Digital Voice Recorder Market Size

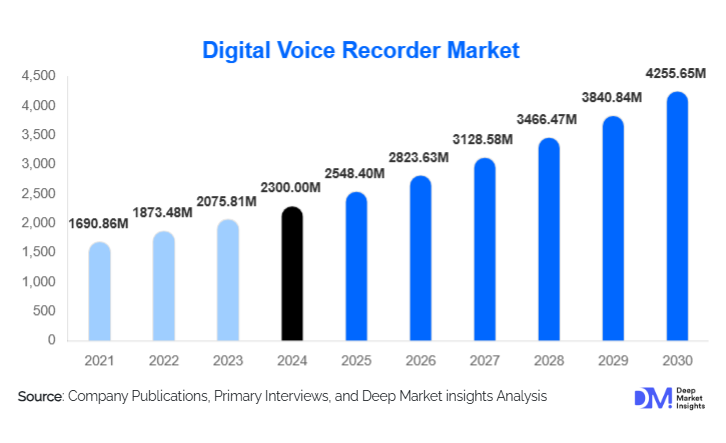

According to Deep Market Insights, the global digital voice recorder market size was valued at USD 2,300 million in 2024 and is projected to grow from USD 2,548.40 million in 2025 to reach USD 4,255.65 million by 2030, expanding at a CAGR of around 10.8% during the forecast period (2025–2030). Growth in the market is primarily driven by rising demand for high-quality audio capture across professional, educational, and personal applications, increasing adoption of AI-enabled transcription tools, and expanding usage of cloud-integrated recording ecosystems.

Key Market Insights

- Handheld digital voice recorders dominate the product landscape, driven by strong adoption among journalists, students, legal professionals, and corporate users.

- AI-powered speech-to-text and cloud connectivity are reshaping innovation, enabling automatic transcription, noise reduction, and multi-device synchronization.

- North America remains the largest market due to high professional usage and rapid adoption of advanced recording technologies.

- Asia-Pacific is the fastest-growing region, driven by rising education digitization, remote-learning adoption, and increased content creation in China and India.

- Professional-grade recorders lead application segments, supported by demand from law enforcement, media, legal services, and corporate enterprises.

- Growing penetration of wearable and pen-style recorders reflects shifts toward discreet, portable, and high-fidelity recording devices.

What are the latest trends in the digital voice recorder market?

AI-Integrated Transcription and Smart Workflow Automation

Digital voice recorders are rapidly evolving beyond simple audio-capture tools into intelligent workflow devices. Manufacturers are integrating AI-driven transcription engines capable of converting speech to text with high accuracy, reducing manual documentation efforts for journalists, lawyers, students, and medical professionals. Newer recorders also incorporate voice-activation, speaker identification, noise-cancelling algorithms, and auto-organizing transcription libraries. The integration of cloud storage is becoming standard, enabling multi-device access, remote collaboration, and secure backup of sensitive recordings. These innovations are transforming recorders from standalone devices into essential components of digital productivity ecosystems.

Miniaturized, Wearable, and Multi-Form-Factor Devices

A major trend shaping the market is the rise of ultra-portable recorders, including pen-type devices, clip-on wearables, and discreet pendant-style models. These formats support field reporters, law enforcement personnel, researchers, and students who require mobility and unobtrusive operation. Battery technology advancements and compact microphone arrays are enabling high-fidelity recording despite smaller device sizes. The trend is complemented by hybrid devices that pair with smartphones via Bluetooth or Wi-Fi, offering instant file transfer and editing capabilities. The shift toward miniaturized recording tools is attracting both consumer and enterprise users, expanding the market beyond traditional professional use cases.

What are the key drivers in the digital voice recorder market?

Growing Adoption in Professional and Enterprise Applications

High-quality audio documentation is increasingly essential across legal, corporate, healthcare, and media environments. Professional-grade digital recorders—featuring encryption, multi-channel audio, long battery life, and secure storage—have become critical tools for court proceedings, interviews, patient documentation, and business meetings. As enterprises standardize digital workflows and hybrid work expands, demand for reliable, portable, and high-fidelity recorders continues to rise. This represents the largest and most lucrative application segment in the global market.

Rapid Digitization of Education and Remote Learning

Universities, colleges, and training institutions are increasingly integrating digital learning tools, making voice recorders essential for capturing lectures, seminars, and research interviews. Students rely on recorders for revision and study support, while educators use them for content creation and remote teaching. The hybrid education model, adopted globally since 2020, remains a persistent growth driver as academic institutions continue to digitize instructional content, strengthening recorder demand across memory, portability, and transcription features.

What are the restraints for the global market?

Substitution from Smartphones and Recording Apps

Smartphones equipped with advanced microphones and built-in voice recording apps represent a major challenge. Casual users often prefer using their phones instead of purchasing a dedicated recorder, especially for basic note-taking or short recordings. While professional users still require specialty devices, the mass-market consumer segment faces strong substitution pressure. This dynamic compels manufacturers to differentiate through AI, noise cancellation, security, and superior audio fidelity.

High Costs of Advanced Features and Miniaturization

Premium recorders with AI transcription, wireless connectivity, high-resolution microphones, and encrypted storage come at significantly higher prices. The need for compact yet powerful components increases production costs, making such devices less accessible in price-sensitive regions. Manufacturers must balance advanced functionalities with affordability, posing a restraint on widespread adoption, particularly in emerging markets.

What are the key opportunities in the digital voice recorder industry?

AI-Driven Productivity Platforms

Integrating digital voice recorders with advanced AI platforms represents one of the most promising opportunities. Seamless speech-to-text, real-time language translation, and automated file organization can significantly improve user workflows across professional and academic settings. Companies can also develop subscription-based transcription and cloud services, shifting from hardware-only models to recurring revenue ecosystems. This hybrid business model offers scalability and enhanced customer retention.

Expansion into Education, Healthcare, and Law Enforcement Ecosystems

Mass adoption of digital learning and remote diagnosis is creating increasing opportunities in education and healthcare, while law enforcement agencies are expanding their use of secure, tamper-proof recorders for interviews, reporting, and field operations. These segments demand ruggedized, long-lasting, encrypted devices with multi-format support. Government-funded modernizations and institutional procurement programs present long-term opportunities for recorder manufacturers to build high-volume and high-value partnerships.

Product Type Insights

Handheld digital voice recorders dominate the product-type segment, accounting for approximately 40–45% of market share in 2024. Their popularity stems from superior audio fidelity, compatibility with professional workflows, and versatile functioning across journalism, education, and corporate settings. Pen-style recorders and wearable devices are gaining traction among law enforcement officers, researchers, and field journalists due to their discreet form factors. Desktop and specialty recorders cater to legal and studio applications where stable, continuous, and high-quality recording is necessary.

Application Insights

Professional applications remain the largest segment, driven by strong usage in legal, media, investigative, and corporate environments. Educational applications are rapidly rising due to the proliferation of hybrid learning and digital lecture capture. Personal-use devices remain relevant for diaries, note-taking, and creative content, while medical settings increasingly utilize recorders for clinical documentation. Business and enterprise deployment is expanding with growing requirements for meeting documentation and transcription.

Distribution Channel Insights

E-commerce platforms dominate sales due to transparent pricing, user reviews, and access to global brands. Direct-to-consumer sales via manufacturer websites are rising rapidly as companies promote bundled transcription and cloud services. Offline electronics retailers remain important for professional buyers who prefer physical evaluation before purchase. B2B and institutional procurement channels are expanding as enterprises and academic institutions adopt standardized digital voice recording tools.

End-User Industry Insights

Media & entertainment holds around 30% of the end-user market share, driven by demand from journalists, podcasters, and content creators. Education is among the fastest-growing end-user segments, supported by digital learning initiatives worldwide. Government and law enforcement agencies represent a high-potential segment due to the need for secure, tamper-proof recordings. Healthcare, BFSI, and corporate sectors continue to adopt recorders for documentation, compliance, and workflow digitization.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America leads the global market with a 35–40% share in 2024, driven by extensive demand from journalism, academia, law enforcement, and corporate environments. High adoption of advanced recorders with AI and cloud capabilities contributes to strong revenue generation. The U.S. market benefits from widespread digital workflow integration and rapid adoption of transcription technologies.

Europe

Europe contributes 20–25% of global demand, led by Germany, France, and the U.K. Strong academic and media sectors, combined with digital transformation in corporate and legal services, drive recorder usage. European institutions prioritize secure documentation tools, boosting demand for encrypted and professional-grade recorders.

Asia-Pacific

Asia-Pacific is the fastest-growing region, supported by expanding education systems, growing numbers of students, and rapid digitization in China, India, and Japan. Rising content creation, remote learning, and hybrid work models contribute to double-digit growth. China’s manufacturing strength also supports lower-cost production and higher domestic adoption.

Latin America

Latin America holds a modest 5–8% market share but is showing steady growth, particularly in Brazil and Mexico. Increasing adoption in education, small businesses, and media agencies drives incremental demand. The region’s growing creator economy also supports recorder adoption.

Middle East & Africa

MEA contributes 3–6% of global market value, with rising demand from educational institutions, government bodies, and corporate sectors. Countries like the UAE and Saudi Arabia show strong uptake of premium recorders due to high consumer spending power and digitization initiatives.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Digital Voice Recorder Market

- Sony Corporation

- Olympus Corporation

- Zoom Corporation

- Philips (Koninklijke Philips N.V.)

- Roland Corporation

- Panasonic Corporation

- Tascam (TEAC Corporation)

- Sennheiser

- Evistr

- Aiworth

- Hyundai Digital

- Maxpro

- TOOBOM

- Yamaha Corporation

- VoicePro Technologies

Recent Developments

- In 2025, Sony introduced a new AI-powered recorder line with real-time multilingual transcription and cloud backup capabilities.

- In 2025, Olympus launched a lightweight wearable recorder designed for journalists and law enforcement professionals seeking discreet, long-duration recording.

- In 2024, Zoom Corporation released upgraded professional recorders with enhanced stereo capture and USB-C high-speed data transfer.