Decorative Rugs Market Size

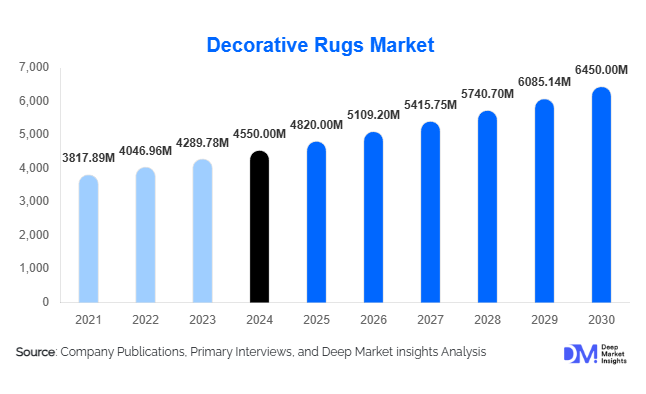

According to Deep Market Insights, the global decorative rugs market size was valued at USD 4,550.00 million in 2024 and is projected to grow from USD 4,820.00 million in 2025 to reach USD 6,450.00 million by 2030, expanding at a CAGR of 6.0% during the forecast period (2025–2030). Market growth is primarily driven by rising home renovation and interior design spending, the growing influence of online and omnichannel retail, and increasing consumer demand for sustainable and artisanal rugs that enhance aesthetic appeal while promoting environmental responsibility.

Key Market Insights

- Machine-made rugs dominate the global decorative rugs market, contributing approximately 42% of 2024 revenue due to scalability, affordability, and diverse design options.

- Wool remains the leading material choice, accounting for roughly 41% of global demand in 2024, driven by its durability, natural texture, and premium appeal.

- Residential applications represent the largest segment, comprising around 67% of the market, supported by home renovation trends and increased consumer spending on décor.

- North America leads globally with approximately 32% market share, while Asia-Pacific is the fastest-growing region with a projected CAGR exceeding 8% through 2030.

- Online retail channels are expanding rapidly, enabling direct-to-consumer access, personalized designs, and global reach for both established brands and new entrants.

- Growing focus on sustainability, including recycled fibres, eco-friendly dyes, and fair-trade production, remains a defining competitive advantage across the market.

Latest Market Trends

Rising Demand for Sustainable and Natural Fibre Rugs

Consumers are increasingly prioritizing sustainability and natural materials in their home furnishings. Decorative rugs made from wool, jute, cotton, and recycled fibres are gaining traction as eco-conscious alternatives to synthetic rugs. Manufacturers are investing in renewable sourcing, low-VOC backing, and biodegradable dyes to meet sustainability goals. Certifications such as OEKO-TEX and GOTS are becoming key differentiators in both domestic and export markets, appealing to environmentally aware buyers and interior designers alike.

Digital Transformation in Rug Retail

The decorative rugs industry is witnessing a digital revolution, with e-commerce emerging as a primary distribution channel. Augmented reality (AR) and virtual visualization tools allow consumers to preview rugs within their own living spaces before purchase, improving conversion rates and reducing return volumes. Online-first brands and marketplaces are expanding global reach, while established rug manufacturers are building D2C platforms to engage consumers directly. This technological shift is fostering brand transparency, customization, and more efficient inventory management.

Decorative Rugs Market Drivers

Increasing Global Home Renovation and Décor Spending

Consumers worldwide are investing more in home improvement, driven by lifestyle changes, remote work, and social media influence. Decorative rugs serve as an accessible, high-impact element for home enhancement, fueling consistent demand. With growing real-estate investments and rising disposable income, particularly across urban centers, rug purchases are becoming part of routine décor updates rather than occasional luxuries.

Growing Penetration of Online and Omnichannel Retail

The convenience, variety, and price transparency offered by online shopping are transforming decorative rug distribution. E-commerce platforms enable smaller artisan brands to reach global audiences, while omnichannel models integrate in-store experiences with digital sales. This trend has significantly lowered entry barriers for new market participants and enhanced accessibility for consumers in emerging regions.

Rising Demand for Artisanal and Custom Rugs

Handcrafted rugs with distinctive designs, traditional motifs, and cultural narratives are increasingly valued as premium home décor investments. Consumers are willing to pay for uniqueness and craftsmanship, driving growth in the hand-knotted and hand-tufted rug segments. These products cater to luxury markets and align with trends favoring authenticity and sustainability, particularly in North America and Europe.

Market Restraints

High Cost of Premium Handmade Rugs

Although handmade rugs offer exceptional quality and design, their production is labour-intensive and time-consuming, leading to higher retail prices. Limited scalability, dependence on artisan skill, and long lead times restrict these rugs to affluent consumers, thereby constraining volume growth in the premium segment.

Competition from Alternative Flooring and Décor Products

Decorative rugs face competition from low-maintenance flooring solutions such as vinyl planks, laminate, and modular carpet tiles. These alternatives often offer greater durability or lower cost per square foot, presenting substitution risks. Market participants must continuously innovate to retain customer interest through new textures, sustainable materials, and improved functionality.

Decorative Rugs Market Opportunities

Expansion Through E-Commerce and D2C Channels

Online platforms present enormous potential for decorative rug brands to reach consumers globally. Enhanced digital merchandising, fast delivery logistics, and visualisation technologies are redefining how rugs are marketed and sold. Brands adopting D2C strategies benefit from higher margins, direct customer insights, and stronger brand control.

Adoption of Sustainable and Ethical Manufacturing Practices

Growing environmental awareness is spurring demand for ethically produced decorative rugs. Companies that invest in traceable raw materials, low-impact dyes, and fair-trade production gain a distinct market advantage. Government incentives and green certification programs further encourage manufacturers to adopt eco-friendly production methods, ensuring long-term brand credibility and customer loyalty.

Emerging Demand in Hospitality and Commercial Interiors

Hotels, restaurants, and corporate offices increasingly use decorative rugs for aesthetic appeal and acoustic comfort. The hospitality sector’s post-pandemic resurgence, along with rapid construction growth in Asia-Pacific and the Middle East, is creating strong institutional demand. Manufacturers focusing on durable, stain-resistant, and custom-branded rug designs can tap into this growing segment.

Product Type Insights

Machine-made rugs dominate the global decorative rugs market, accounting for approximately 42% of total market value in 2024. Their leadership is underpinned by cost-effective large-scale manufacturing, consistency in quality, and the ability to cater to diverse consumer preferences across both residential and commercial applications. These rugs benefit from the integration of advanced textile machinery, automated pattern design, and stain-resistant materials, making them the preferred option for mass-market buyers. Meanwhile, hand-knotted and hand-tufted rugs retain their stronghold in the premium segment, appreciated for their exceptional craftsmanship, durability, and artistic value. Increasing demand for bespoke, artisanal interior décor is sustaining steady growth in these high-end categories. Additionally, flatweave and braided rugs are witnessing accelerated adoption, driven by their lightweight structure, easy maintenance, and compatibility with minimalist and contemporary home aesthetics, particularly popular among urban millennials and apartment dwellers.

Material Insights

Wool-based rugs continue to lead the global market, representing around 41% of total revenue in 2024. Their natural softness, durability, and thermal insulation properties position them as the top choice for luxury and residential décor. Wool rugs are also perceived as sustainable, with increasing adoption of ethically sourced and organically dyed varieties aligning with global eco-design trends. Synthetic materials, including polypropylene and nylon, dominate the mid- and budget-tier segments due to their lower cost, fade resistance, and easy cleaning, attributes that make them ideal for outdoor and high-traffic spaces. In parallel, natural fibre rugs made of jute, sisal, and bamboo are gaining traction among environmentally conscious consumers, offering biodegradable alternatives with a rustic appeal. This ongoing material diversification reflects the market’s shift toward balancing performance, sustainability, and affordability.

End-Use Insights

Residential applications are the cornerstone of the decorative rugs industry, accounting for approximately 67% of total revenue in 2024. Growing global homeownership, rapid urban housing development, and rising spending on home improvement projects underpin this dominance. Consumers increasingly perceive rugs as key elements of interior aesthetics, enhancing comfort, color coordination, and acoustic insulation. However, the commercial and hospitality sectors are emerging as the fastest-growing end-use segments. Hotels, corporate offices, and retail establishments are investing in high-quality decorative rugs to enhance ambiance, brand identity, and customer experience. The hospitality industry, in particular, is driving demand for custom and logo-based rugs, while institutional spaces such as galleries and museums prefer low-pile, durable designs that balance form with function.

Distribution Channel Insights

Online retail has become the most dynamic growth channel in the decorative rugs market, fueled by the rise of digital marketplaces and direct-to-consumer (D2C) brand strategies. Platforms such as Amazon, Wayfair, and niche design retailers offer extensive catalogues, customizable filters, and global product accessibility. This has democratized access to premium designs while reducing distribution costs for manufacturers. Specialty stores remain a key distribution avenue, especially in premium urban markets, where customers prefer tactile inspection and design consultation before purchase. The emergence of hybrid models, physical showrooms integrated with online customization and delivery, has further strengthened their appeal. Hypermarkets and large-format home improvement retailers continue to support bulk and promotional sales, particularly in mature markets like the U.S., U.K., and Germany, while boutique décor outlets are capturing niche demand for handcrafted and locally sourced collections.

| By Product Type | By Material | By End Use | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads the global decorative rugs market, holding approximately 32% of the total share in 2024. The U.S. remains the primary growth engine, driven by high disposable incomes, strong cultural emphasis on interior design, and extensive e-commerce penetration. The region benefits from the widespread adoption of premium home décor products and frequent remodeling cycles in residential properties. Market growth is reinforced by the rising trend of sustainable and custom-designed rugs, supported by eco-friendly manufacturing practices. In addition, growing real estate renovation activity and the popularity of open-concept living spaces are stimulating steady demand for large-area rugs. Canada contributes notably through its expanding housing market and rising affinity for Nordic-style minimalist designs. The key drivers in North America include robust online retail growth, consumer preference for sustainable and luxury home décor, and the strong presence of established rug manufacturers investing in digital sales channels.

Europe

Europe holds about 28% of the global decorative rugs market in 2024, led by Germany, the U.K., France, and Italy. The region’s rich legacy of craftsmanship and artisanal production has sustained a strong appetite for premium handwoven and designer rugs. European consumers place a high value on eco-certified and locally sourced materials, aligning with EU sustainability regulations and green building codes. Demand for wool and natural fibre rugs remains high, particularly in Northern and Western Europe, while Southern Europe is witnessing steady growth in flatweave and cotton-based designs suited for warmer climates. Online and concept-store retail formats are proliferating, bridging the gap between traditional artisans and modern consumers. Rising eco-conscious consumption, stringent environmental regulations promoting sustainable materials, and government incentives for circular economy practices are key growth catalysts across Europe.

Asia-Pacific

Asia-Pacific (APAC) represents the fastest-growing regional market, projected to expand at over 8% CAGR through 2030. Rapid urbanization, increasing disposable incomes, and growing middle-class consumer bases are transforming home décor preferences in China, India, Japan, and Southeast Asia. India is a global hub for handcrafted rug exports, known for its hand-knotted wool and silk rug clusters in Rajasthan and Uttar Pradesh. Meanwhile, China dominates the machine-made rug segment through economies of scale and advanced automation in textile manufacturing. The proliferation of online platforms such as Alibaba and Flipkart is widening product accessibility, while local consumers increasingly gravitate toward modern and minimalistic designs that complement compact urban homes. The primary drivers in APAC include surging residential construction, expanding export capacity, and digitalization of retail channels, alongside a growing preference for affordable yet aesthetic flooring solutions.

Latin America

Latin America accounts for approximately 6–8% of global demand, led by Brazil, Mexico, and Argentina. The regional market is benefiting from increasing urban housing development, improved purchasing power, and cultural shifts toward modern interior styling. Synthetic and mid-range decorative rugs are gaining strong traction, supported by affordability and ease of maintenance. Online and social commerce channels, particularly in Brazil and Mexico, are enabling cross-border purchases and exposing consumers to international brands. Local design influences are also contributing to hybrid collections blending traditional Latin motifs with contemporary materials. Growing middle-class expenditure on home décor, urban residential expansion, and rapid e-commerce adoption are the primary forces propelling Latin American market growth.

Middle East & Africa

The Middle East & Africa (MEA) region captures approximately 7% of global market share in 2024, showcasing strong demand for luxury and hospitality-grade rugs. The UAE and Saudi Arabia lead regional consumption, driven by rapid hotel development, high-end residential projects, and growing preference for opulent interior aesthetics. In contrast, South Africa and Egypt are emerging as regional production and trading hubs for locally handcrafted and natural fibre rugs. Cultural appreciation for intricate patterns and artisanal techniques continues to sustain demand in premium segments, while affordable machine-made imports cater to broader market tiers. Expanding hospitality infrastructure, rising high-net-worth population, government-backed real estate megaprojects, and growing intra-African trade in handmade textiles are accelerating market growth across MEA.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Decorative Rugs Market

- Mohawk Industries, Inc.

- Shaw Industries Group, Inc.

- Balta Group

- Oriental Weavers Group

- Capel Rugs

- Loloi Inc.

- Nourison Industries, Inc.

- Surya Inc.

- Jaipur Living, Inc.

- Momeni Inc.

- Milliken & Company

- Kaleen Rugs

- Dalyn Rug Company

- Harounian Rugs International

- Samad Rugs

Recent Developments

- In March 2025, Mohawk Industries announced new investments in automated tufting technology to expand its sustainable rug production in the U.S.

- In January 2025, Surya launched its “Eco Weave” collection featuring recycled wool and jute rugs aimed at eco-conscious consumers in Europe and North America.

- In June 2024, Jaipur Living partnered with artisans in India to develop a limited-edition hand-knotted rug line under fair-trade and sustainable certification programs.