Domestic Hot Water Storage Tank Market Size

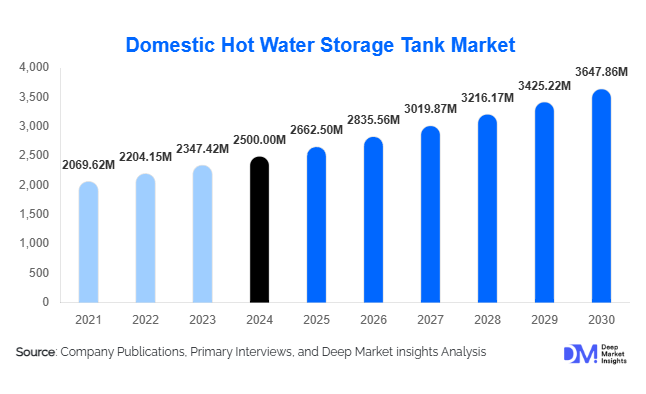

According to Deep Market Insights, the global domestic hot water (DHW) storage tank market size was valued at USD 2,500 million in 2024 and is projected to grow from USD 2,662.50 million in 2025 to reach USD 3,647.86 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The DHW storage tank market growth is primarily driven by rising energy costs, increasing adoption of energy-efficient and renewable-integrated water heating solutions, and technological advancements in smart and connected water heating systems.

Key Market Insights

- Integration with renewable energy systems is gaining traction, particularly with solar thermal and heat pump-connected storage tanks, promoting sustainable hot water solutions and reducing energy costs.

- Residential applications dominate the market, accounting for the majority of demand, while commercial and industrial applications are steadily increasing due to rising hot water consumption.

- North America leads the market, with the United States showing high adoption of energy-efficient and smart water heating systems.

- Asia-Pacific is the fastest-growing region, driven by urbanization, rising disposable incomes, and government initiatives in China and India promoting energy-efficient appliances.

- Smart water heating technology adoption, featuring IoT-enabled monitoring and scheduling, is transforming consumer interaction with DHW systems and supporting market expansion.

- Government incentives and energy efficiency standards are encouraging manufacturers to innovate and consumers to upgrade to advanced water heating systems.

Latest Market Trends

Renewable-Integrated Water Heating

The DHW storage tank market is increasingly integrating renewable energy sources. Solar thermal water heaters, heat pump storage tanks, and hybrid systems are gaining popularity in residential and commercial applications. These solutions store surplus energy for later use, reducing dependence on grid electricity and lowering operational costs. Incentives and rebates offered by governments for renewable-based water heating are further encouraging adoption globally.

Smart and Connected Water Heating Solutions

Smart DHW storage tanks equipped with IoT-based controls, remote monitoring, and energy tracking are becoming mainstream. Consumers can optimize water heating schedules, track energy usage, and receive maintenance alerts via mobile apps. This trend caters to the increasing demand for home automation and energy management solutions, particularly in developed markets like North America and Europe. Intelligent water heating systems also improve efficiency by minimizing energy wastage during off-peak hours.

Domestic Hot Water Storage Tank Market Drivers

Rising Energy Costs

Global energy prices continue to rise, motivating consumers to invest in energy-efficient DHW systems. Integration with renewable energy sources further reduces utility bills, making storage tanks an economically viable long-term solution. Regions with high electricity costs, including North America and parts of Europe, see higher adoption rates of energy-efficient DHW solutions.

Environmental Awareness and Sustainability

Increasing awareness of environmental issues is pushing consumers and businesses to adopt eco-friendly water heating solutions. DHW storage tanks that reduce carbon emissions and integrate renewable energy align with sustainability goals, making them highly attractive for environmentally conscious users.

Technological Innovation

Advancements in insulation materials, corrosion-resistant tanks, and smart heating technologies are improving the efficiency and lifespan of DHW storage tanks. Modern solutions allow precise temperature control, minimize heat loss, and provide real-time monitoring, enhancing consumer convenience and reducing energy consumption.

Market Restraints

High Initial Investment

Advanced DHW storage tanks, especially solar-integrated or smart models, require higher upfront costs. While long-term savings are substantial, the initial investment can be a barrier in price-sensitive markets, limiting adoption.

Space Constraints in Urban Areas

Urban residential units often face limited space for installing DHW storage tanks. Compact models are available but may be more expensive, making installation challenging in densely populated regions.

Domestic Hot Water Storage Tank Market Opportunities

Expansion in Emerging Markets

Asia-Pacific, particularly China and India, offers substantial growth potential due to rising urbanization, increasing disposable income, and government support for energy-efficient appliances. Expanding manufacturing and distribution networks in these regions can help companies capture high-growth demand segments.

Integration with Smart Home Ecosystems

Smart homes and IoT adoption provide opportunities to introduce intelligent water heating systems. Connectivity with mobile apps, home energy management systems, and AI-driven optimization enhances consumer experience, driving higher sales in tech-savvy households.

Government Incentives and Regulatory Support

Policies promoting energy efficiency, such as rebates, tax incentives, and mandatory energy performance standards, provide opportunities for manufacturers and service providers. Compliance with these regulations can help companies gain a competitive advantage while expanding market penetration.

Product Type Insights

Stainless steel DHW storage tanks dominate the market, accounting for roughly 60% of the 2024 market share. Their resistance to corrosion, durability, and ability to maintain water quality make them preferred in both residential and commercial applications. Other tank types, including glass-lined and plastic-lined models, are used in cost-sensitive or niche applications but have lower adoption globally.

Capacity Insights

Tanks with a capacity of 100–250 liters are the most popular in residential applications, representing about 45% of the market in 2024. This range provides sufficient hot water for medium-sized households while balancing space and efficiency. Larger capacities are primarily used in commercial and industrial facilities, whereas compact tanks are suited for small apartments or retrofits.

Application Insights

The residential segment dominates, accounting for approximately 70% of the market in 2024, fueled by household demand for continuous and energy-efficient hot water. Commercial applications, including hospitality, healthcare, and food processing, are experiencing steady growth due to increasing hot water requirements. Industrial usage is emerging as a niche segment, primarily in manufacturing and institutional facilities.

Distribution Channel Insights

Direct sales through manufacturers and retailers dominate, complemented by online platforms that provide price transparency, consumer reviews, and product comparisons. B2B distribution is crucial for commercial and industrial installations, while online marketplaces are increasingly influential for residential buyers seeking convenience and product information.

| By Product Type | By Capacity | By Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds approximately 30% of the 2024 DHW storage tank market, led by the U.S. Strong energy efficiency regulations, high disposable income, and widespread adoption of smart technologies drive demand. Canada is also seeing steady growth, particularly in urban residential areas.

Europe

Europe has a significant market share, with Germany and France leading adoption. Energy efficiency standards, renewable integration policies, and consumer preference for sustainable products support market growth. Europe’s market is mature but continues to grow due to technological upgrades in existing systems.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by China and India. Urbanization, rising middle-class income, and government incentives for energy-efficient appliances are fueling demand. Increasing awareness of renewable-integrated systems is contributing to rapid adoption.

Middle East & Africa

The region is driven by high solar potential and demand for efficient water heating solutions in both residential and commercial sectors. Solar-integrated DHW systems are particularly attractive in areas with high electricity costs.

Latin America

Brazil and Mexico lead demand in Latin America, supported by growing adoption of energy-efficient appliances and urban residential development. Government subsidies for energy-efficient products further encourage market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Domestic Hot Water Storage Tank Market

- AO Smith Corporation

- Ariston Thermo Group

- Rheem Manufacturing Company

- Vaillant Group

- Bosch Thermotechnology

- Bradford White Corporation

- Glen Dimplex Group

- Stiebel Eltron

- Reliance Worldwide Corporation

- Electrolux AB

- Johnson Controls

- Arcelik A.Ş.

- Ferroli S.p.A.

- Hitachi Appliances, Inc.

- Paloma Industries Ltd.

Recent Developments

- In March 2025, AO Smith launched a solar-integrated DHW storage tank with IoT-enabled energy management in the U.S., targeting both residential and commercial segments.

- In January 2025, Ariston Thermo Group expanded its European smart water heating portfolio, introducing energy-efficient, app-controlled DHW tanks for urban apartments.

- In February 2025, Rheem Manufacturing Company unveiled a hybrid heat pump DHW system for North American commercial applications, reducing energy consumption by up to 50%.