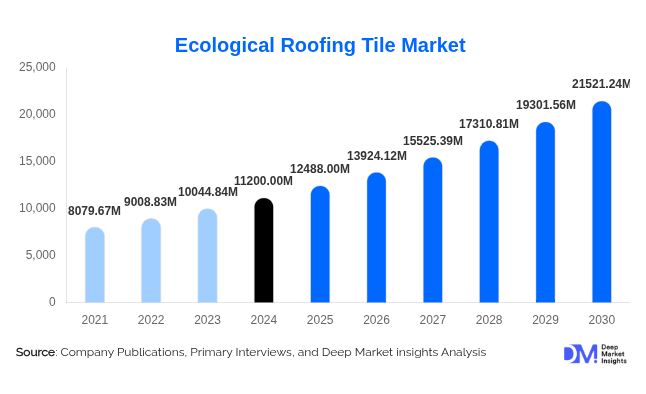

Ecological Roofing Tile Market Size

According to Deep Market Insights, the global ecological roofing tile market size was valued at USD 11,200 million in 2024 and is projected to grow from USD 12,488 million in 2025 to reach USD 21,521.24 million by 2030, expanding at a CAGR of 11.5% during the forecast period (2025–2030). Market growth is primarily driven by increasing demand for sustainable building materials, strict environmental regulations encouraging the use of eco-friendly construction products, and technological advancements in recycled and energy-efficient roofing materials.

Key Market Insights

- Rising adoption of green construction materials across residential and commercial projects is fueling demand for ecological roofing tiles globally.

- Recycled and bio-based tiles made from plastic, wood fiber, or clay composites are gaining traction due to their low carbon footprint and extended lifespan.

- Europe leads the global market owing to strong sustainability regulations, incentives for energy-efficient housing, and the EU Green Deal framework.

- Asia-Pacific is the fastest-growing region, driven by rapid urbanization, government initiatives for sustainable infrastructure, and expanding green building certifications.

- Technological integration, such as solar-integrated eco-tiles and smart temperature-regulating surfaces, is reshaping roofing innovation.

- Public–private partnerships and green infrastructure funding are boosting large-scale adoption in urban construction projects.

Latest Market Trends

Recycled Material Tiles Gaining Prominence

Manufacturers are increasingly utilizing recycled plastics, rubber, and wood composites to produce eco-friendly tiles that mimic traditional clay or slate aesthetics. This trend aligns with circular economy goals and reduces landfill waste. Recycled plastic tiles offer excellent weather resistance and lightweight installation, appealing to both residential and industrial sectors. Many companies are also adopting closed-loop recycling models, allowing old roofing materials to be reprocessed into new tile batches, thereby reducing overall environmental impact.

Solar-Integrated Ecological Tiles

The integration of solar technology into ecological roofing tiles represents one of the fastest-emerging innovations. Companies are embedding photovoltaic cells into tiles to generate renewable energy while maintaining aesthetic appeal. These “energy-generating roofs” are being promoted under smart city initiatives and net-zero energy building projects. With the rise of decentralized energy systems, solar tiles are helping homeowners and businesses offset electricity costs while achieving sustainability goals.

Ecological Roofing Tile Market Drivers

Government Regulations and Green Building Mandates

Strict environmental and building efficiency standards are compelling developers to adopt sustainable materials. Policies like the EU’s Energy Performance of Buildings Directive (EPBD) and LEED/IGBC certifications are encouraging the use of eco-tiles. Additionally, government incentives for renewable materials and energy-efficient roofs are supporting market expansion in both developed and emerging economies.

Growing Consumer Awareness of Sustainable Living

Homeowners are increasingly prioritizing eco-friendly construction materials that reduce environmental impact without compromising aesthetics. Rising disposable income and awareness of long-term cost benefits, such as lower maintenance and higher energy efficiency, are propelling demand for ecological roofing tiles, especially in urban housing and eco-village developments.

Market Restraints

High Initial Costs and Limited Availability

Despite long-term savings, eco-roofing tiles often have higher upfront costs compared to traditional asphalt or ceramic options. Limited production facilities and supply chain constraints in certain regions further hinder mass adoption. Additionally, a lack of standardized labeling for eco-friendly materials creates uncertainty among buyers and builders.

Performance Variability in Extreme Climates

While ecological tiles offer sustainability advantages, some materials, particularly bio-based composites, face durability issues in regions with extreme heat, humidity, or frost. This has limited adoption in certain geographies, requiring continued R&D investments in material innovation and protective coatings.

Ecological Roofing Tile Market Opportunities

Smart Roofing and IoT Integration

The integration of smart sensors and temperature-regulating materials within ecological tiles presents significant opportunities. Future eco-roofs may monitor energy efficiency, detect leaks, and optimize insulation automatically. This convergence of sustainability and technology is expected to reshape modern architecture and urban planning.

Expansion into Developing Economies

Rapid urban growth in Asia, Africa, and Latin America offers a large untapped market for ecological roofing tiles. Government investments in affordable green housing and urban resilience projects are creating new revenue streams for manufacturers. Establishing local production hubs will further reduce costs and enhance regional accessibility.

Product Type Insights

Clay and concrete eco-tiles dominate the market due to their durability and availability. Recycled plastic tiles are the fastest-growing category, offering lightweight alternatives for modern architecture. Wood-plastic composites and bio-based tiles are emerging as premium, sustainable options for green-certified construction. Manufacturers are also exploring hybrid materials combining recycled and natural elements to balance strength, aesthetics, and cost.

Application Insights

The residential sector holds the largest share, driven by rising eco-conscious homeowners and green housing projects. The commercial segment is rapidly growing as corporations adopt sustainability targets in office, hospitality, and retail construction. Industrial applications are also expanding, particularly for warehouses and factories adopting renewable roofing systems to meet energy efficiency standards.

Distribution Channel Insights

Direct sales and project-based supply agreements dominate the market due to large-scale building projects. However, online distribution and digital marketplaces are rapidly expanding, providing easy access to sustainable material catalogs and customized order options. Collaborations between construction firms and e-commerce platforms are expected to streamline the ecological roofing tile supply chain.

End-User Insights

Architects and builders are the primary end-users driving specification-based purchases. Homeowners represent the fastest-growing customer group due to rising DIY renovation projects. Government and institutional buyers are also increasing adoption in public infrastructure and low-carbon housing initiatives, strengthening the B2G segment.

| By Product Type | By Application | By Distribution Channel | By End User |

|---|---|---|---|

|

|

|

|

Regional Insights

Europe

Europe leads the global market, supported by advanced green building regulations and funding for sustainable housing. Countries such as Germany, the U.K., France, and the Netherlands are heavily investing in energy-efficient construction. The EU’s “Renovation Wave” initiative is expected to further accelerate the adoption of ecological roofing tiles across residential retrofits and public buildings.

North America

North America shows strong growth potential, driven by LEED-certified construction, urban sustainability programs, and consumer demand for eco-friendly home renovations. The U.S. market is witnessing a surge in solar-integrated roofing solutions, while Canada is emphasizing green infrastructure in commercial sectors.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China, Japan, and India. Rising infrastructure development, favorable government subsidies for green buildings, and expanding middle-class housing demand are boosting the market. The region’s growing number of smart cities and eco-township projects presents immense opportunities for manufacturers.

Latin America

Latin America’s ecological roofing market is in the early adoption stage but shows promise, particularly in Brazil, Chile, and Mexico. Sustainable construction practices are being encouraged through policy incentives and urban redevelopment initiatives aimed at reducing carbon footprints.

Middle East & Africa

Countries like the UAE, Saudi Arabia, and South Africa are incorporating ecological roofing into large-scale sustainability projects, including smart city developments and eco-resorts. Harsh climatic conditions are driving demand for energy-efficient, heat-resistant roofing tiles designed to minimize cooling energy consumption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Ecological Roofing Tile Market

- Monier Roofing Ltd.

- Boral Limited

- Wienerberger AG

- EcoStar LLC

- Brava Roof Tile

- DaVinci Roofscapes

- CertainTeed Corporation

- GreenStone Slate Company

- Terreal Group

- Enviroshake Inc.

Recent Developments

- In September 2025, Wienerberger AG launched a new line of recycled clay-composite tiles designed for net-zero energy homes across Europe.

- In July 2025, Boral Limited announced the opening of its eco-tile production facility in Texas using 80% recycled materials.

- In May 2025, DaVinci Roofscapes introduced solar-embedded ecological tiles compatible with residential solar power systems.

- In February 2025, EcoStar LLC partnered with LEED-certified architects to develop bio-composite tiles for sustainable commercial roofing.