Edible Cosmetics Market Size

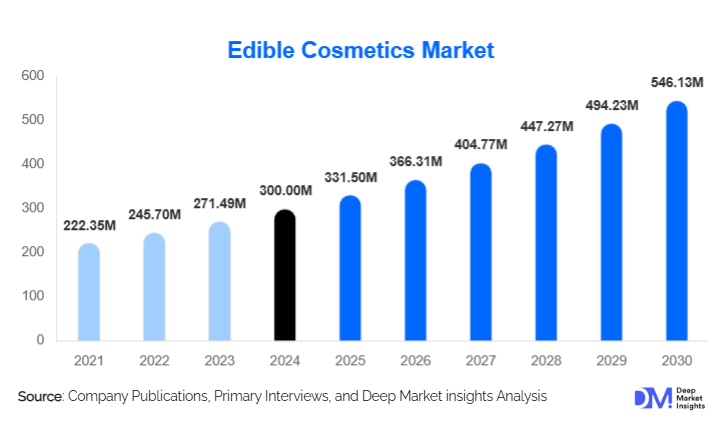

According to Deep Market Insights, the global Edible Cosmetics Market size was valued at USD 300 million in 2024 and is projected to grow from USD 331.5 million in 2025 to reach USD 546.13 million by 2030, expanding at a CAGR of 10.50% during the forecast period (2025–2030). Growth in this market is primarily driven by rising consumer interest in beauty-from-within formulations, increasing availability of food-grade beauty ingestibles (gummies, shots, powders), and the expansion of direct-to-consumer and e-commerce channels enabling rapid global penetration.

Key Market Insights

- Ingestible formats (gummies and shots) dominate the product landscape, offering convenience, repeat-purchase behaviour, and high consumer engagement in wellness-beauty hybrids.

- Clean-label and natural ingredient positioning are gaining traction, as consumers seek safe, transparent, food-grade beauty solutions rather than traditional external cosmetics.

- North America leads the market currently, benefitting from high disposable income, advanced DTC infrastructure, and strong wellness-beauty convergence.

- Asia-Pacific is the fastest-growing region, driven by cultural acceptance of ingestible beauty, rising middle-class incomes, and strong e-commerce expansion.

- Direct-to-consumer and online marketplaces are transforming distribution, enabling smaller players to scale globally and increasing subscription-based models for edible beauty products.

- Ingredient and manufacturing innovation, including food-grade encapsulation, flavour masking, and nutraceutical actives, is enabling more credible and palatable edible cosmetics.

What are the latest trends in the edible cosmetics market?

Subscription-Model Beauty-From-Within

Brands are increasingly moving ingestible beauty offerings into subscription models, allowing consumers to receive monthly deliveries of gummies, powders, or shots formulated for skin, hair, or nails. This transforms a one-time novelty purchase into a recurring beauty-and-wellness habit. Subscription delivers improved customer lifetime value, gives brands predictable revenue, and enables ongoing formulation updates, personalised bundles, and upsell of higher-tier variants. Consumers favour the convenience, perceived efficacy, and ongoing engagement of subscription formats, which is accelerating the adoption of edible cosmetics.

Functional Beverage & Cross-Category Collaborations

Edible cosmetics are increasingly collaborating with the food & beverage sector, producing “beauty-infused” drinks (collagen shots, beauty teas, sparkling functional beverages) and snack bars that promote skin/hair benefits. These cross-category formats leverage existing food-distribution channels and broaden appeal beyond traditional beauty shelves. The convergence of wellness-nutrition and beauty enables brands to tap a larger consumer base, offering ingestible solutions disguised as daily consumables. It’s a key trend unlocking mainstream adoption of edible cosmetics.

What are the key drivers in the edible cosmetics market?

Convergence of Beauty and Wellness

Consumers are seeking products that bridge external beauty and internal health, especially formulations that promote skin, hair, or nails from within. The ‘beauty-from-within’ trend has elevated demand for ingestible formats (gummies, powders, shots) with measurable benefits, which in turn is fueling growth in edible cosmetics. Younger generations in particular value multifunctional products that fit into wellness routines rather than standalone cosmetic items.

Ingredient Innovation and Food-Grade Manufacturing Capabilities

Advances in food-grade formulation technology (encapsulation, flavour-masking, shelf-stable gummy/softgel manufacturing) have reduced technical barriers and enabled credible ingestible beauty products. Reliable sourcing of high-purity actives (collagen peptides, plant extracts, vitamins) and established food-manufacturing infrastructure support scale-up, more predictable supply chains, and better cost structure. As a result, brands can launch differentiated edible cosmetics with credible claims.

Digital Distribution and Direct-to-Consumer Models

The growth of e-commerce and DTC platforms has lowered barriers to entry for edible cosmetics brands, enabling rapid customer acquisition, targeted marketing, and global shipping. Subscription models and social-media-driven campaigns help build community and loyalty. These digital channels bypass some of the constraints of traditional beauty retail (slotting costs, slow shelf access) and accelerate market penetration for ingestible beauty formats.

Regulatory Ambiguity and Classification Challenges (Restraint)

Edible cosmetics occupy a regulatory grey area between food, supplements, and cosmetics. Classification differences across jurisdictions create complexity in labeling, permissible claims, ingredient safety, and distribution. This ambiguity raises compliance costs and slows market entry for some brands.

Safety Perception and Consumer Trust (Restraint)

While ingestible beauty products are appealing, some consumers and healthcare professionals remain cautious about long-term safety, dosage effects, and interactions with medications. Without strong clinical backing and transparent communication, adoption may be limited. Brands must invest in safety data, clear instructions, and education to build consumer trust.

What are the key opportunities in the edible cosmetics industry?

Personalised Beauty-From-Within and Data-Driven Formulations

There is a growing opportunity for brands to offer personalised ingestible beauty solutions based on skin/hair diagnostics, lifestyle data, and biomarker feedback. Using subscription models and digital platforms, consumers can receive tailored gummy/shot formulations aligned with their unique requirements, boosting engagement and repeat purchase. This personalisation differentiates brands, supports premium pricing, and fosters strong customer loyalty.

Export-Led Growth into Emerging Regions

While North America and Europe currently dominate revenue, emerging markets in Asia-Pacific (China, South Korea, India) and Latin America are primed for rapid growth due to rising affluence, wellness awareness, and e-commerce access. Brands that localise formulations (taste profiles, vegetarian/halal-friendly ingredients), use cross-border e-commerce, and secure regulatory compliance can capture high-growth regional demand. Exporting from established markets to these regions offers a strategic growth path with higher volume potential and lower penetration risk.

Strategic Ingredient & Retail Partnerships

Collaborations between beauty brands and ingredient suppliers (for advanced actives), or partnerships with food & beverage players (launching beauty-infused drinks/snacks), represent another key opportunity. These alliances can leverage shared R&D, cross-category distribution, and broader consumer reach. Additionally, strategic alignment with health and pharmacy channels enhances credibility and access. Brands able to form such partnerships will accelerate innovation, scale faster, and access diverse consumer touchpoints.

Product Type Insights

In the edible cosmetics market, ingestible beauty supplements (gummies and shots) lead the product-type segment, accounting for about 34% of the 2024 market (USD 89 million) due to strong consumer familiarity with gummy formats and recurring purchase potential. Within formulation formats, gummies/chews (29% of market) are most popular because they combine ease of consumption with appealing taste and packaging. On ingredient claims, clean-label natural formulations (41% share) dominate as consumers increasingly prioritise transparency and food-grade sourcing. Distribution continues to favour e-commerce/DTC channels (38% share) because they allow brands to launch globally with lower overhead and capture subscription revenue. Regarding price tiers, the premium/mid-market tier (58% share) generates most of the value, reflecting consumers’ willingness to pay more for clinically-backed, premium-packaged ingestibles.

End-Use Insights

The largest end-use segment for edible cosmetics is daily personal care, with repeat-use formats (monthly gummies/shots) capturing the most revenue and driving faster growth. Professional/salon use and clinical/cosmeceutical ingestibles are smaller but expanding. A notable new application is cross-category collaboration in the food & beverage space, beauty-infused drinks, and snack bars are introducing edible cosmetics to mainstream consumers via novel consumption occasions. Export-driven demand is growing as brands reach global consumers seeking ingestible beauty solutions; the nutraceutical and functional food industries’ growth (often in the high‐single to low-double digits globally) underpins this expansion.

| By Product Type | By Ingredient Type | By Function / Application | By Distribution Channel | By End Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the largest region for edible cosmetics, representing approximately 34% of the global 2024 market (USD 89 million). The U.S. leads the region, driven by high consumer spending on wellness–beauty overlap, mature DTC channels, and frequent product innovation. Canada contributes smaller volumes but similar trends. Adoption is strong thanks to a well-developed e-commerce infrastructure and willingness to pay premium prices for novel ingestible beauty formats.

Asia-Pacific

Asia-Pacific is the fastest-growing region in percentage terms. Although its share in 2024 was around 28% of the global market, it is expected to outpace all other regions in CAGR as countries like South Korea, China, Japan, and India ramp up consumption of ingestible beauty formats. Key drivers include cultural familiarity with beauty drinks, rising middle-class income, and strong online retail ecosystems. Localisation of taste profiles and alignment with regional ingredient preferences (plant-based botanicals, vegetarian/halal compliance) further accelerate growth.

Europe

Europe holds a meaningful share in the global edible cosmetics market, with demand concentrated in the UK, Germany, and France. Consumers here value clinically-substantiated products and clean-label credentials. Although regulatory scrutiny is higher and growth is slower than in APAC, premium brands that meet standards and secure pharmacy/beauty-retail listings are gaining share.

Latin America

Latin America is a growing but smaller market, with Brazil and Mexico leading. Although penetration of edible cosmetics is still in early phases, demand is increasing among younger and affluent consumers seeking wellness-beauty hybrids. Local brands, e-commerce growth, and regional flavour customisation are enabling gradual expansion.

Middle East & Africa

While the share is smaller compared to North America or APAC, the Middle East (UAE, Saudi Arabia) shows strong interest in premium luxury ingestible beauty products, supported by high per-capita spending. Africa (South Africa, Nigeria) is gradually developing domestic demand and intra-continental growth in wellness-beauty. Export of premium ingestibles and luxury positioning are key drivers here.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Edible Cosmetics Market

- BASF

- Beiersdorf

- Church & Dwight

- DSM-FIR

- Givaudan

- Glanbia

- IFF

- Kerry Group

- L’Oréal

- Nestlé

- NutraScience Labs

- Roquette

- Wellnex / The Hut Group

- Zuellig Pharma

Recent Developments

- In 2025, a major nutrition-beauty brand announced the launch of a personalised skin-beauty gummy subscription service, leveraging customer skin-score diagnostics and tailored formulations.

- In late 2024, a leading ingredient supplier invested in expanded food-grade gummy manufacturing capacity to support the growth of ingestible beauty categories globally.

- In early 2025, a beauty brand partnered with a café chain to launch a “beauty-shot latte” infused with collagen and antioxidants, introducing edible cosmetics into the mainstream F&B channel.