Dermal Fillers Market Size

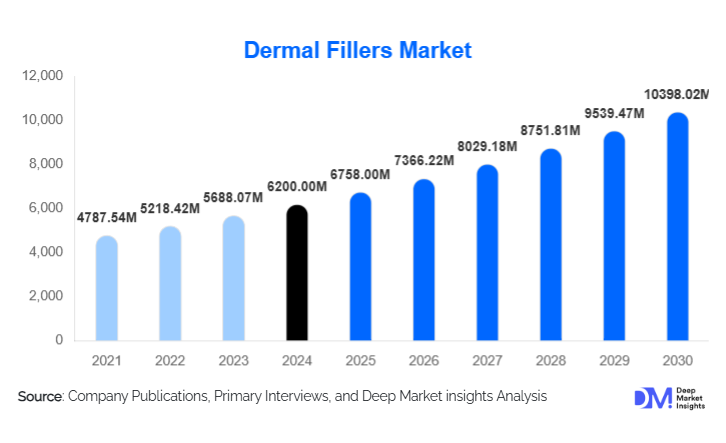

According to Deep Market Insights, the global Dermal Fillers market size was valued at USD 6,200 million in 2024 and is projected to grow from USD 6,758 million in 2025 to reach USD 10,398.02 million by 2030, expanding at a CAGR of 9% during the forecast period (2025–2030). The market growth is primarily driven by the rising demand for minimally invasive aesthetic procedures, technological innovations in filler formulations, and increasing awareness among consumers about cosmetic enhancements across emerging and mature regions.

Key Market Insights

- Hyaluronic Acid (HA) fillers dominate globally, accounting for approximately 80% of the market, due to safety, reversibility, and a wide range of applications from wrinkle correction to lip augmentation.

- Wrinkle correction remains the leading application, representing over 45% of total treatment revenue in 2024, as consumers prioritize anti-aging and facial rejuvenation procedures.

- MedSpas and aesthetic clinics are driving end-user adoption, capturing nearly 35% of the market share in 2024, by providing specialized, consumer-focused, and convenient services.

- North America holds the largest regional share, around 38% in 2024, driven by high disposable incomes, widespread clinic networks, and regulatory support.

- Asia-Pacific is the fastest-growing region, fueled by rising middle-class affluence, medical tourism, and increasing acceptance of cosmetic procedures in China, India, and Southeast Asia.

- Technological advancements, including long-lasting and hybrid fillers, microcannula injection techniques, and AI-assisted treatment planning, are enhancing patient satisfaction and market adoption.

Latest Market Trends in Dermal Fillers

Long-Lasting and Hybrid Filler Innovations

Manufacturers are increasingly focusing on developing long-duration, hybrid, and biostimulatory fillers. These products combine hyaluronic acid with collagen-stimulating agents or other innovative formulations to extend longevity, reduce the frequency of treatments, and deliver more natural results. Crosslinking technologies, higher purity HA, and improved biocompatibility are key trends enhancing the safety profile and patient preference for premium fillers. This innovation-driven approach also helps companies differentiate their portfolios and command higher margins.

Expansion of MedSpas and Non-Surgical Aesthetic Clinics

The growth of medspas and dedicated aesthetic clinics is reshaping the dermal fillers landscape. These centers offer a wide range of minimally invasive procedures in comfortable, non-hospital environments, appealing to younger demographics and male consumers. The flexible operating models, shorter recovery periods, and personalized services offered by medspas have contributed to rapid adoption, especially in urban and suburban areas. Clinics are also integrating digital tools for patient consultation, treatment planning, and post-procedure follow-up to improve outcomes and retention.

Market Drivers

Increasing Demand for Minimally Invasive Procedures

Patients are increasingly seeking non-surgical aesthetic solutions due to shorter recovery times, lower risk, and reduced cost compared to surgical interventions. Social media and influencer culture have normalized cosmetic enhancements, particularly among younger consumers, expanding the target audience for dermal fillers. Preventative treatments for fine lines and early aging are gaining traction, further driving demand across age groups 25–50.

Technological Advancements and Improved Formulations

Recent innovations in crosslinked HA, hybrid fillers, and longer-lasting formulations are improving safety, effectiveness, and patient satisfaction. Microcannula techniques, 3D imaging, and AI-assisted treatment planning are enhancing precision and reducing adverse events, fostering greater consumer confidence and repeat procedures.

Rising Awareness and Disposable Income

In both developed and emerging markets, growing disposable incomes, increasing aesthetic consciousness, and aging populations are driving the adoption of dermal fillers. Male consumers and younger individuals seeking preventative or aesthetic enhancements are expanding the market, particularly in North America, Europe, and the Asia-Pacific.

Market Restraints

High Cost and Affordability

The relatively high cost of dermal fillers, including product and procedure fees, limits accessibility for price-sensitive consumers. In emerging markets, affordability remains a barrier to mass adoption, while repeat treatments for maintenance add to long-term expenses, constraining overall growth.

Safety Concerns and Regulatory Hurdles

Risks of allergic reactions, vascular complications, and granulomas, coupled with varying regulatory standards across countries, pose challenges. Stricter approvals for new formulations and safety concerns regarding counterfeit products can slow adoption and increase operational costs for manufacturers and clinics.

Dermal Fillers Market Opportunities

Innovation in Filler Materials

Developing advanced, long-lasting, and hybrid fillers with improved safety and natural results presents significant growth potential. Patented formulations, crosslinking improvements, and biostimulatory fillers allow premium pricing and brand differentiation, attracting high-end consumers seeking minimally invasive but long-term aesthetic solutions.

Expansion into Emerging Markets

Regions such as Asia-Pacific, Latin America, and the Middle East are underpenetrated and exhibit high growth potential. Rising disposable incomes, increasing medical tourism, and growing awareness of aesthetic procedures provide opportunities for market expansion, regional partnerships, and local manufacturing to reduce costs and enhance accessibility.

Regulatory and Governance Enhancements

Stronger regulatory oversight, certifications, and standardized training programs improve safety and consumer trust. Companies investing in compliance, clinical trials, and certification can differentiate themselves and expand into new geographies while mitigating risks associated with adverse events and counterfeit products.

Product Type Insights

Hyaluronic Acid fillers dominate the product segment, favored for safety, reversibility, and broad application in wrinkle correction, lip augmentation, and facial contouring. Non-HA fillers, including calcium hydroxylapatite and poly-L-lactic acid, are niche but growing in biostimulatory applications. Long-lasting and hybrid fillers are increasingly gaining adoption, reflecting the trend toward premium, differentiated products.

Application Insights

Wrinkle correction remains the leading application, contributing over 45% of 2024 revenue, due to high demand for anti-aging treatments. Lip augmentation, cheek volume restoration, and tear trough correction are among the fastest-growing applications. Scar correction and body area enhancements represent emerging applications, especially in medical tourism and aesthetic clinics.

Distribution Channel Insights

MedSpas and aesthetic clinics dominate distribution, offering personalized services and flexible scheduling. Hospitals and dermatology clinics maintain steady demand, while online platforms and teleconsultations are emerging channels for patient engagement, appointment booking, and treatment planning. Direct clinic bookings are rising as providers enhance digital presence and patient education.

End-User Insights

MedSpas and aesthetic clinics are the fastest-growing end-use segments, reflecting consumer preference for non-hospital, minimally invasive treatments. Hospitals and dermatology clinics remain significant contributors. New applications in scar correction, male aesthetics, and body contouring are expanding the consumer base. Export-driven demand is growing in regions with local manufacturing constraints, particularly in Asia, Africa, and Latin America.

| By Filler type | By Application | By Provider | By Geography |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America is the largest market (38% share in 2024), led by the U.S. High disposable income, strong regulatory support, widespread clinic networks, and increasing male and younger consumer adoption drive growth. Advanced filler technologies and premium products are rapidly adopted in this region.

Europe

Europe accounts for approximately 27% of the global market, with Germany, the UK, and France leading demand. Eco-conscious consumers, mature medspa networks, and regulatory compliance drive growth. Wrinkle correction and lip augmentation are the most popular treatments, with mid- to premium-range fillers dominating.

Asia-Pacific

Asia-Pacific is the fastest-growing region (22% market share in 2024) due to rising disposable incomes, increasing medical tourism, and growing awareness. China, India, Japan, and Southeast Asia are key contributors, with CAGRs exceeding 12% in some countries. Mid-range fillers are popular, though premium products are rapidly expanding.

Latin America

Latin America (6% market share in 2024) is growing gradually, driven by Brazil and Mexico. Affluent consumers favor aesthetic enhancements, while regional distribution networks are expanding. Outbound medical tourism to developed markets is also emerging.

Middle East & Africa

MEA accounts for 7% of 2024 revenue, with GCC countries (UAE, Saudi Arabia) and South Africa showing increasing demand. High-income populations, luxury clinic expansion, and medical tourism contribute to growth, with strong interest in premium HA fillers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Dermal Fillers Market

- AbbVie Inc. (Allergan Aesthetics)

- Galderma Pharma S.A.

- Merz Pharma GmbH & Co. KGaA

- Sinclair Pharma plc

- Teoxane Laboratories

- Suneva Medical, Inc.

- Zimmer Aesthetics

- BioPlus Co., Ltd.

- Bioha Laboratories

- Prollenium Medical Technologies

- Huadong Medicine Co., Ltd.

- Croma Pharma

- Elevance Health Inc.

- Cosmoderm

- Speciality European Pharma

Recent Developments

- In June 2025, AbbVie launched a long-lasting HA filler with enhanced crosslinking technology in North America, targeting high-demand aesthetic clinics.

- In April 2025, Galderma expanded its medspa distribution network in Asia-Pacific, particularly in India and China, to meet rising non-surgical cosmetic demand.

- In February 2025, Merz Pharma introduced a hybrid biostimulatory filler in Europe, combining HA with collagen-stimulating components to extend treatment longevity.