Driving Clothing Market Size

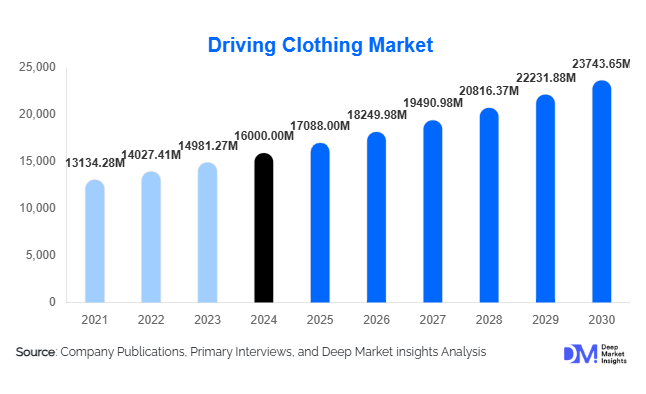

According to Deep Market Insights, the global driving clothing market size was valued at USD 16,000 million in 2024 and is projected to grow from USD 17,088 million in 2025 to reach USD 23,743.65 million by 2030, expanding at a CAGR of 6.8% during the forecast period (2025–2030). The market growth is fueled by rising awareness of driver and rider safety, expanding two-wheeler ownership in emerging economies, growing popularity of motorsports, and the convergence of functional protection with lifestyle fashion. Increasing use of advanced textiles, sustainability-focused manufacturing, and smart safety features such as sensor-embedded apparel are transforming this sector from traditional protective wear into a technology-driven, lifestyle-oriented industry.

Key Market Insights

- Global shift toward advanced protective and smart apparel, integration of airbag systems, impact sensors, and CE-certified materials is redefining product innovation in driving clothing.

- Leather and textile hybrid jackets dominate the market, contributing around 30% of total revenue in 2024 due to their broad application in both motorcycle and car driving segments.

- Asia-Pacific is the fastest-growing region, led by surging two-wheeler demand, improving safety regulations, and rising consumer spending in India and Southeast Asia.

- Premiumization and sustainability are reshaping consumer preference, with eco-friendly leathers, recycled fabrics, and ethical sourcing gaining traction among global buyers.

- Online and direct-to-consumer (D2C) channels are expanding rapidly, accounting for approximately 20% of global sales, driven by digital retail adoption and social media marketing.

- Motorsport and adventure riding apparel remain high-value niches, supported by increasing participation in track-day events and adventure touring activities.

Latest Market Trends

Smart Protective Gear Transforming Driver Safety

Manufacturers are investing heavily in next-generation safety clothing that integrates smart technologies, including wearable airbag systems, GPS tracking, and crash detection sensors. These advancements significantly reduce injury risk for riders while enhancing comfort and performance. Partnerships between apparel brands and technology firms are accelerating innovation, enabling real-time telemetry data collection and automatic emergency alerts. As regulatory agencies tighten safety standards, demand for smart protective jackets and suits is set to surge across both premium and professional segments.

Sustainability and Ethical Manufacturing

The shift toward eco-conscious consumerism is pushing manufacturers to adopt sustainable materials and responsible production practices. Recycled polyester, organic cotton, and plant-based leathers are increasingly being integrated into driving apparel lines. Major brands are investing in transparent supply chains and take-back or repair programs to extend product lifecycles. This movement not only enhances brand equity but also aligns with environmental governance frameworks in Europe and North America, where sustainability compliance is becoming a key differentiator for apparel brands.

Driving Clothing Market Drivers

Rising Global Safety Awareness and Regulation

With governments implementing stricter regulations mandating certified protective gear for motorcyclists and professional drivers, global demand for compliant apparel is rising. Increased public safety campaigns, insurance incentives, and higher consumer consciousness are encouraging riders to invest in high-quality driving jackets, gloves, and boots. This trend is especially strong in Asia-Pacific, where rider protection laws are tightening, resulting in a steady replacement and upgrade cycle for safety gear.

Growth of Motorsport and Adventure Riding Culture

The surge in motorsport participation, adventure riding clubs, and lifestyle-based car ownership is fueling demand for premium driving clothing. Motorsport-inspired gear, featuring aerodynamic designs and branding collaborations with car and bike manufacturers, appeals strongly to younger, performance-oriented consumers. Additionally, adventure motorcycling and track-day experiences are promoting multi-functional apparel capable of combining style, durability, and protection across diverse conditions.

Innovation in High-Performance Materials and Comfort

Material innovation remains central to market expansion. Manufacturers are introducing lightweight composites, high-abrasion textiles, and advanced ventilation systems to enhance wearability and protection. CE-certified body armor, moisture-wicking linings, and temperature-regulating membranes have improved rider comfort and safety, broadening the appeal of protective apparel for both casual and professional use. These innovations are increasing replacement cycles and raising the average selling price across key segments.

Market Restraints

High Cost of Premium Protective Gear

Premium driving apparel with advanced protective technologies and high-grade materials remains costly, restricting access for price-sensitive markets. Many consumers in developing regions still perceive such products as luxury items rather than essentials. This limits mass adoption and creates demand for lower-cost alternatives, which often lack certification or durability. Balancing affordability with compliance will remain a critical challenge for manufacturers.

Counterfeit Products and Fragmented Distribution

Unregulated local markets, counterfeit gear, and inconsistent distribution infrastructure hinder the adoption of certified protective wear, particularly in emerging economies. Substandard imitations undermine consumer confidence, while uneven retail availability limits brand penetration. Companies expanding into developing regions must therefore strengthen authorized dealer networks, after-sales support, and education campaigns to combat low-quality substitutes.

Driving Clothing Market Opportunities

Integration of Smart Technologies

The next phase of growth lies in the fusion of apparel and digital technology. Smart jackets with embedded airbag systems, crash sensors, and Bluetooth connectivity present a high-margin opportunity. As wearable technology becomes mainstream, collaboration between apparel brands and tech firms will unlock new business models such as subscription-based safety analytics and data-driven rider assistance platforms.

Expansion in Emerging Markets

Rapid two-wheeler adoption in India, Indonesia, Brazil, and Mexico presents a massive untapped market for entry-level and mid-range protective clothing. Rising urbanization, improved road safety policies, and e-commerce penetration are accelerating product accessibility. Localized production under initiatives like “Make in India” and “Made in China 2025” is helping global brands scale affordably while adapting to regional climate and cultural preferences.

Sustainable and Fashion-Forward Designs

Eco-friendly driving apparel that merges sustainability with lifestyle appeal offers a lucrative niche. Recycled fibers, biodegradable armor inserts, and vegan leather alternatives are gaining traction. Simultaneously, driving clothing is transitioning into casual fashion, stylish yet protective outerwear worn beyond the road. Brands that position themselves at this intersection of functionality, sustainability, and fashion are poised to lead the next wave of consumer demand.

Product Type Insights

Jackets lead the product category, accounting for approximately 30% of the global market value in 2024. They are essential gear across all vehicle types, offering both safety and style appeal. Leather and textile hybrid jackets dominate due to their comfort, CE certification, and versatility. Other growing categories include gloves and boots with integrated protection, reflecting the broadening scope of full-body protective apparel solutions.

Material Insights

Leather remains the material of choice for professional and high-performance use, representing around 35% of total market revenue in 2024. Its superior abrasion resistance and premium positioning ensure consistent demand despite the rise of synthetic and eco-friendly alternatives. However, textile and hybrid materials are growing rapidly in emerging regions due to affordability and climate adaptability.

Distribution Channel Insights

Online and Direct-to-Consumer (D2C) channels now represent nearly 20% of global driving clothing sales. Brands are leveraging digital marketing, influencer partnerships, and augmented reality fitting tools to enhance online shopping experiences. Specialty stores and OEM partnerships with racing teams continue to serve premium segments, while mass-market retailers expand entry-level product reach. E-commerce acceleration is expected to remain the key enabler of cross-border sales and brand diversification.

End-Use Insights

The two-wheeler rider segment dominates demand, contributing roughly 40% of the 2024 global market share. Rising motorcycle ownership in Asia-Pacific and Latin America, coupled with stricter safety mandates, is fueling strong replacement demand for certified gear. Meanwhile, the professional motorsport and leisure driving segments are seeing rapid premiumization, with customers preferring advanced, brand-endorsed apparel. Export-driven manufacturing in Asia continues to supply European and North American premium markets, strengthening global trade flows.

| By Product Type | By Material Type | By End-Use | By Distribution Channel | By Price Range |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounted for about 30% of the global market in 2024, led by the U.S. and Canada. High disposable incomes, widespread motorsport culture, and consumer preference for branded gear sustain market maturity. Demand for smart protective jackets and airbag-equipped suits is rising among performance riders. Growth remains moderate, at around 4–5% CAGR through 2030.

Europe

Europe holds approximately 25% of the global market, anchored by Germany, the U.K., France, and Italy. Strict safety standards, strong motorcycle communities, and heritage brands make Europe a global leader in certified protective wear. Sustainability-driven innovation, such as recycled leathers and carbon-neutral production, is a key regional focus, aligning with EU environmental policies.

Asia-Pacific

Asia-Pacific is the fastest-growing region, currently representing around 20% of global market value but expanding at a CAGR of 7–10%. India and China are major growth hubs, fueled by surging two-wheeler ownership and improved consumer safety awareness. Japanese and South Korean brands are innovating in lightweight and climate-adaptive designs, further enhancing regional competitiveness.

Latin America

Latin America contributes about 8–10% of market revenue, with Brazil and Mexico leading. The growing adoption of motorcycles for commuting, combined with emerging motorsport events, is encouraging local demand for certified gear. Distribution network expansion and digital retail integration are vital for capturing this growth potential.

Middle East & Africa

Representing approximately 5–7% of the global market, the Middle East & Africa region is witnessing increased interest in motorsport and premium apparel. GCC nations are seeing rising participation in automotive clubs, while South Africa’s strong motorcycling culture supports steady demand. Expansion of luxury retail and government initiatives in tourism and motorsport are providing indirect growth support.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Driving Clothing Market

- Alpinestars

- Dainese S.p.A.

- Fox Head Inc.

- Scott Sports SA

- Puma SE

- Adidas AG

- Under Armor Inc.

- Leatt Corporation

- OMP Racing S.p.A.

- ThorMX

- Rev’It! Sport International

- Klim LLC

- Spidi Sport S.r.l.

- Held GmbH

- Baoxiniao Holding Co., Ltd.

Recent Developments

- In May 2025, Alpinestars launched a new line of smart airbag riding jackets incorporating real-time crash detection and mobile connectivity for instant emergency alerts.

- In March 2025, Dainese introduced its “EcoTrack” collection featuring recycled leather and plant-based dyes to meet growing sustainability standards in Europe.

- In January 2025, Fox Head partnered with Indian OEM manufacturers to localize mid-tier motorcycle apparel production under the “Make in India” initiative, expanding regional accessibility.