Diamond Core Barrels Market Size

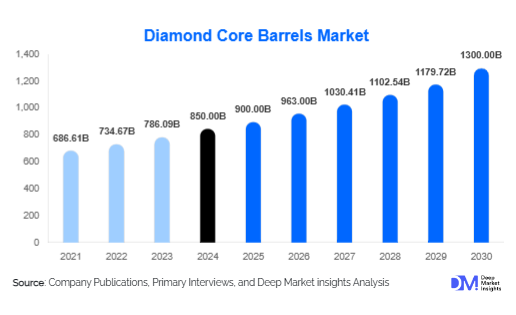

According to Deep Market Insights, the global diamond core barrels market size was valued at USD 850 million in 2024 and is projected to grow from USD 900 million in 2025 to reach USD 1,300 million by 2030, expanding at a CAGR of 7.0% during the forecast period (2025-2030). The market growth is primarily driven by increasing mining and mineral exploration activities, growing demand for precision drilling in civil infrastructure projects, and advancements in barrel technology, such as tungsten carbide-tipped and multi-tube designs.

Key Market Insights

- Mining and mineral exploration dominate global demand, driven by the need for accurate core recovery and high-quality geological data.

- Technological advancements in barrel design, including double and triple-tube barrels, have improved core recovery rates and durability, enhancing operational efficiency.

- APAC leads the market, with China, India, and Australia accounting for a significant share due to large-scale mining and infrastructure projects.

- North America and Europe are major mature markets, with sustained demand from mining, oil & gas, and civil engineering applications.

- Export potential is rising, with high-quality barrels manufactured in Germany, Japan, and Canada being exported to developing countries.

- Government infrastructure initiatives, such as India’s “Make in India” and China’s “Made in China 2025,” are boosting domestic production and adoption.

What are the latest trends in the diamond core barrels market?

Technological Enhancements in Barrel Design

Manufacturers are increasingly focusing on improving barrel durability, precision, and core recovery rates. Innovations such as tungsten carbide-tipped barrels, alloy steel constructions, and multi-tube designs allow for efficient drilling in both soft and hard rock formations. Automated barrel systems and precision engineering reduce operational downtime, attract premium clients, and increase productivity in high-demand sectors. These trends are particularly prevalent in mining-intensive regions like APAC and North America.

Adoption of High-Performance Materials

Steel and tungsten-based diamond core barrels dominate the market due to their strength and wear resistance. Companies are investing in specialty alloys to create barrels with extended lifespans and lower maintenance costs. The use of advanced materials is also supporting export-driven growth, as high-quality barrels are shipped to emerging economies where exploration and construction activities are expanding rapidly.

What are the key drivers in the diamond core barrels market?

Increasing Mining and Mineral Exploration

Rising global demand for minerals, metals, and construction materials is driving exploration and mining activities. Diamond core barrels are essential for obtaining high-quality core samples, particularly in hard rock formations. Countries such as China, India, Australia, and Canada are heavily investing in mining exploration, creating a steady demand for advanced barrels.

Infrastructure Development and Civil Engineering Growth

Large-scale infrastructure projects, including highways, tunnels, and urban development, require accurate geological surveys. Diamond core barrels are increasingly used to obtain precise soil and rock data, facilitating safe and efficient project execution. Government funding and public infrastructure spending are amplifying demand in this sector.

Technological Advancements and Customization

New barrel designs, including double and triple-tube models, enhance recovery rates and operational efficiency. Manufacturers are offering tailored solutions for different rock types and drilling conditions, attracting mining and oil & gas companies willing to invest in high-performance barrels.

What are the restraints for the global market?

High Cost of Advanced Barrels

Premium diamond core barrels, especially multi-tube and tungsten carbide-tipped barrels, are expensive, limiting adoption among smaller firms or price-sensitive markets. High upfront costs remain a significant barrier, particularly in emerging economies.

Fluctuating Raw Material Prices

Steel, tungsten, and alloy price volatility impacts manufacturing costs and profit margins. Manufacturers must navigate price fluctuations carefully, as sudden increases can slow market growth and affect competitive pricing strategies.

What are the key opportunities in the diamond core barrels market?

Expansion in Emerging Economies

Rapid industrialization and urbanization in India, China, Brazil, and Mexico are driving demand for diamond core barrels in mining, oil & gas, and civil construction projects. Companies can capitalize on these opportunities by establishing local manufacturing or strategic partnerships to meet growing regional requirements.

Integration of Advanced Technologies

Investment in R&D for high-performance barrels, including automated systems, laser-cut components, and improved alloy compositions, is opening premium market segments. Advanced barrels increase operational efficiency and attract clients willing to pay for superior performance, particularly in challenging drilling environments.

Government Initiatives and Public Infrastructure Spending

Programs like India’s “Make in India,” China’s “Made in China 2025,” and North American infrastructure funding are stimulating domestic demand for diamond core barrels. These initiatives encourage modernization, local manufacturing, and the adoption of precision drilling technologies, creating sustainable growth pathways for market participants.

Product Type Insights

Double tube barrels dominate the market, representing approximately 35% of global demand in 2024. They are preferred due to superior core recovery and efficiency in hard rock applications. Steel barrels account for 45% of the market, favored for their durability and cost-effectiveness. Medium-size barrels (77-115 mm) hold 40% market share, being the standard choice for mining and civil engineering projects. Mining and mineral exploration are the leading applications, representing 50% of global market demand.

Application Insights

Mining and mineral exploration remain the primary applications, driven by global ore and mineral extraction activities. Civil engineering projects, including tunnels, bridges, and foundations, are growing rapidly due to increased infrastructure spending. Oil & gas exploration and water well drilling are emerging applications contributing to incremental market growth, particularly in APAC and North America.

| By Product Type | By Material/Construction | By Size/Diameter | By Application/End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for 25% of the 2024 market, led by the U.S. and Canada. High mining activity, oil & gas exploration, and government infrastructure initiatives drive demand. Advanced barrel adoption is high due to the preference for precision and operational efficiency.

Europe

Europe represents 20% of the 2024 market, with Germany, France, and Russia as key markets. Demand is supported by industrial applications, mining exploration, and infrastructure projects. Germany is a major importer of high-quality barrels.

Asia-Pacific

APAC is the largest and fastest-growing market, with a 38% share in 2024. China, India, and Australia are driving growth through mining exploration, urban infrastructure projects, and energy sector developments. CAGR in this region exceeds the global average due to government initiatives and industrial expansion.

Middle East & Africa

MEA holds 10% of the market, driven by South Africa’s mining sector and energy exploration in Saudi Arabia and the UAE. Regional exploration and construction projects are increasing the demand for high-performance barrels.

Latin America

LATAM represents 7% of the market, with Brazil and Chile as major contributors due to active mining operations. Emerging infrastructure projects are creating additional opportunities for diamond core barrel adoption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Diamond Core Barrels Market

- Boart Longyear

- Sandvik AB

- Epiroc AB

- Atlas Copco

- Irwin Tools

- Hilti AG

- Ingersoll Rand

- Kennametal Inc.

- Dando Drilling International

- FLSmidth

- Mitsubishi Materials Corporation

- Saint-Gobain Diamond Tools

- Rexton Drilling Solutions

- Drillco Inc.

- Baker Hughes

Recent Developments

- In June 2025, Boart Longyear introduced a new triple-tube diamond core barrel with enhanced tungsten carbide tips, improving core recovery in hard rock formations.

- In April 2025, Sandvik AB expanded its high-performance barrel production line in China to meet growing APAC demand for mining and civil applications.

- In March 2025, Epiroc AB launched a digital monitoring system for barrels, allowing operators to track wear and optimize drilling efficiency in real-time.