Disposable Tableware Market Size

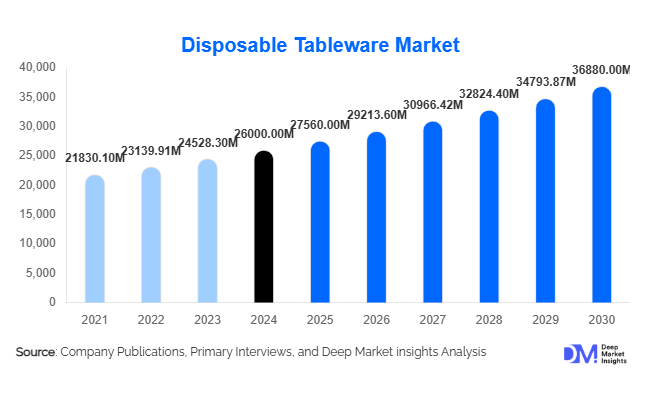

According to Deep Market Insights, the global disposable tableware market size was valued at USD 26,000.00 million in 2024 and is projected to grow from USD 27,560.00 million in 2025 to reach USD 36,880.00 million by 2030, expanding at a CAGR of 6.0% during the forecast period (2025–2030). The market growth is driven by rising demand for convenience, hygiene, and sustainability across the foodservice and household sectors, as well as growing consumption from quick-service restaurants (QSRs), catering, and institutional applications worldwide.

Key Market Insights

- Plastic-based tableware continues to dominate the global market, holding nearly 45% share in 2024, though transitioning toward eco-friendly alternatives is accelerating.

- Foodservice applications accounted for over 55% of total market demand, driven by rapid growth in delivery, takeaway, and catering channels.

- Asia-Pacific and North America collectively captured around 70% of the global market share in 2024, with Asia-Pacific emerging as the fastest-growing region.

- Biodegradable and compostable materials such as bagasse, bamboo, and PLA are gaining prominence as regulatory restrictions on single-use plastics tighten globally.

- Offline distribution channels lead sales, contributing nearly 65% of global revenue, while online and B2B e-commerce are rapidly expanding segments.

- The top five global manufacturers account for roughly 25–30% of total market share, indicating a moderately consolidated industry with strong regional competition.

Latest Market Trends

Shift Toward Sustainable and Compostable Materials

A major transformation in the disposable tableware market is the shift from conventional plastics toward biodegradable, compostable, and bio-based materials such as bagasse, bamboo, and PLA. Governments across Europe, North America, and parts of Asia are imposing bans and restrictions on single-use plastics, accelerating innovation in eco-friendly alternatives. Manufacturers are investing heavily in compostable molding technologies and certification standards to align with regulatory compliance. This trend not only reduces environmental impact but also enhances brand reputation, enabling producers to command premium prices in sustainability-driven markets.

Digital and E-commerce Penetration

The emergence of digital distribution platforms is reshaping the disposable tableware industry. Online B2B and B2C channels enable small restaurants, catering firms, and households to source bulk quantities conveniently and cost-effectively. Major players are launching direct-to-customer websites with real-time customization options for branded cups and plates. In addition, smart inventory systems, automated ordering, and integrated logistics networks are making online procurement faster and more reliable. The rise of digital marketplaces is thus fostering competitiveness and improving accessibility, especially in emerging markets.

Disposable Tableware Market Drivers

Expanding Foodservice and Delivery Ecosystem

Rapid expansion of the foodservice industry, particularly quick-service restaurants (QSRs), cloud kitchens, and food delivery platforms, is driving demand for disposable tableware. Hygiene, convenience, and operational efficiency make single-use items indispensable for takeaway and delivery. With global delivery transactions rising sharply post-pandemic, the segment accounts for over 60% of market consumption. This structural shift continues to reinforce long-term market stability and growth.

Rising Hygiene Awareness and Consumer Convenience

Urban lifestyles and increased hygiene awareness have heightened reliance on single-use tableware across households, events, and institutions. Disposable cups, plates, and cutlery eliminate washing requirements and reduce cross-contamination risks, making them ideal for public and large-scale consumption. As consumer routines become busier, the convenience factor, combined with lower costs, remains a pivotal demand driver worldwide.

Regulatory Support for Sustainable Product Development

Regulatory initiatives promoting sustainable packaging have created opportunities for innovation in biodegradable materials. Governments are incentivizing local production of eco-friendly disposables through subsidies and “Make in Country” programs. Compliance with standards such as EN 13432 and ASTM D6400 is also pushing manufacturers to upgrade product portfolios toward compostable and recyclable solutions, ensuring long-term market resilience.

Market Restraints

High Raw Material Costs for Sustainable Alternatives

Despite growing interest in biodegradable tableware, the high cost of raw materials such as PLA and bagasse continues to challenge profitability. Biodegradable products often cost 20–30% more than plastic equivalents, restricting adoption in cost-sensitive markets. Supply chain limitations and dependence on agricultural by-products further compound cost fluctuations, creating financial pressure for small and mid-sized manufacturers.

Competition from Reusable and Circular Solutions

Sustainability movements promoting reusable tableware and zero-waste models are emerging as competitive substitutes. Restaurants and institutions adopting reusable serviceware programs reduce reliance on disposables. This behavioral and regulatory shift could limit growth in mature markets unless manufacturers adapt through innovation, circular product models, and recyclability enhancements.

Disposable Tableware Market Opportunities

Biodegradable & Compostable Product Expansion

The global sustainability wave presents a major opportunity for manufacturers to invest in biodegradable materials such as bamboo, sugarcane bagasse, and molded fiber. These eco-conscious solutions cater to environmentally aware consumers and institutions seeking compliance with single-use plastic bans. Players that secure certifications and establish sustainable branding are expected to capture a significant premium market segment.

Emerging Market Penetration

Asia-Pacific, Latin America, and Africa present lucrative opportunities due to growing urban populations, increasing disposable income, and expanding foodservice infrastructure. Localized manufacturing and government initiatives encouraging domestic production can reduce import dependence, lower costs, and enhance profitability. Regional demand for catering and quick-serve solutions provides ample room for capacity expansion.

Customization and Digital Integration

Brand-customized disposables, featuring printed logos and event-specific designs, are increasingly demanded by QSRs, catering firms, and corporate clients. Digital ordering platforms allow flexible customization and rapid fulfillment. Integrating digital supply chains, smart manufacturing, and automation offers competitive advantages in terms of turnaround, cost-efficiency, and personalization.

Product Type Insights

Among all product categories, disposable plates hold the largest share, accounting for nearly 30% of the global disposable tableware market in 2024. Their widespread adoption across restaurants, households, and catering services, coupled with low manufacturing costs and improved recyclability, underpins their dominance. The surge in takeaway meals and quick-service restaurants (QSRs) has further elevated demand for durable and lightweight plates, particularly those made from molded fiber, paperboard, and bagasse. Innovation in heat-resistant coatings and leak-proof designs continues to enhance product functionality and consumer appeal.

Disposable cups and cutlery follow closely, driven by growing beverage consumption and the global rise in on-the-go dining culture. Leading manufacturers are increasingly shifting toward bioplastic and compostable cup solutions to meet sustainability goals and comply with emerging plastic regulations. In addition, the cutlery segment benefits from advancements in wooden, bamboo, and CPLA-based utensils that mimic traditional plastic durability while aligning with eco-conscious consumer preferences.

Overall, product diversification, supported by the development of multi-compartment trays, ergonomic lids, and custom branding capabilities, is expected to sustain category growth through 2030, with plates and cups together accounting for over half of total market revenue.

End-Use Application Insights

The foodservice segment leads global demand, representing about 55–60% of the total disposable tableware market value in 2024. Growth is primarily fueled by the proliferation of restaurant chains, catering services, and food delivery platforms, which require convenient, hygienic, and cost-efficient serving solutions. The rise of QSRs such as McDonald’s, Domino’s, and Starbucks, particularly across Asia-Pacific and North America, continues to drive bulk procurement of disposable plates, cups, and lids. Regulatory emphasis on single-use hygiene standards post-COVID-19 has further reinforced product adoption in institutional and hospitality settings.

The events and catering segment is emerging as the fastest-growing end-use category, supported by the global rebound in weddings, corporate gatherings, festivals, and outdoor functions. Organizers increasingly prefer biodegradable and customizable tableware options that ensure both convenience and environmental compliance. Meanwhile, institutional applications, including hospitals, schools, and corporate cafeterias, are maintaining steady growth driven by government procurement programs and sustainability mandates. The household segment remains resilient, with demand sustained by the growing popularity of convenience-driven, disposable solutions for home gatherings, picnics, and family events.

Distribution Channel Insights

The offline distribution channel dominates the global disposable tableware market, accounting for around 65% of total sales in 2024. Supermarkets, wholesalers, and cash-and-carry retailers remain the primary sales conduits, particularly for commercial clients such as restaurants, caterers, and institutions. Bulk purchasing options, faster replenishment cycles, and established supply partnerships reinforce the channel’s dominance.

However, online and B2B e-commerce platforms are rapidly reshaping the market landscape. Small and mid-sized foodservice operators increasingly leverage digital marketplaces for flexible procurement and direct-from-manufacturer access. The rise of platforms such as Alibaba, Amazon Business, and IndiaMART has simplified sourcing for biodegradable and customized tableware, especially in emerging economies. By 2030, the digital channel is expected to capture nearly one-third of total market value, driven by improved logistics, transparency, and data-driven purchasing patterns among SMEs.

| By Product Type | By Material | By End Use | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 35–40% of the global market in 2024, valued at nearly USD 7.5 billion. The United States leads regional demand, supported by a mature foodservice infrastructure, widespread adoption of takeaway culture, and strong purchasing power. Regulatory initiatives such as state-level bans on single-use plastics (e.g., California, New York) are catalyzing the transition toward paper-based and compostable alternatives. Canada follows similar trends, emphasizing eco-labeled and premium biodegradable products. Ongoing innovation by major U.S. manufacturers, such as the introduction of PLA-coated fiber plates and lids, is accelerating domestic adoption. Key growth drivers in this region include rising environmental awareness, robust online food delivery networks, and increased private-label sustainability branding by retailers.

Europe

Europe holds around 25–30% of the global market share in 2024, underpinned by stringent sustainability regulations such as the EU Single-Use Plastics Directive. Countries including Germany, France, the U.K., and Italy are front-runners in adopting biodegradable and compostable materials. The region’s emphasis on circular economy practices is driving high-value innovation in molded fiber and paper-based tableware. Market growth is steady yet shifting toward premium, compliant products that carry sustainability certifications (FSC, EN 13432). Key regional drivers include policy-driven product replacement, consumer preference for eco-friendly goods, and brand differentiation through green packaging.

Asia-Pacific

Asia-Pacific (APAC) represents about 30–35% of global demand and is the fastest-growing regional market during 2025–2030. China, India, and Japan lead both production and consumption, fueled by rapid urbanization, expanding middle-class populations, and the boom in food delivery services. India’s “Make in India” initiative and government restrictions on single-use plastics are simultaneously boosting domestic manufacturing of biodegradable bagasse and bamboo-based tableware. In China, the rise of app-based food delivery and growing café culture is driving exponential consumption of disposable cups and lids. Southeast Asian nations such as Indonesia and Vietnam present new frontiers for growth due to the hospitality sector’s expansion and demand for event catering solutions. Regional growth is also supported by low production costs, large-scale exports, and foreign investment in sustainable packaging infrastructure.

Latin America

Latin America contributes approximately 5–10% of global sales, with Brazil and Mexico dominating regional demand. The region’s growth trajectory is tied to post-pandemic economic recovery and the surge in online food delivery and QSR expansion. Cost-effective plastic-based tableware still holds a major share; however, local manufacturers are increasingly investing in biodegradable alternatives to align with emerging consumer and corporate sustainability preferences. Key growth drivers include urbanization, increased convenience culture, and rising hospitality sector investments across Mexico, Colombia, and Chile.

Middle East & Africa

The Middle East & Africa (MEA) region accounts for roughly 5–8% of global demand but offers strong future potential. The UAE and Saudi Arabia are experiencing rapid growth in the hospitality, tourism, and events sectors, particularly large-scale events such as Expo exhibitions, cultural festivals, and international conferences, which drive bulk demand for premium disposable tableware. South Africa, meanwhile, is witnessing growing acceptance of compostable and paper-based options, supported by environmental awareness campaigns and government waste-reduction initiatives. Regional growth drivers include rising tourism inflows, increased catering activities, and government sustainability programs encouraging local biodegradable manufacturing.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Disposable Tableware Market

- Huhtamäki Oyj

- Dart Container Corporation

- Genpak LLC

- Pactiv Evergreen Inc.

- Novolex Holdings

- Berry Global Group, Inc.

- Duni AB

- Eco-Products, Inc.

- Detmold Group

- International Paper Company

- Reynolds Consumer Products Inc.

- Biopac

- Vegware

- Natural Tableware

- Good Start Packaging

Recent Developments

- In June 2025, Huhtamäki Oyj announced an expansion of its molded fiber production facility in India to meet growing demand for compostable tableware under the “Make in India” initiative.

- In April 2025, Berry Global Group launched a new line of lightweight recyclable plastic cups designed to reduce resin use by 25% while maintaining durability.

- In February 2025, Duni AB introduced its 100% compostable bamboo plate range in European markets, targeting foodservice clients seeking eco-certified alternatives.