAGR through 2030 as luxury resorts and tourism operators adopt eco-friendly dining solutions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Edible Cutlery Market

- Biotrem Sp. z o.o.

- EdiblePRO

- Edibles by Jack

- Wisefood GmbH

- KOOVEE

- Mede Cutlery Company

- Founcy

- FRENVI Private Ltd

- GreenHome

- IPPINKA

- KDD (India) Private Ltd

- Candy Cutlery

- IncrEDIBLE Eats Inc.

- BrightVibes B.V.

- Vegetal Eco Products

Recent Developments

- In August 2025, Biotrem announced the launch of a new multigrain edible spoon line with enhanced heat resistance for soups and beverages, aimed at commercial catering clients in Europe.

- In June 2025, India-based FRENVI Pvt Ltd expanded its manufacturing capacity by 40%, establishing a new export unit under the “Make in India” initiative for biodegradable and edible tableware.

- In April 2025, Wisefood GmbH introduced flavored edible straws for European cafés and hospitality chains, targeting the premium beverage accessory market.

- In February 2025, IncrEDIBLE Eats Inc. secured Series B funding to enhance automation in its U.S. production facilities and expand into airline catering partnerships.