Drone Accessories Market Size

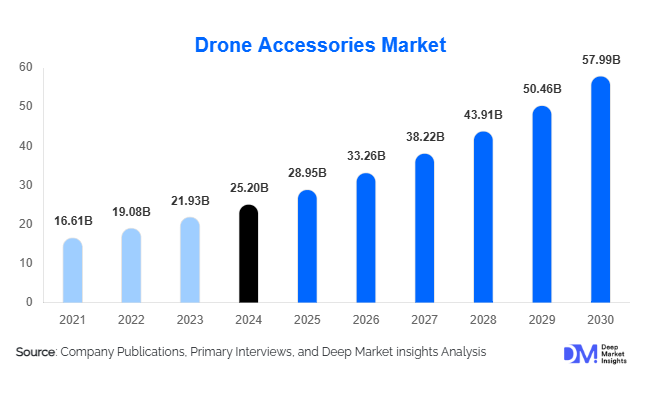

According to Deep Market Insights, the global drone accessories market size was valued at USD 18,000.00 million in 2024 and is projected to grow from USD 20,916.00 million in 2025 to reach USD 44,310.77 million by 2030, expanding at a CAGR of 16.2% during the forecast period (2025–2030). The drone accessories market growth is primarily driven by increasing enterprise and industrial drone adoption, rapid technological innovation in imaging and power systems, and rising government initiatives to promote drone integration in critical applications such as surveillance, agriculture, and logistics.

Key Market Insights

- Commercial drones dominate accessory demand, as enterprises require high-performance batteries, imaging, navigation, and payload systems for industrial applications.

- Camera and imaging accessories lead the market, accounting for nearly 30% of global revenue, driven by rising content creation, surveillance, and precision mapping needs.

- Aftermarket accessories (online retail) represent more than half of sales, supported by rising demand for replacement parts, upgrades, and customization.

- North America leads the global market, with the U.S. contributing significant demand from commercial, consumer, and defense applications.

- Asia-Pacific is the fastest-growing region, with China leading in manufacturing and India showing strong demand growth from agriculture and government programs.

- Technological advancements in batteries, RTK GPS, LiDAR, and AI-integrated sensors are enabling drones to expand into logistics, smart cities, and environmental monitoring.

What are the emerging trends currently shaping the Drone Accessories Market?

Rising Demand for Industrial-Grade Accessories

Enterprise and government users are shifting toward durable, high-performance accessories designed for long missions and harsh environments. Thermal cameras, multispectral sensors, LiDAR, and RTK GPS modules are becoming standard in industries such as agriculture, oil & gas, and public safety. Accessories that meet compliance and safety requirements, such as anti-collision lights, parachutes, and encrypted communication systems, are gaining traction globally. This shift is driving premiumization in the market and creating opportunities for advanced accessory providers.

Aftermarket Growth Through E-Commerce

The rapid rise of e-commerce has transformed how drone accessories are distributed. Online platforms now account for more than 50% of global accessory sales, as hobbyists and professionals alike prefer the convenience of browsing a wide range of options online. Frequent replacement of propellers, batteries, and gimbals, along with demand for camera upgrades, has boosted aftermarket growth. Direct-to-consumer brands, supported by influencer marketing and bundled offerings, are reshaping pricing and customer engagement models.

AI and Modular Payload Integration

Accessories are increasingly designed to support AI-driven applications, enabling real-time object detection, mapping, and surveillance. Modular payload systems, which allow drones to swap sensors and cameras easily, are gaining adoption in enterprise markets. These modular solutions improve fleet efficiency and reduce downtime, appealing to industries that require diverse missions such as infrastructure inspection, delivery, and security. The integration of 5G and satellite connectivity into accessories is also enhancing real-time data transmission and extending mission ranges.

What are the primary drivers propelling growth in the Drone Accessories Market?

Growing Adoption of Drones Across Industries

Industries such as agriculture, construction, utilities, and mining are increasingly leveraging drones for productivity and cost savings. This has spurred demand for precision sensors, imaging systems, and high-capacity batteries. The adoption of drones for tasks like crop monitoring, structural inspection, and land surveying has created a sustained pull for accessories tailored to industry-specific needs.

Technological Advancements in Sensors and Power Systems

Continuous innovation in imaging, thermal, and LiDAR sensors, coupled with improved energy-dense batteries, has expanded drone use cases. Lightweight materials such as carbon composites reduce accessory weight, enabling longer flight times. These advancements are directly translating into stronger accessory sales across both professional and recreational drone markets.

Supportive Government Policies and Investments

Governments are easing regulatory frameworks, permitting beyond-visual-line-of-sight (BVLOS) operations, and launching initiatives to promote domestic drone production. Public safety and defense procurement also contribute significantly to accessory demand, as agencies invest in advanced payloads, communications modules, and compliance systems for surveillance and security missions.

What are the major challenges or restraints limiting the growth of the Drone Accessories Market??

High Cost of Advanced Accessories

Premium imaging systems, LiDAR payloads, and high-density batteries remain costly, limiting adoption in price-sensitive markets. Additionally, shortages of electronic components and specialized materials have led to supply chain challenges and price volatility, raising barriers for widespread penetration of advanced accessories.

Regulatory and Airspace Restrictions

Despite progress, many countries still impose strict rules on drone flights, especially BVLOS operations, urban usage, and surveillance applications. Varying compliance standards across regions increase complexity for manufacturers and restrict accessory adoption in certain markets. Privacy and safety concerns also act as restraints on broader deployment.

What potential opportunities exist for stakeholders in the Drone Accessories Market?

Expansion in Agriculture and Infrastructure

The agricultural sector’s growing reliance on drones for precision farming is creating high demand for multispectral cameras, spraying payloads, and rugged batteries. Similarly, infrastructure monitoring and smart city applications are pushing demand for LiDAR, RTK GPS, and modular payload systems. These industries represent multi-billion-dollar opportunities globally.

Regulatory Enablement and Government Procurement

As governments expand drone programs for surveillance, disaster management, and public safety, the demand for compliant accessories such as anti-collision systems and encrypted communication modules will rise. Public procurement and subsidies for local manufacturing are major growth drivers for accessory providers.

Next-Generation Power and AI Technologies

Advancements in battery chemistry, solar-assisted charging, and AI-powered imaging create strong opportunities for differentiation. Companies that can integrate autonomy and real-time analytics directly into accessory hardware are well-positioned to lead the next wave of adoption across commercial and defense sectors.

Product Type Insights

Camera and imaging systems dominate the accessory market, contributing nearly 30% of total revenue in 2024. Batteries and charging equipment are the second-largest category, driven by high replacement cycles and demand for longer flight times. Propellers and motors account for a significant aftermarket share, while communication and navigation modules are expanding quickly with the rise of BVLOS operations. Safety and compliance accessories, though niche, are expected to grow rapidly as regulations tighten globally.

Application Insights

Security and surveillance applications lead the market, accounting for 35–40% of global demand in 2024, supported by government investments in border control, law enforcement, and public safety. Agriculture is among the fastest-growing applications, driven by precision farming practices and government subsidies in Asia-Pacific and Latin America. Delivery and logistics are emerging, supported by demand for payload release systems, secure containers, and long-endurance power systems. Media, entertainment, and photography remain steady contributors through demand for high-resolution gimbals and imaging kits.

Distribution Channel Insights

Aftermarket and online retail channels dominate sales, representing 50–60% of global accessory demand in 2024. Hobbyists, prosumers, and enterprises alike rely on online marketplaces for replacements, upgrades, and customized solutions. OEM sales remain significant for enterprise and government buyers, especially where integrated, certified accessories are required. Offline specialty stores retain importance in emerging markets but are declining globally as e-commerce penetration rises.

| Power & Propulsion | Control & Navigation | Payload & Protection |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for 30–35% of global accessory demand in 2024, led by the U.S. The region benefits from high enterprise adoption, defense procurement, and a mature aftermarket ecosystem. Regulatory easing for BVLOS operations and increasing demand for drone deliveries are driving market expansion.

Asia-Pacific

Asia-Pacific holds 25–30% of the market and is the fastest-growing region. China dominates in both manufacturing and adoption, while India is emerging rapidly due to agricultural applications and government-led drone initiatives. Japan and South Korea focus on high-tech industrial applications, contributing to demand for premium accessories.

Europe

Europe represents 20–25% of global demand, driven by industrial use in construction, utilities, and mapping. Germany, the U.K., and France lead the market, with growing demand in Eastern and Southern Europe. Strict safety and compliance regulations make Europe a strong market for certified, high-end accessories.

Latin America

Latin America contributes 5–8% of the market, with Brazil and Mexico leading adoption. Agriculture and natural resource monitoring are the primary applications. Government programs to modernize agriculture are boosting accessory demand.

Middle East & Africa

MEA holds a 5–8% share, with the Gulf states (UAE, Saudi Arabia) driving demand through security and infrastructure investments. In Africa, South Africa, Kenya, and Nigeria are key markets, focusing on agriculture and public safety. Growth is strong but from a lower base compared to other regions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Drone Accessories Market

- DJI

- Autel Robotics

- Parrot

- Yuneec

- FLIR Systems (Teledyne FLIR)

- GoPro

- Garmin

- Walkera

- SwellPro

- Delair

- Sky-Drones

- Foxtech FPV

- PowerVision

- SenseFly

- 3D Robotics

Recent Developments

- In July 2025, DJI launched a new line of high-capacity batteries with improved energy density, targeting enterprise drones for long-duration missions.

- In June 2025, Autel Robotics announced partnerships with agriculture technology firms to integrate multispectral payloads with AI-driven imaging software.

- In May 2025, Parrot introduced modular sensor kits for security and inspection markets, focusing on compliance-ready payload solutions.