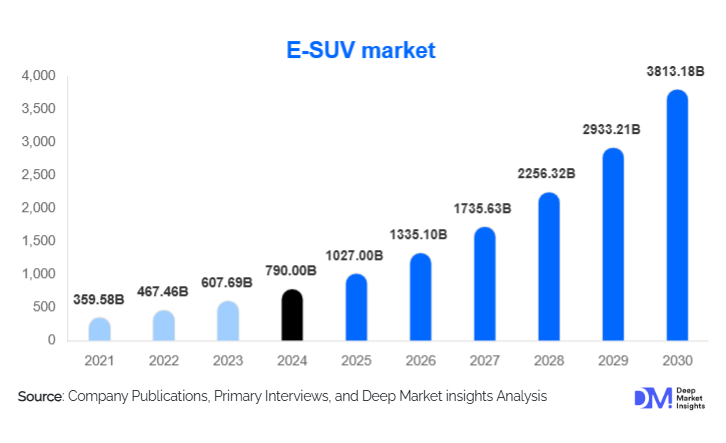

E-SUV Market Size

According to Deep Market Insights, the global electric SUV (E-SUV) market size was valued at USD 790 billion in 2024 and is projected to grow from USD 1,027.00 billion in 2025 to reach USD 3,813.18 billion by 2030, expanding at a robust CAGR of 30% during the forecast period (2025–2030). Growth is primarily driven by accelerating EV adoption, tightening emission regulations, technological advancements in batteries, and the rising preference for spacious, sustainable, and connected SUV platforms among global consumers.

Key Market Insights

- Compact E-SUVs dominate global demand, accounting for more than half of revenue due to affordability, high practicality, and strong adoption in both developed and emerging markets.

- BEVs represent the leading propulsion type, capturing over 70% of the total E-SUV market as battery costs fall and charging infrastructure expands.

- Asia-Pacific is the largest and fastest-growing region, driven by China’s massive EV ecosystem and rising adoption in India and Southeast Asia.

- Europe remains a strong premium E-SUV hub, supported by strict emissions policies and high consumer preference for luxury EVs.

- North America continues to show strong adoption, led by the U.S., where demand for long-range and performance E-SUVs is rising.

- Fleet electrificationincluding ride-hailing, corporate mobility, and logistics emerging as a major new demand driver for E-SUVs.

- Technological integration, such as OTA updates, AI-enhanced driving assistance, and next-generation battery platforms, is reshaping competition.

What are the latest trends in the E-SUV market?

Smart, Connected, and Software-Driven E-SUV Platforms

E-SUVs are rapidly evolving into software-centric vehicles featuring advanced driver assistance systems, AI-based energy optimization, and seamless over-the-air (OTA) updates. Automakers are shifting toward unified EV platforms that integrate infotainment, battery management, and predictive maintenance within a single architecture. Connected navigation systems integrated with charging networks are enhancing long-distance usability, while digital cockpits and cloud-linked services are attracting tech-savvy consumers. These innovations help automakers differentiate their E-SUVs in an increasingly crowded market.

Advancements in Battery Technology and Range Expansion

Battery innovationespecially high-energy-density cells, LFP chemistries, and next-gen solid-state development, enabling longer ranges, faster charging, and lower production costs. Manufacturers are increasingly offering E-SUVs with ranges exceeding 300 miles, addressing range anxiety and increasing mass-market acceptance. Fast-charging E-SUVs are becoming more common, supporting urban and intercity adoption. Modular battery packs and battery-swapping concepts are also being tested in select markets, enhancing operational flexibility for fleets.

What are the key drivers in the E-SUV market?

Regulatory Push and Government Incentives

Governments worldwide are supporting EV adoption through tax credits, subsidies, low-interest financing, ZEV mandates, and stricter emissions standards. These policies are accelerating the shift from internal combustion SUVs to electric SUVs. Major markets such as China, the U.S., and the EU have enacted aggressive targets for EV penetration, pushing automakers to prioritize E-SUV production. Urban low-emission zones are further increasing demand for eco-friendly mobility solutions.

Rising Consumer Preference for Spacious and Sustainable Vehicles

SUVs have long been popular due to their comfort, performance, and versatility. As consumers adopt electric vehicles, many prefer E-SUVs because they offer the same utility with environmental benefits and lower operating costs. Families, commuters, and long-distance drivers are gravitating toward E-SUVs that combine high seating position, large cargo space, and advanced safety features with low emissions and smooth electric driving.

What are the restraints for the global market?

Charging Infrastructure Limitations

Despite rapid expansion, charging networksespecially fast chargingremain inconsistent across regions. Rural areas and developing markets face large infrastructure gaps, creating range anxiety and limiting adoption. Large E-SUVs demand more energy, increasing the need for reliable high-power charging, which remains insufficient in many regions. Grid capacity constraints and slow permitting for new charging stations also pose long-term challenges.

Supply Chain and Raw Material Constraints

The E-SUV market is highly exposed to raw material volatility, particularly lithium, nickel, cobalt, and rare earth elements. Supply chain disruptions, geopolitical tensions, and concentrated mining operations can affect battery production and vehicle cost structure. Automakers are investing in vertical integration and recycling technologies, but material shortages remain a structural restraint on large-scale E-SUV growth.

What are the key opportunities in the E-SUV industry?

Emerging Market Expansion

Developing economies in Asia-Pacific, Latin America, and Africa offer vast growth potential for compact and mid-size E-SUVs. Rising middle-class incomes, government incentives, and improving charging infrastructure are enabling EV adoption beyond premium segments. Automakers can capture significant market share by designing region-specific, cost-optimized E-SUV models with moderate range and affordable battery packs.

Fleet Electrification and Commercial E-SUV Deployment

Global mobility providers, ride-hailing companies, delivery services, and corporate fleets are increasingly adopting E-SUVs due to their favorable total cost of ownership (TCO), passenger capacity, and sustainability benefits. Purpose-built fleet-oriented E-SUVs with modular interiors, fast-charging capabilities, and long battery life offer a significant opportunity. Fleet electrification policies in Europe, China, and North America will further amplify this demand.

Product Type Insights

Compact E-SUVs lead global adoption owing to their balance of affordability, efficiency, and practicality, representing over 55% of market share. These models appeal to mass-market buyers in urban and suburban areas. Mid-size E-SUVs cater to families and long-distance drivers, offering a higher range and interior space. Full-size and luxury E-SUVs are gaining traction among premium buyers seeking advanced performance, long range, and high-tech interiors. Luxury E-SUVs often include advanced driver assistance systems, premium connectivity, and fast-charging capabilities.

Application Insights

Personal use dominates the E-SUV market, contributing approximately 85% of global sales. Consumers prefer E-SUVs for daily commuting, family travel, and lifestyle needs. Commercial fleet applications are rapidly expanding, driven by the need for low-emission transportation and fleet-wide sustainability goals. Ride-hailing operators, corporate mobility providers, and logistics companies are increasingly incorporating E-SUVs. Export-driven applications are also emerging, with automakers producing E-SUVs for high-demand global markets.

Driving Range Insights

E-SUVs with ranges of up to 250 miles account for the largest market share (50–60%) due to affordability and suitability for daily driving. 250–500-mile E-SUVs are gaining popularity for long-distance travel, offering a balance of cost and capability. 500+ mile-range E-SUVs represent a niche but fast-growing category, primarily within premium and performance models leveraging high-capacity battery packs and advanced energy management systems.

Distribution Channel Insights

Online sales channels, including D2C and OEM digital platforms, dominate E-SUV bookings due to transparent pricing, customization options, and seamless purchasing experiences. Traditional dealerships continue to play a strong role, especially for test drives, service packages, and financing. EV-exclusive showrooms and subscription-based mobility models are emerging as influential channels, particularly among younger consumers seeking flexibility. Influencer-driven marketing and digital product launches are also shaping buyer preferences.

Buyer Type Insights

Family buyers represent a major segment, selecting E-SUVs for space, safety, and efficiency. Tech-forward solo buyers prefer feature-rich compact E-SUVs with advanced infotainment and connectivity. Corporate and fleet buyers focus on TCO, durability, and charging support. Luxury buyers are gravitating toward high-end E-SUVs with premium interiors, long range, and superior performance.

| By Product Type | By Propulsion Type | By Driving Range | By Drive Type | By End User / Application |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is a key E-SUV market with strong demand driven by consumer preference for large vehicles and supportive EV incentives. The U.S. leads adoption due to an expanding charging network and growing availability of long-range E-SUVs. High-income urban areas show particularly strong adoption, while fleet electrification programs are gaining momentum.

Europe

Europe remains a premium E-SUV hub, supported by stringent emissions regulations and consumer preference for sustainable mobility. Countries such as Germany, the U.K., Norway, and France are major markets for both luxury and mid-size E-SUVs. Government subsidies, CO₂ targets, and expanding fast-charging networks reinforce growth.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing region, capturing more than half of global E-SUV demand. China dominates due to strong government support, local manufacturing capacity, and extensive EV infrastructure. India and Southeast Asia are showing accelerated adoption of compact E-SUVs. Japan, South Korea, and Australia remain strong markets for premium models.

Latin America

Latin America’s E-SUV market is steadily emerging, led by Brazil, Mexico, and Chile. Adoption is driven by rising environmental awareness, urban electrification initiatives, and government incentives. Infrastructure limitations persist, but affluent consumers and corporate fleets are increasing EV purchases.

Middle East & Africa

MEA is experiencing growing adoption, particularly in the UAE, Saudi Arabia, and South Africa. High-income buyers, government-led sustainability programs, and increasing charging infrastructure are supporting E-SUV penetration. African markets with strong tourism and corporate sectors are also adopting EVs for fleet use.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the E-SUV Market

- Tesla

- BYD

- Hyundai Motor Company

- Volkswagen Group

- Ford Motor Company

- Kia

- BMW

- Mercedes-Benz

- Volvo

- General Motors

- Toyota

- Nissan

- Stellantis

- Audi

- Renault-Nissan-Mitsubishi Alliance

Recent Developments

- In May 2025, Tesla expanded its next-gen E-SUV production line, integrating new high-density battery technology to enhance range and charging speed.

- In April 2025, BYD announced a new compact E-SUV line targeting emerging markets with affordable LFP battery platforms.

- In February 2025, Volkswagen launched a premium AWD E-SUV in Europe featuring improved OTA software architecture and Level-3 ADAS capabilities.