Dishwasher Tablet Market Size

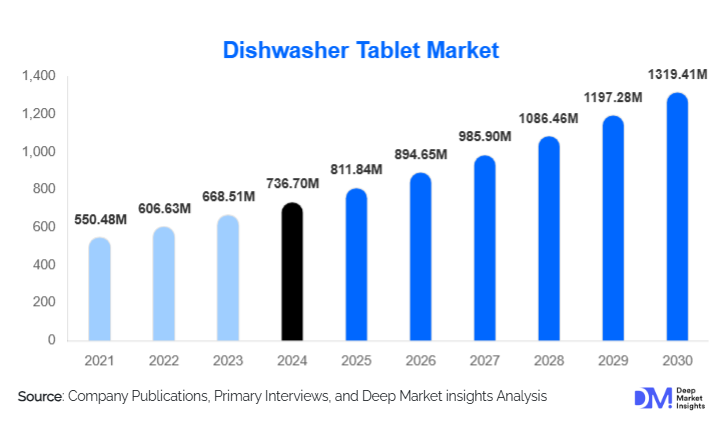

According to Deep Market Insights, the global dishwasher tablet market size was valued at USD 736.70 million in 2024 and is projected to grow from USD 811.84 million in 2025 to reach USD 1,319.41 million by 2030, expanding at a CAGR of 10.20% during the forecast period (2025–2030). The dishwasher tablet market growth is primarily driven by the rising penetration of automatic dishwashers, increasing demand for convenient and efficient cleaning solutions, and the growing adoption of eco-friendly and multi-action tablet formulations among consumers worldwide.

Key Market Insights

- Branded dishwasher tablets dominate the market, accounting for nearly 74% of total revenue in 2024, supported by strong brand trust and superior product innovation.

- Europe leads the global market with a 30.7% share, driven by mature dishwasher adoption and strict environmental regulations favoring eco-friendly cleaning products.

- Asia-Pacific is the fastest-growing region, with emerging economies such as China and India registering double-digit CAGRs due to rising appliance ownership.

- Multi-action tablets are the leading formulation type, offering detergent, rinse aid, and salt functions in a single unit and representing the future of household cleaning convenience.

- Online retail and D2C subscription channels are transforming distribution, enabling personalized offerings and recurring revenue models.

- Sustainability and biodegradable packaging innovations are shaping purchasing decisions, with consumers preferring phosphate-free, eco-certified tablets.

What are the latest trends in the dishwasher tablet market?

Rising Popularity of Eco-Friendly and Biodegradable Tablets

As environmental awareness grows, manufacturers are reformulating dishwasher tablets to be phosphate-free, biodegradable, and packaged in recyclable or compostable materials. Consumers, particularly in Europe and North America, are actively seeking green alternatives that align with sustainability values. Eco-certified tablets, made from plant-based surfactants and wrapped in water-soluble films, are gaining strong shelf traction. Regulatory pressure, such as the EU’s single-use plastics directive, has further accelerated innovation in biodegradable packaging and sustainable ingredients, creating a long-term growth pathway for eco-friendly dishwasher tablets.

Digital Transformation and Subscription-Based Sales Models

E-commerce and digital platforms are reshaping how consumers purchase household cleaning products. Dishwasher tablet brands are increasingly adopting subscription-based direct-to-consumer (D2C) models, ensuring timely refills and customer loyalty. Smart appliance integrations are also emerging; connected dishwashers can now reorder tablets automatically when supplies run low. Online channels enable dynamic pricing, targeted advertising, and customized bundles, making digital sales one of the fastest-growing segments in the market. These innovations enhance convenience and build recurring revenue streams for manufacturers.

What are the key drivers in the dishwasher tablet market?

Expanding Dishwasher Ownership

Global dishwasher penetration is steadily increasing, particularly in urban middle-class households. Rising disposable incomes, smaller family units, and time-constrained lifestyles are encouraging the shift toward automatic dishwashers. As the installed base of dishwashers expands, so does recurring demand for compatible tablets, which provide measured dosing, convenience, and improved washing efficiency. The rising affordability of compact dishwashers in Asia-Pacific and Latin America further enhances tablet market potential.

Consumer Preference for Multi-Action and Premium Products

Consumers are prioritizing convenience and superior performance, fueling the popularity of all-in-one or multi-action tablets. These tablets combine detergent, rinse aid, and salt substitute into a single format, eliminating the need for multiple cleaning agents. Premium tablets with advanced enzymes, fragrance-free options, and fast-dissolving layers are increasingly preferred by consumers willing to pay extra for hassle-free performance. This trend toward premiumisation drives revenue growth and improves manufacturer margins.

Sustainability and Regulatory Tailwinds

Government regulations promoting eco-friendly formulations and consumer awareness of environmental impact are reshaping the market. Regulations limiting phosphate use and mandating recyclable packaging are pushing companies toward greener innovation. Consumers’ willingness to pay for environmentally responsible brands has led to the rise of eco-lines from established players, positioning sustainability as both a growth driver and a competitive differentiator.

What are the restraints for the global market?

Price Sensitivity and Competition from Alternative Formats

Dishwasher tablets are priced higher per wash than powder or gel alternatives, which poses a challenge in cost-sensitive regions. Despite offering superior convenience and performance, tablets face competition from traditional detergents, especially in markets where price elasticity is high. Retailers and manufacturers must balance premium features with affordability to expand adoption among price-conscious consumers.

Low Dishwasher Penetration in Developing Regions

While developed economies exhibit mature dishwasher ownership, developing countries still rely heavily on manual dishwashing. Limited appliance affordability, inconsistent water supply, and low consumer awareness hinder tablet adoption in these markets. Manufacturers must address infrastructure barriers through local manufacturing, smaller pack sizes, and targeted education campaigns to tap into emerging demand effectively.

What are the key opportunities in the dishwasher tablet industry?

Untapped Potential in Emerging Markets

Regions such as India, Southeast Asia, and Africa offer significant white-space opportunities due to their low dishwasher and tablet penetration rates. As appliance affordability improves and urbanization accelerates, these regions present strong long-term potential. Localized manufacturing and strategic partnerships with appliance OEMs can help new entrants establish an early-mover advantage and capture market share in rapidly developing economies.

Innovation in Sustainable Formulations and Packaging

Eco-friendly product innovation remains one of the most lucrative opportunities. Brands investing in biodegradable, microplastic-free, and water-soluble tablet films will attract environmentally conscious consumers and comply with tightening global regulations. Companies that lead in sustainable product design, such as refillable packs or compostable pouches, can command premium pricing and brand loyalty, particularly in Europe and North America.

Integration of Smart Technologies and D2C Subscriptions

Partnerships between appliance manufacturers and detergent brands are unlocking new growth channels. Smart dishwashers that monitor tablet usage and reorder supplies automatically are redefining convenience and retention. Subscription models, supported by AI-based usage prediction and online analytics, will enhance customer lifetime value and reduce churn. For startups and new entrants, digital-first business models provide cost-effective access to global consumers.

Product Type Insights

Branded dishwasher tablets dominate the global market, commanding approximately 73.7% of total revenue in 2024. Market leaders such as Procter & Gamble (Fairy, Cascade), Reckitt Benckiser (Finish), and Unilever (Sun, Persil) have established strong consumer trust through decades of consistent performance, product innovation, and large-scale marketing. Their extensive distribution networks and continuous focus on premium, high-efficiency formulations ensure widespread availability and consumer loyalty. These brands are leveraging advanced cleaning enzymes, fragrance technologies, and water-softening additives to cater to diverse regional water conditions and dishwasher models. Meanwhile, private-label dishwasher tablets, distributed through supermarket chains and discount retailers, are gaining traction across Europe and Asia. Retailers such as Lidl, Aldi, and Carrefour are introducing competitive, eco-certified formulations that offer consumers a cost-effective alternative without compromising performance. This is particularly relevant in inflation-impacted markets, where consumers increasingly balance brand loyalty with affordability considerations.

Formulation Insights

Multi-action or all-in-one dishwasher tablets lead the market and are expected to maintain dominance throughout the forecast period (2025–2030). These tablets integrate detergent, rinse-aid, and salt substitute functions into a single unit, delivering superior convenience and time efficiency for consumers. Their performance in tackling grease, hard-water stains, and glass corrosion has led to widespread household adoption, particularly in mature markets such as North America and Europe. The growing preference for these formats is further driven by the trend toward eco-friendly and biodegradable formulations. Manufacturers are increasingly developing phosphate-free, plant-based, and water-soluble film technologies to meet stringent environmental standards and appeal to sustainability-conscious consumers. The rise of concentrated, low-temperature cleaning tablets also reflects ongoing innovation targeting energy efficiency and appliance longevity.

Distribution Channel Insights

Supermarkets and hypermarkets remain the largest distribution channel, contributing approximately 47.2% of global dishwasher tablet sales in 2024. Consumers continue to prefer these retail formats for their accessibility, in-store promotions, and ability to directly compare brands and prices. Loyalty programs and aggressive in-store marketing by key players have helped sustain this dominance. However, the landscape is rapidly evolving: online retail channels are expanding at double-digit growth rates, driven by the convenience of home delivery, subscription-based restocking models, and dynamic pricing. E-commerce platforms such as Amazon, Walmart, Alibaba, and regional grocery delivery apps are becoming critical sales enablers, especially in North America, Europe, and Asia-Pacific. This shift aligns with broader digital transformation trends in consumer packaged goods, where brands invest heavily in data-driven marketing, influencer partnerships, and targeted online advertising to capture younger, tech-savvy households.

End-Use Insights

The residential sector remains the primary driver of global dishwasher tablet demand, accounting for over 65% of the total market in 2024. The growing penetration of dishwashers in urban households, particularly among dual-income families and in compact living environments, continues to fuel demand. Rising awareness of water conservation, hygiene, and convenience is accelerating adoption in both developed and emerging economies. The commercial segment, which includes hotels, restaurants, cafeterias, and institutional kitchens, is also expanding steadily. This growth is supported by stringent hygiene regulations, rising standards in the hospitality and foodservice industries, and the global recovery of tourism post-pandemic. Export-driven demand from international hospitality chains further enhances consumption levels. As sustainability becomes a key differentiator, commercial operators are increasingly adopting energy-efficient dishwashers and high-performance tablets designed for bulk-use applications, strengthening long-term demand stability.

| By Product Type | By Formulation | By Distribution Channel | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

Europe

Europe leads the global dishwasher tablet market, representing approximately 30.7% of total revenue in 2024. High dishwasher penetration across households, strict eco-regulations, and mature consumer awareness of sustainability drive this leadership position. Germany, the U.K., and France are key contributors, with Germany leading in both volume and innovation adoption. Growth is propelled by rising demand for biodegradable and recyclable packaging solutions as European Union directives push for reduced plastic waste and carbon-neutral manufacturing. Local production clusters, advanced recycling infrastructure, and R&D investments in enzyme-based cleaning technologies further strengthen the region’s dominance. Moreover, strong private-label expansion through supermarket chains such as Aldi, Lidl, and Tesco reinforces consumer accessibility and price competition, maintaining Europe’s leadership in both value and volume.

North America

North America accounts for an estimated 25–28% of global market revenue in 2024, anchored by the United States’ strong dishwasher ownership rates and household disposable income. Consumers show a high preference for premium and fragrance-rich multi-action tablets, often marketed under well-known brands like Cascade and Finish. The region’s growth is supported by the proliferation of subscription-based sales models, direct-to-consumer e-commerce, and retail partnerships that ensure consistent product availability. In Canada, sustainability concerns are promoting a gradual transition toward phosphate-free and plant-based dishwasher tablets. Market growth is further bolstered by technological advancements in dishwashers themselves, such as smart load sensors and energy-efficient cycles, which complement the use of high-performance detergents.

Asia-Pacific

Asia-Pacific (APAC) is the fastest-growing regional market, valued at approximately USD 207 million in 2024 and projected to grow at a robust CAGR of 10.6% through 2030. Rapid urbanization, expanding middle-class populations, and growing consumer awareness of hygiene and convenience underpin this surge. China and India are emerging as key demand hubs, supported by increased dishwasher affordability and government initiatives promoting household appliance adoption. In Japan and Australia, mature consumer markets are shifting toward eco-friendly, concentrated formulations that emphasize sustainability and water efficiency. Retail modernization and the rise of regional e-commerce giants such as JD.com, Rakuten, and Flipkart have significantly expanded market reach. Additionally, increasing construction of modern residential complexes equipped with built-in dishwashers is stimulating recurring tablet demand, further solidifying APAC’s position as the most dynamic growth frontier.

Latin America

Latin America currently holds a smaller market share of approximately 7%, yet displays steady expansion driven by improving economic conditions and increasing dishwasher adoption in middle-income households. Brazil and Argentina are key growth markets where rising disposable incomes, greater exposure to Western lifestyle trends, and expanding modern retail networks are creating new opportunities. The ongoing introduction of affordable dishwashers by global appliance brands is further accelerating tablet sales. However, challenges persist due to price sensitivity and reliance on imported detergents, which expose regional markets to currency fluctuations and supply chain disruptions. Governments promoting local manufacturing and retail competition may help mitigate these risks over time.

Middle East & Africa

The Middle East and Africa (MEA) region, while holding a limited share of global revenue, presents significant long-term potential. GCC countries such as Saudi Arabia and the UAE are leading adoption, driven by rising urbanization, growing hospitality investments, and increasing adoption of modern home appliances. The region’s expanding luxury hospitality and tourism sectors are stimulating commercial demand for high-performance dishwasher tablets. In Africa, South Africa is emerging as a focal market due to the expansion of organized retail, improving appliance availability, and gradual shifts toward Western-style convenience living. Regional growth is further supported by government-led initiatives to diversify economies, build smart cities, and enhance residential infrastructure, creating fertile ground for sustained demand in the coming years.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Dishwasher Tablet Market

- Procter & Gamble

- Reckitt Benckiser

- Unilever

- Henkel

- Church & Dwight Co., Inc.

- McBride plc

- Ecolab Inc.

- Amway Corporation

- Seventh Generation Inc.

- Kao Corporation

- Colgate-Palmolive Company

- LIBY Group

- Eurotab

- Method Products, PBC

- Nopa Nordic A/S

Recent Developments

- In March 2025, Reckitt Benckiser expanded its Finish Quantum Ultimate range with a 100% biodegradable wrapper, targeting eco-conscious consumers in Europe and North America.

- In January 2025, Procter & Gamble launched a smart dishwasher tablet dispenser integrated with AI-based usage tracking for its Cascade Platinum line in the U.S. market.

- In July 2024, Henkel announced a USD 40 million investment in its German plant to upgrade production lines for sustainable, phosphate-free dishwasher tablets.