Earmuffs Market Size

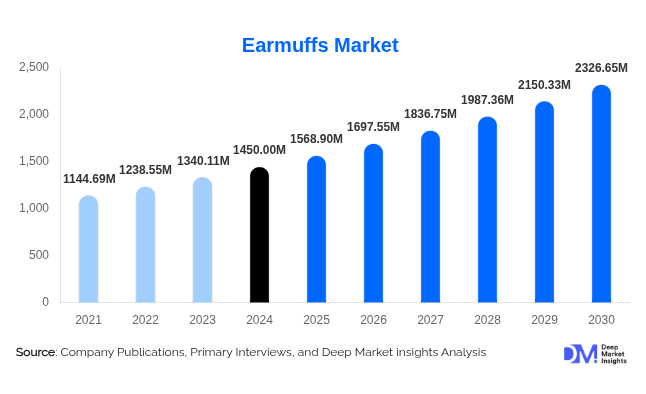

According to Deep Market Insights, the global earmuffs market size was valued at USD 1,450 million in 2024 and is projected to grow from USD 1,568.90 million in 2025 to reach USD 2,326.65 million by 2030, expanding at a CAGR of 8.2% during the forecast period (2025–2030). The market growth is primarily driven by rising awareness of hearing protection across industrial and construction sectors, growing demand for stylish and multifunctional winter earmuffs, and technological advancements in noise-canceling and communication-integrated models.

Key Market Insights

- Rising hearing safety regulations across manufacturing, mining, and defense industries are boosting demand for protective earmuffs globally.

- Bluetooth and active noise-cancellation earmuffs are rapidly gaining traction, merging comfort, communication, and safety functions.

- Winter fashion earmuffs continue to see seasonal demand surges in North America, Europe, and East Asia, especially through online retail channels.

- Industrial earmuffs dominate the market share, driven by occupational safety mandates under OSHA, ANSI, and EU Directive standards.

- Asia-Pacific leads production and export volumes, with China and India emerging as key manufacturing hubs for both consumer and industrial segments.

- Customization and ergonomic design innovations, including lightweight materials and foldable frames, are enhancing product appeal and user comfort.

Latest Market Trends

Integration of Smart and Connected Technologies

Leading earmuff manufacturers are incorporating smart features such as Bluetooth connectivity, voice assistants, and built-in microphones for two-way communication. These advancements are particularly popular in the defense and construction sectors, where communication and protection are equally critical. Smart earmuffs with integrated hearing protection and wireless communication capabilities are improving operational efficiency and safety in high-noise environments.

Fashion-Functional Convergence

The earmuffs market is witnessing a blending of fashion and function, especially in consumer-focused categories. Designer brands and winterwear companies are offering earmuffs that combine aesthetic appeal with warmth, often using faux fur, plush fabrics, and vibrant colors. Additionally, eco-friendly materials such as recycled polyester and plant-based fibers are being adopted to align with sustainability trends in the apparel industry.

Earmuffs Market Drivers

Stringent Industrial Safety Standards

Growing enforcement of occupational safety norms is a major driver. Organizations such as OSHA (Occupational Safety and Health Administration) and the European Agency for Safety and Health at Work mandate hearing protection equipment for workers exposed to high-decibel environments. This regulatory push is fostering consistent demand from the construction, manufacturing, and mining industries. Furthermore, defense agencies are increasingly adopting tactical earmuffs to protect personnel from hearing loss during training and combat operations.

Technological Advancements and Product Innovation

Continuous improvements in noise attenuation technology, comfort design, and materials have expanded product appeal. Innovations such as gel-filled cushions, adjustable headbands, and electronic hearing protection are enhancing usability. Active noise cancellation (ANC) earmuffs are particularly gaining momentum among professionals in aviation, defense, and heavy machinery sectors.

Market Restraints

High Cost of Advanced Earmuffs

Premium earmuffs equipped with Bluetooth, ANC, or smart communication systems remain expensive, limiting adoption in cost-sensitive regions. Price-sensitive buyers in developing countries often opt for disposable or low-cost earplugs, hindering the market’s full growth potential.

Limited Awareness in Emerging Economies

Despite regulatory frameworks, worker compliance and awareness regarding hearing protection remain low in several developing nations. The lack of enforcement mechanisms and limited training in occupational safety restrain earmuff demand in industrial sectors of Africa and parts of Asia.

Earmuffs Market Opportunities

Adoption of Eco-Friendly and Sustainable Materials

Growing environmental consciousness is creating opportunities for earmuff manufacturers to adopt recyclable and biodegradable materials. Brands focusing on sustainability, such as using organic cotton, bamboo fiber, or recycled plastics, are attracting eco-conscious consumers, especially in Europe and North America.

Expansion Through E-commerce and D2C Channels

The rapid expansion of online retail platforms offers significant growth potential for earmuff brands. Digital sales allow manufacturers to reach new consumer segments, offer customization options, and build brand loyalty through subscription models and limited-edition product drops. Social media and influencer marketing are also fueling demand, particularly for fashionable winter earmuffs.

Product Type Insights

Passive earmuffs remain the largest segment, offering affordable, durable protection for industrial use. Electronic earmuffs featuring active noise cancellation and volume control are the fastest-growing category, catering to defense, shooting sports, and aviation professionals. Thermal earmuffs, designed primarily for warmth and comfort, dominate the consumer winterwear market. Meanwhile, smart earmuffs with integrated communication and sensor capabilities represent a niche but rapidly expanding segment.

Application Insights

The earmuffs market serves multiple applications: industrial safety, military and defense, commercial use (airports, workshops, and factories), and consumer use (winterwear and sports). Industrial safety applications dominate, accounting for more than 45% of total revenue. The consumer and fashion segments are expanding quickly, particularly in regions with cold climates and strong e-commerce ecosystems.

Distribution Channel Insights

Offline distribution channels such as safety equipment suppliers, retail chains, and specialty stores continue to generate the majority of sales, particularly for industrial and defense clients. However, online sales through e-commerce platforms like Amazon, Decathlon, and brand-owned websites are rising sharply. Direct-to-consumer (D2C) models are gaining traction as manufacturers emphasize digital branding, influencer collaborations, and targeted promotions to reach niche consumers.

End-User Insights

Industrial and construction workers form the core user base for protective earmuffs, followed by military personnel and aviation ground crews. Sports shooters and hunters represent a steady demand niche, driven by safety requirements during training. Consumers seeking winter warmth or fashion accessories also contribute to seasonal spikes in sales, especially in colder regions of Europe, North America, and East Asia.

| By Product Type | By Application | By Distribution Channel | By End-User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads the global earmuffs market, driven by strict OSHA regulations and high adoption in the industrial and defense sectors. The U.S. accounts for the largest share, supported by technological innovation and premium brand presence. The region also witnesses strong consumer demand for thermal and fashion earmuffs during winter seasons.

Europe

Europe represents a significant market, propelled by the EU’s stringent hearing protection directives and cold-weather demand. Germany, the U.K., and France are major contributors. The region is also at the forefront of sustainable and eco-friendly earmuff product launches, aligning with circular economy goals.

Asia-Pacific

Asia-Pacific is the fastest-growing region, fueled by rapid industrialization, urbanization, and occupational safety awareness in China, India, and Southeast Asia. The region also serves as a global manufacturing base, producing both premium and budget earmuffs for export. Japan and South Korea are key consumers of smart earmuffs integrated with communication systems.

Latin America

Latin America’s earmuff market is growing steadily, driven by expanding construction and mining industries. Brazil and Mexico lead regional demand, with increasing adoption of industrial safety gear and the influence of winter apparel trends in southern regions.

Middle East & Africa

The market in the Middle East & Africa is expanding gradually, primarily in the mining and oil & gas sectors. South Africa represents a key emerging market, while GCC nations are witnessing increased use of advanced earmuffs in industrial maintenance and defense training activities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Earmuffs Market

- 3M Company

- Honeywell International Inc.

- Moldex-Metric Inc.

- Peltor

- MSA Safety Incorporated

- Delta Plus Group

- Hellberg Safety

- Radians Inc.

- Protear

- David Clark Company

Recent Developments

- In August 2025, 3M launched a new series of Bluetooth-enabled earmuffs under its WorkTunes line, integrating voice assistant compatibility and enhanced comfort for industrial users.

- In May 2025, Honeywell announced an expansion of its “Howard Leight” range featuring adaptive noise control technology for manufacturing and aviation workers.

- In February 2025, Delta Plus Group introduced eco-conscious earmuffs using recycled plastic shells and plant-based cushioning, aligning with EU sustainability directives.