Door Closers Market Size

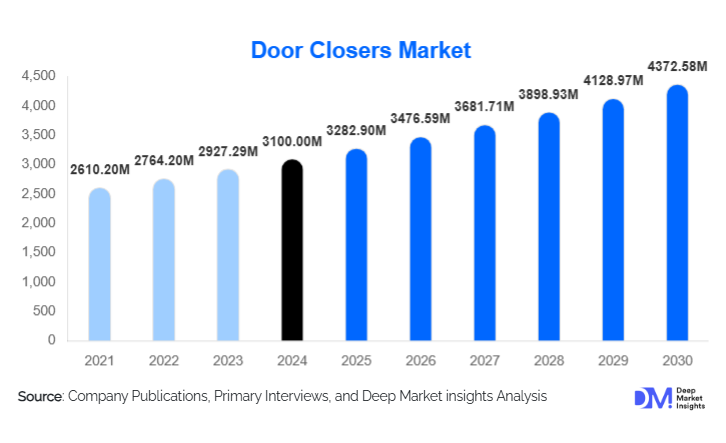

According to Deep Market Insights, the global door closers market size was valued at USD 3,100 million in 2024 and is projected to grow from USD 3,282.90 million in 2025 to reach USD 4,372.58 million by 2030, expanding at a CAGR of 5.9% during the forecast period (2025–2030). The market growth is primarily driven by increasing construction activities across commercial and residential infrastructure, rising adoption of automated and IoT-enabled door solutions, and stringent fire safety and accessibility regulations worldwide.

Key Market Insights

- Smart and automated door closers are gaining traction, with IoT-enabled and sensor-driven solutions increasingly adopted in commercial, industrial, and premium residential buildings.

- Hydraulic and surface-mounted door closers dominate globally, offering reliability, compliance with fire safety standards, and cost-effectiveness for high-traffic areas.

- North America leads demand, driven by large-scale commercial infrastructure, safety regulations, and a preference for automated door solutions in corporate buildings.

- Asia-Pacific is the fastest-growing region, fueled by urbanization, infrastructure expansion, and rising awareness of safety and energy-efficient building systems.

- Europe maintains strong demand, particularly in Germany, France, and the U.K., supported by retrofitting of older infrastructure and compliance with strict building codes.

- Technological adoption, including smart, automated, and energy-efficient door closers integrated with building management systems, is reshaping market dynamics.

What are the latest trends in the door closers market?

Smart and Automated Door Closers

IoT-enabled, sensor-driven, and electromagnetic door closers are increasingly replacing conventional manual systems in high-end commercial buildings and public infrastructure. These products offer energy efficiency, integration with access control, and improved user safety. Many manufacturers are focusing on retrofitting solutions for existing buildings, allowing facility managers to upgrade to smart systems without major renovations. The trend is strongest in North America and APAC, where commercial buildings and airports are investing heavily in automated door solutions for operational efficiency and safety compliance.

Energy-Efficient and Fire-Compliant Solutions

Hydraulic and electromagnetic door closers that reduce energy loss and comply with global fire safety standards are becoming a standard in both new and retrofit projects. Energy-efficient products are particularly popular in commercial and residential buildings that prioritize sustainability. Manufacturers are increasingly offering adjustable hydraulic closers and integrated fire-rated systems that reduce maintenance costs and improve longevity, meeting growing regulatory requirements.

What are the key drivers in the door closers market?

Expanding Commercial and Residential Construction

The rise in office complexes, retail malls, hospitals, and high-rise residential buildings is creating sustained demand for door closers. In 2024, commercial buildings accounted for 48% of the global market, highlighting their dominant contribution. Developers prefer hydraulic and surface-mounted door closers for ease of installation, durability, and regulatory compliance.

Technological Advancements and Automation

Automated, IoT-enabled, and smart door closers are increasingly adopted for energy management, access control, and user convenience. Integration with building management systems enhances operational efficiency, making automated solutions attractive for corporate offices, airports, and high-security facilities.

Regulatory and Safety Compliance

Fire safety, accessibility, and building codes in Europe, North America, and the Middle East are driving demand for high-quality, compliant door closers. Retrofits and upgrades in older buildings also create recurring revenue opportunities for manufacturers.

What are the restraints for the global market?

High Cost of Automated Solutions

Automated and IoT-enabled door closers carry higher initial costs compared to conventional manual or hydraulic systems, limiting adoption in small residential or low-budget projects. This cost barrier slows market penetration in certain regions despite rising awareness of automation benefits.

Raw Material Price Volatility

Steel, aluminum, and other materials used in manufacturing door closers are subject to frequent price fluctuations, impacting product pricing and profit margins. Manufacturers must balance cost pressures with quality standards, which can constrain growth.

What are the key opportunities in the door closers market?

Integration with Smart Building Solutions

Door closers integrated with IoT-based security, energy management, and automated access control systems present a lucrative growth opportunity. As smart buildings become mainstream in North America, Europe, and APAC, suppliers can offer premium solutions with high margins, attracting new entrants and encouraging technological innovation.

Infrastructure Development in Emerging Economies

Rapid urbanization in India, China, Southeast Asia, and Latin America is driving demand for commercial, industrial, and residential projects. Governments are investing heavily in airports, hospitals, schools, and metro systems, creating opportunities for both new installations and retrofit projects.

Regulatory Compliance and Retrofitting

Strict building codes and fire safety regulations in developed countries are increasing the demand for compliant door closers. Retrofitting existing infrastructure with modern hydraulic or automated door closers provides a recurring revenue stream and ensures compliance with evolving standards.

Product Type Insights

Hydraulic door closers dominate the global market, representing 42% of 2024 revenue due to their reliability and widespread adoption in commercial and public buildings. Pneumatic and spring door closers are common in residential and low-traffic areas, while electromagnetic/electric closers are gaining share in high-security and automated environments. The trend toward smart and fire-compliant hydraulic products is driving a gradual market transformation.

Application Insights

Surface-mounted door closers are leading, accounting for 55% of the 2024 market share due to easy installation, retrofit capability, and maintenance advantages. Concealed and floor-spring closers are gaining traction in premium commercial spaces, glass doors, and high-traffic areas, driven by aesthetic and functional preferences. Adoption of automated systems is increasing across commercial, industrial, and public infrastructure segments.

End-Use Insights

Commercial buildings remain the largest end-use segment, contributing 48% of market revenue, driven by office complexes, retail malls, hospitals, and airports. Residential buildings follow, with growing demand for security, energy efficiency, and automation. Industrial facilities and public infrastructure projects are increasingly adopting automated and heavy-duty door closers. Export-driven demand from North America and Europe to APAC and the Middle East is further supporting growth, with industrial facilities in APAC expected to grow at a 6.5% CAGR.

| By Product Type | By Application / Installation Type | By End-Use Industry | By Operation Type | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 35% of the 2024 market share, led by the U.S. and Canada. Demand is fueled by new commercial projects, retrofits of older buildings, and regulatory compliance for fire safety and accessibility. High adoption of smart building solutions drives growth, with corporate offices and airports as key end-users.

Europe

Europe holds 30% of the market, with Germany, France, and the U.K. as leading contributors. Retrofits, stringent safety regulations, and demand for energy-efficient solutions drive market expansion. The region also has a mature adoption of automated and concealed door closers.

Asia-Pacific

The APAC region is the fastest-growing, projected to expand at a 7.2% CAGR. China, India, and Japan lead demand, fueled by urbanization, infrastructure projects, and rising awareness of safety and energy efficiency. Industrial and commercial projects, particularly in Tier-1 cities, are key drivers.

Middle East & Africa

Demand is concentrated in the UAE, Saudi Arabia, and South Africa. Growth is supported by high investments in commercial and government infrastructure, luxury residential projects, and strong government support for safety and compliance with building regulations.

Latin America

Brazil and Mexico dominate LATAM, with moderate growth at 5.5% CAGR. Commercial buildings and industrial facilities are driving the adoption of hydraulic and automated door closers. Export-driven demand from North America is supporting market penetration.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Door Closers Market

- Allegion PLC

- ASSA ABLOY AB

- Dormakaba Holding AG

- Stanley Black & Decker, Inc.

- Hager Group

- GEZE GmbH

- Ryobi Limited

- Bohle AG

- DORMA+KABA

- Hafele AG

- Cisa S.p.A

- Nabtesco Corporation

- Yalco Industrial Co., Ltd

- Sugatsune Kogyo Co., Ltd

- Hawa Sliding Solutions

Recent Developments

- In 2025, Dormakaba launched a new series of IoT-enabled door closers in North America, enhancing building automation and energy efficiency.

- In 2025, GEZE GmbH introduced fire-rated hydraulic door closers for large-scale commercial projects in Europe, meeting updated EN 1154 standards.

- In 2024, ASSA ABLOY expanded its distribution network across APAC, focusing on automated and smart door closers for high-rise residential and commercial buildings.