Dissolvable Tobacco Market Size

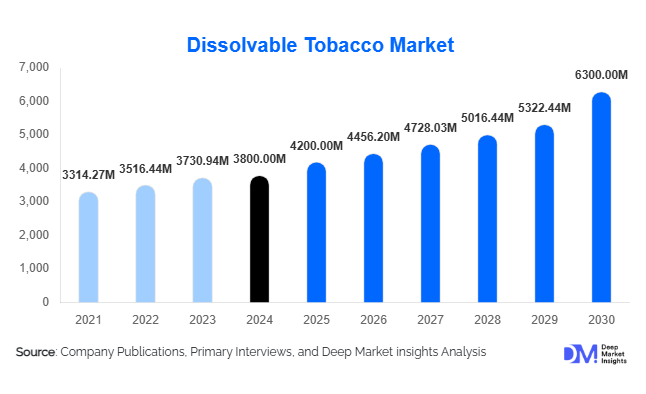

According to Deep Market Insights, the global dissolvable tobacco market size was valued at USD 3,800 million in 2024 and is projected to grow from USD 4,200 million in 2025 to reach USD 6,300 million by 2030, expanding at a CAGR of 6.1% during the forecast period (2025–2030). The market growth is primarily driven by the rising demand for smoke-free tobacco alternatives, increased adoption among young adult consumers, and the growing focus of tobacco companies on innovative product formats that align with harm-reduction strategies.

Key Market Insights

- Shift toward discreet, smoke-free consumption is a major driver, as dissolvable tobacco products provide convenience and reduced stigma compared to traditional cigarettes.

- Flavor innovations such as mint, fruit, and coffee blends are boosting consumer interest, particularly among younger demographics.

- North America leads the market with strong adoption of dissolvable tobacco products and the presence of major players such as R.J. Reynolds.

- Asia-Pacific is the fastest-growing region, driven by rising urbanization, increasing disposable incomes, and growing acceptance of alternative nicotine products.

- Technological advancements in oral nicotine delivery are reshaping the market with new dissolvable formats like strips, lozenges, and sticks.

Latest Market Trends

Flavor-Driven Product Innovation

Tobacco manufacturers are increasingly focusing on flavored dissolvable products to capture younger consumers and differentiate themselves from traditional tobacco products. Novel flavors such as citrus, berry, and herbal fusions are expanding consumer choice and boosting repeat purchases. Flavor innovation also helps position dissolvable products as lifestyle-oriented alternatives, aligning with global trends toward personalization and premiumization.

Integration of Nicotine Replacement Concepts

The dissolvable tobacco market is adopting strategies from the nicotine replacement therapy (NRT) sector by emphasizing controlled dosage, reduced harm, and user-friendly formats. This trend supports wider acceptance among health-conscious consumers seeking reduced-risk alternatives. Brands are promoting dissolvables as socially acceptable and convenient options that fit into modern lifestyles, further accelerating adoption.

Dissolvable Tobacco Market Drivers

Growing Preference for Smoke-Free Alternatives

Increasing health awareness and smoking restrictions worldwide are pushing consumers toward smoke-free options such as dissolvable tobacco. With bans on indoor smoking and public health campaigns discouraging combustible products, dissolvable formats offer a discreet, odorless, and convenient option. This shift is expanding market penetration, particularly in urban areas where smoking restrictions are strict.

Product Accessibility and Innovation

Manufacturers are investing in innovative delivery formats such as pouches, lozenges, and dissolvable strips to appeal to diverse consumer groups. Convenience store distribution, e-commerce expansion, and enhanced marketing campaigns are improving product accessibility. Strategic branding that emphasizes modernity, portability, and reduced social stigma is further accelerating consumer uptake.

Market Restraints

Regulatory Challenges

The dissolvable tobacco market faces strict regulatory scrutiny, especially regarding flavored products that are often perceived as targeting younger consumers. Several regions are imposing restrictions on flavors, nicotine content, and marketing practices, creating compliance challenges for manufacturers. These regulations limit market expansion and increase operational costs for global players.

Health Concerns and Public Perception

Despite being marketed as reduced-risk alternatives, dissolvable tobacco products continue to face criticism from health organizations due to their nicotine content. Concerns over youth initiation and long-term health effects act as barriers to widespread acceptance. Negative public perception and ongoing debates around harm reduction versus nicotine dependence also restrain growth.

Dissolvable Tobacco Market Opportunities

Expansion in Emerging Markets

Rapid urbanization, growing disposable incomes, and changing social norms in Asia-Pacific and Latin America present significant opportunities. Tobacco companies are actively investing in these regions to introduce dissolvable products, supported by the rising acceptance of alternative nicotine consumption and increasing demand for innovative lifestyle products.

Premiumization and Lifestyle Branding

The introduction of premium dissolvable products positioned as lifestyle accessories creates opportunities to capture high-income consumers. Packaging innovations, sleek product designs, and targeted marketing campaigns aimed at image-conscious consumers are opening up new avenues for differentiation. Partnerships with lifestyle and wellness brands are also emerging to reframe dissolvables as socially acceptable choices.

Product Type Insights

Lozenges dominate the dissolvable tobacco market, offering ease of use, portability, and longer-lasting nicotine delivery. Strips are gaining popularity due to rapid dissolution and discreet use, appealing to younger, on-the-go consumers. Dissolvable sticks and pouches are niche but growing segments, supported by product innovation and regional marketing campaigns.

Distribution Channel Insights

Convenience stores remain the leading distribution channel, benefiting from impulse purchases and accessibility. Online platforms are rapidly growing, driven by direct-to-consumer models and the ability to reach younger demographics more effectively. Supermarkets and hypermarkets also play a significant role, offering wider product visibility. The rise of subscription-based delivery services for nicotine products is an emerging trend in distribution.

Consumer Demographics Insights

Young adults (ages 18–30) represent the largest consumer group, driven by curiosity, lifestyle branding, and preference for flavored alternatives. Middle-aged consumers (31–50) are increasingly adopting dissolvables as reduced-risk alternatives to smoking, particularly in urban and professional settings. Older demographics (50+) remain a smaller segment but are showing gradual uptake due to smoking restrictions and harm-reduction campaigns.

| By Product Type | By Application / Use Case | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America dominates the dissolvable tobacco market, driven by strong demand in the U.S. and the presence of leading manufacturers. Regulatory frameworks, combined with consumer openness to smoke-free products, support market maturity. Premium and flavored dissolvables remain particularly popular in this region.

Europe

Europe presents a growing market, with demand driven by smoking bans and increasing consumer interest in harm-reduction products. Regulatory challenges remain a hurdle, but rising acceptance of alternative nicotine products, particularly in Western Europe, is fueling steady growth.

Asia-Pacific

The Asia-Pacific region is the fastest-growing, led by China, Japan, and India. Rising middle-class wealth, social acceptance of discreet consumption, and increasing investment by multinational tobacco companies are key growth drivers. E-commerce channels and flavored products are gaining rapid traction in this region.

Latin America

Latin America is an emerging market with significant growth potential. Brazil and Mexico are key countries driving adoption, supported by urbanization and growing consumer interest in innovative tobacco products. Marketing campaigns highlighting modernity and convenience are resonating strongly with younger consumers.

Middle East & Africa

The Middle East shows growing demand for premium dissolvable products, supported by high-income populations and increasing restrictions on combustible tobacco. Africa remains in the early adoption stage, but urbanization and rising disposable incomes are expected to create opportunities for market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Dissolvable Tobacco Market

- R.J. Reynolds Tobacco Company

- Philip Morris International

- British American Tobacco

- Japan Tobacco International

- Swedish Match AB

- Altria Group

- KT&G Corporation

Recent Developments

- In May 2024, R.J. Reynolds expanded its dissolvable tobacco product line in the U.S., introducing new flavored lozenges targeted at urban markets.

- In March 2024, Philip Morris International announced pilot launches of dissolvable strips in select European markets, emphasizing harm-reduction strategies.

- In January 2024, British American Tobacco invested in product development for premium dissolvable sticks with herbal infusions, targeting Asia-Pacific consumers.