DSLR Cameras Market Size

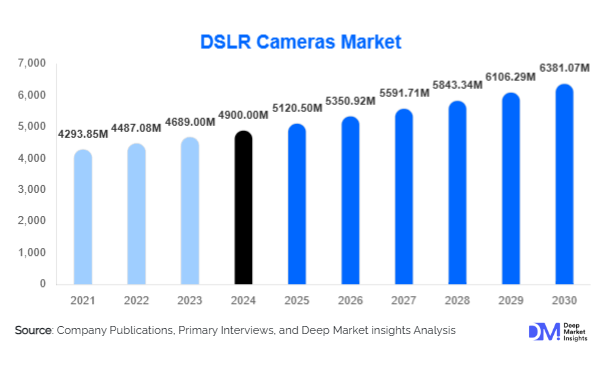

According to Deep Market Insights, the global DSLR cameras market size was valued at USD 4,900 million in 2024 and is projected to grow from USD 5,120.5 million in 2025 to reach USD 6,381.07 million by 2030, expanding at a CAGR of 4.5% during the forecast period (2025–2030). The DSLR cameras market contraction is largely influenced by the rise of mirrorless systems, continuous advancements in smartphone imaging, and changing consumer preferences. However, professional demand, niche photography segments, and educational adoption continue to provide resilience in certain sub-markets.

Key Market Insights

- Professional and enthusiast photographers continue to sustain demand, particularly in full-frame and interchangeable-lens DSLR models.

- Full-frame DSLR cameras dominate, accounting for nearly 60% of the global DSLR market share in 2024.

- Asia-Pacific remains a vital hub, driven by Japan’s manufacturing dominance and growing consumer bases in China and India.

- North America continues to lead in professional adoption, with the U.S. sustaining demand for education, sports, and wildlife photography sectors.

- Mirrorless substitution is the fastest-growing challenge, drawing away entry-level and enthusiast consumers from DSLR purchases.

- Technological upgrades, including AI-driven autofocus, enhanced 4K/8K video features, and cloud connectivity, are being integrated to prolong DSLR relevance.

What are the latest trends in the DSLR cameras market?

Professional and Enthusiast-Centric Growth

Although smartphone adoption continues to challenge DSLR sales, professionals and enthusiasts still prefer DSLRs for their optical precision and adaptability across photography genres. DSLR cameras are increasingly used in wildlife, sports, and landscape photography due to superior sensor performance and lens versatility. Specialized features like low-light capabilities and high frame rates are attracting photographers requiring precision in demanding environments.

Technology Integration and Connectivity

DSLR manufacturers are integrating AI-enhanced autofocus, high-definition video recording, and wireless connectivity to make cameras compatible with mobile devices and cloud platforms. These trends enhance usability for content creators, vloggers, and educational programs. Mobile apps allow remote control, instant editing, and social media sharing, while firmware updates continue to improve functionality, making DSLRs relevant in a tech-driven era.

What are the key drivers in the DSLR cameras market?

Durability and Longevity

DSLR cameras are known for robust builds that withstand challenging conditions, appealing to professionals working in field photography, journalism, and outdoor sports. This durability ensures a longer product lifecycle, making them a preferred investment for photographers who require reliable equipment over time.

Education and Training Programs

Photography schools and training institutions still rely heavily on DSLR cameras for hands-on learning. Manual controls, optical viewfinders, and physical lens adjustments are key educational tools, ensuring continued demand from institutions and students.

Professional Photography Demand

Professional photographers rely on DSLRs for high-quality imaging and versatility. Industries like fashion, wildlife, events, and sports require specialized cameras and lenses, which sustain premium segment demand despite competition from mirrorless and smartphone cameras.

What are the restraints for the global market?

Competition from Smartphones and Mirrorless Cameras

Advanced smartphones and compact mirrorless systems increasingly offer high-resolution imaging, computational photography, and portability, reducing the demand for traditional DSLR cameras among casual users and even some semi-professionals.

Market Saturation in Developed Regions

North America, Europe, and Japan have mature DSLR markets, with limited growth opportunities. High penetration and the shift toward mobile photography in these regions constrain new customer acquisition and overall revenue growth.

What are the key opportunities in the DSLR cameras market?

Emerging Markets Expansion

Asia-Pacific and Latin America present significant growth potential due to rising middle-class populations, increasing disposable incomes, and growing interest in photography. Local education programs, photography workshops, and targeted marketing campaigns can stimulate adoption among enthusiasts and semi-professionals.

Integration with Emerging Technologies

Incorporating AI, cloud connectivity, 4K/8K video capabilities, and live streaming features can attract younger content creators, videographers, and professionals seeking hybrid solutions. Technology-focused DSLRs can also integrate with smartphone ecosystems to enhance creative flexibility.

Sustainability and Eco-Friendly Initiatives

Consumers are increasingly seeking environmentally conscious products. Cameras made from recycled materials, energy-efficient manufacturing, and eco-friendly packaging can appeal to environmentally aware buyers and align with broader global sustainability trends.

Product Type Insights

Full-frame DSLRs dominate the market, accounting for approximately 60% of the global market in 2024, driven by professional demand for superior image quality. Mid-range models, popular among enthusiasts, provide a balance of performance and affordability, while entry-level DSLRs maintain niche relevance for students and hobbyists.

Application Insights

Professional photography remains the leading application, followed by education, wildlife, sports, and event photography. The growth of social media content creation is also driving the adoption of mid-range DSLRs capable of high-quality video and image production.

Distribution Channel Insights

Online platforms, including direct-to-consumer websites and e-commerce retailers, dominate DSLR sales, allowing users to compare specifications and read reviews. Authorized retail stores remain important for professional segments requiring personalized advice, lens compatibility checks, and service support.

Traveler Type Insights

Professional photographers and enthusiasts represent the primary demand segment. Students and hobbyists comprise a secondary segment, particularly in regions with strong educational outreach programs. Online communities and photography clubs also contribute to sustained engagement and repeat purchases.

Age Group Insights

Individuals aged 25–45 represent the largest consumer base, combining disposable income with interest in photography as a hobby or career. Younger audiences (18–24) are growing as potential users via social media-driven content creation, while older professionals (46–65) continue to prefer high-end full-frame DSLRs for commercial and artistic work.

| By Type | By Application | By Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds around 30% of the global DSLR market in 2024, driven by high professional and enthusiast adoption in the U.S. and Canada. Strong photography culture, robust retail presence, and advanced service infrastructure support market stability.

Europe

Europe accounts for approximately 25% of the global market in 2024, with Germany, the U.K., and France leading demand. Preference for professional-grade DSLRs and strong educational institutions maintains demand, while emerging interest in mirrorless systems is slightly reducing overall growth.

Asia-Pacific

Asia-Pacific is the fastest-growing region, particularly in China, India, Japan, and South Korea. Rising middle-class income, growing photography workshops, and increasing content creation trends are driving DSLR adoption.

Latin America

Brazil and Mexico are the key markets, showing gradual growth as consumer awareness increases and disposable incomes rise. Export-driven demand for quality DSLRs contributes to growth.

Middle East & Africa

Emerging markets in the Middle East, led by the UAE and Saudi Arabia, are showing growing interest, particularly among professionals and hobbyists seeking premium models. Africa remains a niche market but is expanding slowly through education and wildlife photography initiatives.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the DSLR Cameras Market

- Canon

- Nikon

- Sony

- Pentax

- Panasonic

- Fujifilm

- Olympus

- Leica

- Samsung

- Sigma

- Hasselblad

- Phase One

- Ricoh

- Yongnuo

- Tamron

Recent Developments

- In March 2025, Canon launched a new full-frame DSLR model with AI-assisted autofocus and improved low-light performance, targeting professional photographers.

- In January 2025, Nikon introduced a mid-range DSLR optimized for hybrid photo-video content creation, appealing to content creators and enthusiasts.

- In December 2024, Sony expanded its DSLR-compatible lens lineup, enhancing versatility for professional and semi-professional users.