Disposable Lid Market Size

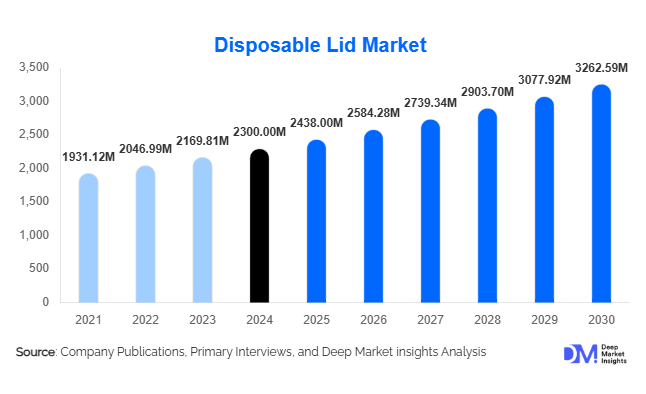

According to Deep Market Insights, the global disposable lid market size was valued at USD 2,300 million in 2024 and is projected to grow from USD 2,438 million in 2025 to reach USD 3,262.59 million by 2030, expanding at a CAGR of 6.0% during the forecast period (2025–2030). This growth is driven by rising takeaway and delivery food culture, increasing adoption of sustainable packaging materials, and continuous innovation in lid design and manufacturing processes that improve functionality, recyclability, and branding opportunities for foodservice operators.

Key Market Insights

- Plastic lids remain the dominant material category, accounting for nearly 48% of global revenue in 2024, owing to their affordability and established supply chains across foodservice industries.

- Sustainable and biodegradable materials such as paper, molded fiber, and PLA are rapidly gaining market share due to global bans on single-use plastics.

- Foodservice outlets and quick-service restaurants (QSRs) represent the largest end-use segment, contributing over 50% of total demand in 2024.

- North America leads the global disposable lid market with a 34% share, driven by high coffee consumption and takeaway beverage culture.

- Asia-Pacific is the fastest-growing region, expanding at a CAGR above 6% through 2030 as café culture and food-delivery platforms boom in China and India.

- Technological advancements in tamper-evident, leak-proof, and compostable lid designs are reshaping competitive dynamics.

Latest Market Trends

Shift Toward Sustainable Materials

Manufacturers are increasingly investing in eco-friendly and biodegradable materials for disposable lids, such as molded fiber, paperboard with aqueous coatings, and plant-based plastics like PLA and PHA. This transition is fueled by global regulations on single-use plastics and growing consumer preference for sustainable packaging. Leading brands are launching recyclable and compostable lids that meet EU and North American food-safety standards, while QSRs are piloting paper lids to replace plastic. Sustainability is no longer an option but a strategic differentiator, driving material innovation and partnerships with recycling and composting firms.

Premium and Customizable Lid Designs

The market is witnessing a surge in premium and branded lids that enhance consumer experience and strengthen brand identity. Tamper-evident, heat-resistant, and ergonomic sip-through designs are gaining traction, particularly among premium coffee chains and food-delivery brands. Laser embossing, color-coding, and embossed logos are being adopted to enhance aesthetics while supporting product differentiation. Custom-fit lids for meal kits and reusable container systems are also emerging, aligning with circular packaging trends and brand-specific sustainability initiatives.

Disposable Lid Market Drivers

Growth of Takeaway and Food-Delivery Services

The rapid expansion of online food-delivery platforms such as DoorDash, Uber Eats, Swiggy, and Deliveroo has significantly boosted demand for secure, spill-proof disposable lids. As urban consumers increasingly rely on takeout and on-the-go dining, the requirement for reliable beverage and food-container lids has surged. QSRs, cafés, and cloud kitchens represent the primary consumers, collectively driving over half of the total global demand in 2024.

Regulatory Push Toward Eco-Friendly Packaging

Governments across Europe, North America, and the Asia-Pacific are implementing bans and taxes on single-use plastics, compelling manufacturers to shift toward recyclable or compostable materials. Initiatives such as the EU Single-Use Plastics Directive and “Plastic Waste Management Rules” in India are accelerating the adoption of sustainable lids. This regulatory environment presents both challenges and opportunities, fostering R&D in alternative materials and driving growth in biodegradable packaging segments.

Material and Design Innovations

Advancements in molding technology, digital design, and material science have enabled manufacturers to produce lightweight, durable, and multifunctional lids. New designs integrate strawless sip-tops, stackable profiles, and tamper-evident seals suitable for automated packaging lines. These innovations reduce material costs and enhance consumer convenience, creating added value for both brands and end-users.

Market Restraints

Raw Material Price Volatility

Fluctuating costs of polypropylene (PP), polystyrene (PS), and bioplastics significantly affect manufacturer margins. Supply disruptions and petroleum price volatility further exacerbate these challenges, especially for small and mid-sized producers with limited cost absorption capacity.

Limited Recycling and Composting Infrastructure

Despite the rise in eco-friendly lids, recycling and composting infrastructure remains insufficient in many developing markets. Without efficient collection and processing systems, even biodegradable lids risk ending up in landfills, undermining sustainability goals and slowing market adoption.

Disposable Lid Market Opportunities

Sustainability and Circular Economy Integration

Growing environmental awareness presents opportunities for manufacturers to invest in renewable materials, closed-loop systems, and partnerships with recycling networks. Companies developing lids certified as home-compostable or easily recyclable are likely to command higher margins and brand loyalty from major QSR chains and eco-conscious consumers.

Expansion in Emerging Economies

Asia-Pacific, Latin America, and the Middle East are rapidly urbanizing, with rising disposable incomes and a growing café culture. Establishing local manufacturing and distribution facilities in these markets can reduce logistics costs and provide significant growth opportunities for international players seeking regional diversification.

Smart and Functional Lid Technologies

Innovation in smart packaging, such as heat-sensing color changes, RFID integration for quality tracking, and improved seal technology, can help differentiate premium brands. As automation in foodservice packaging grows, intelligent lids compatible with automated sealing machines will create new product niches and efficiency benefits.

Product Type Insights

Among product forms, sip-through lids dominate the global market, accounting for nearly 38% of revenue in 2024. Their widespread adoption in cafés and takeaway coffee outlets stems from convenience and improved design ergonomics. Dome-shaped lids are popular in cold beverage applications, while tamper-evident and flat lids are gaining traction in food-delivery packaging for soups and meals. Continuous R&D in lightweighting and leak resistance is expected to further strengthen the sip-through segment’s position over the forecast period.

Material Insights

Plastic lids primarily made of PP and PET lead the market with about 48% share in 2024, driven by cost efficiency and supply availability. However, paper and fiber-based lids are the fastest-growing segment, projected to grow at over 8% CAGR through 2030. Rising government regulations and corporate sustainability goals are pushing beverage brands toward recyclable and compostable alternatives.

End-Use Insights

Foodservice outlets, including QSRs, cafés, and restaurants, represent the largest end-use category with approximately 52% of global demand. Online food-delivery platforms and meal-kit services are emerging as the fastest-growing consumers of disposable lids. Institutions such as hospitals, schools, and corporate cafeterias are increasingly adopting hygienic, single-use packaging solutions, further fueling market expansion.

| By Material | By Product Form | By End-Use Industry | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America dominates the global disposable lid market, capturing roughly 34% share in 2024 (USD 780 million). The U.S. leads consumption with widespread coffee culture, large-scale QSR chains, and advanced recycling programs. Demand for paper and compostable lids is growing due to local plastic bans and sustainability commitments from national café chains.

Europe

Europe holds around 27% market share, with Germany, the U.K., and France leading regional demand. Strict environmental regulations, including the EU ban on single-use plastics, are accelerating the adoption of paper and fiber lids. Premium coffee chains and food-delivery apps are key consumers, emphasizing recyclable materials and circular packaging models.

Asia-Pacific

Asia-Pacific is the fastest-growing market, representing nearly 28% of the global share in 2024. China and India are the primary growth engines due to the rapid expansion of food-delivery services and rising café culture. Increasing local production capacities and government initiatives to reduce plastic waste are driving the adoption of sustainable lids across the region.

Middle East & Africa

MEA contributes about 11% of the global market, led by the Gulf Cooperation Council (GCC) countries. Growth is supported by expanding hospitality sectors, rising disposable income, and the proliferation of Western-style coffee chains. The region is also witnessing early-stage initiatives promoting biodegradable packaging.

Latin America

Latin America holds a modest share (6%) but presents strong growth prospects, particularly in Brazil and Mexico. Increasing investment by international foodservice chains and local manufacturers’ shift to recyclable materials are key growth enablers for the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Disposable Lid Market

- Dart Container Corporation

- Huhtamaki Oyj

- Pactiv Evergreen Inc.

- Berry Global Inc.

- Genpak LLC

- Greiner Packaging International GmbH

- Amcor Plc

- Fabri-Kal Corporation

- ECO-Products Inc.

- Sabert Corporation

- Reynolds Group Holdings Ltd.

- WinCup Inc.

- Airlite Plastics Co.

- Cosmoplast (Harwal Group)

- Michael Procos

Recent Developments

- In June 2025, Huhtamaki Oyj unveiled a new range of fully recyclable paper lids for hot beverages, developed using renewable fiber sourced from sustainably managed forests.

- In March 2025, Dart Container announced the expansion of its manufacturing facility in Georgia, U.S., to enhance production of recyclable PET and PLA lids for North American QSR chains.

- In January 2025, Pactiv Evergreen launched a new tamper-evident lid line tailored for the food-delivery industry, integrating a lightweight design and improved sealing performance.