Digital Slide Scanners Market Size

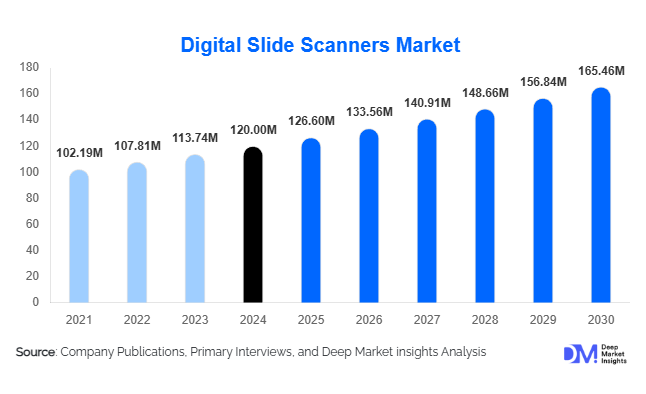

According to Deep Market Insights, the global digital slide scanners market size was valued at USD 120.00 million in 2024 and is projected to grow from USD 126.60 million in 2025 to reach USD 165.46 million by 2030, expanding at a CAGR of 5.5% during the forecast period (2025–2030). Market growth is primarily driven by the rapid transition from conventional microscopy to digital pathology, the rising need for telepathology and remote diagnostics, and the increasing integration of artificial intelligence (AI) in slide imaging workflows. Hospitals, diagnostic laboratories, and biopharmaceutical research centres are accelerating adoption as part of broader digitisation and healthcare modernisation initiatives.

Key Market Insights

- Automated digital slide scanners lead the market, accounting for over 57 % of 2024 revenues due to their high throughput and reduced manual handling.

- Brightfield technology dominates globally, representing approximately 70 % of total sales, supported by its extensive use in routine histopathology.

- Hospitals and clinical pathology laboratories constitute the largest end-user segment, holding about 36 % of the 2024 market.

- Asia-Pacific is the fastest-growing region, forecast to record a CAGR of 13–14 % to 2030, driven by healthcare digitisation in China and India.

- North America remains the largest market, contributing roughly 44 % of global revenues, with the U.S. leading adoption for primary diagnostics.

- AI-enabled scanners and cloud-integrated workflows are emerging as key differentiators in vendor offerings, improving diagnostic speed and accuracy.

What are the latest trends in the digital slide scanners market?

Telepathology and Remote Diagnostics Expansion

One of the strongest trends reshaping the market is the global adoption of telepathology. Hospitals and laboratories are increasingly digitising slides to enable cross-site consultations and remote primary diagnosis. This has been accelerated by healthcare network consolidation and the shortage of pathologists in rural and emerging regions. Cloud-based slide sharing platforms, coupled with secure LIS/PACS integration, allow instant case review and second opinions, reducing turnaround times and expanding diagnostic reach.

AI-Augmented Imaging and Workflow Automation

Vendors are embedding artificial intelligence into scanning software to automatically detect regions of interest, flag anomalies, and standardise image quality. AI-ready slide scanners, when integrated with pathology analytics platforms, support automated tissue segmentation, biomarker quantification, and cancer grading. Such integration not only improves throughput but also establishes the technological foundation for future precision-medicine applications. Leading players are partnering with AI pathology firms to develop end-to-end diagnostic solutions.

What are the key drivers in the digital slide scanners market?

Rising Adoption of Digital Pathology Workflows

Healthcare providers are shifting from glass slide microscopy to digital workflows to boost operational efficiency and enable data-driven diagnosis. Whole slide imaging enhances archiving, collaboration, and automation. Regulatory approvals for WSI in primary diagnosis and institutional digitisation projects are further accelerating market growth.

Growth of Telepathology and Remote Consultations

Cross-border and multi-site pathology collaboration is fueling demand for digital slide scanners. Hospitals use telepathology to link with reference labs and academic centres, reducing diagnostic delays and optimising pathologists' workload. This driver is especially strong in Asia-Pacific and Latin America, where specialist shortages are pronounced.

Integration with AI and Advanced Imaging Modalities

Growing interest in multi-modal imaging, combining brightfield, fluorescence, and Z-stack technologies, has led to higher-end scanner sales. AI-integrated imaging enhances diagnostic accuracy and reduces interpretation time, encouraging lab upgrades to next-generation scanners.

What are the restraints for the global market?

High Capital and Infrastructure Costs

Premium digital slide scanners can cost hundreds of thousands of dollars, making them inaccessible to small labs. Additionally, digitisation requires large storage capacity, high-bandwidth networks, and integration with existing LIS systems. These infrastructure requirements raise the total cost of ownership and slow penetration in resource-limited regions.

Regulatory and Workflow Standardisation Challenges

Despite growing acceptance, digital slides for primary diagnosis are still subject to regulatory restrictions in several countries. Validation requirements, data security compliance, and pathologist training create barriers to scaling digital pathology workflows across institutions.

What are the key opportunities in the digital slide scanners industry?

Expansion of Telepathology in Emerging Markets

Governments in the Asia-Pacific and the Middle East are promoting digital health infrastructure through public funding and telemedicine initiatives. Supplying affordable, portable digital slide scanners to regional hospitals offers manufacturers a significant growth avenue. Partnerships with telemedicine platforms can unlock new distribution channels and recurring service revenue.

Integration of AI-Powered Analytics

Combining AI with scanners creates high-value solutions for cancer screening, drug discovery, and research applications. Vendors offering cloud-based AI diagnostics or software-as-a-service (SaaS) models can generate recurring income beyond hardware sales. AI integration is expected to be a key competitive differentiator by 2030.

Emerging Market Digitisation Programs

Initiatives like India’s “Digital Health Mission” and China’s “Made in China 2025” are driving local production and deployment of medical imaging equipment. Regional manufacturers and joint ventures stand to benefit from domestic procurement and export opportunities to other developing regions.

Product Type Insights

Automated digital slide scanners remain the cornerstone of the global market, accounting for approximately 57% of the total market in 2024 ( USD 90 million). Their dominance stems from advanced automation features such as high-speed batch scanning, auto-focusing, and robotic slide loaders that drastically improve workflow efficiency. Automated scanners cater primarily to hospitals, research laboratories, and pathology networks that process thousands of slides daily. The growing integration of AI-assisted image analysis and cloud-based archiving has further strengthened this segment, allowing pathologists to manage large-scale diagnostic workloads remotely. Vendors are now focusing on enhancing throughput, resolution, and software interoperability to align with digital pathology platforms and LIMS systems.

In contrast, manual and portable scanners occupy niche segments, addressing low-throughput needs such as training, academic research, and field pathology. These systems appeal to smaller labs or educational institutions where cost and flexibility outweigh automation requirements. However, their limited capacity restricts scalability. The market trend suggests a gradual shift toward semi-automated systems that bridge the affordability of manual scanners with the performance of automated ones, providing a cost-effective pathway for emerging markets to transition toward full digital workflows.

Application Insights

Clinical diagnostics continue to represent the largest application area, commanding roughly 43% of the global market in 2024 ( USD 69 million). The growing reliance on digitized slides for oncology, hematology, and histopathology has transformed diagnostic workflows, enabling faster and more consistent interpretations. The FDA and EMA’s progressive stance on whole slide imaging (WSI) for primary diagnosis has further legitimized digital pathology adoption in clinical settings. Moreover, increasing cancer incidence and the need for second-opinion consultations are driving laboratories toward digital systems that enable remote collaboration and telepathology.

Research and drug discovery form the second-largest application segment, with demand driven by pharmaceutical and biotech firms leveraging digital imaging for biomarker validation, toxicology studies, and histological profiling. As AI-powered image quantification gains traction in preclinical research, slide scanners are being integrated with high-content analytics software for data-rich image management. Telepathology and education/training applications are also witnessing accelerated growth due to enhanced cloud connectivity, e-learning platforms, and virtual slide sharing for academic collaboration across borders.

End-User Insights

Hospitals and clinical pathology laboratories dominate end-user demand, accounting for around 36% of total revenues in 2024 ( USD 58 million). This dominance is attributed to high diagnostic volumes, regulatory validation for digital pathology in clinical workflows, and growing emphasis on precision medicine. Health systems in the U.S., Japan, and Europe are rapidly digitizing histopathology departments to enable AI-assisted diagnostics and centralize case review. Large reference laboratories are deploying networked slide scanners to handle regional and national workloads.

Pharmaceutical and biotechnology companies represent the fastest-growing user group, projected to grow at a CAGR of nearly 13% through 2030. The need for faster target validation, biomarker analysis, and tissue profiling in drug development pipelines has spurred the adoption of digital scanners. Contract Research Organizations (CROs) are another strong end-user segment, contributing to outsourced preclinical and toxicological assessments. Academic institutes continue to be pivotal for training, research collaborations, and AI algorithm development using open-access slide repositories. Collectively, these end-users drive a virtuous cycle of adoption, innovation, and data generation across the ecosystem.

| Product Type | Application | End-User |

|---|---|---|

|

|

|

Regional Insights

North America

North America led the digital slide scanners market with about 44% share in 2024 ( USD 70 million). The United States dominates regional demand, supported by FDA approval of WSI for primary diagnosis, robust pathology infrastructure, and early adoption of AI-assisted image analysis. The presence of leading scanner manufacturers, strong investment in precision medicine, and centralized pathology networks fuel growth. The trend of integrating scanners with AI pathology algorithms and electronic health record (EHR) systems continues to boost upgrades among hospitals and diagnostic networks. Canada is also expanding digital pathology pilots, especially within provincial cancer screening programs. Overall, government incentives for digital transformation in healthcare and collaborations between academia and AI firms are key drivers of regional growth.

Europe

Europe holds a market share of 20–25% ( USD 35 million), led by Germany, the U.K., and France. Regional growth is driven by government-backed digital health initiatives, increasing R&D investments, and pan-European research collaborations such as Horizon Europe. Academic medical centers are deploying scanners for multicenter pathology trials, while hospitals adopt WSI systems to improve diagnostic turnaround times and support teleconsultations. The European Digital Pathology Association (EDPA) and growing reimbursement coverage for digital workflows are accelerating adoption. Germany’s investment in AI-integrated diagnostics and the U.K.’s NHS digitization roadmap are key enablers of continued growth through 2030.

Asia-Pacific

Asia-Pacific (APAC) is the fastest-growing regional market, projected to expand at a CAGR of 13–14% between 2025 and 2030. The region’s growth is underpinned by rising healthcare expenditure, expanding biopharma research, and government-led AI initiatives. China and Japan lead in technology integration, supported by domestic scanner manufacturing and increasing regulatory approvals. India’s digital slide scanner market is expected to grow from approximately USD 5 million in 2024 to USD 11 million by 2030, driven by public health digitization and adoption among private diagnostic chains. South Korea is leveraging digital scanners in pathology AI validation projects, while Australia is emphasizing remote diagnostic capabilities for rural healthcare. The convergence of cloud computing, AI analytics, and digital pathology training programs positions APAC as a major growth engine globally.

Latin America

Latin America contributes less than 10% of global revenues but is showing gradual adoption in key markets such as Brazil, Mexico, and Argentina. Growth is driven by the expansion of private diagnostic laboratory chains, rising cancer screening initiatives, and partnerships with North American vendors. While import dependency remains high, regional governments are investing in digital pathology for public health laboratories. Brazil’s initiatives in AI-assisted diagnostics and Mexico’s telepathology pilot programs are paving the way for broader adoption, although infrastructure gaps continue to constrain faster growth.

Middle East & Africa

The Middle East & Africa (MEA) region is still in the early stages of adoption but offers substantial long-term potential. GCC countries such as the UAE, Saudi Arabia, and Qatar are actively investing in digital pathology infrastructure for oncology screening and medical training. South Africa and Egypt are exploring telepathology applications to address diagnostic shortages in remote regions. Public-private partnerships, along with government digitization programs such as Saudi Vision 2030 and UAE Smart Health Strategy, are expected to propel market growth. The region’s focus on healthcare modernization, medical education, and cross-border collaboration positions MEA as a frontier growth region for the digital slide scanners market over the next decade.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Digital Slide Scanners Market

- Danaher Corporation (Leica Biosystems)

- Hamamatsu Photonics K.K.

- Koninklijke Philips N.V. (Philips Healthcare)

- Olympus Corporation

- 3DHISTECH Ltd.

- Nikon Corporation

- Roche Holdings AG (Ventana Medical Systems)

- Indica Labs Inc.

- Huron Digital Pathology Inc.

- Paige.AI Inc.

- Visiopharm A/S

- OptraSCAN Inc.

- ZEISS Group

- Aperio Technologies (merged under Leica)

- Motic Digital Pathology Ltd.

Recent Developments

- June 2025 — Leica Biosystems (Danaher) launched its next-generation Aperio GT 500 scanner series with AI-based focusing and faster throughput for clinical labs.

- April 2025 — Hamamatsu Photonics introduced a fluorescence slide scanner optimized for multi-channel biomarker analysis in drug discovery.

- February 2025 — Philips Healthcare expanded its digital pathology cloud platform to support real-time remote consultation across Europe and Asia.