Desk Lamp Market Size

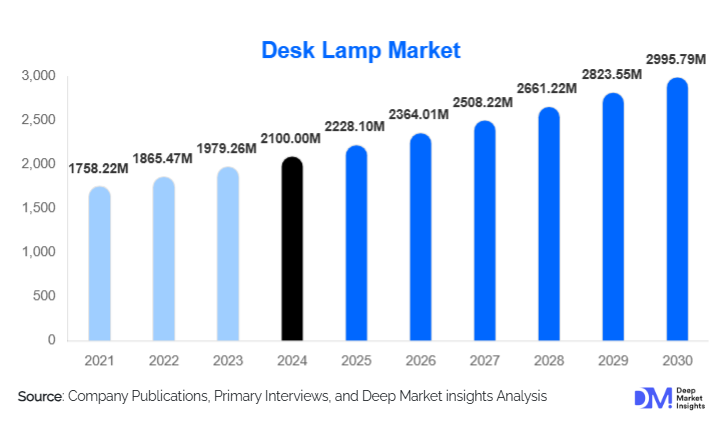

According to Deep Market Insights, the global desk lamp market size was valued at USD 2,100 million in 2024 and is projected to grow from USD 2,228.1 million in 2025 to reach USD 2,995.79 million by 2030, expanding at a CAGR of 6.1% during the forecast period (2025–2030). Market growth is driven by rising adoption of remote and hybrid work models, growing emphasis on ergonomic and eye-healthy lighting, and rapid penetration of energy-efficient and smart LED desk lamps across residential and commercial environments.

Key Market Insights

- LED desk lamps dominate global demand, driven by energy efficiency, long operating life, and adjustable light-temperature features.

- Smart and connected desk lamps are the fastest-growing segment, boosted by IoT integration, voice assistant compatibility, and wireless charging functionality.

- Residential applications lead global usage due to increasing work-from-home adoption, online learning, and premium home-office setups.

- North America represents the largest regional market, supported by high consumer spending on home and office furnishings.

- Asia-Pacific is the fastest-growing region, fueled by expanding middle-class populations and surging manufacturing output in China and India.

- E-commerce is rapidly transforming distribution channels, with Amazon, Alibaba, and brand-owned D2C websites driving sales.

What are the latest trends in the desk lamp market?

Rise of Smart, Connected & Multi-Functional Desk Lamps

The integration of IoT-enabled features, such as mobile app control, voice activation, brightness automation, and energy monitoring, is reshaping the desk lamp market. Modern desk lamps increasingly incorporate wireless charging pads, USB-C ports, ambient light sensors, and programmable color temperatures to support productivity, screen-work comfort, and energy savings. This trend aligns with the global shift toward smart homes, appealing particularly to tech-savvy users seeking multifunctional work-desk accessories. Brands are also launching modular, minimalist, and sustainable designs that fit premium décor themes, reinforcing the trend of lamps as both functional and aesthetic products.

Premiumization & Ergonomic Lighting Design

Consumers are placing greater emphasis on eye-care, posture alignment, and focused task lighting. This has pushed manufacturers to integrate anti-glare optics, flicker-free LED systems, adjustable arms, and customizable brightness modes. The surge in professional home offices has led to a higher willingness to invest in premium desk lamps made with aluminum alloys, precision joints, and minimalistic industrial design. Decorative and design-led lamps are also gaining traction in retail and hospitality environments where style and ambience play a key role in purchasing decisions.

What are the key drivers in the desk lamp market?

Growing Adoption of Remote Work and E-Learning

With millions of users adopting permanent or hybrid remote working models, the need for dedicated workspace lighting has surged. Students increasingly require task lighting for digital learning and prolonged study hours, reinforcing sustained demand for desk lamps. This shift is structural rather than temporary, and it continues to create long-term growth momentum across residential markets.

Shift Toward LED Lighting and Energy Efficiency

Consumers and institutions are moving from incandescent, halogen, and fluorescent desk lamps toward LED-based models that consume less power and deliver superior light quality. Governments worldwide are implementing efficiency regulations and phasing out high-energy light sources, accelerating LED adoption. Adjustable color temperature and flicker-free output have made LED the preferred choice in both homes and offices.

Increasing Demand for Smart Features and Modern Aesthetics

The desire for modern, clutter-free, and tech-enhanced furniture elements has made smart desk lamps an attractive category. Built-in wireless chargers, USB ports, adaptive ambience lighting, and connectivity with smart-home ecosystems contribute to rising demand. These lamps often command premium pricing, helping manufacturers improve margins while diversifying product portfolios.

What are the restraints for the global market?

Intense Price Competition and Market Saturation

The desk lamp market faces substantial pricing pressure due to the presence of numerous manufacturers offering low-cost products, especially across Asia. Commoditization in basic lamp categories affects brand differentiation and reduces margins. Consumers often prioritize price over long-term quality in the budget segment, limiting premium adoption in price-sensitive regions.

Volatile Raw Material and Component Costs

Fluctuations in prices of LEDs, electronic drivers, metals, plastics, and semiconductors impact production costs. Supply-chain challenges, such as chip shortages or shipping constraints, can delay delivery cycles and elevate final retail prices. These risks particularly affect manufacturers dependent on imported components and those operating with narrow margins.

What are the key opportunities in the desk lamp industry?

Integration of IoT, Sensors & Wireless Charging

Smart desk lamps equipped with wireless charging pads, USB-C hubs, motion sensors, and app-based controls represent a major innovation opportunity. This segment is growing at double the market CAGR, and manufacturers can differentiate through modular add-ons, AI-driven light optimization, and integration with smart home ecosystems like Google Home, Alexa, and Apple HomeKit.

Growth of Emerging Markets and Design-Led Lighting

Asia-Pacific (India, China, Southeast Asia) and Latin America offer significant growth potential as urbanization and disposable incomes rise. Consumers in these regions are increasingly shifting toward organized retail and branded home furnishings. Premium, stylish, and minimalist desk lamps are gaining popularity, creating opportunities for companies to expand through both offline retail and e-commerce channels.

Product Type Insights

Task desk lamps hold the largest share of the global market, accounting for approximately 45% of the 2024 market. These lamps are preferred for focused illumination, adjustable intensity, and user-friendly ergonomic design. Smart and multifunctional desk lamps represent the fastest-growing product category, driven by demand for wireless charging, USB hubs, and app/voice-controlled lighting. Decorative desk lamps continue to serve hospitality and lifestyle-focused consumers, while compact rechargeable lamps are increasingly popular for portable use cases.

Application Insights

Residential applications dominate the market, representing about 55% of total demand in 2024, primarily due to hybrid work adoption and increasing home-office setups. Commercial usage, including offices, co-working spaces, and corporate workstations, accounts for roughly 30% and is poised for steady upgrades as companies focus on employee wellness and productivity. Educational institutions represent the remaining share, as schools and universities prioritize eye-care and energy-efficient lighting solutions for modern study environments.

Distribution Channel Insights

Online distribution channels account for nearly 40% of global desk lamp sales in 2024 and continue to grow rapidly due to product variety, price transparency, and doorstep convenience. E-commerce platforms such as Amazon, Alibaba, Flipkart, and brand-owned D2C sites are central to market expansion. Offline retail, including lighting stores, furniture chains, and contract-based institutional procurement, still holds a majority share but is steadily losing ground to online sales. Omnichannel models combining physical experience with online checkout are gaining traction.

End-Use Insights

The fastest-growing end-use category is residential home offices, driven by long-term hybrid work adoption. Commercial end-users (corporate offices, co-working spaces, libraries) are upgrading to energy-efficient LED desk lamps with ergonomic and smart features. New use applications, including gaming setups, livestreaming studios, and design-oriented décor, are expanding market boundaries. Export-driven demand from China, India, and Vietnam continues to support global supply and cost-effective procurement.

| By Product Type | By Application | By Distribution Channel | By Material | By Lighting Technology |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for the largest share of the global desk lamp market at approximately 37% in 2024. The U.S. leads demand due to the widespread adoption of home offices, a strong culture of aesthetic-focused interior décor, and early adoption of smart lighting technologies. Canada contributes additional growth through premium retail purchases and rising student populations.

Europe

Europe represents the world’s second-largest premium desk lamp region, with design-centric markets including Germany, the U.K., France, and Italy. Strict energy-efficiency regulations and demand for sustainable, minimalist Scandinavian designs drive steady growth. Europe accounts for nearly 20% of the global share in 2024.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expected to expand at a CAGR above the global average. China dominates manufacturing and consumption, while India and Southeast Asia are emerging as major demand hubs due to rapid urbanization and increasing middle-class incomes. Japan and South Korea contribute additional demand through premium LED and smart-home products.

Latin America

LATAM demand is gradually increasing in Brazil, Mexico, and Argentina, driven by growing urban middle-class populations and rising e-commerce penetration. While the region represents a smaller portion of global demand, the trend toward home-office setups and design-driven décor is boosting adoption.

Middle East & Africa

MEA shows rising demand, particularly in the GCC countries (UAE, Saudi Arabia, Qatar), supported by high consumer spending and strong hospitality expansion. Africa’s desk lamp market is smaller but growing due to educational infrastructure development and increasing access to organized retail.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Desk Lamp Market

- Signify (Philips Lighting)

- Artemide S.p.A.

- BenQ Corporation

- FLOS S.p.A.

- Herman Miller, Inc.

- IKEA

- Koncept Inc.

- OPPLE Lighting

- OttLite Technologies

- Xiaomi Corporation

- Pablo Designs

- Panasonic Holdings Corporation

- Toshiba Lighting

- Newhouse Lighting

- GUANYA

Recent Developments

- In April 2025, BenQ introduced a new generation of eye-care LED desk lamps with adaptive brightness technology designed for hybrid workers.

- In March 2025, Signify launched a smart-home integrated desk lamp lineup featuring Matter compatibility and voice automation.

- In January 2025, Artemide announced a partnership with European design studios to develop eco-friendly aluminum desk lamps using recycled materials.